BASE PROSPECTUS Dated 9 September 2016 NOMURA BANK

... specified entity or entities (Credit Linked Securities), Index Linked Securities or Equity Linked Securities which are short price payout N&C Securities (Short Price Payout N&C Securities) and excluded index securities linked to a series of preference shares (Preference Share Linked N&C Securities) ...

... specified entity or entities (Credit Linked Securities), Index Linked Securities or Equity Linked Securities which are short price payout N&C Securities (Short Price Payout N&C Securities) and excluded index securities linked to a series of preference shares (Preference Share Linked N&C Securities) ...

Final decision - Review of electricity transmission and distribution

... Calculated as the yield on 10 year BBB rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.45 per cent). Calculated as the yield on 10 year A rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.28 per cent). Calculated as the yield ...

... Calculated as the yield on 10 year BBB rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.45 per cent). Calculated as the yield on 10 year A rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.28 per cent). Calculated as the yield ...

Credit Suisse AG Credit Suisse International

... Directive 2003/71/EC, as amended from time to time, including by Directive 2010/73/EU (the "Prospectus Directive") in respect of all Securities other than Exempt Securities. It is valid for one year and may be supplemented from time to time under the terms of the Prospectus Directive. It should be r ...

... Directive 2003/71/EC, as amended from time to time, including by Directive 2010/73/EU (the "Prospectus Directive") in respect of all Securities other than Exempt Securities. It is valid for one year and may be supplemented from time to time under the terms of the Prospectus Directive. It should be r ...

Timing the Treasury Bond Market

... company has a model, based on a number of indicators, for allocating between stocks and bonds. This model has been developed over the past ten years and is a tool that supports investors in creating high returns whilst limiting the risk. The model for the allocation between different Treasury bonds ...

... company has a model, based on a number of indicators, for allocating between stocks and bonds. This model has been developed over the past ten years and is a tool that supports investors in creating high returns whilst limiting the risk. The model for the allocation between different Treasury bonds ...

INVESTEC BANK PLC - Investec Treasury Portal > UK

... performance of one or more underlying assets (each an "Underlying"), being (i) a single share or a basket of shares (such Notes being the "Equity Linked Notes"), (ii) a single index or a basket of indices (such Notes being the "Index Linked Notes"), (iii) two separate underlyings, being any combinat ...

... performance of one or more underlying assets (each an "Underlying"), being (i) a single share or a basket of shares (such Notes being the "Equity Linked Notes"), (ii) a single index or a basket of indices (such Notes being the "Index Linked Notes"), (iii) two separate underlyings, being any combinat ...

Segmented Iterators and Hierarchical Algorithms

... Pointers are Random Access Iterators, which means that they are Bidirectional Iterators and Forward Iterators as well. Dispatching algorithms and iterator traits The reason for the different iterator concepts is that they support different kinds of algorithms. Forward Iterators are sufficient for an ...

... Pointers are Random Access Iterators, which means that they are Bidirectional Iterators and Forward Iterators as well. Dispatching algorithms and iterator traits The reason for the different iterator concepts is that they support different kinds of algorithms. Forward Iterators are sufficient for an ...

Addison Wesley - Algorithms in Java, Parts 1-4, 3rd Edition

... make use of methods from a previous chapter. The orientation of the book is to study algorithms likely to be of practical use. The book provides information about the tools of the trade to the point that readers can confidently implement, debug, and put algorithms to work to solve a problem or to pr ...

... make use of methods from a previous chapter. The orientation of the book is to study algorithms likely to be of practical use. The book provides information about the tools of the trade to the point that readers can confidently implement, debug, and put algorithms to work to solve a problem or to pr ...

Compressed Suffix Trees: Design, Construction, and Applications

... the ASCII alphabet and the size n of the text is smaller than 232 . The price for the space reduction was often a log n factor in the time complexity of the solution. However with additional tables like the longest common prefix array (LCP) and the child table it is possible to replace the suffix tr ...

... the ASCII alphabet and the size n of the text is smaller than 232 . The price for the space reduction was often a log n factor in the time complexity of the solution. However with additional tables like the longest common prefix array (LCP) and the child table it is possible to replace the suffix tr ...

New data structures and algorithms for the efficient management of

... of binary grids but also supports changes in the grid. Our data structures can be used in several application domains. We propose specific variants and combinations of our generic proposals to represent temporal graphs, RDF databases, OLAP databases, binary or general raster data, and temporal raste ...

... of binary grids but also supports changes in the grid. Our data structures can be used in several application domains. We propose specific variants and combinations of our generic proposals to represent temporal graphs, RDF databases, OLAP databases, binary or general raster data, and temporal raste ...

Australian Valuation Practices Survey 2015

... Welcome to KPMG’s Australian Valuation Practices Survey 2015. This is KPMG’s second survey and it builds on the findings of our inaugural 2013 survey. We hope it will offer a unique reference point for corporate financiers and financial analysts, providing insight into the valuation parameters and a ...

... Welcome to KPMG’s Australian Valuation Practices Survey 2015. This is KPMG’s second survey and it builds on the findings of our inaugural 2013 survey. We hope it will offer a unique reference point for corporate financiers and financial analysts, providing insight into the valuation parameters and a ...

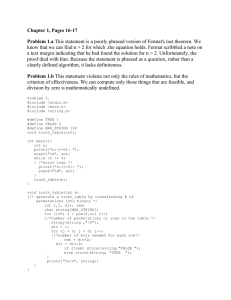

Page 264, Exercise 1

... Chapter 1, Pages 16-17 Problem 1.a This statement is a poorly phrased version of Fermat's last theorem. We know that we can find n > 2 for which ‚the equation holds. Fermat scribbled a note on a text margin indicating that he had found the solution for n = 2. Unfortunately, the proof died with him. ...

... Chapter 1, Pages 16-17 Problem 1.a This statement is a poorly phrased version of Fermat's last theorem. We know that we can find n > 2 for which ‚the equation holds. Fermat scribbled a note on a text margin indicating that he had found the solution for n = 2. Unfortunately, the proof died with him. ...

Data Structure Repair Using Goal-Directed Reasoning C.

... in partial fulfillment of the requirements for the degree of Doctor of Philosophy at the ...

... in partial fulfillment of the requirements for the degree of Doctor of Philosophy at the ...

Working Paper No. 14 -Studies on the Validation of Internal Rating

... “Basel II” or the “revised Framework”). When following the “internal ratings-based” (IRB) approach to Basel II, banking institutions will be allowed to use their own internal measures for key drivers of credit risk as primary inputs to their minimum regulatory capital calculation, subject to meeting ...

... “Basel II” or the “revised Framework”). When following the “internal ratings-based” (IRB) approach to Basel II, banking institutions will be allowed to use their own internal measures for key drivers of credit risk as primary inputs to their minimum regulatory capital calculation, subject to meeting ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.