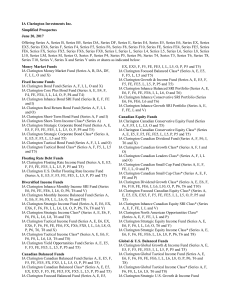

IA Clarington Investments Inc. Simplified Prospectus June 20, 2017

... IA Clarington Short-Term Bond Fund ............................................................................................... 71 IA Clarington Short-Term Income Class ............................................................................................ 74 IA Clarington Strategic Corporat ...

... IA Clarington Short-Term Bond Fund ............................................................................................... 71 IA Clarington Short-Term Income Class ............................................................................................ 74 IA Clarington Strategic Corporat ...

Prospectus db x-trackers II

... Unless otherwise specified in the relevant Product Annex (as defined below), the purpose of the Company is for each of its Sub-Funds through having its Shares listed on one or more stock exchanges to qualify as an exchange traded fund ("ETF"). As part of those listings there is an obligation on one ...

... Unless otherwise specified in the relevant Product Annex (as defined below), the purpose of the Company is for each of its Sub-Funds through having its Shares listed on one or more stock exchanges to qualify as an exchange traded fund ("ETF"). As part of those listings there is an obligation on one ...

Final decision - Review of electricity transmission and distribution

... Calculated as the yield on 10 year BBB rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.45 per cent). Calculated as the yield on 10 year A rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.28 per cent). Calculated as the yield ...

... Calculated as the yield on 10 year BBB rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.45 per cent). Calculated as the yield on 10 year A rated bonds calculated over the five year period 1 April 2004 to 1 April 2009 (i.e. 7.28 per cent). Calculated as the yield ...

Draft technical specifications

... SCR.10.7. Shock for revision risk ..................................................................................... 310 SCR.11. Ring- fenced funds............................................................................................... 314 SCR.12. Risk mitigation – financial instruments . ...

... SCR.10.7. Shock for revision risk ..................................................................................... 310 SCR.11. Ring- fenced funds............................................................................................... 314 SCR.12. Risk mitigation – financial instruments . ...

English - Vanguard Global sites

... hereto and the latest audited annual financial report and any subsequent semi-annual financial report of the Company. ...

... hereto and the latest audited annual financial report and any subsequent semi-annual financial report of the Company. ...

Fidelity Retirement Master Trust

... for switching instruction submitted via other means, 4:00p.m. on a day which is 1 Business Day before the relevant Member’s birthday. If such switching instruction for partial switching out of the DIS received by the Trustee before the dealing cut-off time above is still being processed on the annua ...

... for switching instruction submitted via other means, 4:00p.m. on a day which is 1 Business Day before the relevant Member’s birthday. If such switching instruction for partial switching out of the DIS received by the Trustee before the dealing cut-off time above is still being processed on the annua ...

Pillar 3 Risk and Capital Management Report 2016

... The definition of capital includes the foreign currency translation reserve (FCTR), share-based payment (SBP) reserve, property revaluation (PR) reserve and available-for-sale (AFS) reserve as common-equity tier 1 (CET1) capital under Basel III. SUMMARY OF THE TREATMENT FOLLOWED FOR BASEL III CONSOL ...

... The definition of capital includes the foreign currency translation reserve (FCTR), share-based payment (SBP) reserve, property revaluation (PR) reserve and available-for-sale (AFS) reserve as common-equity tier 1 (CET1) capital under Basel III. SUMMARY OF THE TREATMENT FOLLOWED FOR BASEL III CONSOL ...

The market pricing of accruals quality

... betas increase monotonically across AQ quintiles, with a difference in betas between the lowest and highest quintiles of 0.35 (significantly different from zero at the 0.001 level). Assuming a 6% market risk premium, this difference implies a 210 bp higher cost of equity for firms with the worst AQ re ...

... betas increase monotonically across AQ quintiles, with a difference in betas between the lowest and highest quintiles of 0.35 (significantly different from zero at the 0.001 level). Assuming a 6% market risk premium, this difference implies a 210 bp higher cost of equity for firms with the worst AQ re ...

Mind the gap: the arms length principle and MNE value

... MNE economic rent. The paper looks at the sources of economic rent in general, and then examines in detail the impact on economic rent of operating as a MNE by way of controlled subsidiaries rather than through independent or uncontrolled entities. The paper then examines the impact of the recent wo ...

... MNE economic rent. The paper looks at the sources of economic rent in general, and then examines in detail the impact on economic rent of operating as a MNE by way of controlled subsidiaries rather than through independent or uncontrolled entities. The paper then examines the impact of the recent wo ...

Influencing Control: Jawboning in Risk Arbitrage

... Our study builds on three disjoint subsamples covering all M&A deals between 2000 and 2013. The most important of the three is the “event sample:” a manually composed sample of 335 activist risk arbitrage events where there was observed jawboning by outside blockholders after the initial announcemen ...

... Our study builds on three disjoint subsamples covering all M&A deals between 2000 and 2013. The most important of the three is the “event sample:” a manually composed sample of 335 activist risk arbitrage events where there was observed jawboning by outside blockholders after the initial announcemen ...

The Accruals Anomaly: A 50/50 chance game? Evidence from the

... returns: the market forecast higher (lower) future earnings from continuous operations to firms with higher (lower) levels of accruals. This topic has been very controversial, dividing the scientific community, either because some authors affirms that the anomaly exists and will persist in time and ...

... returns: the market forecast higher (lower) future earnings from continuous operations to firms with higher (lower) levels of accruals. This topic has been very controversial, dividing the scientific community, either because some authors affirms that the anomaly exists and will persist in time and ...

Prospectus - Franklin Templeton Investment Funds (SICAV)

... unauthorised and unlawful. The distribution of this Prospectus and the offering of the Shares may be restricted in certain other jurisdictions. It is the responsibility of any persons wishing to make an application for Shares pursuant to this Prospectus to inform themselves of and to observe all app ...

... unauthorised and unlawful. The distribution of this Prospectus and the offering of the Shares may be restricted in certain other jurisdictions. It is the responsibility of any persons wishing to make an application for Shares pursuant to this Prospectus to inform themselves of and to observe all app ...

Copula-based top-down approaches in financial risk aggregation

... GARCH(1,1) model to account for volatility clustering and leptokurtic return distributions. The distribution of 1-year market portfolio returns that are obtained from the simulations of successive one-day returns are then used to model the one-year market risk and its correlation with other risk typ ...

... GARCH(1,1) model to account for volatility clustering and leptokurtic return distributions. The distribution of 1-year market portfolio returns that are obtained from the simulations of successive one-day returns are then used to model the one-year market risk and its correlation with other risk typ ...

Investment Policy Manual

... executed as the result of investment capital calls or distributions as well as in support of the internal management of international equity portfolios and shall monitor the performance of agent securities lenders, with a focus on the lenders' investment of securities lending cash collateral. 6. The ...

... executed as the result of investment capital calls or distributions as well as in support of the internal management of international equity portfolios and shall monitor the performance of agent securities lenders, with a focus on the lenders' investment of securities lending cash collateral. 6. The ...

Guidance Document for Highway Infrastructure Asset Valuation

... and GRC models which represent the cost of replacing an existing asset with a Modern Equivalent Asset. Assets are consumed during service due to ageing, usage, deterioration, damage, a fall in the Level of Service (assessed through appropriate Performance Measures) and obsolescence. ...

... and GRC models which represent the cost of replacing an existing asset with a Modern Equivalent Asset. Assets are consumed during service due to ageing, usage, deterioration, damage, a fall in the Level of Service (assessed through appropriate Performance Measures) and obsolescence. ...

WESTPAC BANKING CORP (Form: 6-K, Received

... and mitigate potential loss or damage. We adopt a Three Lines of Defence approach to risk management (see page 11) which reflects our culture of ‘risk is everyone’s business’ and that all employees are responsible for identifying and managing risk and operating within the Group’s desired risk profil ...

... and mitigate potential loss or damage. We adopt a Three Lines of Defence approach to risk management (see page 11) which reflects our culture of ‘risk is everyone’s business’ and that all employees are responsible for identifying and managing risk and operating within the Group’s desired risk profil ...

Common KIM Old File January 2017.cdr

... moderately high risk FUND OF FUNDS SCHEMES This product is suitable for investors who are seeking*: returns in line with performance of Birla Sun Life Gold ETF (BSL GETF) over long term investments predominantly in units of Birla Sun Life Gold ETF BSL GETF invests in physical gold of 99.5% purity (f ...

... moderately high risk FUND OF FUNDS SCHEMES This product is suitable for investors who are seeking*: returns in line with performance of Birla Sun Life Gold ETF (BSL GETF) over long term investments predominantly in units of Birla Sun Life Gold ETF BSL GETF invests in physical gold of 99.5% purity (f ...

A Practical Guide to Forecasting Financial Market Volatility

... Volatility forecasting is crucial for option pricing, risk management and portfolio management. Nowadays, volatility has become the subject of trading. There are now exchange-traded contracts written on volatility. Financial market volatility also has a wider impact on financial regulation, monetary ...

... Volatility forecasting is crucial for option pricing, risk management and portfolio management. Nowadays, volatility has become the subject of trading. There are now exchange-traded contracts written on volatility. Financial market volatility also has a wider impact on financial regulation, monetary ...

Possible Appendix/Side panel/Sidebar/Footnote(s) re: references

... these requirements and explains the measurement context in which the risk adjustment operates 3: An entity shall measure an insurance contract initially at the sum of: a) the fulfilment cash flows (an explicit, unbiased and probability-weighted estimate, i.e., expected value) of both the expected pr ...

... these requirements and explains the measurement context in which the risk adjustment operates 3: An entity shall measure an insurance contract initially at the sum of: a) the fulfilment cash flows (an explicit, unbiased and probability-weighted estimate, i.e., expected value) of both the expected pr ...

Impact of Yen on Japanese Stocks

... Japan is known for the export‐driven nature of its economy and, given the importance of the exchange rate in driving exports, the yen is therefore closely monitored by Japanese companies and policymakers alike (Hashi and Ito (2009)). In the last few years, the yen has been on an appreciating trend ...

... Japan is known for the export‐driven nature of its economy and, given the importance of the exchange rate in driving exports, the yen is therefore closely monitored by Japanese companies and policymakers alike (Hashi and Ito (2009)). In the last few years, the yen has been on an appreciating trend ...

Developing Annuities Markets The Experience of Chile

... This study of the Chilean annuities market consists of seven chapters, two technical annexes, and one statistical annex. It is part of a broader project on annuities coordinated by the Operations Policy Department (OPD) of the World Bank and designed to identify best regulatory practices and institu ...

... This study of the Chilean annuities market consists of seven chapters, two technical annexes, and one statistical annex. It is part of a broader project on annuities coordinated by the Operations Policy Department (OPD) of the World Bank and designed to identify best regulatory practices and institu ...

Scholar`s Edge Enrollment Kit

... This material is provided for general and educational purposes only and is not intended to provide legal, tax or investment advice, or for use to avoid penalties that may be imposed under U.S. federal tax laws. Contact your attorney or tax advisor regarding your specific legal, investment or tax si ...

... This material is provided for general and educational purposes only and is not intended to provide legal, tax or investment advice, or for use to avoid penalties that may be imposed under U.S. federal tax laws. Contact your attorney or tax advisor regarding your specific legal, investment or tax si ...

Two Essays on Managerial Behaviors in the Mutual Fund Industry

... managerial actions including the pursuit of window-dressing behavior. For robustness, we repeat all analyses using return gap as a proxy for window-dressing. We find that fund flows in the first month of the quarter are sensitive to return gap of the prior quarter-ending month while fund flows in th ...

... managerial actions including the pursuit of window-dressing behavior. For robustness, we repeat all analyses using return gap as a proxy for window-dressing. We find that fund flows in the first month of the quarter are sensitive to return gap of the prior quarter-ending month while fund flows in th ...

Risk Management and Value Creation in Financial Institutions

... management can create (shareholder) value. However, from a theoretical point of view, it is not immediately clear if and how risk management at the corporate level can be useful. Very little research has been conducted as to why there is an economic rationale for risk management at the bank level. T ...

... management can create (shareholder) value. However, from a theoretical point of view, it is not immediately clear if and how risk management at the corporate level can be useful. Very little research has been conducted as to why there is an economic rationale for risk management at the bank level. T ...

Stock market liquidity and firm value

... Next, the direction of causality is established by examining the effect of an exogenous shock to liquidity (decimalization) on firm performance. Decimalization increased stock liquidity in general but it increased it more for actively traded stocks. The change in liquidity surrounding decimalization ...

... Next, the direction of causality is established by examining the effect of an exogenous shock to liquidity (decimalization) on firm performance. Decimalization increased stock liquidity in general but it increased it more for actively traded stocks. The change in liquidity surrounding decimalization ...

Beta (finance)

In finance, the beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not go up or down a lot, so it has a low beta. An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market.A beta greater than one generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like equity put options can have large negative betas.Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. In the capital asset pricing model, beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest.The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio. Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types.Beta decay refers to the tendency for a company with a high beta coefficient (β > 1) to have its beta coefficient decline to the market beta. It is an example of regression toward the mean.