* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Four Myths in the Active/Passive Debate

Startup company wikipedia , lookup

Interbank lending market wikipedia , lookup

Short (finance) wikipedia , lookup

Corporate venture capital wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

International investment agreement wikipedia , lookup

History of private equity and venture capital wikipedia , lookup

Mutual fund wikipedia , lookup

Leveraged buyout wikipedia , lookup

Private equity wikipedia , lookup

Investment banking wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Private money investing wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Stock trader wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Private equity secondary market wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Socially responsible investing wikipedia , lookup

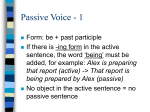

MARKETVIEW FourMythsintheActive/PassiveDebate November7,2016 4745Views Wetakeadeeperdiveintokeymisconceptionsaboutactiveinvesting. Thereare,inourview,f ourmythsof tenrepeatedintheactive/passivedebate. 1)It’simpossibleforactivemanagerstobeatindexes. Fiveyearsago,thiswouldhavebeenastrawmanargumentthatnoonewouldhavetaken seriously.Butoverthepastf ewyears,someinvestorshaveembracedthisclaimasalegitimate one.It’sbolsteredbyoverblownheadlinessuchastherecentoneintheFinancialTimes,which statedthat“99%of activelymanagedU.S.equityf undsunderperf orm.” Manyof theseheadlinestreatpassiveoutperf ormanceasaninevitability.Thetruthisthatpassive strategiesareenjoyingaperiodof unprecedentedperf ormancerelativetoactivepeers.Chart1 showsthat,asof October31,2016,thethree-yearperf ormanceof theS&P500® Indexwould rankinthetenthpercentileof theLipperLarge-CapBlendclassif ication,thestrongestrankingin25 years. Chart1.IndexPerformanceisUnusuallyStrongRelativetoActiveManagers S&P500rankinginLipperLarge-CapBlendclassification,rollingthree-yearperformance Source:Lipper.Note:Rollingthree-yearperf ormancerankingstabulatedonanannualbasis;2016dataasof 10/31/2016. Pastperformanceisnoguaranteeoffutureresults.Forillustrativepurposesonlyanddoesnotref lectanyspecif ic portf oliomanagedbyLordAbbettoranyparticularinvestmentandshouldnotberelieduponasinvestmentadvice. 1 Indexesareunmanaged,donotref lectdeductionof f eesandexpensesandarenotavailablef ordirectinvestment. Af urtherlookatthestudiesunderlyingtheheadlinesshowssomeseriousf lawsinthe methodology.Oneof thebiggestisthattheshareclassusedf oractiveperf ormancemeasurement bytheS&PDowJonesinitsSPIVA[StandardPoor'sIndexVersusActive]studiesisthe“largest shareclass.”Thatmostof tenisthe‘A’shareclass,whichtalliesdistributionchargesinits managementf ees.Theclassisconstructedinthismannerbecausetheusersareof ten commission-basedadvisors,onbehalf of theirclients.Thissetof advisorsdoesnotchargean ongoingadvisoryf ee,andsoearnsalivingthroughsharesof otherf ees,someof whichare containedinmutualf unds’managementf ees.Fee-basedadvisors,ontheotherhand,chargean annualf eetomanagemoney,whichisnotincludedinthef unds’managementf eesandnot deductedf romperf ormance.Comparingshareclassesbuiltf orcommission-basedadvisorswith otherclassesbuiltf orf ee-basedadvisorsistocompareanetresulttoagrossresult. Morecaref ullyconstructedstudiesdon’tgrabtheheadlinesliketheSPIVAstudiesdo,butthey showmorerealisticresults—suchas,thatasmallmajorityof managersunderperf ormindexesand somemanagersearnwellinexcessof theirf ees.Managersthatf ocusonactivestockpicking,f or example,havebeenshowntoexhibitexcessreturnsof 1.4%,onaverage,asindicatedinresearch byMartijnCremersandAnttiiPetajisto,intheirseminalpaperon“activeshare,”“HowActiveIs YourFundManager?” 2)Passivefundsarealwayssignificantlycheaperthanactivefunds. Inanothercaseof headlinenumbersnottellingthewholestory,theaveragemanagementf eeof passivef undsissometimescomparedtotheaveragemanagementf eeof activef unds. Morningstar,f orexample,f igurestheaverageactivef undf eeatabout80basispoints(bps)and theaveragepassivef undf eeatabout20bps—adisparitythatisof tencitedtojustif ycapital f lighttopassivestrategies.However,it’simportanttounderstandthattheseareasset-weighted expenseratiosandthattheassetmixbetweenactiveandpassiveisquitedif f erentindif f erent assetclassesandstyles.Thepassiveshareof theMorningstarLargeBlendcategory,f or example,is71%,whiletheshareof theMorningstarLargeGrowthcategorythatispassively managedisonly13%.Furthermore,whenpassivef undsdocompeteinspecializedsectors,the managementf eeistypicallymuchhigherthananasset-weightedaverageof allpassivef ees.In equityincome,f orexample,theaverageETF(exchange-tradedf und)managementf eeis47bps whiletheaverageS&P500ETFisonly13bps,accordingtoLipper. Inaddition,activemanagerscannotallbegroupedintoa“highcost”bucket,asthereareawide rangeof f eestructuresavailable.Low-costactivef undscanbeacompellinginvestment propositionwiththeopportunityf oralphaf romactivemanagementatcostscomparableto competingpassivef unds.Morningstar’smostrecentActive/PassiveBarometerf oundthatthe lowest-costquartileof activef undswaslikeliertosurvive,andenjoyedgreateroddsof success (successbeingdef inedasbeatingpassivecompetitors)ineverycategoryversusthehighest-cost quartile—andsometimesthedif f erencewasdramatic.Inmid-capvalue,f orexample,thelowest expensequartileof activef undshada10timeshighersuccessratethanthehighestexpense quartile. 3)Allequityallocationsaregoingpassive. Theheadlinesalsosuggestmassivecapitaloutf lowsf romactivelymanagedequityf undsinto passivestrategies.Whilethisdirectionallyistrue,themagnitudeisof tenoverstated.Atthevery least,theimplicationsof thesecapitalf lowsshouldbeconsidered. Ithasbeenwell-documentedthatinvestorstendtochaseperf ormance,andthat,historically,this tendencyhasbeendetrimentaltoinvestorreturnswhencomparedtoasset-classreturns.Manyof thedollarsf lowingintopassivelymanagedequitystrategiestodaymaybeperf ormance-drivenas 2 well.Ourconcerniswhathappenswhentheperf ormanceandf lowsreverse.Arecentstudyf rom DeutscheBankrevealedthattheaverageholdingperiodf orequityETFswasonly137days. PassiveinvestorschoosingtheETFvehiclemaybeinvestingalongsideshort-termtradersand otherswhoarechasing“hotmoney”thatcouldpotentiallyf leequicklyif perf ormancerankingswere toreverttothehistoricalmean.Mutualf undinvestors,ontheotherhand,tendtoinvestf orthe longterm,assupportedbyarecentICIstudythatreportedthat91%of mutualf undinvestors statethatretirementisoneof theirinvestmentobjectives. Finally,theheadlinenumbersdetailingthef lowsf romactivelymanagedequitiesoverlookacritical distinction.Flowsareonlytrackedf ormutualf unds,andaredif f iculttotracef orless-transparent vehicles,suchascollectiveinvestmenttrusts(CITs).Asadoptionof collectivetrustsbydef ined contributionplansaccelerates,onlytheoutf lowsarecapturedwheninvestorstransf erf rom activelymanagedmutualf undstoactivelymanagedCITs.IntheweekendedOctober26,f or example,investorsredeemed$16.6billioninequityf unds,but$11.7billionof thatf igurewasdue toarestructuringof anactivelymanagedproprietaryf undtoaCITstructure,accordingtoLipper’s WeeklyFundFlowsInsightReport. 4)Activemanagementisazero-sumgame,mathematicallyforcingtheaverage managertolosetolow-costindexes. Mutualf undsrepresentonly24%of theownershipof U.S.equitiesand,despitetheassetgatheringbingeinthelastf ewyears,ETFsstillrepresentonlyabout5%of themarket(seeChart 2).Thismeansmutualf undscantradewithmanyothertypesof activeinvestors.Households,f or example,arestill37%of themarket,withpensionf undsandinternationalinvestorsrepresenting otherlarge,non-mutual-f undcohorts.Further,thereissubstantialevidencethatsomeportionsof thisactivemarket,especiallyretailinvestors,underperf ormtheassetclassreturnssystematically. Sowhileactivemanagementmaybeazero-sumgame,institutionalmanagerslikemutualf undsare notrelegatedtomarketreturnsminusf ees,asissometimesargued. Chart2.MutualFundsRepresentOnly24%oftheU.S.CorporateEquityOwnership OwnershipofU.S.corporateequitymarket($36trillion),asofJune30,2016 Source:FederalReserveandGoldmanSachsGlobalInvestmentResearch. Note:Dataasof June30,2016;markettotals$36trillion,whichincludes$7trillioninf oreignequityholdings. Forillustrativepurposesonlyanddoesnotref lectanyspecif icportf oliomanagedbyLordAbbettoranyparticular investmentandshouldnotberelieduponasinvestmentadvice.Indexesareunmanaged,donotref lectdeductionof f eesandexpensesandarenotavailablef ordirectinvestment. 3 Inthisliesanopportunityf orprof essionaladvisors.If itwereeasytopickanoutperf orming manageratrandom,anyonecoulddoit,andalargeportionof anadvisor’sworthwouldbe questionable.Fortunately,notallmanagersarethesame.Ittakessomeknowledge,some quantitativeandqualitativeresearch,and,indeed,someskilltochoosethosewhowilloutperf orm goingf orward.Aprudentinvestorwilllookf ormanagerswithacommitmenttoinvestmentresearch, along-termrecordof perf ormancethroughavarietyof marketconditions,investmentandriskcontrolprocessesthatarerepeatableandsound,and,of course,reasonablef ees. RiskstoConsider:Thevalueof investmentsinequitysecuritieswillf luctuateinresponsetogeneraleconomic conditionsandtochangesintheprospectsof particularcompaniesand/orsectorsintheeconomy.Historically speaking,growthandvalueinvestmentstendtoreactdif f erentlyduringtheeconomiccycle.Sincevaluestocksare of tencyclicalinnature,theymaybenef itf romtheincreasedspendingthatusuallyoccursduringaneconomic expansion.Growthstocksmayalsoperf ormwellduringanexpansion,buttheymayalsobeoutof f avorduringmarket downturns,wheninvestorspaymoreattentiontopriceratios.Whilegrowthstocksaresubjecttothedailyupsand downsof thestockmarket,theirlong-termpotentialaswellastheirvolatilitycanbesubstantial.Noinvestingstrategy canovercomeallmarketvolatilityorguaranteef utureresults. Note:Statementsconcerningf inancialmarkettrendsarebasedoncurrentmarketconditions,whichwillf luctuate. Thereisnoguaranteethatmarketswillperf orminasimilarmannerundersimilarconditionsinthef uture. LipperLarge-CapBlendportf oliosareFundsthat,byportf oliopractice,investatleast75%of theirequityassetsin companieswithmarketcapitalizations(onathree-yearweightedbasis)aboveLipper’sUSDElarge-capf loor.Largecapcoref undshavemorelatitudeinthecompaniesinwhichtheyinvest.Thesef undstypicallyhaveaverage characteristicscomparedtotheS&P500Index. MorningstarLargeBlendportf oliosaref airlyrepresentativeof theoverallU.S.stockmarketinsize,growthrates, andprice.Stocksinthetop70%of thecapitalizationof theU.S.equitymarketaredef inedaslargecap.Theblend styleisassignedtoportf olioswhereneithergrowthnorvaluecharacteristicspredominate.Theseportf oliostendto investacrossthespectrumof U.S.industries,andowingtotheirbroadexposure,theportf olios’returnsaref oten similartothoseof theS&P500Index.MorningstarLarge-Growthportf oliosinvestprimarilyinbigU.S.companiesthat areprojectedtogrowf asterthanotherlarge-capstocks.Stocksinthetop70%of thecapitalizationof theU.S. equitymarketaredef inedaslargecap.Growthisdef inesbasedonf astgrowth(highgrowthratesf orearnings, sales,bookvalue,andcashf low)andhighvaluations(highpriceratiosandlowdividendyields).Mostof these portf oliosf ocusoncompaniesinrapidlyexpandingindustries. MorningstarLargeGrowthportf oliosinvestprimarilyinbigU.S.companiesthatareprojectedtogrowf asterthan otherlarge-capstocks.Stocksinthetop70%of thecapitalizationof theU.S.equitymarketaredef inedaslargecap. Growthisdef inesbasedonf astgrowth(highgrowthratesf orearnings,sales,bookvalue,andcashf low)andhigh valuations(highpriceratiosandlowdividendyields).Mostof theseportf oliosf ocusoncompaniesinrapidlyexpanding industries. TheS&P500 ® Indexiswidelyregardedasthestandardf ormeasuringlargecapU.S.stockmarketperf ormanceand includesarepresentativesampleof leadingcompaniesinleadingindustries. TheopinionsinMarketViewareasof thedateof publication,aresubjecttochangebasedonsubsequent developments,andmaynotref lecttheviewsof thef irmasawhole.Thematerialisnotintendedtoberelieduponas af orecast,research,orinvestmentadvice,isnotarecommendationorof f ertobuyorsellanysecuritiesortoadopt 4 anyinvestmentstrategy,andisnotintendedtopredictordepicttheperf ormanceof anyinvestment.Readersshould notassumethatinvestmentsincompanies,securities,sectors,and/ormarketsdescribedwereorwillbeprof itable. Investinginvolvesrisk,includingpossiblelossof principal.Thisdocumentispreparedbasedontheinf ormationLord Abbettdeemsreliable;however,LordAbbettdoesnotwarranttheaccuracyandcompletenessof theinf ormation. Investorsshouldconsultwithaf inancialadvisorpriortomakinganinvestmentdecision. Investorsshouldcarefullyconsidertheinvestmentobjectives,risks,chargesandexpensesof theLordAbbettFunds.Thisandotherimportantinformationiscontainedinthefund's summaryprospectusand/orprospectus.Toobtainaprospectusorsummaryprospectusonany LordAbbettmutualfund,youcanclickhereorcontactyourinvestmentprofessionalorLord AbbettDistributorLLCat888-522-2388.Readtheprospectuscarefullybeforeyouinvestor sendmoney. NotFDIC-Insured.Maylosevalue.Notguaranteedbyanybank.Copyright©2017Lord,Abbett& Co.LLC.Allrightsreserved.LordAbbettmutualfundsaredistributedbyLordAbbett DistributorLLC.ForU.S.residentsonly. Theinformationprovidedisnotdirectedatanyinvestororcategoryofinvestorsandis providedsolelyasgeneralinformationaboutLordAbbett’sproductsandservicesandto otherwiseprovidegeneralinvestmenteducation.Noneoftheinformationprovidedshouldbe regardedasasuggestiontoengageinorrefrainfromanyinvestment-relatedcourseofaction asneitherLordAbbettnoritsaffiliatesareundertakingtoprovideimpartialinvestmentadvice, actasanimpartialadviser,orgiveadviceinafiduciarycapacity.Ifyouareanindividual retirementinvestor,contactyourfinancialadvisororotherfiduciaryaboutwhetheranygiven investmentidea,strategy,productorservicemaybeappropriateforyourcircumstances. 5