* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download 50 The LC Gupta Committee Report: Some Observations

Private equity secondary market wikipedia , lookup

Black–Scholes model wikipedia , lookup

Systemically important financial institution wikipedia , lookup

Foreign exchange market wikipedia , lookup

Securities fraud wikipedia , lookup

Currency intervention wikipedia , lookup

Futures contract wikipedia , lookup

Contract for difference wikipedia , lookup

Short (finance) wikipedia , lookup

Systemic risk wikipedia , lookup

High-frequency trading wikipedia , lookup

Market sentiment wikipedia , lookup

Efficient-market hypothesis wikipedia , lookup

Financial crisis wikipedia , lookup

Stock selection criterion wikipedia , lookup

Trading room wikipedia , lookup

Financial Crisis Inquiry Commission wikipedia , lookup

Stock market wikipedia , lookup

Algorithmic trading wikipedia , lookup

Commodity market wikipedia , lookup

Stock exchange wikipedia , lookup

Day trading wikipedia , lookup

Hedge (finance) wikipedia , lookup

2010 Flash Crash wikipedia , lookup

I C R A B U L L E T I N

Money

&

Finance

J U L Y – S E P T. . 1 9 9 8

The L.C. Gupta Committee

Report: Some Observations

SUMON KUMAR BHAUMIK

Introduction

. . . human and

technological capital

are of paramount

The previous two issues of Money & Finance highlighted the nature

of financial derivatives, the risks associated with derivatives trading, and

some regulatory measures that can alleviate the risk-related problems

(Bhaumik, 1997b, 1998). To recapitulate, the two papers pointed out the

following:

•

importance in the

context of derivatives

•

trading. These are

necessary to avoid

miscalculations and to

•

bring about market

efficiency which forms

•

the basis of pricing of

a number of

derivatives

instruments.

50

financial derivatives can be used to effectively hedge against

risks associated with volatility of financial variables, but that

these instruments can also be used for speculative purposes;

speculation is an essential ingredient of a liquid financial

market, and the risk of a financial crisis by way of speculative

activity is perhaps overstated because dealers of over-thecounter (OTC) derivatives are careful about the choice of

counterparties and derivatives exchanges mitigate such risks

through use of regulatory provisions like daily marking

portfolios to the market;

standard trading practices like dynamic hedging of positions in

the cash market using, for example, stock index futures

contracts can lead to greater volatility (and hence risk) during

periods of sharp downturn in market sentiments;1 and

most of the major disasters involving financial derivatives have

been consequences of sustained failures in internal monitoring

mechanisms.2

Further, the papers argued that stylised regulatory measures like

capital adequacy of dealers and exchange members, and ad hoc measures

like trading halts are perhaps the best possible way to avoid sudden crises

that can adversely affect liquidity and solvency of the traders, thereby

precipitating systemic problems. They also brought into focus the fact that

human and technological capital are of paramount importance in the

context of derivatives trading. These are necessary to avoid miscalculations

as in the case of Orange County, and to bring about market efficiency which

forms the basis of pricing of a number of derivatives instruments.3

1

See Bhaumik (1998) for a description of the events during the 1987 collapse at

the New York Stock Exchange.

2

The high-profile insolvency of Barings, and the de facto absence of monitoring

of the its Singapore based trader Nick Leeson is a case in point.

3

If a market is efficient then it offers few (and ideally no) arbitrage

opportunities, and this absence of arbitrage opportunities forms the basis for estimation of

“correct” prices of futures contracts.

Since the publication of these papers, the Securities and Exchange

Board of India (SEBI) has gone a long way towards the introduction of

financial derivatives in India. The apex body has accepted the proposals of

the L. C. Gupta Committee, and has decided to introduce derivatives

trading in the form of stock index futures contracts. This decision has been

welcomed by the central government, and these instruments are expected to

make their appearance at the National Stock Exchange (NSE) by the end of

the year. Hence, time is ripe to take a close look at the Gupta Committee

Report Specifically, it would be of interest to see whether the report

recognises the problems associated with trading of financial derivatives in

India, and how it proposes to address these problems within the regulatory

framework.

L. C. Gupta Committee Report

The Findings and the Proposals

The Committee came out strongly in favour of “introduction of

financial derivatives in order to provide the facility for hedging in the most

cost-efficient way against market risk.” More importantly, it recognised the

fact that “the market should ...... have speculators who are prepared to be

counterparties to hedgers,” and that while a market comprising largely of

speculators is unwarranted, “[a] soundly based derivatives market requires

the presence of both hedgers and speculators.” It should be noted that the

Committee restricted the scope of its report to exchange traded derivatives,

thereby leaving out of its purview structured instruments like swaptions.4

The important findings of the Committee include the following:

•

•

of the 112 respondents to the questionnaire sent to brokers and

financial institutions, about 67 per cent favoured the

introduction of stock index futures as the first step towards

introduction of financial derivatives trading in India,5 and

stock index options came a distant second with 39 per cent

support; and

an overwhelming 70 per cent of the respondents viewed

financial derivatives as hedging instruments, the shares those

expressing interests about participation as dealer/ speculator,

broker and option writer being 39 per cent, 64 per cent and

36 per cent respectively.

After taking into consideration the views expressed by the

respondents, as well as experiences of other developed financial markets like

those in the United States, the Committee floated several proposals

pertaining to the regulatory paradigm. These include:

4

A swaption is a combination of a swap and an option. Indian corporates and

banks are familiar with OTC derivatives in the foreign exchange market, by way of trades

involving forward and swap contracts. More complex OTC products involve combinations

of forward and options contracts, and are often known as structured notes. One such note

precipitated the high profile insolvency of Orange County.

5

This is hardly surprising given that 67 out of the 112 respondents to the

Committee’s questionnaire are members of the broking community.

I C R A B U L L E T I N

Money

&

Finance

J U L Y – S E P T. . 1 9 9 8

The committee

recognised the fact

that “the market

should ...... have

speculators who are

prepared to be

counterparties to

hedgers,” and that

while a market

comprising largely of

speculators is

unwarranted, “[a]

soundly based

derivatives market

requires the presence

of both hedgers and

speculators.”

51

I C R A B U L L E T I N

•

Money

&

Finance

J U L Y – S E P T. . 1 9 9 8

•

•

•

•

the development of a two track framework for derivatives

trading comprising of SEBI’s rules and regulations regarding

derivatives exchanges and their members, and the exchanges’

own rules and regulations governing concerning net worth of

members/ traders, amount of security deposits that they would

have to maintain with the exchanges, maintenance of order

books, price bands for each contract, and the maximum

permissible open positions;

use of on-line screen-based systems for all trades in financial

derivatives, and making all rules pertaining to trading,

clearing, settlement, margin maintenance, reporting and

monitoring more stringent than those in the cash market6

[possibly because derivatives trading is more leveraged and

sophisticated and hence inherently more risky];

creation of an independent clearing corporation which will

strictly enforce the rules pertaining to maximum exposure

limit(s), marking of portfolios to the market, and margin

maintenance;

introduction of strict risk disclosure norms governing options

trades between options dealers and their customers, given the

nature of options [which impose contingent liabilities on the

one of the trading parties], and the complexity associated with

the pricing of these products [see Box 1]; and

exposing the traders/brokers to the nature and uses of financial

derivatives through intensive and extensive training

programmes.

The Report at First Glance

It is evident that the Committee has recognised the importance of

technology and prudential norms like capital adequacy and marking to

market in the context of derivatives trading. Further, it has also taken

cognisance of the fact that human capital is a crucial element of this market

and hence the emphases on training programmes for trading participants

and on the gradual phasing in of regulated options trading at a later date.7

Indeed, the Committee has signalled significant conservatism by deciding to

initiate trade in financial derivatives by way of stock index futures which

have several advantages from the regulators’ standpoint:8

52

6

For example, the Committee proposed that all members of derivatives

exchanges and clearing houses, not just 10 per cent of them, should be inspected annually

during the initial years, for verification of their compliance with SEBI and exchangespecific rules.

7

There is an informal and, therefore, unregulated market for options in India. In

this market a call option is known as teji and a put option is known as mandi. The two

strategies that are most often used in this market are the straddle (or bhav-bhav) and the

top vertical combination (or fatak). For details see Endo (1998), p. 159-161.

8

Bhaumik (1997a) has shown that the movements of the market indices

approximate a random walk, and that hence a key precondition for the introduction of

stock index futures has been met.

•

•

•

•

•

stock index futures contracts use equities as the underlying

security, and the institution of the secondary equity market in

India has seen significant improvements during the nineties

with the introduction of screen-based trading, creation of

depositories, and dematerialisation of some of the shares;

the participants in equity trading have had long exposures to

this activity and hence have a fairly good understanding of the

market and, given that stock index futures are fairly simple

financial instruments, they are likely to move up the learning

curve rapidly;

trading in stock index futures does not involve actual delivery

of shares, and obligations by way of outstanding positions are

met through cash settlements, thereby enabling traders to avoid

the problems associated with bad deliveries;

the estimation of daily “gains” and “losses” is easy, and hence

it should not be difficult to mark traders’ portfolios to market

on daily basis; and

there is a significantly long time series of stock prices which

can, in principle, be used to estimate the appropriate margin

requirement with a reasonably high degree of confidence.

In other words, prima facie the Committee has set forth a vision of

a deeper financial market which is implementable and yet cautious about

circumventing the possible pitfalls of trading in exotic financial instruments.

But still dissenting voices both within and outside the Committee have

argued that Indian financial markets are unprepared for the derivatives

instruments. Some of these objections involve technical issues like the

possible tax treatment of profits arising out of derivatives activities and

stamp duty for such trades, and hence lie outside the scope of this

discussion. In any event, these are matters that can easily be addressed

within a short period of time. Similarly, while it can be argued, for

example, that short selling can make cash markets more efficient through

increased (inter-temporal) arbitrage opportunities, and that hence it is an

essential precondition of derivatives trading, such issues can, in principle, be

addressed within a relatively short period of time.

Further, while it is difficult to be optimistic about the possibility of

an alleviating impact of stock index futures (and the options products) on

the sentiments prevailing in the secondary equity market, this is hardly a

relevant issue. As correctly mentioned in the Committee’s report, financial

derivatives are instruments which have evolved as a consequence of the

perceived need for hedging exposures in various markets. They provide

depth and liquidity to the markets and hence encourage trading. But they

are not the primary determinants of market sentiments; such sentiments are

determined by economic and political signals. Hence the expected impact of

such instruments on market sentiments cannot be the basis for determining

whether or not they should be introduced in a financial market.

However, there are other issues which require more thought and a

I C R A B U L L E T I N

Money

&

Finance

J U L Y – S E P T. . 1 9 9 8

. . . financial

derivatives are

instruments which

have evolved as a

consequence of the

perceived need for

hedging exposures in

various markets. They

provide depth and

liquidity to the markets

and hence encourage

trading. But they are

not the primary

determinants of market

sentiments; such

sentiments are

determined by

economic and political

signals.

53

I C R A B U L L E T I N

Money

&

Finance

J U L Y – S E P T. . 1 9 9 8

. . . a country with

volatile inflation rate

and (international)

capital flows is much

more in need of

interest rate derivatives

products than stock

index futures

contracts.10 This

argument can be

closer look. Specifically, there are two questions that beg satisfactory

responses.9 First, given that derivatives exchanges would have to work in

harmony with other institutions in the financial market, will the setting up

of an efficiently functioning derivatives exchange necessarily ensure the

avoidance of major systemic crises? Second, given the reasonable

assumption that other forms of derivatives products will enter the market

once trading in stock index futures becomes established, will the Indian

trading community ready for the more exotic varieties of these products in

the short to medium run?

Although the former question is perhaps more relevant in the short

run, the importance of the latter question is paramount. As argued by

Bhaumik (1998), a country with volatile inflation rate and (international)

capital flows is much more in need of interest rate derivatives products than

stock index futures contracts.10 This argument can be extended to the

currency market where cost-efficient hedging in the face of currency

volatility might require the introduction of products like path-dependent

options [see Box 2].11 However, such products are more complex and

require a higher level of human capital than plain vanilla products like

stock index futures. Indeed, human capital is important not only from the

traders’ perspective but also from the perspective of the regulators who

would have to understand the nature and magnitude of the risks associated

with the products in order to be able to determine prudential norms like

margin and capital requirements (Estrella et al., 1994). It is important to

verify, therefore, whether the Committee, which has acknowledged the

operational complexity of options, has envisaged a way in which the human

capital of those involved with derivatives trading can be improved.

extended to the

currency market . . .

However, such

products are more

complex and require a

higher level of human

capital than plain

vanilla products like

stock index futures.

54

9

At this point, it is extremely tempting to get into a discussion about the merits

and demerits of stock index futures vis a vis the badla. However, at the outset one has to

recognise the fact that, by their very nature, the two instruments are very different. The

badla allows an investor to postpone taking delivery of one or more listed scrips, subject to

some margin requirements [for details, see Endo, 1998, p. 107-112]. In other words, badla

trading allows investors to take quasi-forward positions on individual scrips and provides

for flexibility by allowing the investors to postpone settlement up to a maximum of 90

days. On the other hand, stock index futures contracts allow investors to bet on the market

movement and, in the process, helps avoid problems associated with volatility in prices of

individual stocks. More importantly, we should take into cognisance the fact that the

Gupta Committee Report is not about the introduction of stock index futures per se but

addresses the broader issue of introduction of financial futures in India, the scope of such

financial instruments being far wider than that of stock index futures alone.

10

International capital flows affect the liquidity of the banks, and might also

affect the money supply by way of changes in the reserve or high powered money. Both

these, in turn, affect interest rates in an economy where such rates are market determined.

It is hardly surprising that both in the options and futures markets interest rate products

contribute to the lion’s share of outstanding notional capitals.

11

Some of these products like knock out options are such that the options expire

once the exchange rate exceeds or falls below some pre-determined value (Malz, 1993).

Since there is a higher probability, vis a vis standard American and European options, that

these products would expire unused, their prices are lower than those of standard options.

Hence, they are more cost efficient from a hedger’s point of view.

The Report Revisited

At the outset, let us take a look at the institutional requirements that

can be deemed important for smooth functioning of derivatives markets

when the product concerned is stock index futures contracts. As discussed in

Bhaumik (1998), effective enforcement of margin requirements is an

important precondition for avoidance of a derivatives-market-initiated

systemic crisis. This, in turn, requires daily settlement of margin calls by

traders and, by extension, brings into focus the ability of the traders to meet

their obligations on a daily basis.12 The Committee has recognised the

importance of a trader’s ability to pay, and has recommended that each

trader should have some minimum recommended net worth, and should be

subjected to payment of a security deposit. It has also recommended the

establishment of a margin requirement and the marking of portfolios to the

market on a daily basis.13 Finally, it has recommended that each clearing

member be subjected to the dual requirements of net worth of Rs. 300 crore

and a deposit of a minimum of Rs. 50 lakhs with the derivatives exchange

or the clearing corporation.14

However, while appropriate laws facilitate the prevention of

systemic crises arising out of payments related problems, they require the

support of infrastructure related to transfer of funds. Indeed, unless funds can

be transferred from the traders’ and/or the clearing members’ bank accounts

to the accounts of the clearing house every trading day, marking portfolios

to the market and margin calls might not act as effective checks for systemic

problems. Can, therefore, the Indian derivatives market(s) depend on sameday funds transfer facilities? The National Stock Exchange (NSE), which is

likely to play a pioneering role in the introduction of stock index futures

(and possibly other derivatives products) in India, is indeed in a position to

enforce same day settlement of margin requirements. The exchange has

operational relationships with three banks—Canara Bank, HDFC Bank, and

I C R A B U L L E T I N

Money

&

Finance

J U L Y – S E P T. . 1 9 9 8

. . . unless funds can

be transferred from the

traders’ and/or the

clearing members’

bank accounts to the

accounts of the

clearing house every

trading day, marking

portfolios to the

market and margin

calls might not act as

effective checks for

12

Note that if a trader loses money on a sustained basis, and hence faces margin

calls every day, then it should act as a signal that (s)he has taken positions in the

derivatives market that are inimical to the financial health of the firms/funds/individuals

on whose behalf (s)he has taken such positions. Thereafter, it is the responsibility of these

firms/funds/individuals to force the trader to reverse or liquidate his/her positions. In the

absence of such market discipline, a trader might continue to maintain a loss-making

position over a long period and thereby precipitate a systemic problem of significant

dimensions. A case in point, once again, is the insolvency of Barings by the hands of Nick

Leeson.

13

Note that the margin requirement implicitly establishes an upper limit for the

exposure of each trader in the derivatives market. The Committee took cognisance of the

inadequacy of a minimum net worth based criterion in the Indian context, and hence felt

that it was necessary to juxtapose the net worth based criterion with the margin

requirement for an effective prevention of systemic crises.

14

In the words of the Committee, a clearing member is one “who is admitted by

the Clearing Corporation and who may clear and settle transactions either on their own

account or on account of their client [or on account of other trading members] in the

manner prescribed in [the] bye-laws.” Given that the clearing corporation will be a

counterparty to all traders in the derivatives market, it is evident that in the event of a

default by a trading member of the derivatives exchange, the financial burden associated

with the defaulting member’s position(s) has to be borne by the clearing members. Hence,

their solvency is a matter of extreme importance.

systemic problems.

55

I C R A B U L L E T I N

Money

&

Finance

J U L Y – S E P T. . 1 9 9 8

While prices of

standard derivatives

products are stylised

and can hence be

obtained off-theshelves, the use of the

products for both

hedging and

speculation require an

understanding of both

sophisticated

mathematics and

strategies, . . .

56

Global Trust Bank—which help the exchange to settle trades in the cash

market that are routed through the National Securities Clearing Corporation

Limited (NSCCL).15 In other words, the existing institutional set up allows

effective use of the practice of marking portfolios to market, and margin

requirements, to mitigate potential systemic problems arising out of

positions taken by traders in the derivatives market.

The ability of human capital to rapidly adapt to the financial

innovation that is implicit in derivatives trading is less apparent, and is

more likely to pose a problem in the medium to long run if more

sophisticated derivatives products are introduced. While prices of standard

derivatives products are stylised and can hence be obtained off-the-shelves,

the use of the products for both hedging and speculation require an

understanding of both sophisticated mathematics and strategies, 16 and

anecdotal evidence suggests that such understanding is not wide-spread

among Indian financial professionals.17

Taking a step in the right direction, therefore, the Committee has

recognised this lacuna in the Indian trading community and the end-users of

derivatives products, and has suggested that (i) all approved users of

derivatives terminals should compulsorily undergo training prior to the

initiation of trading in such instruments, and should pass a SEBI-approved

certification program; and (ii) all brokers-dealers of relatively complex

instruments should compulsorily obtain and verify information about the net

worth of their customers, as well as their investment related experience, and

should offer investors an explanation about the nature of the products and

the risks associated with them. It has further suggested that investors should

not be allowed to open, for example, options positions if it is felt that (s)he

would subsequently not be able to evaluate the related risks and bear the

financial consequences of the market movements. It can be argued that it is

15

As highlighted in the NSE’s information brochures, “[t]he clearing members

may maintain accounts with any one of the clearing banks at their designated branches

through which settlement transactions are processed. The banks are electronically

connected to the NSCCL and electronic funds transfer is effected for pay-in and pay-out

on the instruction of the NSCCL.”

16

For example, a simple strategy might involve the use of options and holding

cash (or cash equivalents like T-bills) to meet obligations if the options are exercised. How

can the extent of cash requirement be determined? The simplest rule involving the

determination of such capital requirement involve the use of the delta equivalent rule.

“[C]onsider a portfolio consisting of a $100 long position in the underlying asset, and a

written call option on $100 of the asset. If the delta of the option were to equal 0.25, then

the delta of the portfolio is 0.75 (the written call has a negative delta of 0.25 and the

underlying has a delta of 1, where both are weighted equally since the underlying amount

is the same for each position). Assuming [that] a three standard deviation confidence

interval for the capital rule represents a $20 change in the price of the underlying asset, the

capital charge is $15, ($15 = 0.75 x $20) (Estrella et al., 1994, p. 9).” While the estimation

of delta itself is a non-trivial process, the mathematics gets more complicated if one takes

into consideration the need for additional capital to hedge against volatility risk.

17

It has, for example, been pointed out that Indian traders/investors routinely

misprice warrants in the secondary market, warrants essentially being American call

options written (and often bundled with other securities) by companies listed in various

stock exchanges. {See Are we ready for derivatives? by Samir Barua, Business Standard,

May 25, 1998.)

difficult, and perhaps impossible, to ascertain whether the dealers-brokers

would honestly implement these norms, even if they are enshrined in the

bye-laws of the derivatives exchange. However, the risk of dishonesty

among one or more brokers-dealers is a possibility in all markets, and the

best an exchange and a supervisory body like the SEBI can do is to ensure

that such an act does not go unpunished, and that the traders, investors and

clearing members are financially capable of absorbing the loss(es) arising

out of such indiscretion. The onus of understanding the nature of the

instruments and their appropriate uses, as well as the monitoring of the

activities of in-house traders, lies with the individual and institutional

investors, and rightly so.

I C R A B U L L E T I N

Money

&

Finance

J U L Y – S E P T. . 1 9 9 8

Concluding Remarks

There has been a sustained debate (reportedly) both within and

outside the Committee about the efficacy of the use of derivatives in India.

The nature of the debate has ranged from the ludicrous—suggestions that

financial derivatives are superfluous because of the existence of the badla—

to the more credible stance that the Indian institutional set up might not be

adequate for sophisticated instruments like derivatives. As discussed in the

previous sections, neither the institutional framework nor the degree of

sophistication of human capital is likely to be the limiting factor in so far as

trade in plain vanilla derivatives products is concerned, especially if

standardised and exchange traded and products are used during the initial

years of such trade in India.

Indeed, an important aspect of the Committee’s report, one that is

surprisingly not highlighted, is that it restricts the discussion of financial

derivatives to those that are standardised and exchange traded. This is

extremely important in so far as human capital development and systemic

risk management is concerned. It is obvious that it would be easier for

traders, investors and brokers to move up the learning curve is standardised

products are traded in the derivatives market, thereby enabling them to

learn from market trends as well as experiences of their own and those of

others.18 Further, the existence of an exchange and a clearing corporation,

along with prudential norms like marking portfolios to market, margin

requirements, maximum exposure, security deposits, and minimum net

worth of trading and clearing members, render it easier to mitigate systemic

problems by way of early detection. Indeed, with the notable exception of

the Barings fiasco, high profile derivatives related crises like those related to

Procter and Gamble, and Orange County have typically been associated

with OTC derivatives, primarily because OTC products typically combine

attributes of several derivatives instruments and are, therefore, more

complex than their exchange traded counterparts.19

. . . an important

aspect of the

Committee’s report,

one is that it restricts

the discussion of

financial derivatives to

those that are

standardised and

exchange traded.

18

This idea, formalised by Adam Smith, is as old as human civilisation, and

merely suggests that an individual can be made to enhance his/her productivity and

efficiency by making him/her use an instrument repeatedly.

19

Moreover, dealers of OTC products are usually banks and hence defaults and

payments problems related to such products can get transformed into systemic problems

much faster than those related to exchange traded derivatives.

57

I C R A B U L L E T I N

Money

&

Finance

J U L Y – S E P T. . 1 9 9 8

At the end of the day, one has to take note of the fact that while

these products pose a challenge to the combined ability and the creativity of

both the finance professionals and the regulators, they add depth to the

financial market through their potential for facilitating both hedging and

speculation. Individually, and in some cases together, they would have to

rise to the challenge by way of developing the skills and regulatory

institutions required for efficient functioning of derivatives markets. The

importance of the development of institutions and human capital cannot and

should not be overlooked, but the process of progressive policy making

cannot wait indefinitely for the market players in emerging economies to

catch up with the skills and intuitions of their counterparts in the more

developed financial markets. Liberalisation, after all, is not a process

whereby the powers that be wait for behavioural and institutional changes

before they change the parameters of a system. Rather, it is a process

whereby they change the parameters, and create institutions, such that the

resultant change in the behaviour of the economic agents paves the way for

a better future.

References

Bhaumik, S. K., “Stock Index Futures in India: Does the Market Justify its Use?”

Economic and Political Weekly, XXXII(41): 2608-2611, 1997a.

______, “Financial Derivatives I: A Bird’s Eye View of the Products,” Money &

Finance, December, 45-71, 1997b.

______, “Financial Derivatives II: The Risks and Their Regulation,” Money &

Finance, April, 42-62, 1998.

Endo, T., The Indian Securities Market: A Guide for Foreign and Domestic

Investors, Vision Books, 1998.

Estrella, A. et al., “Options Positions: Risk Management and Capital

Requirements,” Federal Reserve Bank of New York Research Paper, No. 9415, 1994.

Malz, A. M., “New Varieties of Foreign Currency Options,” Federal Reserve

Bank of New York Research Paper, No. 9331, 1993.

Securities and Exchange Board of India, L. C. Gupta Committee Report,

SEBI Web Site (in html format), 1998.

58

I C R A B U L L E T I N

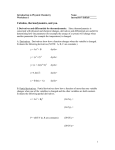

BOX 1: Options Pricing

The most widely used formula for computation of options prices was developed by

Fischer Black and Myron Scholes in 1973. According to the Black-Scholes formula, the

price of an European call option (C) is given by

C = S 0 N ( d1 ) − Xe − rT N ( d 2 )

when

d1 =

Money

&

Finance

J U L Y – S E P T. . 1 9 9 8

ln( S 0 / X ) + ( r + σ 2 / 2)T

σ T

and

d 2 = d1 − σ T

The interpretation of the symbols are as follows:

S0

=

current price of the security

N(d) =

the probability that a number drawn randomly from standard normal

distribution will have value less than d

X

=

exercise or strike price of the option

r

=

the annualised continuously compounded rate on a safe asset with the

same maturity as that of the option

T

=

time to maturity of option expressed in years

s

=

standard deviation of the annualised continuously compounded rate of

return of the security

The symbols e and ln have their usual meaning, i.e., e is equal to 2.718, and ln refers to

the natural logarithm of some numerical value.

The price of the corresponding European put option can be estimated using the put-call

parity relationship which argues that in an efficient market the payoff from a strategy

which involves purchasing a security (of value S0) and a put option (priced as P) should

equal the payoff from that which involves purchasing a call option (prices as C) and

holding the required amount of money (ST) in the form of a risk-free and liquid asset

(yielding rf rate of return). Hence, if the time to maturity of the call and the put options is

T then the put-call parity relationship is given by

C+

ST

= S0 + P

(1+ rf ) T

Apart from the advantages usually associated with a closed-form solution, the above

formula/ algorithm has another major advantage. The hedge ratio or delta, the use of

which was explained in some detail in Bhaumik (1997b), can easily be obtained from the

Black-Scholes formulation. The delta for a call option is given by N(d1) and that for a put

option is given by [N(d1) - 1]. Since hedging using options requires extensive and

continual use of the delta, the Black-Scholes model can be of substantial advantage to

options traders and fund managers.

Source: Z. Bodie, A. Kane and A. Marcus, Investments, Irwin, 1993.

59

I C R A B U L L E T I N

Money

&

Finance

J U L Y – S E P T. . 1 9 9 8

Box 2: Path Dependent Options

The increased sophistication of the global financial markets has seen yet another

manifestation in the form of the so-called path dependent options. The three most common

varieties of path dependent options are average rate options, barrier options and lookback

options. Unlike standard European options, whose payoffs depend on, among other

things, the strike price and the spot price on the strike date, the payoffs for the path

dependent options depend on the relationship between the strike price and some function

of the current and/or historical spot prices. The computation of their prices/premia,

therefore, involve mathematical formulations that are more complicated than the simple

Black-Scholes variety.

Average rate options, which are strictly European in nature, yield a payoff which is a

function of a pre-determined strike price and some average of the price of the underlying

asset computed during some period that precedes the strike date. In the simplest of

averate rate options, the aforementioned time period could span the entire lifespan of the

option. Alternatively, it could be some pre-determined sub-period with the sampling

frequency varying from daily to monthly. It is easily seen that the volatility of the average

of the spot price of an underlying asset would be much less than the volatility of the spot

price itself. Hence, given the nature of the Black-Scholes formulation, the price/premia for

an average rate option would be lower, and this is an important reason behind the rising

popularity of the option. Part of the popularity can also be explained by the fact that an

average rate option can act as a cubstitute for an European strip for which a liquid market

may be non-existent.

An even more exotic form of path dependent option is the barrier option which is another

low (up front) cost hedging instrument in the foreign exchange market. A barrier option

belongs to two broad categories: it either gets activated or stands canceled if the price of

the underlying asset exceeds or falls below some pre-determined level. These are popularly

known as knock-in and knock-out options respectively. For example, an up-and-out option

is one which stands canceled if the price of the undrelying asset increases beyond some

pre-determined level. As with the average rate options, the sampling frequencies of the

underlying asset price, which determines whether an option is knocked in or knocked out,

are contract specific. Further, given that a barrier option might never be knocked in or

might be knocked out, the price of such an option is lower than the simple European

variety, thereby contributing to its popularity. The problem with barrier options, however,

is that if it is not in force on maturity then a significant proportion of an investor’s portfolio

might remain unhedged.

Finally, lookback options are designed such that the payoff for one such option is a

function of the difference between the price of the underlying asset at expiration and the

lowest price prevailing during some pre-determined period prior to the strike date.

Alternatively, a lookback option can yield a payoff that is a function of some strike price

and the aforementioned lowest price. It is evident that, on the average, a lookback option

yields a higher payoff than a simple European option of otherwise similar specifications,

and hence such options are more expensive than their plain vanilla counterparts.

60