ABSTRACT ESSAYS ON UNIFORM PRICE AUCTIONS Mat´ıas Herrera Dappe Doctor of Philosophy, 2009

... be expected to be low, which tends to have a negative effect on expected revenues. For this reason, the seller might prefer a single auction over a sequence of auctions to keep transaction costs low. In the event that bidders face budget or borrowing constraints a single auction might limit the quan ...

... be expected to be low, which tends to have a negative effect on expected revenues. For this reason, the seller might prefer a single auction over a sequence of auctions to keep transaction costs low. In the event that bidders face budget or borrowing constraints a single auction might limit the quan ...

Chen_uta_2502D_12115

... likely to drop with trades. On the other hand, if investors trade because they do not agree with each other about asset prices, asset prices are less likely to converge and may be oscillating. Thus, volatilities will increase with trading volume. Of all the potential explanations for reasons of tra ...

... likely to drop with trades. On the other hand, if investors trade because they do not agree with each other about asset prices, asset prices are less likely to converge and may be oscillating. Thus, volatilities will increase with trading volume. Of all the potential explanations for reasons of tra ...

“Audit and Non-audit Fees inGermany – Impact of Audit Market

... ‘small’ audit client segment is highly competitive because the number of potential suppliers is relatively large compared to the ‘large’ audit client segment, whereas the ‘large’ audit client segment is less competitive because the number of potential suppliers is usually restricted to the Big X, cu ...

... ‘small’ audit client segment is highly competitive because the number of potential suppliers is relatively large compared to the ‘large’ audit client segment, whereas the ‘large’ audit client segment is less competitive because the number of potential suppliers is usually restricted to the Big X, cu ...

Causes and Consequences of Margin Levels in Futures Markets

... I use a novel data set on margin requirements, obtained through a Freedom of Information Act request, for 16 commodity futures contracts over the period 2000–2011 to explore how margins are set and to test the existing theories on the implications of changing margin levels. Margins are important fo ...

... I use a novel data set on margin requirements, obtained through a Freedom of Information Act request, for 16 commodity futures contracts over the period 2000–2011 to explore how margins are set and to test the existing theories on the implications of changing margin levels. Margins are important fo ...

Why do foreign firms leave US equity markets?

... exchange listings were affected adversely by SOX at all seems to depend on the benchmark used. For some benchmarks, there is a negative wealth effect of SOX for foreign listed firms as well as for deregistering firms, but for other benchmarks there is no such effect. A reasonable assessment of the ...

... exchange listings were affected adversely by SOX at all seems to depend on the benchmark used. For some benchmarks, there is a negative wealth effect of SOX for foreign listed firms as well as for deregistering firms, but for other benchmarks there is no such effect. A reasonable assessment of the ...

Bid-ask spread components on the foreign exchange market: The

... This thesis is written in order to obtain my second master’s degree in Business Engineering with a major in Finance. The subject was chosen because it had so many different elements in it which could provide me with the necessary variation during the whole period I worked on it and because I have a ...

... This thesis is written in order to obtain my second master’s degree in Business Engineering with a major in Finance. The subject was chosen because it had so many different elements in it which could provide me with the necessary variation during the whole period I worked on it and because I have a ...

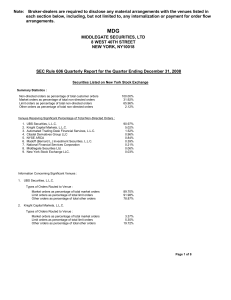

Note: Broker-dealers are required to disclose any material

... Note: Broker-dealers are required to disclose any material arrangements with the venues listed in each section below, including, but not limited to, any internalization or payment for order flow arrangements. ...

... Note: Broker-dealers are required to disclose any material arrangements with the venues listed in each section below, including, but not limited to, any internalization or payment for order flow arrangements. ...

Quantitative Easing and Volatility Spillovers across

... global financial system has increased. More importantly, we find that US quantitative easing is the primary driver of volatility spillovers from the US to the rest of the world: it alone can explain 40% to 55% of variation in spillover. The addition of US short rate and currency factors increases ex ...

... global financial system has increased. More importantly, we find that US quantitative easing is the primary driver of volatility spillovers from the US to the rest of the world: it alone can explain 40% to 55% of variation in spillover. The addition of US short rate and currency factors increases ex ...

Predicting Returns and Volatilities with Ultra

... http://gsbwww.uchicago.edu/fac/jeffrey.russell/research/ http://weber.ucsd.edu/~mbacci/engle/ ...

... http://gsbwww.uchicago.edu/fac/jeffrey.russell/research/ http://weber.ucsd.edu/~mbacci/engle/ ...

The Impact of Hidden Liquidity in Limit Order Books

... Many limit order markets use a market design that allows traders to submit hidden liquidity. The option to submit hidden liquidity alongside the visible liquidity makes the strategic interaction between different market participants more complicated and raises a number of questions. To what extent c ...

... Many limit order markets use a market design that allows traders to submit hidden liquidity. The option to submit hidden liquidity alongside the visible liquidity makes the strategic interaction between different market participants more complicated and raises a number of questions. To what extent c ...

Page 1 of 5 Q1 2017 100.00% 95.64% 3.93% 0.43% 90.72

... UBS Financial Services Inc. has prepared this report pursuant to a U.S. Securities and Exchange Commission rule requiring all brokerage firms to make publicly available quarterly reports on their order routing practices. The report provides information on the routing of “non-directed orders” – any o ...

... UBS Financial Services Inc. has prepared this report pursuant to a U.S. Securities and Exchange Commission rule requiring all brokerage firms to make publicly available quarterly reports on their order routing practices. The report provides information on the routing of “non-directed orders” – any o ...

Make and Take Fees in the US Equity Market

... traders change their quotes such that the effect of the fee is completely offset. Alternatively, Colliard and Foucault (2012) show that an increase in the total fee can be associated with increased trading activity due to heterogeneous patience across investors. With a fee increase, patient investo ...

... traders change their quotes such that the effect of the fee is completely offset. Alternatively, Colliard and Foucault (2012) show that an increase in the total fee can be associated with increased trading activity due to heterogeneous patience across investors. With a fee increase, patient investo ...

Portfolio Performance, Discount Dynamics, and the Turnover of Closed-End Fund Mangers

... market. In principle, the fund’s board of directors can fire a manager (and the management company) by terminating the management contract with the management company. In practice the probability of such actions is close to zero since board directors usually have close relationships with the manage ...

... market. In principle, the fund’s board of directors can fire a manager (and the management company) by terminating the management contract with the management company. In practice the probability of such actions is close to zero since board directors usually have close relationships with the manage ...

Determinants of market reactions to restatement announcements

... reports qualified for uncertainties, higher debt, fewer income-increasing GAAP alternatives, and more diffuse ownership. Other concurrent research provides descriptive data on restating companies and restatement characteristics. For example, based on a sample of both earning announcement revisions an ...

... reports qualified for uncertainties, higher debt, fewer income-increasing GAAP alternatives, and more diffuse ownership. Other concurrent research provides descriptive data on restating companies and restatement characteristics. For example, based on a sample of both earning announcement revisions an ...

Speculation and Risk Sharing with New Financial Assets

... diversi…cation and the sharing of risks.1 However, this view does not take into account that new assets are often associated with much uncertainty, especially because they do not have a long track record. Belief disagreements come as a natural by-product of this uncertainty and change the implicatio ...

... diversi…cation and the sharing of risks.1 However, this view does not take into account that new assets are often associated with much uncertainty, especially because they do not have a long track record. Belief disagreements come as a natural by-product of this uncertainty and change the implicatio ...

Dark pools in European equity markets

... orders to buy or sell at different prices. Dark pools have grown in response to investors’ demands for protection against information leakage in a rapidly changing trading environment. Regulation making more pre-trade transparency mandatory on the majority of European equity trading venues (MiFID I) ...

... orders to buy or sell at different prices. Dark pools have grown in response to investors’ demands for protection against information leakage in a rapidly changing trading environment. Regulation making more pre-trade transparency mandatory on the majority of European equity trading venues (MiFID I) ...

Growth Options, Limited Risk Sharing, and Asset Prices

... assets associated with innovations such as blueprints and research and development (R&D) projects. The investment decision is an option that the firm exercises optimally only when it receives an investment opportunity. Their investment opportunities arrive randomly over time and are subject to firm- ...

... assets associated with innovations such as blueprints and research and development (R&D) projects. The investment decision is an option that the firm exercises optimally only when it receives an investment opportunity. Their investment opportunities arrive randomly over time and are subject to firm- ...

Trading Volume Reaction to the Earnings Reconciliation from IFRS

... accounting, the value-relevance literature’s reported associations between accounting numbers and common equity valuations have limited implications or inferences for standard setting: they are mere associations.” On the contrary, the short-term reaction study of trading volume enables us to directl ...

... accounting, the value-relevance literature’s reported associations between accounting numbers and common equity valuations have limited implications or inferences for standard setting: they are mere associations.” On the contrary, the short-term reaction study of trading volume enables us to directl ...

Decimalization, trading costs, and information transmission between

... the effect of an increase in tick size of S&P 500 futures. They find increases in the S&P 500 futures bid–ask spreads, but the spreads remain low relative to those of S&P 500 ETFs, which is consistent with the empirical results here. DeJong and Donders (1998) examine the relations between futures, o ...

... the effect of an increase in tick size of S&P 500 futures. They find increases in the S&P 500 futures bid–ask spreads, but the spreads remain low relative to those of S&P 500 ETFs, which is consistent with the empirical results here. DeJong and Donders (1998) examine the relations between futures, o ...

2 - Goethe-Universität

... the securities markets (bonds, and stocks). • An investor will only pay a price that reflects the average quality of firms. • Bad firms are happy to take loans from investors. • Good firms are not willing to borrow on this market. ...

... the securities markets (bonds, and stocks). • An investor will only pay a price that reflects the average quality of firms. • Bad firms are happy to take loans from investors. • Good firms are not willing to borrow on this market. ...

Do retail traders suffer from high frequency traders?

... spread, which is a standard measure of market quality, would not help those that switch from (better priced) limit orders to market orders. Moreover, if the crowding-out phenomenon disproportionately affects a particular group of traders, such as unsophisticated retail traders, then one may worry th ...

... spread, which is a standard measure of market quality, would not help those that switch from (better priced) limit orders to market orders. Moreover, if the crowding-out phenomenon disproportionately affects a particular group of traders, such as unsophisticated retail traders, then one may worry th ...

Stock Splits, Liquidity and Limit Orders

... We find that daily share volume decreases by about 9% following a stock split. This result is consistent with Copeland (1979), Lamoureux and Poon (1987) though it differs from Desai, Nimalendran and Venkataraman (1998), who find no significant change. We find no evidence, however, of a change in to ...

... We find that daily share volume decreases by about 9% following a stock split. This result is consistent with Copeland (1979), Lamoureux and Poon (1987) though it differs from Desai, Nimalendran and Venkataraman (1998), who find no significant change. We find no evidence, however, of a change in to ...

Financial System Risk and Flight to Quality

... of the Fall of 1998 beginning with the Russian default and ending with the bailout of LTCM; as well as the events that followed the attacks of 9/11. Behind each of these episodes lies the specter of a meltdown that may lead to a prolonged slowdown as in Japan during the 1990s, or even a catastrophe ...

... of the Fall of 1998 beginning with the Russian default and ending with the bailout of LTCM; as well as the events that followed the attacks of 9/11. Behind each of these episodes lies the specter of a meltdown that may lead to a prolonged slowdown as in Japan during the 1990s, or even a catastrophe ...

Hedging With Futures Contract

... been criticized for not taking into account the expected return which is inconsistent with the mean-variance framework. Since the selection of a hedge ratio is dependent on the hedgers’ objective in the hedging position, this will be different for various participants in the carbon market. For exam ...

... been criticized for not taking into account the expected return which is inconsistent with the mean-variance framework. Since the selection of a hedge ratio is dependent on the hedgers’ objective in the hedging position, this will be different for various participants in the carbon market. For exam ...

Quote Stuffing - Mississippi State University`s College of Business

... sample includes all trades and quotes for NYSE- and NASDAQ-listed stocks for all trading days in 2010. We apply conventional filters to TAQ, excluding trades and quotes that are coded as having an error or a correction, or are reported out of time sequence. In addition, we omit a quote if the bid is ...

... sample includes all trades and quotes for NYSE- and NASDAQ-listed stocks for all trading days in 2010. We apply conventional filters to TAQ, excluding trades and quotes that are coded as having an error or a correction, or are reported out of time sequence. In addition, we omit a quote if the bid is ...