NBER WORKING PAPER SERIES A MARKET BASED SOLUTION TO PRICE EXTERNALITIES:

... incentive comparability constraints. More generally, an agent’s required rights to trade can be defined by excess demand functions for relevant commodities, which are again functions of his endowments, his choice of trades, and the specific target price. A key take away from our approach is that we ...

... incentive comparability constraints. More generally, an agent’s required rights to trade can be defined by excess demand functions for relevant commodities, which are again functions of his endowments, his choice of trades, and the specific target price. A key take away from our approach is that we ...

Financial Instability Revisited: The Economics of Disaster

... third is the acceptance by lenders of assets that previously would have been considered as low-yield--when the yield is adjusted to allow for the risks borne by the asset acquirer (lenderfs risk).—' These concepts can be made more precise. ...

... third is the acceptance by lenders of assets that previously would have been considered as low-yield--when the yield is adjusted to allow for the risks borne by the asset acquirer (lenderfs risk).—' These concepts can be made more precise. ...

making agricultural market systems work for the poor

... (iv) perhaps most important of all, markets require money, which is not only an essential condition for wider exchange, but also the critical medium for savings, loans and investment; (v) coordination costs are different and include macroeconomic management to maintain the value of money and a polic ...

... (iv) perhaps most important of all, markets require money, which is not only an essential condition for wider exchange, but also the critical medium for savings, loans and investment; (v) coordination costs are different and include macroeconomic management to maintain the value of money and a polic ...

Market Design with Blockchain Technology

... of other traders; most of these are small and accept the large investor’s offer with some positive probability. The other large trader is one of many in the continuum and is thus contacted with probability zero. Trades between the investors here occur at the funda7 ...

... of other traders; most of these are small and accept the large investor’s offer with some positive probability. The other large trader is one of many in the continuum and is thus contacted with probability zero. Trades between the investors here occur at the funda7 ...

The Round-the-Clock Market for US Treasury Securities

... he U.S. Treasury securities market is one of the most important financial markets in the world. Treasury bills, notes, and bonds are issued by the federal government in the primary market to finance its budget deficits and meet its short-term cash-management needs. In the secondary market, the Feder ...

... he U.S. Treasury securities market is one of the most important financial markets in the world. Treasury bills, notes, and bonds are issued by the federal government in the primary market to finance its budget deficits and meet its short-term cash-management needs. In the secondary market, the Feder ...

Hedge Funds and the Technology Bubble

... clients. It is perceivable however, that hedge fund managers could deliberately induce bubbles in some individual stocks. Our data provides some examples that are at least suggestive of that. Furthermore, Ofek and Richardson (2001) argue that arbitrageurs might be unable to exploit some mispricing, ...

... clients. It is perceivable however, that hedge fund managers could deliberately induce bubbles in some individual stocks. Our data provides some examples that are at least suggestive of that. Furthermore, Ofek and Richardson (2001) argue that arbitrageurs might be unable to exploit some mispricing, ...

competition tribunal of south africa

... 11) Although the combined market share post the transaction is high the effect of the transaction in South Africa would be minimal for the following reasons: 1) The price of nickel is benchmarked to the London Metal Exchange and nickel producers are generally price takers. 2) The only customer of ni ...

... 11) Although the combined market share post the transaction is high the effect of the transaction in South Africa would be minimal for the following reasons: 1) The price of nickel is benchmarked to the London Metal Exchange and nickel producers are generally price takers. 2) The only customer of ni ...

Weather, Stock Returns, and the Impact of Localized Trading Behavior

... suggest that individual investors are more likely to deviate from rational valuation of securities than are institutional investors. Despite the power of our tests, we find almost no relation between local cloud cover and stock returns, even after adjusting for market returns. This paper contributes ...

... suggest that individual investors are more likely to deviate from rational valuation of securities than are institutional investors. Despite the power of our tests, we find almost no relation between local cloud cover and stock returns, even after adjusting for market returns. This paper contributes ...

PART V - Georgia College & State University

... ownership of the underlying assets at the time the contract is initiated. A derivative represents an agreement to transfer ownership of underlying assets at a specific place, price, and time specified in the contract. Its value (or price) depends on the value of the underlying assets. The underlying ...

... ownership of the underlying assets at the time the contract is initiated. A derivative represents an agreement to transfer ownership of underlying assets at a specific place, price, and time specified in the contract. Its value (or price) depends on the value of the underlying assets. The underlying ...

does anonymity matter in electronic limit order markets?1

... In the last decade, the security industry has witnessed a proliferation of electronic trading systems. Several of these new trading venues (e.g. Island for equity markets, Reuters D2000-2 for the foreign exchange market or MTS in bond markets) are organized as limit order markets where traders can e ...

... In the last decade, the security industry has witnessed a proliferation of electronic trading systems. Several of these new trading venues (e.g. Island for equity markets, Reuters D2000-2 for the foreign exchange market or MTS in bond markets) are organized as limit order markets where traders can e ...

An Empirical Analysis of the Limit Order Book and the Order

... market is computerized and centralized, and 4) the market is very transparent, so that agents can use detailed information about the order book in their order placement strategies.1 The recency of the availability of order flow data as well as its richness and complexity make it necessary to design ...

... market is computerized and centralized, and 4) the market is very transparent, so that agents can use detailed information about the order book in their order placement strategies.1 The recency of the availability of order flow data as well as its richness and complexity make it necessary to design ...

Chapter 2 Securities Markets and Transactions

... • It describes the key aspects of the securities to be issued , the issuer’s management, and the issuer’s financial position. • While waiting for the registration statement SEC’s approval , investors may receive a preliminary prospectus, this version is called red herring because a notice printed in ...

... • It describes the key aspects of the securities to be issued , the issuer’s management, and the issuer’s financial position. • While waiting for the registration statement SEC’s approval , investors may receive a preliminary prospectus, this version is called red herring because a notice printed in ...

Factors Determining the Price of Butter

... Despite the small share of the nation's butter bought and sold through the Exchanges, the trade has a strong interest in seeing that Exchange prices properly reflect supply and demand. Nearly all butter purchase and sales agreements are based on exchange quotations. Exchange prices are quoted by two ...

... Despite the small share of the nation's butter bought and sold through the Exchanges, the trade has a strong interest in seeing that Exchange prices properly reflect supply and demand. Nearly all butter purchase and sales agreements are based on exchange quotations. Exchange prices are quoted by two ...

Balancing and Intraday Market Design: Options for Wind Integration

... European Member States and the Commission have committed in the EU Renewables Directive to the large-scale deployment of intermittent renewable energy sources across Europe and are assessing barriers that could cause delays and increase costs. The paper addresses the three distinct types of markets ...

... European Member States and the Commission have committed in the EU Renewables Directive to the large-scale deployment of intermittent renewable energy sources across Europe and are assessing barriers that could cause delays and increase costs. The paper addresses the three distinct types of markets ...

Traditional vs. Modern Food Systems? Insights from Vegetable

... have been added particular concerns arising from the Vietnamese context: • Market share not only involves the relative volumes supplied by competing channels but also the number and spatial distribution of available retail outlets. The market share indicator has been used in previous studies on the ...

... have been added particular concerns arising from the Vietnamese context: • Market share not only involves the relative volumes supplied by competing channels but also the number and spatial distribution of available retail outlets. The market share indicator has been used in previous studies on the ...

“Auction Design and Strategy,” Presentation

... bid only matters when I win, so I should condition my bid on winning (i.e., that I overestimated the most). • Winning is bad news about my estimate of value. No one else was willing to bid as much. ...

... bid only matters when I win, so I should condition my bid on winning (i.e., that I overestimated the most). • Winning is bad news about my estimate of value. No one else was willing to bid as much. ...

International Capital Flows, Economic Growth and

... by Bolton and Freixas (2000) to provide the first synthesis of capital structure choice theories based on information asymmetries. They show that in equilibrium, all three types of financing coexist and their distribution depends on the riskiness of the project to be financed as well as on the supply o ...

... by Bolton and Freixas (2000) to provide the first synthesis of capital structure choice theories based on information asymmetries. They show that in equilibrium, all three types of financing coexist and their distribution depends on the riskiness of the project to be financed as well as on the supply o ...

MultiFractality in Foreign Currency Markets

... Market efficiency has been the most celebrated theory of financial markets during the past three decades. In its simplest formulation this theory claims that changes in asset prices reflect fully and instantaneously the release of all new relevant information. Furthermore, because such a flow of inf ...

... Market efficiency has been the most celebrated theory of financial markets during the past three decades. In its simplest formulation this theory claims that changes in asset prices reflect fully and instantaneously the release of all new relevant information. Furthermore, because such a flow of inf ...

2-7 Function of Financial Markets

... investors may be subject to adverse selection and moral hazard problems that may hinder the efficient operation of financial markets and may also keep investors away from financial markets The Securities and Exchange Commission (SEC) requires corporations issuing securities to disclose certain inf ...

... investors may be subject to adverse selection and moral hazard problems that may hinder the efficient operation of financial markets and may also keep investors away from financial markets The Securities and Exchange Commission (SEC) requires corporations issuing securities to disclose certain inf ...

Market Turmoil and Destabilizing Speculation Supplementary Material

... This section investigates which types of funds are more likely to exploit increased uncertainty, with evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short- ...

... This section investigates which types of funds are more likely to exploit increased uncertainty, with evidence in support of Hypotheses 2 and 3. The hypothesis suggested by the model is that the funds that are more prone to sell their holdings when uncertainty spikes are those most a¤ected by short- ...

mandlebrot

... Before his death, Benoit Mandelbrot was one of the most celebrated mathematicians in the world, and most of his work was based on the belief that the wider view of price behavior in financial markets is primitive and in need of large revisions. Mandelbrot's work sought to update these “medieval” vie ...

... Before his death, Benoit Mandelbrot was one of the most celebrated mathematicians in the world, and most of his work was based on the belief that the wider view of price behavior in financial markets is primitive and in need of large revisions. Mandelbrot's work sought to update these “medieval” vie ...

The Information Content of the NCREIF Index

... reflects constant information updates and anticipation of the current and future real activity. This degree of liquidity, however, is unavailable to unsecuritized real estate, such as commingled funds. Return series on privately held real estate are impacted by infrequent appraisals, are often label ...

... reflects constant information updates and anticipation of the current and future real activity. This degree of liquidity, however, is unavailable to unsecuritized real estate, such as commingled funds. Return series on privately held real estate are impacted by infrequent appraisals, are often label ...

TMP 38E050 Advanced Topics Economics of Competition and

... – DL = (Qc- Qm2)(pm2- pc)/2 – Cost savings due to the decrease in MC • Amount is (pc-MC2)Qm2 – Efficiency is increased due to cost savings and decreased due to market power - deadweight loss ...

... – DL = (Qc- Qm2)(pm2- pc)/2 – Cost savings due to the decrease in MC • Amount is (pc-MC2)Qm2 – Efficiency is increased due to cost savings and decreased due to market power - deadweight loss ...

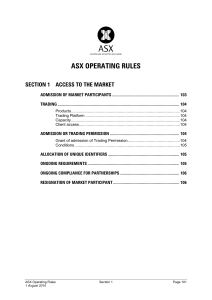

ASX Operating Rules Section 01

... Trading Permission in respect of one or more Products if ASX considers it appropriate and is satisfied that the applicant will have in place and maintain adequate clearing arrangements in accordance with Rule [1003] and Schedule 1 for those products and have the technical capacity and knowledge requ ...

... Trading Permission in respect of one or more Products if ASX considers it appropriate and is satisfied that the applicant will have in place and maintain adequate clearing arrangements in accordance with Rule [1003] and Schedule 1 for those products and have the technical capacity and knowledge requ ...

EC63-822 Wheat, People and the Plains

... is because most foreign buyers, especially in dollar markets, rely on U.S. grades as measures of quality. They can't actually inspect or test what they're buying, so all they have to go on is grade. A common criticism from foreign buyers concerns milling and baking uniformity in our overseas shipmen ...

... is because most foreign buyers, especially in dollar markets, rely on U.S. grades as measures of quality. They can't actually inspect or test what they're buying, so all they have to go on is grade. A common criticism from foreign buyers concerns milling and baking uniformity in our overseas shipmen ...