ESPP Prospectus 2016: 2nd offering period

... Presentation of financial information Certain financial and other information presented in this prospectus may have been rounded off for the purpose of making this prospectus more easily accessible for the reader. As a result, the figures in certain columns may not exactly add up with the stated tot ...

... Presentation of financial information Certain financial and other information presented in this prospectus may have been rounded off for the purpose of making this prospectus more easily accessible for the reader. As a result, the figures in certain columns may not exactly add up with the stated tot ...

LULD Plan 12th Amendment Plan Text (FINAL with markings)

... Eligible Reported Transactions for the NMS Stock have occurred over the immediately preceding fiveminute period, the previous Reference Price shall remain in effect. The Price Bands for an NMS Stock shall be calculated by applying the Percentage Parameter for such NMS Stock to the Reference Price, ...

... Eligible Reported Transactions for the NMS Stock have occurred over the immediately preceding fiveminute period, the previous Reference Price shall remain in effect. The Price Bands for an NMS Stock shall be calculated by applying the Percentage Parameter for such NMS Stock to the Reference Price, ...

exhibit 1 - New York Stock Exchange

... Limitations on Trades and Quotations Outside of Price Bands ...

... Limitations on Trades and Quotations Outside of Price Bands ...

THU VI?N PHÁP LU?T

... issuance and payment conditions, assurance of legitimate rights and benefits of investors and other conditions. 3. Conditions for public offering of fund certificates to the public include: a/ The total value of fund certificates registered for offering is at least VND 50 billion; b/ There are an is ...

... issuance and payment conditions, assurance of legitimate rights and benefits of investors and other conditions. 3. Conditions for public offering of fund certificates to the public include: a/ The total value of fund certificates registered for offering is at least VND 50 billion; b/ There are an is ...

High Idiosyncratic Volatility and Low Returns

... and is also observed in the larger sample of 23 developed markets. Second and perhaps most interesting, the negative spread in returns between stocks with high and low idiosyncratic volatility in international markets strongly comoves with the difference in returns between U.S. stocks with high and ...

... and is also observed in the larger sample of 23 developed markets. Second and perhaps most interesting, the negative spread in returns between stocks with high and low idiosyncratic volatility in international markets strongly comoves with the difference in returns between U.S. stocks with high and ...

INTERCONTINENTALEXCHANGE INC

... We operate the leading electronic global futures and over-the-counter, or OTC, marketplace for trading a broad array of energy products. We are the only marketplace to offer an integrated electronic platform for side-by-side trading of energy products in both futures and OTC markets. Through our ele ...

... We operate the leading electronic global futures and over-the-counter, or OTC, marketplace for trading a broad array of energy products. We are the only marketplace to offer an integrated electronic platform for side-by-side trading of energy products in both futures and OTC markets. Through our ele ...

Quantitative Easing and Volatility Spillovers across

... Recent literature also links monetary policy to systemic risk. For example, Jimenez, Ongena, Peydro and Suarina (2014) show that monetary policy in the form of low interest rates is a potential source of systemic risk because it leads to bank risk taking. Allen (2014) argues that systemic risk is en ...

... Recent literature also links monetary policy to systemic risk. For example, Jimenez, Ongena, Peydro and Suarina (2014) show that monetary policy in the form of low interest rates is a potential source of systemic risk because it leads to bank risk taking. Allen (2014) argues that systemic risk is en ...

NASDAQ OMX GROUP, INC. (Form: 10-K, Received

... listing, and public company services across six continents. Our global offerings are diverse and include trading and clearing across multiple asset classes, market data products, financial indexes, capital formation solutions, financial services, corporate solutions and market technology products an ...

... listing, and public company services across six continents. Our global offerings are diverse and include trading and clearing across multiple asset classes, market data products, financial indexes, capital formation solutions, financial services, corporate solutions and market technology products an ...

The Performance of Individual Investors in Structured Financial

... leverage certificates by an economically large 3.5% and 4.0%, respectively. Finding no evidence for poor market or volatility timing, they conclude the negative gross performance of investors is primarily driven by issuers’ margins. From issuer’s perspective, it is often argued that structured finan ...

... leverage certificates by an economically large 3.5% and 4.0%, respectively. Finding no evidence for poor market or volatility timing, they conclude the negative gross performance of investors is primarily driven by issuers’ margins. From issuer’s perspective, it is often argued that structured finan ...

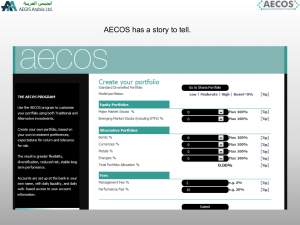

Portfolio Comparisons. - Artex Component System

... Final Analysis The AECOS program allows investors to test different portfolio strategies to determine the best mix of sectors, and the proper leverage to apply. Results for each sector are from the Aegis investment programs. Past results cannot predict future returns, but the AECOS program is desig ...

... Final Analysis The AECOS program allows investors to test different portfolio strategies to determine the best mix of sectors, and the proper leverage to apply. Results for each sector are from the Aegis investment programs. Past results cannot predict future returns, but the AECOS program is desig ...

Optimal strategies of hedging portfolio of unit

... adverse individual prefers to have the expectation of the random variable with probability 1 rather than having a random variable where the probability is unknown. This means that between two games with identical expectations of earnings, the agent will choose the least risky. However, they will be ...

... adverse individual prefers to have the expectation of the random variable with probability 1 rather than having a random variable where the probability is unknown. This means that between two games with identical expectations of earnings, the agent will choose the least risky. However, they will be ...

On the history of the Growth Optimal Portfolio

... expanded the analysis of Kelly (1956) and discussed applications for long term investment and gambling in a more general mathematical setting. Calculating the growth optimal strategy is generally very difficult in discrete time and is treated in Bellman and Kalaba (1957), Elton and Gruber (1974) and ...

... expanded the analysis of Kelly (1956) and discussed applications for long term investment and gambling in a more general mathematical setting. Calculating the growth optimal strategy is generally very difficult in discrete time and is treated in Bellman and Kalaba (1957), Elton and Gruber (1974) and ...

dollar cost averaging - the role of cognitive error

... price is relatively low, so price fluctuations will always mean that DCA investors buy at less than the average price, regardless of the particular path taken by prices. The difference is particularly large in the example above due to the large price movements, but any price volatility favors DCA. O ...

... price is relatively low, so price fluctuations will always mean that DCA investors buy at less than the average price, regardless of the particular path taken by prices. The difference is particularly large in the example above due to the large price movements, but any price volatility favors DCA. O ...

Low volatility anomaly and mutual fund allocations - Aalto

... and expected return is tenuous: “Volatility and long-term average returns are positively related across assets classes.” and “However, the most volatile assets within each asset class – highvolatility stocks, 30-year Treasuries, and CCC-rated corporate – tend to offer low long-run returns and even w ...

... and expected return is tenuous: “Volatility and long-term average returns are positively related across assets classes.” and “However, the most volatile assets within each asset class – highvolatility stocks, 30-year Treasuries, and CCC-rated corporate – tend to offer low long-run returns and even w ...

Chapter 22 Futures Markets

... A. maintains that for most commodities, there are natural hedgers who desire to shed risk. B. maintains that speculators will enter the long side of the contract only if the futures price is below the expected spot price. C. assumes that risk premiums in the futures markets are based on systematic r ...

... A. maintains that for most commodities, there are natural hedgers who desire to shed risk. B. maintains that speculators will enter the long side of the contract only if the futures price is below the expected spot price. C. assumes that risk premiums in the futures markets are based on systematic r ...

Pricing Volatility Swaps Under Heston`s Stochastic

... Recently, there has been a considerable interest in pricing and hedging variance swaps and volatility swaps. Grünbuchler and Longstaff (1996) developed pricing models for options on variance based on Heston’s stochastic volatility model. Carr and Madan (1998) showed how derivatives on volatility c ...

... Recently, there has been a considerable interest in pricing and hedging variance swaps and volatility swaps. Grünbuchler and Longstaff (1996) developed pricing models for options on variance based on Heston’s stochastic volatility model. Carr and Madan (1998) showed how derivatives on volatility c ...

ABSTRACT ESSAYS ON UNIFORM PRICE AUCTIONS Mat´ıas Herrera Dappe Doctor of Philosophy, 2009

... Independent System Operator allocates installed capacity payments through a sequence of monthly uniform price auctions6 ; and the Colombian system operator will procure forward electricity supply contracts to match the annual forecast electricity demand by means of a sequence of four quarterly aucti ...

... Independent System Operator allocates installed capacity payments through a sequence of monthly uniform price auctions6 ; and the Colombian system operator will procure forward electricity supply contracts to match the annual forecast electricity demand by means of a sequence of four quarterly aucti ...

Why do foreign firms leave US equity markets?

... which foreign firms would choose to deregister from U.S. markets and for the shareholder wealth consequences of such decisions. With the bonding theory, a cross-listing has a cost for corporate insiders, which is that they face restrictions in consuming private benefits, and a benefit, which is that ...

... which foreign firms would choose to deregister from U.S. markets and for the shareholder wealth consequences of such decisions. With the bonding theory, a cross-listing has a cost for corporate insiders, which is that they face restrictions in consuming private benefits, and a benefit, which is that ...

Overnight Versus Intraday Expected Returns

... We first examine when institutional investors likely trade. Specifically, we link changes in institutional ownership to the components of contemporaneous firm-level stock returns. We find that for all institutional ownership quintiles, institutional ownership increases more with intraday than with o ...

... We first examine when institutional investors likely trade. Specifically, we link changes in institutional ownership to the components of contemporaneous firm-level stock returns. We find that for all institutional ownership quintiles, institutional ownership increases more with intraday than with o ...

Momentum and Investor Sentiment

... such as the Hochiminh Stock Exchange (HOSE) in Vietnam. As in Griffin et al. (2005), a minimum of 50 stocks are required to be listed on the stock exchange to enable momentum and subsequent tests to be carried out. This restriction weeds out exchanges with limited listings such as the Maldives Stoc ...

... such as the Hochiminh Stock Exchange (HOSE) in Vietnam. As in Griffin et al. (2005), a minimum of 50 stocks are required to be listed on the stock exchange to enable momentum and subsequent tests to be carried out. This restriction weeds out exchanges with limited listings such as the Maldives Stoc ...

Chen_uta_2502D_12115

... reported the highest turnover rate of 138% with a total trading volume of over 800 million shares in 2008. The main corresponding derivative market, the Chicago Board of Options Exchange (CBOE), also had about 1.2 billion in total number of contracts traded. It translates into an annual total tradin ...

... reported the highest turnover rate of 138% with a total trading volume of over 800 million shares in 2008. The main corresponding derivative market, the Chicago Board of Options Exchange (CBOE), also had about 1.2 billion in total number of contracts traded. It translates into an annual total tradin ...

The pricing of volatility risk across asset classes

... allows us to entertain the possibility of more than one priced component of stock market volatility. When we price synthetic volatility swaps, it appears that at least one additional volatility factor may be helpful in explaining the cross-section of swap returns. We find that our simple two-factor ...

... allows us to entertain the possibility of more than one priced component of stock market volatility. When we price synthetic volatility swaps, it appears that at least one additional volatility factor may be helpful in explaining the cross-section of swap returns. We find that our simple two-factor ...

Influencing Control: Jawboning in Risk Arbitrage

... in those deals, the board and the management, by endorsing the deals with favored acquirers, may not have done their due diligence to challenge the acquirers for better terms or to solicit competing bids. These results suggest that activist risk arbitrage is potentially an important form of governa ...

... in those deals, the board and the management, by endorsing the deals with favored acquirers, may not have done their due diligence to challenge the acquirers for better terms or to solicit competing bids. These results suggest that activist risk arbitrage is potentially an important form of governa ...

Transaction Costs, Trade Throughs, and Riskless Principal Trading

... throughs. With these results, I then obtain econometric estimates of total transaction costs and total tradethrough values for the entire market. The results have strong implications for how bond markets should be structured and regulated. I find that average transaction costs that customers incur w ...

... throughs. With these results, I then obtain econometric estimates of total transaction costs and total tradethrough values for the entire market. The results have strong implications for how bond markets should be structured and regulated. I find that average transaction costs that customers incur w ...