LULD Plan 12th Amendment Plan Text (FINAL with markings)

... Eligible Reported Transactions for the NMS Stock have occurred over the immediately preceding fiveminute period, the previous Reference Price shall remain in effect. The Price Bands for an NMS Stock shall be calculated by applying the Percentage Parameter for such NMS Stock to the Reference Price, ...

... Eligible Reported Transactions for the NMS Stock have occurred over the immediately preceding fiveminute period, the previous Reference Price shall remain in effect. The Price Bands for an NMS Stock shall be calculated by applying the Percentage Parameter for such NMS Stock to the Reference Price, ...

exhibit 1 - New York Stock Exchange

... Limitations on Trades and Quotations Outside of Price Bands ...

... Limitations on Trades and Quotations Outside of Price Bands ...

Do Noise Traders Move Markets?

... returns. (See Kyle and Wang (1997), Odean (1998b), Daniel, Hirshleifer, and Subrahmanyam (1998, 2001), ...

... returns. (See Kyle and Wang (1997), Odean (1998b), Daniel, Hirshleifer, and Subrahmanyam (1998, 2001), ...

Bid-ask spread components on the foreign exchange market: The

... This thesis is written in order to obtain my second master’s degree in Business Engineering with a major in Finance. The subject was chosen because it had so many different elements in it which could provide me with the necessary variation during the whole period I worked on it and because I have a ...

... This thesis is written in order to obtain my second master’s degree in Business Engineering with a major in Finance. The subject was chosen because it had so many different elements in it which could provide me with the necessary variation during the whole period I worked on it and because I have a ...

Interest Rate Derivatives – Fixed Income Trading Strategies

... Question 74 Why is taking short positions in fixed income futures called a “bear strategy”? Question 75 A trader holds an open short position of 15 Euro Bobl Futures. At the time of the valuation the settlement price has risen 48 ticks in comparison with the previous day’s rate. What is the Variatio ...

... Question 74 Why is taking short positions in fixed income futures called a “bear strategy”? Question 75 A trader holds an open short position of 15 Euro Bobl Futures. At the time of the valuation the settlement price has risen 48 ticks in comparison with the previous day’s rate. What is the Variatio ...

volatility as an asset class

... leverage effect: A decline in the value of a company’s equity results in an increase of the company’s balance sheet leverage, making its equity more risky and hence increasing the volatility of its share price. ...

... leverage effect: A decline in the value of a company’s equity results in an increase of the company’s balance sheet leverage, making its equity more risky and hence increasing the volatility of its share price. ...

Quantitative Easing and Volatility Spillovers across

... Recent literature also links monetary policy to systemic risk. For example, Jimenez, Ongena, Peydro and Suarina (2014) show that monetary policy in the form of low interest rates is a potential source of systemic risk because it leads to bank risk taking. Allen (2014) argues that systemic risk is en ...

... Recent literature also links monetary policy to systemic risk. For example, Jimenez, Ongena, Peydro and Suarina (2014) show that monetary policy in the form of low interest rates is a potential source of systemic risk because it leads to bank risk taking. Allen (2014) argues that systemic risk is en ...

Dark pools in European equity markets

... The effect of dark pools on the integrity and stability of financial markets is still being debated. When dark pools first emerged, regulators and financial authorities expressed concern about two mechanisms through which dark trading could have negative effects on market stability. First, trading ...

... The effect of dark pools on the integrity and stability of financial markets is still being debated. When dark pools first emerged, regulators and financial authorities expressed concern about two mechanisms through which dark trading could have negative effects on market stability. First, trading ...

Volatility Derivatives

... volatility swaps. As its name suggests, a volatility swap payoff is linear in realized volatility. Practitioners preferred thinking in terms of volatility, familiar from the notion of implied volatility, rather than variance, and this created a demand for volatility swaps. For example, an article in ...

... volatility swaps. As its name suggests, a volatility swap payoff is linear in realized volatility. Practitioners preferred thinking in terms of volatility, familiar from the notion of implied volatility, rather than variance, and this created a demand for volatility swaps. For example, an article in ...

Quote Stuffing - Mississippi State University`s College of Business

... According to their model, high frequency traders increase the price impact of liquidity trades, increasing (decreasing) the price at which liquidity traders buy (sell). These costs increase with the size of the trade, suggesting that large liquidity traders (i.e. large institutional traders making s ...

... According to their model, high frequency traders increase the price impact of liquidity trades, increasing (decreasing) the price at which liquidity traders buy (sell). These costs increase with the size of the trade, suggesting that large liquidity traders (i.e. large institutional traders making s ...

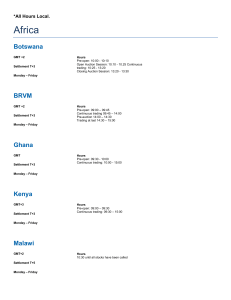

Global Trading Hours

... Volatility Auction Activated when the maximum price range deviation is exceeded, decided by the exchange. Generally ends after 3 or 5 minutes, depending on security. The change to the next scheduled trading phase is carried out whether or not a price occurs. Single volatility interruption occurs if ...

... Volatility Auction Activated when the maximum price range deviation is exceeded, decided by the exchange. Generally ends after 3 or 5 minutes, depending on security. The change to the next scheduled trading phase is carried out whether or not a price occurs. Single volatility interruption occurs if ...

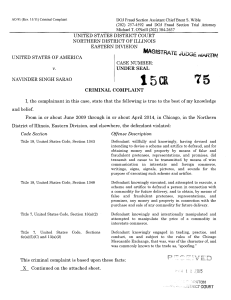

Criminal Complaint

... lied about his use of computer automation to effectuate the massive split-second modification and cancellation of orders that facilitated his market manipulation. ...

... lied about his use of computer automation to effectuate the massive split-second modification and cancellation of orders that facilitated his market manipulation. ...

Exchange Gann Financial Astrology Ebooks

... 34,Raphael 1905 : Raphael's Mundane Astrology 35,Rodden Louise : Money−− how to find it with astrology 36,sedgwick phillip:sun in the centre−heliocentric astrology 37,tyler j ross : financial astrology 38,tyl noel : astrology's special measurements 39,winski Norman: energy point trend technique If s ...

... 34,Raphael 1905 : Raphael's Mundane Astrology 35,Rodden Louise : Money−− how to find it with astrology 36,sedgwick phillip:sun in the centre−heliocentric astrology 37,tyler j ross : financial astrology 38,tyl noel : astrology's special measurements 39,winski Norman: energy point trend technique If s ...

Self-Study Guide to Hedging with Grain and Oilseed

... know something about futures markets. This is because futures contracts are the underlying instruments on which the options are traded. And, as a result, option prices – referred to as premiums – are affected by futures prices and other market factors. In addition, the more you know about the market ...

... know something about futures markets. This is because futures contracts are the underlying instruments on which the options are traded. And, as a result, option prices – referred to as premiums – are affected by futures prices and other market factors. In addition, the more you know about the market ...

Evidence about Bubble Mechanisms: Precipitating Event

... The Chinese put warrants bubble occurred on the Shanghai and Shenzhen stock exchanges during 2005–2008. Between November 2005 and June 2007 18 Chinese companies issued put warrants with maturities of between six months and two years.2 These warrants gave their holders the right to sell the issuing c ...

... The Chinese put warrants bubble occurred on the Shanghai and Shenzhen stock exchanges during 2005–2008. Between November 2005 and June 2007 18 Chinese companies issued put warrants with maturities of between six months and two years.2 These warrants gave their holders the right to sell the issuing c ...

0224 - European Financial Management Association

... leads to an asymmetric distribution of returns, traditional performance measures such as the Sharpe or Treynor ratios5 can lead to biased conclusions. Traditionally, a strategy of writing calls rather than puts on a portfolio was generally supposed to be more profitable. Bookstaber and Clarke (1985) ...

... leads to an asymmetric distribution of returns, traditional performance measures such as the Sharpe or Treynor ratios5 can lead to biased conclusions. Traditionally, a strategy of writing calls rather than puts on a portfolio was generally supposed to be more profitable. Bookstaber and Clarke (1985) ...

Frequently Asked Questions about Exchange

... amount to satisfy the NYSE Arca listing requirements) on the initial trade date. After the initial trade date, the ...

... amount to satisfy the NYSE Arca listing requirements) on the initial trade date. After the initial trade date, the ...

CBOE Holdings, Inc. Annual Report 2012 40 Years of Innovation

... April commemorates the 40th anniversary of the Chicago Board Options Exchange (CBOE) and the U.S. options industry. For four decades, CBOE has been the undisputed options innovator, with nearly every major industry “first” conceived by CBOE. The creation of listed options in 1973; index options in 1 ...

... April commemorates the 40th anniversary of the Chicago Board Options Exchange (CBOE) and the U.S. options industry. For four decades, CBOE has been the undisputed options innovator, with nearly every major industry “first” conceived by CBOE. The creation of listed options in 1973; index options in 1 ...

Essentials of Financial Risk Management

... an organization including treasury, sales, marketing, legal, tax, commodity, and corporate finance. The risk management process involves both internal and external analysis. The first part of the process involves identifying and prioritizing the financial risks facing an organization and understandi ...

... an organization including treasury, sales, marketing, legal, tax, commodity, and corporate finance. The risk management process involves both internal and external analysis. The first part of the process involves identifying and prioritizing the financial risks facing an organization and understandi ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.

![Since Slonczewski calculated [1] interfacial exchange - cerge-ei](http://s1.studyres.com/store/data/005381392_1-e9747be9e01b230768e0b5cde433f905-300x300.png)