Quantitative Easing and Volatility Spillovers across

... easing has attracted heated debate because it is believed to have strong spillover effects on global financial markets and broader economic conditions. Spillovers through financial market prices are important and readily observable. For example, when the first round of US quantitative easing (QE1) w ...

... easing has attracted heated debate because it is believed to have strong spillover effects on global financial markets and broader economic conditions. Spillovers through financial market prices are important and readily observable. For example, when the first round of US quantitative easing (QE1) w ...

Note: Broker-dealers are required to disclose any material

... Note: Broker-dealers are required to disclose any material arrangements with the venues listed in each section below, including, but not limited to, any internalization or payment for order flow arrangements. ...

... Note: Broker-dealers are required to disclose any material arrangements with the venues listed in each section below, including, but not limited to, any internalization or payment for order flow arrangements. ...

Why do foreign firms leave US equity markets?

... Karolyi thanks the Dice Center for Financial Economics for financial support. ...

... Karolyi thanks the Dice Center for Financial Economics for financial support. ...

The pricing of volatility risk across asset classes

... index from the Chicago Board Options Exchange. They document over their sampling period of 1986 - 2000 a negative volatility risk premium, and confirm that stocks that are more sensitive to volatility risk do earn lower returns. Adrian and Rosenberg (2008) decompose the market volatility into separa ...

... index from the Chicago Board Options Exchange. They document over their sampling period of 1986 - 2000 a negative volatility risk premium, and confirm that stocks that are more sensitive to volatility risk do earn lower returns. Adrian and Rosenberg (2008) decompose the market volatility into separa ...

Chen_uta_2502D_12115

... reported the highest turnover rate of 138% with a total trading volume of over 800 million shares in 2008. The main corresponding derivative market, the Chicago Board of Options Exchange (CBOE), also had about 1.2 billion in total number of contracts traded. It translates into an annual total tradin ...

... reported the highest turnover rate of 138% with a total trading volume of over 800 million shares in 2008. The main corresponding derivative market, the Chicago Board of Options Exchange (CBOE), also had about 1.2 billion in total number of contracts traded. It translates into an annual total tradin ...

The Impact of Hidden Liquidity in Limit Order Books

... Many limit order markets use a market design that allows traders to submit hidden liquidity. The option to submit hidden liquidity alongside the visible liquidity makes the strategic interaction between different market participants more complicated and raises a number of questions. To what extent c ...

... Many limit order markets use a market design that allows traders to submit hidden liquidity. The option to submit hidden liquidity alongside the visible liquidity makes the strategic interaction between different market participants more complicated and raises a number of questions. To what extent c ...

Transaction Costs, Trade Throughs, and Riskless Principal Trading

... elsewhere. Such trades may be risky to the dealer if the dealer is committing capital (trading for its inventory account). But most dealers immediately offset these trades by taking the better price offered elsewhere because doing so guarantees that they profit with little risk. For example, if the ...

... elsewhere. Such trades may be risky to the dealer if the dealer is committing capital (trading for its inventory account). But most dealers immediately offset these trades by taking the better price offered elsewhere because doing so guarantees that they profit with little risk. For example, if the ...

Hedging With Futures Contract

... the penalty was 40 Euro/t CO2, from 2008 it has been increased to 100 Euro/t CO2 which provides more incentives for carbon trading. Meanwhile, all credit deficiencies must be purchased in addition to fines paid. All the reported emissions must be audited by an independent third party. 3. Literature ...

... the penalty was 40 Euro/t CO2, from 2008 it has been increased to 100 Euro/t CO2 which provides more incentives for carbon trading. Meanwhile, all credit deficiencies must be purchased in addition to fines paid. All the reported emissions must be audited by an independent third party. 3. Literature ...

Bid-ask spread components on the foreign exchange market: The

... Declaration of Confidentiality with Regard to the MICEX Data ....................................................... II Preface ....................................................................................................................................... III Table of contents .............. ...

... Declaration of Confidentiality with Regard to the MICEX Data ....................................................... II Preface ....................................................................................................................................... III Table of contents .............. ...

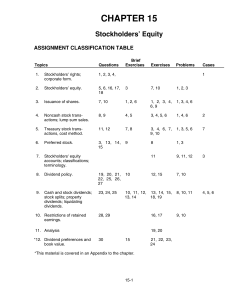

CHAPTER 15 Stockholders` Equity

... Research Bulletin No. 43 specifies that a distribution in excess of 20% to 25% of the number of shares previously outstanding would cause a material decrease in the market value. This is a characteristic of a stock split as opposed to a stock dividend, but, for legal reasons, the term “dividend” mus ...

... Research Bulletin No. 43 specifies that a distribution in excess of 20% to 25% of the number of shares previously outstanding would cause a material decrease in the market value. This is a characteristic of a stock split as opposed to a stock dividend, but, for legal reasons, the term “dividend” mus ...

Predicting Returns and Volatilities with Ultra

... Two indistinguishable classes of traders - informed and uninformed When there is good news, informed traders will buy while the rest will be buyers and sellers. When there are more buyers than sellers, there is some probability that this is due to information traders – hence prices are increased by ...

... Two indistinguishable classes of traders - informed and uninformed When there is good news, informed traders will buy while the rest will be buyers and sellers. When there are more buyers than sellers, there is some probability that this is due to information traders – hence prices are increased by ...

When Does Information Asymmetry Affect the Cost of

... liquidity risk as the covariation between a stock’s return and market liquidity. Their predictions are derived in part from Campbell, Grossman, and Wang’s (1993) perfect competition model in which time-varying risk aversion by a subset of traders implies that current order flow predicts future retu ...

... liquidity risk as the covariation between a stock’s return and market liquidity. Their predictions are derived in part from Campbell, Grossman, and Wang’s (1993) perfect competition model in which time-varying risk aversion by a subset of traders implies that current order flow predicts future retu ...

Stop-loss orders and price cascades in currency markets

... The analysis first shows that exchange rates tend to move rapidly after reaching levels where stop-loss orders cluster. 6 This indicates that a trend can be prolonged by the execution of some stop-loss orders triggered by that trend, consistent with the paper’s main hypothesis. However, this result ...

... The analysis first shows that exchange rates tend to move rapidly after reaching levels where stop-loss orders cluster. 6 This indicates that a trend can be prolonged by the execution of some stop-loss orders triggered by that trend, consistent with the paper’s main hypothesis. However, this result ...

stop-loss orders and price cascades in currency markets

... The analysis first shows that exchange rates tend to move rapidly after reaching levels where stop-loss orders cluster. 6 This indicates that a trend can be prolonged by the execution of some stop-loss orders triggered by that trend, consistent with the paper’s main hypothesis. However, this result ...

... The analysis first shows that exchange rates tend to move rapidly after reaching levels where stop-loss orders cluster. 6 This indicates that a trend can be prolonged by the execution of some stop-loss orders triggered by that trend, consistent with the paper’s main hypothesis. However, this result ...

Demand-Based Option Pricing

... We take on this challenge. Our model departs fundamentally from the noarbitrage framework by recognizing that option market-makers cannot perfectly hedge their inventories, and, consequently, option demand impacts option prices. We obtain explicit expressions for the effects of demand on option pric ...

... We take on this challenge. Our model departs fundamentally from the noarbitrage framework by recognizing that option market-makers cannot perfectly hedge their inventories, and, consequently, option demand impacts option prices. We obtain explicit expressions for the effects of demand on option pric ...

NBER WORKING PAPER SERIES DEMAND-BASED OPTION PRICING Nicolae Garleanu Lasse Heje Pedersen

... in zero net supply, a representative investor holds no options. We reconcile this finding for dealers who have significant short index option positions. Intuitively, an investor will short index options, but only a finite number of options. Hence, while a standardutility investor may not be marginal ...

... in zero net supply, a representative investor holds no options. We reconcile this finding for dealers who have significant short index option positions. Intuitively, an investor will short index options, but only a finite number of options. Hence, while a standardutility investor may not be marginal ...

Did Stop Signs Stop Investor Trading?

... Exchange Act” (SEC 1963). More recently, Aggarwal and Wu (2006) find that stocks of OTCBB and PS firms account for nearly half (68 out of 142) of the stock market manipulation cases pursued by the SEC from 1989 to 2001. Perhaps not surprisingly, the Pink Sheets website also directly warns investors ...

... Exchange Act” (SEC 1963). More recently, Aggarwal and Wu (2006) find that stocks of OTCBB and PS firms account for nearly half (68 out of 142) of the stock market manipulation cases pursued by the SEC from 1989 to 2001. Perhaps not surprisingly, the Pink Sheets website also directly warns investors ...

Causes and Consequences of Margin Levels in Futures Markets

... realized variance slowly mean-reverts. Margin changes are of course endogenous as they are set by the clearing house primarily based on volatility, and I address this endogeneity problem throughout the paper. Traders in commodity futures often state that margin increases squeeze out speculators and ...

... realized variance slowly mean-reverts. Margin changes are of course endogenous as they are set by the clearing house primarily based on volatility, and I address this endogeneity problem throughout the paper. Traders in commodity futures often state that margin increases squeeze out speculators and ...

Derivatives on RDX USD Index

... Eurex and Eurex Clearing offer services directly to members of the Eurex exchanges respectively to clearing members of Eurex Clearing. Those w ho desire to trade any products available on the Eurex market or w ho desire to offer and sell any such products to others or w ho desire to possess a cleari ...

... Eurex and Eurex Clearing offer services directly to members of the Eurex exchanges respectively to clearing members of Eurex Clearing. Those w ho desire to trade any products available on the Eurex market or w ho desire to offer and sell any such products to others or w ho desire to possess a cleari ...

Trading Volume Reaction to the Earnings Reconciliation from IFRS

... whether investors still find the earnings reconciliation from IFRS as issued by the IASB to U.S. GAAP useful in their trading decision, which is more pertinent to the SEC’s decision to abolish the reconciliation requirement. Third, we explore two mechanisms that might affect the trading volume reac ...

... whether investors still find the earnings reconciliation from IFRS as issued by the IASB to U.S. GAAP useful in their trading decision, which is more pertinent to the SEC’s decision to abolish the reconciliation requirement. Third, we explore two mechanisms that might affect the trading volume reac ...

New Evidence on the Financialization of Commodity Markets*

... information about subsequent changes in futures prices because most CLNs are poor vehicles for speculating on commodity prices. The issuers must embed the costs of structuring, marketing, and hedging the CLNs in their issue prices, negatively impacting CLN returns. The CLNs generally provide no or l ...

... information about subsequent changes in futures prices because most CLNs are poor vehicles for speculating on commodity prices. The issuers must embed the costs of structuring, marketing, and hedging the CLNs in their issue prices, negatively impacting CLN returns. The CLNs generally provide no or l ...

Mergers and Acquisitions

... takeover bids. The Panel's rules, the City Code on Takeovers and Mergers, regulate the takeover process. It requires, for example, that all shareholders must be given the same information, and the target company should not take any action to frustrate an offer (e.g. use poison pills) without allowin ...

... takeover bids. The Panel's rules, the City Code on Takeovers and Mergers, regulate the takeover process. It requires, for example, that all shareholders must be given the same information, and the target company should not take any action to frustrate an offer (e.g. use poison pills) without allowin ...

Hedge Funds and the Technology Bubble

... 1978 all institutions with more than $100 million under discretionary management are required to disclose their holdings to the SEC each quarter on form 13F. This concerns all long positions in section 13(f) securities greater than 10,000 shares or $200,000, over which the manager exercises sole or ...

... 1978 all institutions with more than $100 million under discretionary management are required to disclose their holdings to the SEC each quarter on form 13F. This concerns all long positions in section 13(f) securities greater than 10,000 shares or $200,000, over which the manager exercises sole or ...

Common Option Strategies - NYU Stern School of Business

... long vol or being short vol? The answer is short vol, at least since the beginning of the 2001 calendar year. Option time values were “taken in” during 2001 arguably because there has been a “volatility supply glut” or “volatility overhang”. If one thinks of volatility as a commodity like wheat, the ...

... long vol or being short vol? The answer is short vol, at least since the beginning of the 2001 calendar year. Option time values were “taken in” during 2001 arguably because there has been a “volatility supply glut” or “volatility overhang”. If one thinks of volatility as a commodity like wheat, the ...

Financial Liberalization and Emerging Stock Market Volatility

... may become informationally more efficient leading to higher volatility as prices quickly react to relevent information or speculative capital may induce excess volatility. On the other hand, in the pre-liberalization process, there may be large swings from fundamental values leading to higher volatili ...

... may become informationally more efficient leading to higher volatility as prices quickly react to relevent information or speculative capital may induce excess volatility. On the other hand, in the pre-liberalization process, there may be large swings from fundamental values leading to higher volatili ...