* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download MAY 2010. FINAL doc - Institute of Bankers in Malawi

Beta (finance) wikipedia , lookup

Modified Dietz method wikipedia , lookup

Internal rate of return wikipedia , lookup

Private equity secondary market wikipedia , lookup

Systemic risk wikipedia , lookup

Rate of return wikipedia , lookup

Securitization wikipedia , lookup

Credit rationing wikipedia , lookup

Present value wikipedia , lookup

Business valuation wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Interest rate wikipedia , lookup

Investment management wikipedia , lookup

Stock selection criterion wikipedia , lookup

Land banking wikipedia , lookup

Interbank lending market wikipedia , lookup

Financialization wikipedia , lookup

Investment banking wikipedia , lookup

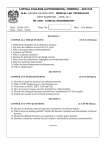

MODEL ANSWERS SECTION A Question 1 (a) (b) The two components of an investor’s required rate of return are as follows; The time value of money during the period of the investment. (2 marks) The expected rate of inflation during the period. (2 marks) The fundamental principles of investment are as follows; Time value of money: this is the influence that interest rates have on the value of money over a period of time. (2 marks) Risk versus return: Risk refers to uncertainty about the occurrence of a future outcome. Risk can be divided into financial and non financial risk. Financial risk is the possibility that a future event will diminish the value of an investment. Financial risk is measured by the standard deviation and the coefficient of variation. Non financial risk is exposure to uncertainty which is non monetary in nature, e.g. health and safety risk. Return refers to the capital appreciation or loss in the form of cash dividends or interest resulting from investment. Historical returns are measured by the holding period return (HPR) and holding period yield (HPY), whereas future returns are measured by the expected return and required rate of return. (4marks) (c) Students must choose any five from the following asset classes (5 marks) Equity Fixed income securities (which would include bonds, shares and bank deposits) Debt instruments Real estate Art objects Rare stamps Currencies Question 2 (a) An investment Manager would take the following steps: Establish investment objectives and constraints. (2 marks) Establish the investment policy. (2 marks) 1 (b) Select a portfolio strategy. (2 marks) Select assets. (2 marks) Measure and evaluate performance. (2 marks) The expected rate of return is the rate expected to be realised from an investment and is calculated by multiplying the probabilities of occurrence by their associated outcomes. The required rate of return is the minimum return an investor would require from an investment, given the riskiness of the instrument. If the expected return is less than the required return, the investment is not worth pursuing. (5 marks) Question 3 Interest – bearing instruments are instruments that pay interest on the initial investment amount to the holder. They include: (2.5 marks) Overnight/time/term deposits (1 mark) Negotiable certificate of deposit (1 mark) Reserve bank debentures (1 mark) Repurchase agreements (1 mark) Roads board bridging bonds (1 mark) Discount instruments are instruments that do not pay interest to the holder, but are purchased at a discount on the nominal value. They include: (2.5 marks) Treasury bills (1 mark) Bankers Acceptances (1 mark) Commercial paper (1 mark) Promissory notes (1 mark) Land bank bills (1 mark) Capital project bills (1 mark) Question 4 The Securities Industry and Financial Markets Association in U.S.A and Asia classify the broader bond market into five specific bond markets. (15 marks) Corporate 2 Government & agency Municipal Mortgage backed, asset backed, and collateralized debt obligation Funding SECTION B Question 5 Primary markets are markets dealing in the issue of new securities. These can be initial public offerings (IPOs) for public companies, government bonds or other private and public sector funding programs. In a primary market, the security is sold directly to the investor from the company or organization itself. As in the case with IPOs, it is a purchase between the company and the investor. In the case of municipal bonds, it is the purchase of the debenture directly from the municipality. Primary markets are a vital part of the capital markets and underlying strength of the economy. (5 marks) Secondary Market Once something has gone through its offering in the primary market, it will then be made available in secondary markets such as stock exchanges and through brokerage firms. There may be a specified period before the issue can be sold on a secondary market to allow it to preserve the strength and integrity of the offering as in cases with IPOs. Once securities are on the aftermarket, they can be bought and sold based on demand. Securities exchanges are the "store" that these securities are sold with sales forces extending through brokerage firms. The information presented on the nightly news with market ups and downs is referring to the secondary markets most often. (5 marks) The secondary markets support the primary market by: Giving investors liquidity, price continuity and depth. Investors would be hesitant to purchase new securities if they did not have the opportunity to sell them at a later stage. (5 marks) Providing information about current prices and yield. Prices and yield in the secondary market are taken into consideration when investment bankers plan for new issues of securities. (5 marks) Question 6 (i) Required return (ABC) = Rf + Bi (Km –Rf) = 0.07 + 2.4 (0.12 – 0.07) = 0.19 = 19% Required return (XYZ) = Rf + Bi (Km –Rf) 3 = 0.07 + 0.8 (0.12 - 0.07) = 0.11 = 11% (ii) Required return (XYZ) = Rf + Bi (Km –Rf) = 0.08 + 0.8 (0.12 - 0.08) = 0.112 = 11.2% It would offer a higher return. (20 marks) Question 7 (a) FV = K10,816 PV = Principal added: K10,000 Interest added: Period No. 01/01/08 0 K400 K416 ←6 months→ 06/30/08 1 ←6 months→ 12/31/08 2 n = 2 semi-annual periods; i = 4% per semi-annual period (5 marks) (b) Input Function 1000 PMT 5 N 7 I CPT 4 FV 5750.74 (5 marks) Question 8 (a) The top down approach involves an analysis of microeconomic influences and industry analysis before the company can be analysed. The bottom up approach uses valuation techniques to value assets without considering the influences of macroeconomic and industry forces on the prospects of the company. (5 marks) (b) A restrictive monetary policy has the effect of raising the market interest rates, which, in turn, increases companies’ borrowing costs and thus affects the profitability of companies. Individuals would also be affected because it would be expensive for them to borrow money from the bank to finance their homes, motor vehicles and other durable goods. (5 marks) (c) The idea behind the three step valuation process is to identify the macroeconomic influences that may impact on the company’s ability to generate earnings. Once you have identified these factors, it is easier to analyse the earning capabilities of industries and companies. (5 marks) (d) The following is a list of porter’s five forces The threat of substitute products (1 mark) The threat of the entry of new competitors (1 mark) The intensity of competitive rivalry (1 mark) The bargaining power of customers (1 mark) The bargaining power of suppliers (1 mark) 5