* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

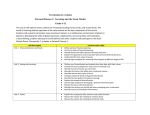

Download Fundamentals of Investing Chapter Fifteen

Private equity in the 2000s wikipedia , lookup

Interbank lending market wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Negative gearing wikipedia , lookup

Internal rate of return wikipedia , lookup

Private equity secondary market wikipedia , lookup

Foreign direct investment in Iran wikipedia , lookup

Private equity wikipedia , lookup

Fund governance wikipedia , lookup

Money market fund wikipedia , lookup

Systemic risk wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Mutual fund wikipedia , lookup

Hedge (finance) wikipedia , lookup

Corporate venture capital wikipedia , lookup

Stock trader wikipedia , lookup

International investment agreement wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Early history of private equity wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Investment banking wikipedia , lookup

Private money investing wikipedia , lookup

Investing Fundamentals Investing for the Future: Goal Setting • Investment goals should be specific and measurable. Develop your goals by asking questions: • • • • What will I use the money for? How much will I need? How will I get the money I need? How long will it take me to get the money I need? • How much risk am I willing to take on? 13-2 Goal Setting (continued) • What could make me change my goals? • Given my economic circumstances, are my investment goals reasonable? • Am I willing to make the sacrifices necessary, to meet my goals? • What will the consequences be if I don’t reach my investment goals? 13-3 First Steps • Get a good education and good training to win the means to finance your future. • Establish a budget and stick to it. • Establish a savings account. • Save for emergencies (3 – 9 months of living expenses). • Save for your education. • Save to invest. • Avoid debt. • Make sure you are insured. 13-4 Second Steps • Start or have someone start for you a Roth IRA • Choose a reputable no-load mutual fund or Exchange-traded fund. Plow into your future as much as you can of gifts, inheritances, and windfalls. 13-5 Third Steps • Participate in any 401(k) or other savings / investing plan your employer may offer. • Add to your portfolio of mutual funds and exchange-traded funds. • Educate yourself about other possibilities, such as investing directly in the stock market. The Value of Investing into and for the Future • Many people don’t start investing because they only have a small amount to invest, but.... • Even small amounts invested regularly grow over a long period of time. • If you save $2,000 each year at 5%, you would have $241,600 at the end of 40 years. The higher the rate of return the greater the risk. 13-6 Factors Affecting the Choice of Investments • Safety and risk. • Safety means a lessening of the possibility of losing your money. • Risk means hat there’s a chance you WILL lose your money. • Investments range from very safe to very risky. • The greater the risk, the greater the potential return: risk is best borne by the young. 13-7 Five Components of Risk • Inflation risk - during periods of high inflation your investment return may not keep pace with the inflation rate. • Interest rate risk - you may invest in a bond at a 6%, rates later go up to 8%; your bond price falls. • Business failure risk - bad management or products affect stocks and corporate bonds. • Market risk - prices fluctuate because of behaviors of investors. • Global investment risk - changes in currency affect the return on your investment. 13-8 Investment Risk: the Lows and Highs • Safe investments = predictable and low income. • Savings accounts and certificates of deposit. • U.S. savings bonds. • United States treasury bills. • Riskier investments = higher potential income. • • • • • Municipal bonds. Corporate bonds. Preferred stocks and income common stocks. Income mutual funds. Real estate rental property. 13-9 Investment Growth and Liquidity • Growth:investment will increase in value over time. • Liquidity. • The ability to buy or sell an investment quickly without substantially affecting the investment’s value. • Cash is immediately liquid. • Savings is very liquid. • Precious metals are not very liquid. • Real estate is not very liquid. 13-10 Asset Allocation and Diversification • Asset allocation is the process of spreading your assets among several different types of investments, usually by percentage, to lessen risk. • Determine what percent you want in stock, bonds, CDs, and mutual funds based on your time frame, age, and tolerance for risk. • Investing in different asset classes provides diversification. • Younger investors generally should put a larger percentage in growth-oriented investments. 13-11 Investment Alternatives - Stock • Stock or equity financing. • Equity capital is provided by stockholders, who buy shares of a company’s stock. • Stockholders are owners and share in the success of the company. • A corporation is not required to repay the money obtained from the sale of stock. • They are under no legal obligation to pay dividends to stockholders. They may instead retain all or part of earnings. 13-12 Investment Alternatives - Bonds • Corporate and government bonds. • A bond is a loan to a corporation, the federal government, or a municipality. • Bondholders receive periodic interest payments, and the principal is repaid at maturity (1-30 years). • Bondholders can keep the bond until maturity or sell it to another investor before maturity. 13-13 Investment Alternatives – Mutual Funds • Mutual funds. • Investors’ money is pooled and invested by a • • • • professional fund manager. You buy shares in the fund. Provides diversification to reduce risk . Funds range from conservative to extremely speculative. Match your needs with a fund’s objective. 13-14 Investment Alternatives - Real Estate • The goal of a real estate investment is to buy a property and sell it at a profit. Nationally, 3% appreciation in price a year is average. • Location, location, location is important. 13-15 Speculation – Don’t Be Stupid! • Speculative investments. • A speculative investment is a high-risk investment made in the hope of earning a relatively large profit in a short time. Typical speculative investments include: • • • • • Antiques and collectibles. Options. Commodities. Coins and stamps. Precious metals and gemstones. 13-17 A Personal Investment Plan • Establish realistic goals. • Determine the amount of money needed to meet your goals. • Specify the amount of money available to fund your investments. • List different investments you want to evaluate. • Evaluate risk and potential return for each. • Reduce possible investments to a reasonable number. • Choose at least two different investments. • Continue to evaluate your investment program. 13-18 Your Role in the Investment Process • Evaluate potential investments. • Seek the assistance of a financial planner (see Appendix at the back of the text). • Monitor the value of your investments. • Keep accurate and current records. • Consider the tax consequences of selling your investments. 13-19 Sources of Investment Information • The internet. • A wealth of investment information is available. • View sites such as www.fool.com, www.cnn.com , and www.money.com • Newspapers and news programs. • Business periodicals such as Smart Money and government publications. • Corporate Reports. • Investor services and newsletters, such as ValueLine or Morningstar. 13-20