* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Investment Terminology and Concepts

Systemic risk wikipedia , lookup

Internal rate of return wikipedia , lookup

Negative gearing wikipedia , lookup

Private equity wikipedia , lookup

Securitization wikipedia , lookup

Present value wikipedia , lookup

Syndicated loan wikipedia , lookup

Individual Savings Account wikipedia , lookup

Business valuation wikipedia , lookup

Beta (finance) wikipedia , lookup

Pensions crisis wikipedia , lookup

Private equity secondary market wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Corporate venture capital wikipedia , lookup

Stock valuation wikipedia , lookup

Interest rate wikipedia , lookup

Interbank lending market wikipedia , lookup

International investment agreement wikipedia , lookup

Early history of private equity wikipedia , lookup

Land banking wikipedia , lookup

Stock trader wikipedia , lookup

Investment banking wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

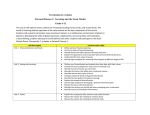

Investments Joan Koonce, Ph.D., AFC® Extension Financial Planning Specialist Investment Terminology and Concepts • What is Investing? – Investing is putting your money into an asset that generates a rate of return. – Some examples of investments are stocks, bonds, mutual funds, and real estate. back Investment Terminology and Concepts • Investment Income – Income that you receive from the investment while you have it • from bonds you receive interest • from stocks you receive dividends • from real estate you receive rent back Investment Terminology and Concepts • Capital Gain or Loss – Profit or loss received when you sell an investment that has increased or decreased in value back Investment Terminology and Concepts • Rate of Return – Total return (investment income and capital gains) generated from an investment stated in percentage terms • Investment Risk – Uncertainty that an investment will not perform as expected back Investment Terminology and Concepts • Types of Risk – Interest rate risk – Inflation (purchasing power) risk – Financial (default) risk – Liquidity risk – Business risk – Market risk back Investment Terminology and Concepts • Risk Capacity – The amount of risk you can afford to accept • Risk Tolerance – The amount of risk you feel comfortable accepting back Investment Terminology and Concepts • What is your “risk” personality? – http://www.rce.rutgers.edu:8080/money /riskquiz/default.asp back Investment Terminology and Concepts • Diversification – Investing in several different types of securities in an effort to reduce overall risk in your investment portfolio • Dollar-Cost Averaging – Investing an equal amount of money regularly regardless of the investment’s price back Investment Terminology and Concepts • Asset Allocation – Allocating proportions of your investment portfolio to different categories of assets • Leverage – Using borrowed money to make an investment • Time Horizon – The period of time before you will need the money you invested back Investment Terminology and Concepts • Types of Investments – Ownership investments (Equity) • Stock • Real estate – Lending investments (Debt) • Bonds back What are Stocks? • Stocks are shares of ownership in a company. • Stock represents a claim on the company's assets and earnings. back What Does Stock Ownership Mean? • Voting Rights • Owning shares in Home Depot does not mean you can go help yourself to free home improvement or other building materials! back Buying Stocks • Brokers • DRIPs & DSPPs or DIPs – Dividend Reinvestment Plans (DRIPs) and – Direct Stock Purchase Plans (DSPPs) or Direct Investment Plans (DIPs) are plans with which individual companies for a minimal cost, allow shareholders to purchase stock directly from the company. back Why Consider Stocks? • Stocks can provide investors with dividends and capital gains. • Over time, common stocks outperform all other investments. • Stocks are somewhat liquid. • Growth of your investment is determined by more than just interest rates. back General Classifications of Stock • • • • • • • Blue-Chip Stocks Growth Stocks Income Stocks Speculative Stocks Cyclical Stocks Defensive Stocks Large-Cap, Mid-Cap, Small-Cap and Micro-Cap Stocks back What are Bonds? • Similar to an I.O.U. When you purchase a bond, you are making a loan to a corporation, local, state or federal government, federal government agency or other entity known as the issuer. • The issuer promises to pay you a specified rate of interest during the life of the bond and to repay the principal when it “matures,” or comes due. back Why Consider Bonds? • Bonds produce steady current income. • Bonds can be a safe investment if held to maturity. back Basic Bond Terminology and Features • Face Value: the amount you loan (principal) and is returned to you at maturity • Coupon Rate: the annual interest rate that is paid over the life of the bond • Maturity date: the date the investor receives the principal back back Types of Bonds • Corporate Bonds • Municipal Bonds • Treasury Bills, Notes, Bonds and Treasury Inflation-Protected Securities (TIPS) back Bond Ratings • Generally ratings run from AAA or aaa for the safest to D for the extremely risky. • Ratings categorize bonds by default risk. • Rating Companies – Standard & Poor’s – Moody’s • http://www.moodys.com/ – Fitch back What are Mutual Funds? • An investment company that pools money from investors to buy stocks, bonds, and other investments. Investors own shares of the fund proportionate to the amount of their investment. back Why Invest in Mutual Funds? • Benefits the Small Investor – Mutual funds allow people with a limited amount of money the opportunity to invest and purchase enough investments to have a fully diversified investment portfolio. back Advantages of Mutual Fund Investing • Diversification • Professional Management • Minimal Transaction Costs • Liquidity • Flexibility • Service back Disadvantages of Mutual Fund Investing • Lower Than Market Performance • Costs – Loads – Management fees – 12b-1 fees • Capital Gains Distributions back Types and Objectives of Mutual Funds • Money Market Mutual Funds • Stock Mutual Funds – Aggressive growth funds – Small company growth funds – Growth funds – Growth and income funds – Sector funds – Index funds – International funds back Types and Objectives of Mutual Funds • Balanced Mutual Funds • Asset Allocation Funds • Life-Cycle Funds • Bond Funds back Investing for Emergencies • Savings Accounts • Money Market Accounts • Money Market Mutual Funds • Short-term Certificates of Deposit back Investing for Education • Qualified Tuition Plans (QTPs or 529 Plans) – Prepaid Tuition Plans – Savings Plans • Coverdell Education Savings Account (ESA) • Series EE Savings Bonds • Traditional IRA • Roth IRA back Investing for Retirement • Employer-Sponsored Plans – Defined-Contribution Plans – Defined-Benefit Plans • Personal Savings Plans – Traditional IRAs – Roth IRAs back Investing for Retirement • Self-Employed Plans – Keogh plan – Simplified Employee Pension Plan (SEP) back www.gafamilies.com 1-800-ASK-UGA1 back