* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download accounting of carbon credit

Climate governance wikipedia , lookup

Iron fertilization wikipedia , lookup

Global warming wikipedia , lookup

Emissions trading wikipedia , lookup

Kyoto Protocol wikipedia , lookup

Economics of climate change mitigation wikipedia , lookup

Clean Development Mechanism wikipedia , lookup

Solar radiation management wikipedia , lookup

Climate change mitigation wikipedia , lookup

2009 United Nations Climate Change Conference wikipedia , lookup

European Union Emission Trading Scheme wikipedia , lookup

Reforestation wikipedia , lookup

Decarbonisation measures in proposed UK electricity market reform wikipedia , lookup

United Nations Framework Convention on Climate Change wikipedia , lookup

Citizens' Climate Lobby wikipedia , lookup

Carbon pricing in Australia wikipedia , lookup

IPCC Fourth Assessment Report wikipedia , lookup

Climate-friendly gardening wikipedia , lookup

Climate change feedback wikipedia , lookup

Mitigation of global warming in Australia wikipedia , lookup

Carbon Pollution Reduction Scheme wikipedia , lookup

Low-carbon economy wikipedia , lookup

Politics of global warming wikipedia , lookup

Carbon emission trading wikipedia , lookup

Carbon credit wikipedia , lookup

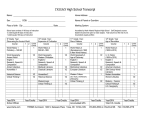

CARBON CREDITS PRESENTED BY: CORPORATES EFFECTS OF GLOBAL WARMING Over the last many years climatologists, geologists and various researchers have given us warnings on climate changes. “GLOBAL WARMING” R E S U L T S IN Season shifting, Changing landscapes, Rising sea levels, Floods & Droughts, Storms and other Epidemics GLOBAL WARMING IS RESULT OF “GREEN HOUSE GASES” (GHG’s) MAJOR GREEN HOUSE GASES • Carbon Dioxide (CO2) • Methane (CH4) • Nitrous Oxide (N20) • Hydrofluorocarbons (HFCs) KYOTO PROTOCOL In the year 1997 World Earth Summit held at Kyoto, Japan. The objective of the Kyoto climate change conference was to establish a legally binding international agreement, whereby all the participating nations commit themselves to tackling the issue of global warming and greenhouse gas emissions. As of 14 January 2009, a total of 183 countries have ratified the agreement. PRINCIPLES OF KYOTO PROTOCOL 1] Commitments to reduce greenhouse gases that are legally binding for annex I countries, as well as general commitments for all member countries 2] Implementation to meet the Protocol objectives, 3] Minimizing impacts on developing countries by establishing an adaptation fund for climate change; 4] Accounting, reporting and review to ensure the integrity of the Protocol; 5] Compliance by establishing a compliance committee to enforce compliance with the commitments under the Protocol. KYOTO PROTOCOL Countries are divided into Annexure I countries (Developed) Annexure II countries (Developing) REQUIREMENTS AS PER PROTOCOL First phase target - Annexure I countries to reduce emission between 2008 & 2012 to 5.2% below the 1990 level. Second phase target is yet to be ascertained. As of now annexure II countries are not required to reduce their emission for now. CARBON CREDIT CONCEPT 1 Carbon Credit = 1 Ton of CO2 (or its equivalent in greenhouse gases) removed from the atmosphere. * Note that Measure of Carbon credit is Certified Emission Reduction.(CER) PROJECTS THAT QUALIFY FOR CARBON CREDIT • Energy Efficiency • Renewable Energy • Biogas flaring on farms • Reforestations, etc. CARBON EMISSION RIGHTS (CER) OR CARBON CREDITS It is in the form of Certificate, just like Stock, which is given by the CDM (Clean Development Mechanism) Executive Board. A CDM Executive Board is a board comprising of 10 members who supervise the operation of CDM. Every project is registered with the CDM Executive board. The Designated Operational Entity (DOE) periodically checks whether emission reduction has actually taken place or not. Only after verification by DOE, CER’s are delivered. These certificates can be traded at designated markets called as Climate Exchange. TRADING OF CARBON CREDITS Sale of Carbon Credits Developing Countries Developed Countries Inflow of FOREX ILLUSTRATION OF CARBON TRADING BUYER • A business that owns a factory putting out 100,000 tones of greenhouse gas emissions in a year. It is in the Annexure- I country, that enacts a law to limit the emissions that the business can produce. Say 80,000 tonnes per year. • The factory is required to either reduce its emissions to 80,000 tonnes or purchase carbon credits to offset the excess. SELLER • A company which makes investments in the projects in the developing countries like Power generation plant using Wind power instead of Fossil fuel. • Another company which already invests in the new Low-emission project and has surplus of Carbon Credits. ADVANTAGES. For Polluting companies from developed countries No need to investment in the New expensive projects instead they buy Carbon credits. For Non-polluting companies from developing countries They can sell the Carbon credits and earn profits. ADVANTAGES. • Pollution Control • Remedy against Global Warming • Foreign Exchange earnings • Development of Poor countries ACCOUNTING OF CARBON CREDIT • As of now, there are no separate Indian accounting standards to measure income and expenditure from carbon reducing projects. • Guidance note on Accounting for Certified Emission Reductions is under consideration of ICAI. ACCOUNTING OF CARBON CREDIT • Issues involved 1. Accounting for Expenditure on Projects 2. Accounting for Self generated Credits 3. Recognition of Carbon credits 4. Disclosure requirement ACCOUNTING OF CARBON CREDIT AS-26 Intangible Assets which are • Identifiable assets • Without physical existance • Held for production or rental use or administrative purpose. Assets should be recognized as an Intangible Asset. If : 1) It is available for use/sale. 2) intention to use/sale. 3) ability to use/sale. ACCOUNTING OF CARBON CREDIT • AS-2 Valuation of Inventories INVENTORY Assets Held for Sale in ordinary course. VALUATION Cost of Purchase Expenses incurred for bringing inventories at their present location and condition. ACCOUNTING FOR CARBON CREDIT • AS-9 REVENUE RECOGNISITION 1. Transfer of Property and all risks and rewards. 2. No Uncertainty regarding realization of consideration. COMPANY LAW CER Sale is Other Income and not Turnover: A combined reading of section 43A (Turnover) and Schedule VI of the Companies Act Case Laws • TATA Consultancy Services Ltd. Vs. State of Andhra Pradesh • CER credits are considered goods, as they have all the attributes thereof. TAXATION OF CARBON CREDITS • CER credits satisfies definition of Capital Asset. • CERs are Capital Assets for the purpose taxation under Income Tax Act,1932 & tax liability should be admitted under the head Capital Gain. • Cost of Acquisition of CER credits acquired from other parties for the purposes of trading is actual cost of acquisition. • While Cost of self generated CER credits, Cost of Acquisition will be NIL. INDIA’ POTENTIAL IN CARBON TRADING • India’s is 2nd largest seller of Carbon credits. • Manufactures of Electric scooters also have huge potential in earning Carbon Credits. • Reliance power expects to earn Rs.4000 crores from Carbon trading from Sasan power project in MP over next 10 years. SOURCES OF INFORMATION : • ICAI Journal: April 2006 Edition • ICAI Journal: October 2006 Edition • Greatest source of Information ever invented : INTERNET THANK YOU………. CORPORATES GROUP