* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 4

Private equity secondary market wikipedia , lookup

Securitization wikipedia , lookup

Investment fund wikipedia , lookup

Financialization wikipedia , lookup

Financial economics wikipedia , lookup

Interest rate swap wikipedia , lookup

Credit card interest wikipedia , lookup

Investment management wikipedia , lookup

Present value wikipedia , lookup

Stagflation wikipedia , lookup

Quantitative easing wikipedia , lookup

Interbank lending market wikipedia , lookup

Lattice model (finance) wikipedia , lookup

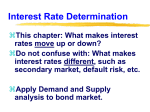

© 2014 Pearson Education, Inc. LEARNING OBJECTIVES After studying this chapter, you should be able to: 4.1 Discuss the most important factors in building an investment portfolio. 4.2 4.3 Use a demand and supply model to determine market interest rates for bonds. Use the bond market model to explain changes in interest rates. 4.4 Use the loanable funds model to analyze the international capital market. © 2014 Pearson Education, Inc. Are There Any Safe Investments? •Recently, interest rates on U.S. Treasury notes and corporate bonds have been falling from their historical averages. •If interest rates on those securities rose back to their historical averages, bond holders would suffer capital losses. •Many financial advisers have warned investors of this interest rate risk in holding bonds. •In this chapter, we study how investors take into account expectations of inflation and other factors when making investment decisions. © 2014 Pearson Education, Inc. Key Issue and Question Issue: Federal Reserve policies to combat the recession of 2007– 2009 led some economists to predict that inflation would rise and make long-term bonds a poor investment. Question: How do investors take into account expected inflation and other factors when making investment decisions? © 2014 Pearson Education, Inc. 4.1 Learning Objective Discuss the most important factors in building an investment portfolio. © 2014 Pearson Education, Inc. 5 of 56 How to Build an Investment Portfolio The Determinants of Portfolio Choice Determinants of portfolio choice (asset demand) are: 1. The saver’s wealth 2. The expected rates of return from different investments 3. The degrees of risk in different investments 4. The liquidity of different investments 5. The costs of acquiring information about different investments How to Build an Investment Portfolio © 2014 Pearson Education, Inc. 6 of 56 Wealth An increase in wealth generally increases the quantity demanded for most financial assets. Expected Rate of Return Expected return is the return expected on an asset during a future period. The expected return on an investment is: Expected return = [(Probability of event 1 occurring) X (Value of event 1)] + [(Probability of event 2 occurring) X (Value of event 2)]. Example: Equal probability of a rate of return of 15% and 5%. Expected return = (0.50)(15%) + (0.50)(5%) = 10%. How to Build an Investment Portfolio © 2014 Pearson Education, Inc. 7 of 56 Risk Risk is the degree of uncertainty in the return on an asset. • Most investors are risk averse – choose the asset with the lower risk when two assets have the same expected returns – resulting in trade-offs between risk and return. • Risk-loving investors prefer to hold risky assets with the possibility of maximizing returns. • Risk-neutral investors make decisions on the basis of expected returns, ignoring risk. How to Build an Investment Portfolio © 2014 Pearson Education, Inc. 8 of 56 Making the Connection Fear the Black Swan! • Investors in stocks of small companies from 1926 to 2011 experienced the highest average returns but also accepted the most risk (measured by the standard deviation of returns). • U.S. Treasury bills had the lowest average returns but also the least risk. • Some economists see the financial crisis as a black swan – a rare event that has a large impact on the economy – which might affect the conventional measure of risk. How to Build an Investment Portfolio © 2014 Pearson Education, Inc. 9 of 56 Liquidity • The greater an asset’s liquidity, the more desirable the asset is to investors. The Cost of Acquiring Information • All else being equal, investors will accept a lower return on an asset that has lower costs of acquiring information. Desirable characteristics of a financial asset cause the quantity of the asset demanded by investors to increase, and vice versa. How to Build an Investment Portfolio © 2014 Pearson Education, Inc. 10 of 56 How to Build an Investment Portfolio © 2014 Pearson Education, Inc. 11 of 56 Diversification Diversification is dividing wealth among many different assets to reduce risk. Market (systematic) risk is risk that is common to all assets of a certain type, e.g., changes in stock returns as a result of the business cycle. Idiosyncratic (unsystematic) risk is risk that pertains to a particular asset (or a firm) rather than to the market as a whole. How to Build an Investment Portfolio © 2014 Pearson Education, Inc. 12 of 56 Making the Connection In Your Interest How Much Risk Should You Tolerate in Your Portfolio? • Your time horizon is an important factor in deciding on the degree of risk. • Saving plans are also affected by the effects of inflation and taxes. How to Build an Investment Portfolio © 2014 Pearson Education, Inc. 13 of 56 4.2 Learning Objective Use a demand and supply model to determine market interest rates for bonds. © 2014 Pearson Education, Inc. 14 of 56 Market Interest Rates and the Demand and Supply for Bonds • A bond’s price (P) and its yield to maturity (i) are linked by the equation showing its coupon payments (C), face value (FV) and maturity in n years: • Because C and FV do not change, once we know P in the bond market, we have determined the equilibrium i. • The bond market approach (bonds as the good) is useful when considering how the factors affecting the demand and supply for bonds affect the interest rate. • The market for loanable funds approach (funds as the good) is useful when considering how changes in the demand and supply of funds affect the interest rate. Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 15 of 56 A Demand and Supply Graph of the Bond Market Figure 4.1 The Market for Bonds The equilibrium price of bonds is determined in the bond market. By determining the price of bonds, the bond market also determines the interest rate on bonds. Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 16 of 56 Figure 4.2 Equilibrium in Markets for Bonds At $960, the quantity of bonds demanded by investors equals the quantity of bonds supplied by borrowers. At any price higher or lower than $960, the quantity of bonds demanded is not equal to the quantity of bonds supplied. The interest rate on the bond is: Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 17 of 56 Explaining Changes in Equilibrium Interest Rates In drawing the demand and supply curves for bonds, factors other than the prices of bonds are held constant. If the price of bonds changes, we move along the demand (supply) curve, so we have a change in quantity demanded (supplied). If any other relevant variable changes, then the demand (supply) curve shifts, and we have a change in demand (supply). Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 18 of 56 Factors That Shift the Demand Curve for Bonds Five factors cause the demand curve for bonds to shift: 1. Wealth 2. Expected return on bonds 3. Risk 4. Liquidity 5. Information costs Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 19 of 56 Wealth Figure 4.3 (1 of 2) Shifts in the Demand Curve for Bonds An increase in wealth will shift the demand curve for bonds to the right. As a result, both the equilibrium price of bonds and the equilibrium quantity of bonds increase. Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 20 of 56 Wealth Figure 4.3 (2 of 2) Shifts in the Demand Curve for Bonds (continued) A decrease in wealth will shift the demand curve for bonds to the left. As a result, both the equilibrium price and the equilibrium quantity of bonds decrease. Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 21 of 56 Expected Return on Bonds If the expected return on bonds rises relative to expected returns on other assets, investors will increase their demand for bonds. Risk A decrease in the riskiness of bonds relative to the riskiness of other assets increases the willingness of investors to buy bonds. Liquidity If the liquidity of bonds increases, investors demand more bonds at any given price. Information Costs As a result of the lower information costs, investors are more willing to buy bonds. Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 22 of 56 Table 4.2 (1 of 3) Factors That Shift the Demand Curve for Bonds Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 23 of 56 Table 4.2 (2 of 3) Factors That Shift the Demand Curve for Bonds Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 24 of 56 Table 4.2 (3 of 3) Factors That Shift the Demand Curve for Bonds Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 25 of 56 Factors That Shift the Supply Curve for Bonds Important factors for explaining shifts in the supply curve for bonds: 1. Expected pretax profitability of physical capital investments 2. Business taxes 3. Expected inflation 4. Government borrowing Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 26 of 56 Expected Pretax Profitability of Physical Capital Investments Figure 4.4 (1 of 2) Shifts in the Supply Curve for Bonds An increase in firms’ expectations of the profitability of investments in physical capital will shift the supply curve for bonds to the right. As a result, the equilibrium price of bonds falls and the equilibrium quantity of bonds rises. Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 27 of 56 Expected Pretax Profitability of Physical Capital Investments Figure 4.4 (2 of 2) Shifts in the Supply Curve for Bonds (continued) If firms become pessimistic about the profits they could earn from investing in physical capital, the supply curve for bonds will shift to the left. As a result, the equilibrium price increases and the equilibrium quantity of bonds decreases. Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 28 of 56 Business Taxes When business taxes are raised, the profits on new investments in physical capital decline, and firms issue fewer bonds. Expected Inflation For any given nominal interest rate, an increase in the expected rate of inflation reduces the expected real interest rate. A lower expected real interest rate is attractive for a firm as it will pay less in real terms to borrow funds. Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 29 of 56 Government Borrowing Figure 4.5 The Federal Budget, 1960-2012 The recession of 2007–2009 led to record federal government deficits that required borrowing heavily by selling bonds. Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 30 of 56 Making the Connection Why Are Bond Interest Rates So Low? If nothing else changes, a larger government deficit and thus borrowing shifts the bond supply curve to the right, resulting in a higher interest rate. In 2012, bond interest rates remained low despite record deficits. When the government runs a deficit, households may begin to increasing saving in anticipation for future tax payments to finance the deficit. Due to increased household saving, the demand curve for bonds shifts to the right when the supply curve for bonds also shifts to the right. As a result, the interest rate would not rise. The Loanable Funds Model and the International Capital Market © 2014 Pearson Education, Inc. 31 of 56 Table 4.3 (1 of 2) Factors That Shift the Supply Curve for Bonds Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 32 of 56 Table 4.3 (2 of 2) Factors That Shift the Supply Curve for Bonds Market Interest Rates and the Demand and Supply for Bonds © 2014 Pearson Education, Inc. 33 of 56 4.3 Learning Objective Use the bond market model to explain changes in interest rates. © 2014 Pearson Education, Inc. 34 of 56 The Bond Market Model and Changes in Interest Rates Examples of using the bond market model to explain changes in interest rates: (1) The movement of interest rates over the business cycle. (2) The Fisher effect, which is the movement of interest rates in response to changes in the inflation rate. The Bond Market Model and Changes in Interest Rates © 2014 Pearson Education, Inc. 35 of 56 Why Do Interest Rates Fall During Recessions? Figure 4.6 Interest Rate Changes in an Economic Downturn 1. An economic downturn reduces household wealth and thus decreases the demand for bonds. 2. The fall in expected profitability reduces lenders’ supply of bonds. 3. In the new equilibrium (E2), the bond price rises. The Bond Market Model and Changes in Interest Rates © 2014 Pearson Education, Inc. 36 of 56 How Do Changes in Expected Inflation Affect Interest Rates? The Fisher Effect The Fisher effect (asserted by Irving Fisher) indicates that the nominal interest rate changes point-for-point with changes in the expected inflation rate. The Fisher effect implies that: 1. Higher inflation rates result in higher nominal interest rates, and vice versa. 2. Changes in expected inflation can lead to changes in nominal interest rates before a change in actual inflation occurrs. The Bond Market Model and Changes in Interest Rates © 2014 Pearson Education, Inc. 37 of 56 Figure 4.7 Expected Inflation and Interest Rates 1. An increase in expected inflation reduces investors’ expected real return, thus the demand curve for bonds shifts to the left. 2. The increase in expected inflation increases firms’ willingness to issue bonds, thus the supply curve for bonds shifts to the right. 3. In the new equilibrium (E2), the bond price falls. The Bond Market Model and Changes in Interest Rates © 2014 Pearson Education, Inc. 38 of 56 Solved Problem 4.3 In Your Interest Should You Worry About Falling Bond Prices When the Inflation Rate Is Low? The inflation rate in late 2012 was about 2%. In the Wall Street Journal, a columnist wrote: “Someone buying long-term bonds yielding 1.5% or 2%, and then seeing consumer price inflation of 4%, will be on the losing end of the bet.” a. Explain what will happen to the price of bonds if the expected inflation rate increases to 4% from 2%. Include a demand and supply graph of the bond market. b. Suppose that you expect a greater increase in inflation than do other investors, but that you don’t expect the increase to occur until 2015. Should you wait until 2015 to sell your bonds? Briefly explain. The Bond Market Model and Changes in Interest Rates © 2014 Pearson Education, Inc. 39 of 56 Solved Problem 4.3 In Your Interest (continued) Should You Worry About Falling Bond Prices When the Inflation Rate Is Low? c. The columnist also argued that long-term bonds would be a good investment only if “we get serious price deflation.” Explain the effect on bond prices if investors decide that price deflation is likely to occur. How would an unexpected deflation affect the rate of return on your investment in bonds? d. If expected inflation is increasing, would you have made a worse investment if you had invested in long-term bonds than if you had invested in short-term bonds? The Bond Market Model and Changes in Interest Rates © 2014 Pearson Education, Inc. 40 of 56 Solved Problem 4.3 In Your Interest Should You Worry About Falling Bond Prices When the Inflation Rate Is Low? Solving the Problem Step 1 Review the chapter material. Step 2 Answer part (a) by explaining why an increase in expected inflation may make bonds a bad investment and illustrate your response with a graph. The Bond Market Model and Changes in Interest Rates © 2014 Pearson Education, Inc. 41 of 56 Solved Problem 4.3 In Your Interest Should You Worry About Falling Bond Prices When the Inflation Rate Is Low? Solving the Problem (continued) Step 3 Answer part (b) by discussing the difference in the effects of actual and expected inflation on changes in bond prices. Changes in bond prices result from changes in the expected rate of inflation. If buyers and sellers change their expectations, the nominal interest rate will adjust. Waiting until the nominal interest rate had risen would be too late to avoid the capital losses from owning bonds. Step 4 Answer part (c) by explaining the effect on the bond market of unexpected deflation. An unexpected deflation will shift the demand curve for bonds to the right and the supply curve to the left. The price of bonds will increase as a result, so a bond investor will experience a higher rate of return or capital gain. The Bond Market Model and Changes in Interest Rates © 2014 Pearson Education, Inc. 42 of 56 Solved Problem 4.3 In Your Interest (continued) Why Worry About Falling Bond Prices When the Inflation Rate Is Low? Solving the Problem (continued) Step 5 Answer part (d) by explaining why long-term bonds are a particularly bad investment if expected inflation increases. An increase in expected inflation will increase the nominal interest rate on all bonds, but the increases will be more on bonds with a longer maturity. So, the capital losses on long-term bonds will be greater than on short-term bonds. The Bond Market Model and Changes in Interest Rates © 2014 Pearson Education, Inc. 43 of 56 4.4 Learning Objective Use the loanable funds model to analyze the international capital market. © 2014 Pearson Education, Inc. 44 of 56 The Loanable Funds Model and the International Capital Market A borrower is the buyer of loanable funds and a lender is the seller. When looking at the flow of funds between the U.S. and foreign financial markets, the loanable funds approach is more useful than the demand and supply of bonds approach. The Loanable Funds Model and the International Capital Market © 2014 Pearson Education, Inc. 45 of 56 The Demand and Supply of Loanable Funds Figure 4.8 The Demand for Bonds and the Supply of Loanable Funds In panel (a), the bond demand curve (Bd) shows a negative relationship between the quantity of bonds demanded by lenders and the price of bonds. In panel (b), the supply curve for loanable funds (Ls) shows a positive relationship between the quantity of loanable funds supplied by lenders and the interest rate. The Loanable Funds Model and the International Capital Market © 2014 Pearson Education, Inc. 46 of 56 The Demand and Supply of Loanable Funds Figure 4.9 The Supply of Bonds and the Demand for Loanable Funds In panel (a), the bond supply curve (Bs) shows a positive relationship between the quantity of bonds supplied by borrowers and the price of bonds. In panel (b), the demand curve for loanable funds (Ld) shows a negative relationship between the quantity of loanable funds demanded by borrowers and the interest rate. The Loanable Funds Model and the International Capital Market © 2014 Pearson Education, Inc. 47 of 56 Equilibrium in the Bond Market from the Loanable Funds Perspective Figure 4.10 Equilibrium in the Market for Loanable Funds At the equilibrium interest rate, the quantity of loanable funds supplied by lenders equals the quantity of loanable funds demanded by borrowers. The Loanable Funds Model and the International Capital Market © 2014 Pearson Education, Inc. 48 of 56 The International Capital Market and the Interest Rate The foreign sector influences the domestic interest rate and the quantity of funds available in the domestic economy. The loanable funds approach provides a good framework for analyzing the interaction between U.S. and foreign bond markets. In a closed economy, households, firms, and governments do not borrow or lend internationally. In an open economy, households, firms, and governments borrow and lend internationally. The Loanable Funds Model and the International Capital Market © 2014 Pearson Education, Inc. 49 of 56 Small Open Economy In a small open economy, the quantity of loanable funds supplied or demanded is too small to affect the world real interest rate. Key Features: •The real interest rate in a small open economy is the same as the interest rate in the international capital market. •If the quantity of loanable funds supplied domestically exceeds the quantity of funds demanded domestically, the country invests some of its loanable funds abroad. •If the quantity of loanable funds demanded domestically exceeds the quantity of funds supplied domestically, the country finances some of its domestic borrowing needs with funds from abroad. The Loanable Funds Model and the International Capital Market © 2014 Pearson Education, Inc. 50 of 56 Small Open Economy Figure 4.11 Determining the Real Interest Rate in a Small Open Economy The domestic real interest rate in a small open economy is the world real interest rate (rw), which is 3% in this case. The Loanable Funds Model and the International Capital Market © 2014 Pearson Education, Inc. 51 of 56 Large Open Economy In a large open economy, changes in the demand and supply for loanable funds are large enough to affect the world real interest rate. In this case, we cannot assume that the domestic real interest rate is equal to the world real interest rate. The Loanable Funds Model and the International Capital Market © 2014 Pearson Education, Inc. 52 of 56 Figure 4.12 Determining the Real Interest Rate in a Large Open Economy The world real interest rate adjusts to equalize desired international borrowing and desired international lending. The Loanable Funds Model and the International Capital Market © 2014 Pearson Education, Inc. 53 of 56 Making the Connection Did a Global “Saving Glut” Cause the U.S. Housing Boom? In response to the argument that the Fed’s low-interest-rate policy in the 2000s fueled the housing boom, Ben Bernanke argued that “a significant increase in the global supply of saving—a global saving glut . . . helps to explain . . . the relatively low level of long-term interest rates in the world today.” The Loanable Funds Model and the International Capital Market © 2014 Pearson Education, Inc. 54 of 56 Answering the Key Question At the beginning of this chapter, we asked the question: “How do investors take into account expected inflation and other factors when making investment decisions?” Investors change their demand for bonds as a result of changes in a number of factors. When expected inflation increases, the real interest rate decreases and thus investors reduce their demand for bonds for each nominal interest rate. Increases in expected inflation also lead to higher nominal interest rates and capital losses for investors who hold bonds. © 2014 Pearson Education, Inc. 55 of 56