Comments Template QRT Assets final - eiopa

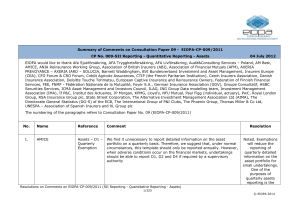

... AMICE, ANIA Reinsurance Working Group, Association of British Insurers (ABI), Association of Financial Mutuals (AFM), AXERIA PREVOYANCE – AXERIA IARD – SOLUCIA, Barnett Waddingham, BVI Bundesverband Investment and Asset Management, Insurers Europe (CEA), CFO Forum & CRO Forum, Crédit Agricole Assura ...

... AMICE, ANIA Reinsurance Working Group, Association of British Insurers (ABI), Association of Financial Mutuals (AFM), AXERIA PREVOYANCE – AXERIA IARD – SOLUCIA, Barnett Waddingham, BVI Bundesverband Investment and Asset Management, Insurers Europe (CEA), CFO Forum & CRO Forum, Crédit Agricole Assura ...

(IS) Y

... Web: http://sites.google.com/site/huynhvanthinhsite http://sites.google.com/site/economicsfamily HUỲNH VĂN THỊNH [email protected] ...

... Web: http://sites.google.com/site/huynhvanthinhsite http://sites.google.com/site/economicsfamily HUỲNH VĂN THỊNH [email protected] ...

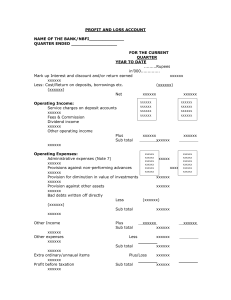

profit and loss account - State Bank of Pakistan

... Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 Gross ...

... Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 Gross ...

THE AMOUNTS AND THE EFFECTS OF MONEY LAUNDERING

... 0.4 The amount of money laundered is sizeable The International Monetary Fund (IMF) estimated money laundering at 2-5% of world GDP but few others have made an attempt to quantify global money laundering. John Walker (1999) was the first analyst to make a serious attempt at quantifying money launder ...

... 0.4 The amount of money laundered is sizeable The International Monetary Fund (IMF) estimated money laundering at 2-5% of world GDP but few others have made an attempt to quantify global money laundering. John Walker (1999) was the first analyst to make a serious attempt at quantifying money launder ...

National Infrastructure Bank Aff – 7WK

... remains the world’s largest; its citizens are among the world’s richest. The government is not constitutionally opposed to grand public works. The country stitched its continental expanse together through two centuries of ambitious earthmoving. Almost from the beginning of the republic the federal g ...

... remains the world’s largest; its citizens are among the world’s richest. The government is not constitutionally opposed to grand public works. The country stitched its continental expanse together through two centuries of ambitious earthmoving. Almost from the beginning of the republic the federal g ...

Complete Annual Report 2011

... of economic developments. The SNB’s monetary policy strategy consists of three elements: a definition of price stability, a medium-term conditional inflation forecast, and, at operational level, a target range for a reference interest rate, which is the Libor (London Interbank Offered Rate) for thre ...

... of economic developments. The SNB’s monetary policy strategy consists of three elements: a definition of price stability, a medium-term conditional inflation forecast, and, at operational level, a target range for a reference interest rate, which is the Libor (London Interbank Offered Rate) for thre ...

Summary Note dated 3 November 2014

... nominal value on the Redemption Date or any of the Designated Early Redemption Dates, bearing interest at the rate of 6% per annum, which in aggregate with the GBP Bonds would not exceed the Euro equivalent of €15,000,000 (or €25,000,000 in case of exercise of the Over-Allotment Option) in value of ...

... nominal value on the Redemption Date or any of the Designated Early Redemption Dates, bearing interest at the rate of 6% per annum, which in aggregate with the GBP Bonds would not exceed the Euro equivalent of €15,000,000 (or €25,000,000 in case of exercise of the Over-Allotment Option) in value of ...

ECB Unconventional Monetary Policy Actions: Market Impact

... Supplementary Long Term Refinancing Operations (SLTROs), with maturity between six months and one year and “Very” Long Term Refinancing Operations (VLTROs), with maturity of three years 5. To address the illiquidity in euro area money markets, and in particular tight financing conditions at long mat ...

... Supplementary Long Term Refinancing Operations (SLTROs), with maturity between six months and one year and “Very” Long Term Refinancing Operations (VLTROs), with maturity of three years 5. To address the illiquidity in euro area money markets, and in particular tight financing conditions at long mat ...

Investment Statement for Subordinated Bonds

... Bonds are unsecured, subordinated obligations of Kiwibank and are not guaranteed by New Zealand Post, the Crown, or by any other person. The proceeds of this Offer will be used to provide Kiwibank with additional capital to meet its growth aspirations. The Subordinated Bonds have been assigned a rat ...

... Bonds are unsecured, subordinated obligations of Kiwibank and are not guaranteed by New Zealand Post, the Crown, or by any other person. The proceeds of this Offer will be used to provide Kiwibank with additional capital to meet its growth aspirations. The Subordinated Bonds have been assigned a rat ...

Seminar Paper No. 680 HOW SHOULD MONETARY POLICY BE by

... Current in‡ation is lower than in many decades, which, together with the situation in Japan, has brought the potential threat of sustained de‡ation and a liquidity trap into focus. In section 5, I discuss the threat of de‡ation and a liquidity trap. More precisely, I specify what a liquidity trap is ...

... Current in‡ation is lower than in many decades, which, together with the situation in Japan, has brought the potential threat of sustained de‡ation and a liquidity trap into focus. In section 5, I discuss the threat of de‡ation and a liquidity trap. More precisely, I specify what a liquidity trap is ...

The Swiss National Bank 1907 – 2007

... its doors for business on 20 June 1907. In looking back over the SNB’s history, we are picking up the thread of the last three anniversary publications – those of 1932, 1957 and 1982. This time, however, we are not only presenting the view from inside, but have also been able to call upon a number ...

... its doors for business on 20 June 1907. In looking back over the SNB’s history, we are picking up the thread of the last three anniversary publications – those of 1932, 1957 and 1982. This time, however, we are not only presenting the view from inside, but have also been able to call upon a number ...

Principles of Macroeconomics - Test Item File 1 Ninth Edition by

... 4) Prices that do not always adjust rapidly to maintain equality between quantity supplied and quantity demanded are A) administered prices. B) sticky prices. C) regulatory prices. D) market prices. Answer: B 5) The demand for corn has increased in May without any change in supply. Eight months late ...

... 4) Prices that do not always adjust rapidly to maintain equality between quantity supplied and quantity demanded are A) administered prices. B) sticky prices. C) regulatory prices. D) market prices. Answer: B 5) The demand for corn has increased in May without any change in supply. Eight months late ...

29305000 trustees of the california state university systemwide

... Official Statement nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in the affairs of the State of California or the California State University since the date hereof. This Official Statement is submitted in connection with the sale of ...

... Official Statement nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in the affairs of the State of California or the California State University since the date hereof. This Official Statement is submitted in connection with the sale of ...

VANDEMOORTELE NV public limited liability company (naamloze

... from any Financial Intermediary, including compliance with any rules of conduct or other legal or regulatory requirements under or in connection with such public offer. Neither the Issuer nor any Manager has authorised any public offer of the Bonds by any person in any circumstance and such person i ...

... from any Financial Intermediary, including compliance with any rules of conduct or other legal or regulatory requirements under or in connection with such public offer. Neither the Issuer nor any Manager has authorised any public offer of the Bonds by any person in any circumstance and such person i ...

Report of Bank Pekao SA Group for the three quarters of

... after a decline of -0.1% quarter on quarter in the first quarter. Pace of growth of domestic demand declined in the second quarter of 2016 to 2.4% year on year vs. 4.1% year on year growth reported in the previous quarter. Slower demand growth was mainly a consequence of further deepening of decline ...

... after a decline of -0.1% quarter on quarter in the first quarter. Pace of growth of domestic demand declined in the second quarter of 2016 to 2.4% year on year vs. 4.1% year on year growth reported in the previous quarter. Slower demand growth was mainly a consequence of further deepening of decline ...

IFRS - PwC

... returns of the SE is the bond selection process. The bonds were selected upon setup of SE by the sponsoring bank, and the incorporation documents state that no further bonds may be purchased. No further bond selection decisions are therefore required after the SE is set up. Does the sponsoring bank ...

... returns of the SE is the bond selection process. The bonds were selected upon setup of SE by the sponsoring bank, and the incorporation documents state that no further bonds may be purchased. No further bond selection decisions are therefore required after the SE is set up. Does the sponsoring bank ...

Local Markets Compendium 2014

... improves market liquidity, diversity among foreign investors contributes to variations in behaviour under different market conditions. We show that dedicated EM bond funds represent slightly less than half of all foreign investors. As a result of this diversity, the scale of selling in aggregate has ...

... improves market liquidity, diversity among foreign investors contributes to variations in behaviour under different market conditions. We show that dedicated EM bond funds represent slightly less than half of all foreign investors. As a result of this diversity, the scale of selling in aggregate has ...

naic blanks (e) working group - National Association of Insurance

... This schedule should include a detailed listing of all securities that were purchased/acquired during the current reporting year that are still owned as of the end of the current reporting year (amounts purchased and sold during the current reporting year are reported in detail on Schedule D, Part 5 ...

... This schedule should include a detailed listing of all securities that were purchased/acquired during the current reporting year that are still owned as of the end of the current reporting year (amounts purchased and sold during the current reporting year are reported in detail on Schedule D, Part 5 ...

N - Piazza

... Even before the Czech Republic gained independence from communism, an underground translation was secretly used in macroeconomics seminars at Charles University in Prague. There is no greater pleasure for teachers and textbook authors than to see their efforts succeed so concretely around the world. ...

... Even before the Czech Republic gained independence from communism, an underground translation was secretly used in macroeconomics seminars at Charles University in Prague. There is no greater pleasure for teachers and textbook authors than to see their efforts succeed so concretely around the world. ...

The Choice between Non-Callable and Callable Bonds

... Another argument suggests that some issuers can use callable bonds to hedge interest rate risk. In fact, Banko and Zhou (2010) find some evidence of this for investment grade callable bonds. Recently, Choi, Jameson and Jung (2013) observe that asymmetric information generates an incentive to issue c ...

... Another argument suggests that some issuers can use callable bonds to hedge interest rate risk. In fact, Banko and Zhou (2010) find some evidence of this for investment grade callable bonds. Recently, Choi, Jameson and Jung (2013) observe that asymmetric information generates an incentive to issue c ...

14_dimitri_vittas_1

... A major part of the market is based on collective labor agreements, which favor defined-contribution plans and encourage the use of variable annuities, including both life and term annuities. ...

... A major part of the market is based on collective labor agreements, which favor defined-contribution plans and encourage the use of variable annuities, including both life and term annuities. ...

Core Inflation: Concepts, Uses and Measurement

... First, as Keynes notes “[c]hanges in relative prices may, of course, affect partial indexnumbers which represent price changes in particular classes of things, e.g. the index of the cost of living of the working classes.”12 Since all price indices produced by statistical agencies can be regarded as ...

... First, as Keynes notes “[c]hanges in relative prices may, of course, affect partial indexnumbers which represent price changes in particular classes of things, e.g. the index of the cost of living of the working classes.”12 Since all price indices produced by statistical agencies can be regarded as ...

Enhancing Monetary Analysis - ECB

... directions. Our research has demonstrated that money and credit aggregates are strongly influenced by the dynamics of asset markets. If we seek to understand the links between underlying trends in money and consumer prices, we must form a view on whether the asset price developments that condition t ...

... directions. Our research has demonstrated that money and credit aggregates are strongly influenced by the dynamics of asset markets. If we seek to understand the links between underlying trends in money and consumer prices, we must form a view on whether the asset price developments that condition t ...

Banco do Brasil S.A. U.S.$1,000,000,000 Global Medium

... admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange. The Bank may apply to, but is not obliged to, admit the Notes to be issued under the Program to listing on the Official List of the Luxembourg Stock Exchange and to trading on the Euro MTF market. The Pricing Supplement app ...

... admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange. The Bank may apply to, but is not obliged to, admit the Notes to be issued under the Program to listing on the Official List of the Luxembourg Stock Exchange and to trading on the Euro MTF market. The Pricing Supplement app ...