Reporting Standard ARS 720.4 ABS/RBA Debt Securities Held

... Debt securities issued by residents and non-residents are separately identified. Note that this treatment differs from Reporting Form ARF 720.0A ABS/RBA Statement of Financial Position (Banks) (ARF 720.0A) where debt securities issued by non-residents are not separately identified. Include debt secu ...

... Debt securities issued by residents and non-residents are separately identified. Note that this treatment differs from Reporting Form ARF 720.0A ABS/RBA Statement of Financial Position (Banks) (ARF 720.0A) where debt securities issued by non-residents are not separately identified. Include debt secu ...

Joint Stock Company “NORVIK BANKA” Consolidated and Separate

... common pattern across the Latvian banking sector in 2016 for those banks serving international clients. The global economic situation is still unclear, with significant changes in 2016 that will have long-term impacts that are hard to predict: In 2016 financial markets globally were driven primarily ...

... common pattern across the Latvian banking sector in 2016 for those banks serving international clients. The global economic situation is still unclear, with significant changes in 2016 that will have long-term impacts that are hard to predict: In 2016 financial markets globally were driven primarily ...

The role of inflation-linked bonds Increasing, but still modest

... government and that are held by risk-averse investors. The model offers two reasons why a government may find it unattractive to use inflation-linked bonds to finance its public debt. The most important one is liquidity risk. Because of liquidity risk, investors may be unwilling to step into ILBs. I ...

... government and that are held by risk-averse investors. The model offers two reasons why a government may find it unattractive to use inflation-linked bonds to finance its public debt. The most important one is liquidity risk. Because of liquidity risk, investors may be unwilling to step into ILBs. I ...

The Effect of Deflation or High Inflation on the Insurance Industry

... physical commodities such as gold which naturally had a limited supply. In these economies with limited money supplies, there are two common explanations for increasing prices: (1) demand-pull inflation and (2) cost-push inflation (see Baghestani and AbuAl-Foul, 2010). First, in growing economies, i ...

... physical commodities such as gold which naturally had a limited supply. In these economies with limited money supplies, there are two common explanations for increasing prices: (1) demand-pull inflation and (2) cost-push inflation (see Baghestani and AbuAl-Foul, 2010). First, in growing economies, i ...

The Effect of Deflation or High Inflation on the Insurance Industry

... physical commodities such as gold which naturally had a limited supply. In these economies with limited money supplies, there are two common explanations for increasing prices: (1) demand-pull inflation and (2) cost-push inflation (see Baghestani and AbuAl-Foul, 2010). First, in growing economies, i ...

... physical commodities such as gold which naturally had a limited supply. In these economies with limited money supplies, there are two common explanations for increasing prices: (1) demand-pull inflation and (2) cost-push inflation (see Baghestani and AbuAl-Foul, 2010). First, in growing economies, i ...

monetary policy rules and macroeconomic stability: evidence and

... in the Funds rate. There are at least three reasons why. First, the specication assumes an immediate adjustment of the actual Funds rate to its target level, and thus ignores the Federal Reserve’s tendency to smooth changes in interest rates.12 Second, it treats all changes in interest rates over t ...

... in the Funds rate. There are at least three reasons why. First, the specication assumes an immediate adjustment of the actual Funds rate to its target level, and thus ignores the Federal Reserve’s tendency to smooth changes in interest rates.12 Second, it treats all changes in interest rates over t ...

Macroeconomics

... 10.5 The long-run neutrality of money . . . . . . . . . . . . . . . . . . . . . . . . . . . 315 10.6 Monetary policy indicators . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 318 Key concepts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 320 End of chap ...

... 10.5 The long-run neutrality of money . . . . . . . . . . . . . . . . . . . . . . . . . . . 315 10.6 Monetary policy indicators . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 318 Key concepts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 320 End of chap ...

macroeconomics

... Doug Curtis is a specialist in macroeconomics. He is the author of twenty research papers on fiscal policy, monetary policy, and economic growth and structural change. He has also prepared research reports for Canadian industry and government agencies and authored numerous working papers. He complet ...

... Doug Curtis is a specialist in macroeconomics. He is the author of twenty research papers on fiscal policy, monetary policy, and economic growth and structural change. He has also prepared research reports for Canadian industry and government agencies and authored numerous working papers. He complet ...

Fiscal and Monetary Policy under Imperfect Commitment Davide Debortoli Universitat Pompeu Fabra

... can change over time. In chapter 2, we analyze a fiscal policy problem, taking into account that policymakers with different policy objectives alternate in office. This part of our work is related to the political economy literature, as recently summarized in the books of Drazen (2000) and Persson a ...

... can change over time. In chapter 2, we analyze a fiscal policy problem, taking into account that policymakers with different policy objectives alternate in office. This part of our work is related to the political economy literature, as recently summarized in the books of Drazen (2000) and Persson a ...

Liquidity and Reserve Management: Strategies and Policies

... how, when, and where liquid funds can be raised. Most liquidity problems arise from outside the financial firm as a result of the activities of customers. In effect, customers’ liquidity problems gravitate toward their liquidity suppliers. If a business is short liquid reserves, for example, it will ...

... how, when, and where liquid funds can be raised. Most liquidity problems arise from outside the financial firm as a result of the activities of customers. In effect, customers’ liquidity problems gravitate toward their liquidity suppliers. If a business is short liquid reserves, for example, it will ...

Lending-of-last-resort is as lending-of-last

... Focusing on the interplay between sovereign and bank risk, Acharya et al. (2014a) examine the feedback effects between sovereign credit risk and bank bailouts using credit default swap information. They find that, following bank bailouts, sovereign risk materialized in the Eurozone starting mid-2011 ...

... Focusing on the interplay between sovereign and bank risk, Acharya et al. (2014a) examine the feedback effects between sovereign credit risk and bank bailouts using credit default swap information. They find that, following bank bailouts, sovereign risk materialized in the Eurozone starting mid-2011 ...

Monetary Policy, Imperfect Information and the Expectations Channel

... The effects and the role of monetary policy have received a great deal of attention in the economics literature. While there is a wide consensus on the long-run neutrality of money and the medium- and short-run real effects of monetary policy, the debate has moved on the policies and strategies the ...

... The effects and the role of monetary policy have received a great deal of attention in the economics literature. While there is a wide consensus on the long-run neutrality of money and the medium- and short-run real effects of monetary policy, the debate has moved on the policies and strategies the ...

Watani Investment Company K.S.C.C. (“NBK Capital”) and KAMCO

... any circumstances, create any implication that there has been no change in the affairs of the Bank since the date hereof. ...

... any circumstances, create any implication that there has been no change in the affairs of the Bank since the date hereof. ...

1 Principles of Macroeconomics, 9e

... velocity of money to decrease. B) the interest rate to increase, the quantity demanded of money to decrease, and the velocity of money to increase. C) the interest rate to decrease, the quantity demanded of money to decrease, and the velocity of money to increase. D) the interest rate to decrease, t ...

... velocity of money to decrease. B) the interest rate to increase, the quantity demanded of money to decrease, and the velocity of money to increase. C) the interest rate to decrease, the quantity demanded of money to decrease, and the velocity of money to increase. D) the interest rate to decrease, t ...

Violating the law of one price: the role of non

... to the denomination in foreign currency. We find that the basis including eligible USDdenominated bonds was lower than the basis including non-eligible USD-denominated bonds during the eight weeks after the ECB collateral expansion. Our estimates suggest that the change in the ECB eligibility crite ...

... to the denomination in foreign currency. We find that the basis including eligible USDdenominated bonds was lower than the basis including non-eligible USD-denominated bonds during the eight weeks after the ECB collateral expansion. Our estimates suggest that the change in the ECB eligibility crite ...

1 M.A.PART - I ECONOMIC PAPER

... Table : 1.1 shows that consumption is an increasing function of income. When income is zero (00) people spend out of their past saving or borrowed income on consumption because they must eat in order to live. When income increases in the economy to the extent of Rs. 70 crores, but it is not enough t ...

... Table : 1.1 shows that consumption is an increasing function of income. When income is zero (00) people spend out of their past saving or borrowed income on consumption because they must eat in order to live. When income increases in the economy to the extent of Rs. 70 crores, but it is not enough t ...

Credit Default Swaps and Bank Regulatory Capital

... to support those assets. We find substantial increases in the zero-risk-weight assets relative to the total on-balance-sheet assets for CDS-using banks, while their assets in the higher risk-weight categories decrease. In other words, CDS-using banks move more assets out of the coverage of regulato ...

... to support those assets. We find substantial increases in the zero-risk-weight assets relative to the total on-balance-sheet assets for CDS-using banks, while their assets in the higher risk-weight categories decrease. In other words, CDS-using banks move more assets out of the coverage of regulato ...

- UniCredit Bank

... We expect a growth path similar to that in CEE-EU, with 3Q activity supported by record-high tourism receipts in Croatia and a bumper harvest in Serbia before easing in both in 4Q on weakening foreign demand. In both countries, macroeconomic imbalances are likely to ease thanks to significant fiscal ...

... We expect a growth path similar to that in CEE-EU, with 3Q activity supported by record-high tourism receipts in Croatia and a bumper harvest in Serbia before easing in both in 4Q on weakening foreign demand. In both countries, macroeconomic imbalances are likely to ease thanks to significant fiscal ...

Inflation in the Euro Area

... al. (2015) questions this view. The authors test the historical link between output growth and deflation in a sample covering 140 years for up to 38 economies. Their evidence suggests that this link is weak and derives largely from the Great Depression. ...

... al. (2015) questions this view. The authors test the historical link between output growth and deflation in a sample covering 140 years for up to 38 economies. Their evidence suggests that this link is weak and derives largely from the Great Depression. ...

AVVISO n. 198

... Finances’ website, to settle all claims on Untendered Debt, including bonds in litigation in the United States, subject to two conditions: first, obtaining approval by the Argentine Congress, and second, lifting the pari passu injunctions. The Settlement Proposal contemplated two frameworks for sett ...

... Finances’ website, to settle all claims on Untendered Debt, including bonds in litigation in the United States, subject to two conditions: first, obtaining approval by the Argentine Congress, and second, lifting the pari passu injunctions. The Settlement Proposal contemplated two frameworks for sett ...

Inflation Through the Lens of the Fiscal Theory

... of GDP from 2014 to 2024.2 Evidently, there are substantial fiscal consequences from central bank exits from very low policy interest rates. ...

... of GDP from 2014 to 2024.2 Evidently, there are substantial fiscal consequences from central bank exits from very low policy interest rates. ...

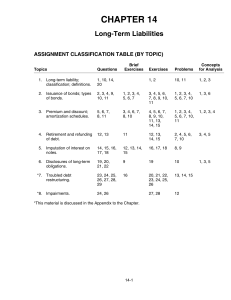

CHAPTER 14 Long-Term Liabilities

... When a debtor company runs into financial difficulty, creditors may recognize an impairment on a loan extended to that company. Subsequently, the creditor may modify the terms of the loan, or settles it on terms unfavorable to the creditor. In unusual cases, the creditor forces the debtor into bankr ...

... When a debtor company runs into financial difficulty, creditors may recognize an impairment on a loan extended to that company. Subsequently, the creditor may modify the terms of the loan, or settles it on terms unfavorable to the creditor. In unusual cases, the creditor forces the debtor into bankr ...

What the Entry Load?

... the settlement was “futures-style” and was on a fortnightly basis. means that trading done during a fortnight would be settled at the end of the fortnight. system of badla =enabled the brokers to carry forward their liability (of money or securities) to next settlement. so, brokers could postpone se ...

... the settlement was “futures-style” and was on a fortnightly basis. means that trading done during a fortnight would be settled at the end of the fortnight. system of badla =enabled the brokers to carry forward their liability (of money or securities) to next settlement. so, brokers could postpone se ...

4 Why Price Stability? 1. Introduction

... the currency, their chemical properties, etc.) are relatively unimportant. Here, then, the rulers of society have an opportunity of showing their economic wisdom – or folly. Monetary history reveals the fact that folly has frequently been paramount; for it describes many fateful mistakes. On the oth ...

... the currency, their chemical properties, etc.) are relatively unimportant. Here, then, the rulers of society have an opportunity of showing their economic wisdom – or folly. Monetary history reveals the fact that folly has frequently been paramount; for it describes many fateful mistakes. On the oth ...

Outside Liquidity, Rollover Risk, and Government Bonds

... We use the term “outside liquidity” in the sense of Holmström and Tirole (2011), Bolton et al. (2011), and Gourinchas and Jeanne (2012). The concept of inside and outside liquidity is to some degree reminiscent to the definition of inside and outside money (see, e.g., Lagos, 2006), but there are su ...

... We use the term “outside liquidity” in the sense of Holmström and Tirole (2011), Bolton et al. (2011), and Gourinchas and Jeanne (2012). The concept of inside and outside liquidity is to some degree reminiscent to the definition of inside and outside money (see, e.g., Lagos, 2006), but there are su ...