Money - Microsoft

... The information contained in this document represents the current view of Microsoft Corp. on the issues discussed as of the date of publication. Because Microsoft must respond to changing market conditions, it should not be interpreted to be a commitment on the part of Microsoft, and Microsoft canno ...

... The information contained in this document represents the current view of Microsoft Corp. on the issues discussed as of the date of publication. Because Microsoft must respond to changing market conditions, it should not be interpreted to be a commitment on the part of Microsoft, and Microsoft canno ...

Inflation targeting, economic performance, and income distribution: a

... “emerging market economies have had a relatively worse performance.” In short, as Bernanke et al. (1999, p. 288) put it, “[o]ne of the main benefits of inflation targets is that they may help to ‘lock in’ earlier disinflationary gains, particularly in the face of one-time inflationary shocks. . . . ...

... “emerging market economies have had a relatively worse performance.” In short, as Bernanke et al. (1999, p. 288) put it, “[o]ne of the main benefits of inflation targets is that they may help to ‘lock in’ earlier disinflationary gains, particularly in the face of one-time inflationary shocks. . . . ...

Advanced Macroeconomics - Juridica – Kolegji Evropian

... international factors affecting macroeconomics. Words fall short to express my deep sense of gratitude to my research guide, Dr. Neeraj Hatekar, Professor, Department of Economics, University of Mumbai, Mumbai, India. His continuous support in my research was a source of inspiration. He taught me va ...

... international factors affecting macroeconomics. Words fall short to express my deep sense of gratitude to my research guide, Dr. Neeraj Hatekar, Professor, Department of Economics, University of Mumbai, Mumbai, India. His continuous support in my research was a source of inspiration. He taught me va ...

This PDF is a selection from a published volume from

... PARTNER, GAVEAINVESTIMENTOS; PONTIFICAL CATHOLIC UNIVERSITY OF RIO DE JANEIRO; AND CENTRAL BANK OF BRAZIL ...

... PARTNER, GAVEAINVESTIMENTOS; PONTIFICAL CATHOLIC UNIVERSITY OF RIO DE JANEIRO; AND CENTRAL BANK OF BRAZIL ...

External Debt Statistics: Guide for Compilers and Users

... in the same instrument until the liability is extinguished. Then, arrears are identified as a supplementary category of the original asset or liability, rather than treated as the repayment of the original liability and the creation of a new short-term liability. 2. This appendix summarizes the trea ...

... in the same instrument until the liability is extinguished. Then, arrears are identified as a supplementary category of the original asset or liability, rather than treated as the repayment of the original liability and the creation of a new short-term liability. 2. This appendix summarizes the trea ...

Sveriges Riksbank Economic Review 2016:1

... policy to improve target attainment without first analysing why inflation has deviated from the target and to what extent the Riksbank has predicted the factors that have led to the deviation. Without this kind of analysis it is difficult to gain an impression of which changes to the framework might ...

... policy to improve target attainment without first analysing why inflation has deviated from the target and to what extent the Riksbank has predicted the factors that have led to the deviation. Without this kind of analysis it is difficult to gain an impression of which changes to the framework might ...

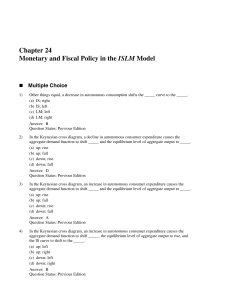

Chapter 24 Monetary and Fiscal Policy in the ISLM Model

... When the central bank _____ the money supply, the LM curve shifts to the _____, interest rates _____, and equilibrium aggregate output _____. (a) increases; right; fall; increases (b) increases; left; rise; decreases (c) decreases; left; rise; increases (d) decreases; left; fall; increases Answer: A ...

... When the central bank _____ the money supply, the LM curve shifts to the _____, interest rates _____, and equilibrium aggregate output _____. (a) increases; right; fall; increases (b) increases; left; rise; decreases (c) decreases; left; rise; increases (d) decreases; left; fall; increases Answer: A ...

The monetary policy of the ECB (Third edition, May 2011)

... Since its inception the ECB has adopted a clear monetary policy strategy, which has been effective both in turbulent times and during quieter periods. Since 1998 the ECB has defined price stability as a year-on-year increase in the Harmonised Index of Consumer Prices for the euro area of below 2% ov ...

... Since its inception the ECB has adopted a clear monetary policy strategy, which has been effective both in turbulent times and during quieter periods. Since 1998 the ECB has defined price stability as a year-on-year increase in the Harmonised Index of Consumer Prices for the euro area of below 2% ov ...

Contents Isi

... In more recent economic thinking, deflation is related to risk: where the risk-adjusted return on assets drops to negative, investors and buyers will hoard currency rather than invest it, even in the most solid of securities. [ 5 ] This can produce a liquidity trap . Dalam pemikiran ekonomi yang leb ...

... In more recent economic thinking, deflation is related to risk: where the risk-adjusted return on assets drops to negative, investors and buyers will hoard currency rather than invest it, even in the most solid of securities. [ 5 ] This can produce a liquidity trap . Dalam pemikiran ekonomi yang leb ...

NBER WORKING PAPER SERIES ON THE ORIGINS OF "A MONETARY HISTORY"

... replaced Mitchell as director of the NBER, asked Friedman to take over.6 The choice of Friedman made sense. Friedman had successfully completed several projects at the Bureau. He had already, moreover, developed an interest in the problem of inflation while working at the Treasury in World War II, ...

... replaced Mitchell as director of the NBER, asked Friedman to take over.6 The choice of Friedman made sense. Friedman had successfully completed several projects at the Bureau. He had already, moreover, developed an interest in the problem of inflation while working at the Treasury in World War II, ...

How Independent Should a Central Bank Be?

... conference to address these questions. The five papers presented at the conference fall into three broad areas. First, John Taylor and Jeffrey Fuhrer each discuss the efficiency of U.S. monetary policy, taking as given that policy has both inflation and (in the short run) output targets, and that mo ...

... conference to address these questions. The five papers presented at the conference fall into three broad areas. First, John Taylor and Jeffrey Fuhrer each discuss the efficiency of U.S. monetary policy, taking as given that policy has both inflation and (in the short run) output targets, and that mo ...

- TestbankU

... 20) Commodity money can best be described as A) money used to purchase agricultural products B) a good used as money that also has value independent of its use as money C) standardized goods like gold that trade in a financial market D) the form of money used in a barter system Answer: B Diff: 2 Pa ...

... 20) Commodity money can best be described as A) money used to purchase agricultural products B) a good used as money that also has value independent of its use as money C) standardized goods like gold that trade in a financial market D) the form of money used in a barter system Answer: B Diff: 2 Pa ...

NBER WORKING PAPER SERIES FEDERAL RESERVE PRIVATE INFORMATION AND THE BEHAVIOR

... inflation forecasts and monetary policy. 2 As Scharfstein and Stein (1990), Lament (1995), Ehrbeck and Waldmann (1996), and others point out, there may be agency problems between commercial forecasters and their clients that cause forecasters not to report their true expectations of inflation. This ...

... inflation forecasts and monetary policy. 2 As Scharfstein and Stein (1990), Lament (1995), Ehrbeck and Waldmann (1996), and others point out, there may be agency problems between commercial forecasters and their clients that cause forecasters not to report their true expectations of inflation. This ...

Emerging Markets Monthly EM Vulnerabilities Exposed Deutsche Bank Markets Research

... As we enter the latter part of the year, we expect to see clearer signs that the global economy has bottomed and is accelerating into 2015. With DB’s considerable downward revisions in EU growth, it is also clearer that the recovery we foresee has become increasingly dependent on the outlook for the ...

... As we enter the latter part of the year, we expect to see clearer signs that the global economy has bottomed and is accelerating into 2015. With DB’s considerable downward revisions in EU growth, it is also clearer that the recovery we foresee has become increasingly dependent on the outlook for the ...

Three essays about monetary policy in China - ROS Home

... In practice, the monetary policy measures China has used for a similar purpose have varied substantially in different time periods since the 1980s. In the third quarter of 1988, the inflation based on the consumer price index (CPI) soared to 23.1 per cent. Frightened by inflation and other social un ...

... In practice, the monetary policy measures China has used for a similar purpose have varied substantially in different time periods since the 1980s. In the third quarter of 1988, the inflation based on the consumer price index (CPI) soared to 23.1 per cent. Frightened by inflation and other social un ...

Full Employment, Guideposts and Economic Stability

... than government officials planned or expected. Largely as a result of their actions, the economic expansion that started in April, 1958, came to a premature end and unemployment rose at a time when it was already ex cessive. These unhappy consequences, however, had their redeeming side. The very ab ...

... than government officials planned or expected. Largely as a result of their actions, the economic expansion that started in April, 1958, came to a premature end and unemployment rose at a time when it was already ex cessive. These unhappy consequences, however, had their redeeming side. The very ab ...

Volume 71 No. 3, September 2008 Contents Themed issue: Inflation

... This article reproduces the paper for a speech given by Governor Alan Bollard on 30 July 2008. We argue that New Zealand’s flexible inflation-targeting framework serves the economy well, but one should not to ask too much of it. Inflation targeting is the best approach New Zealand and many other sim ...

... This article reproduces the paper for a speech given by Governor Alan Bollard on 30 July 2008. We argue that New Zealand’s flexible inflation-targeting framework serves the economy well, but one should not to ask too much of it. Inflation targeting is the best approach New Zealand and many other sim ...

True/False Questions

... II. Pool funds of small savers and invest in either money or capital markets III. Provide consumer loans and real estate loans funded by deposits IV. Accumulate and transfer wealth from work period to retirement period V. Underwrite and trade securities and provide brokerage services ...

... II. Pool funds of small savers and invest in either money or capital markets III. Provide consumer loans and real estate loans funded by deposits IV. Accumulate and transfer wealth from work period to retirement period V. Underwrite and trade securities and provide brokerage services ...

"Super Equivalent" Basel III Liquidity Coverage Ratio

... the "federal banking agencies") released a notice of proposed rulemaking implementing quantitative liquidity requirements for large, internationally active banking organizations and their consolidated depository institution subsidiaries (the LCR). Although consistent with the international liquidity ...

... the "federal banking agencies") released a notice of proposed rulemaking implementing quantitative liquidity requirements for large, internationally active banking organizations and their consolidated depository institution subsidiaries (the LCR). Although consistent with the international liquidity ...

Central Bank Digital Currencies: assessing

... the form of private banks’ deposits, cash is the cornerstone of money supply and, together with the banks’ deposits in the central bank, integrates “high-powered money”. Despite its widespread use and convenience, cash has many drawbacks: it is the main instrument of tax evasion, money laundering an ...

... the form of private banks’ deposits, cash is the cornerstone of money supply and, together with the banks’ deposits in the central bank, integrates “high-powered money”. Despite its widespread use and convenience, cash has many drawbacks: it is the main instrument of tax evasion, money laundering an ...

City Deposits and Investments

... Generally, all statutory city funds will be controlled by the city council. Different funds would not be eligible for separate FDIC insurance coverage simply because the funds are kept in separate accounts. Thus, if a city has a special account for its municipal liquor store, an account for the poli ...

... Generally, all statutory city funds will be controlled by the city council. Different funds would not be eligible for separate FDIC insurance coverage simply because the funds are kept in separate accounts. Thus, if a city has a special account for its municipal liquor store, an account for the poli ...

Danish Covered Bond Handbook

... that future new mortgage banks were only to be approved if there was an apparent need. The number of mortgage banks was subsequently reduced from 24 to seven. Another important change in 1970 was the switch from a three-tier to a two-tier system – ordinary and special mortgage credit loans. This sub ...

... that future new mortgage banks were only to be approved if there was an apparent need. The number of mortgage banks was subsequently reduced from 24 to seven. Another important change in 1970 was the switch from a three-tier to a two-tier system – ordinary and special mortgage credit loans. This sub ...

Principles of Macroeconomics Self-study quiz and Exercises March

... A) the total spending of everyone in the economy. B) the value of all output in the economy. C) the total income of everyone in the economy. D) all of the above 3) Which of the following is an example of a final good or service? A) wheat a bakery purchases to make bread B) coffee beans Starbucks pur ...

... A) the total spending of everyone in the economy. B) the value of all output in the economy. C) the total income of everyone in the economy. D) all of the above 3) Which of the following is an example of a final good or service? A) wheat a bakery purchases to make bread B) coffee beans Starbucks pur ...

MacroPolicy - Purdue Agriculture

... at 1: there’s a shortage. Businesses respond to the shortage by raising the price. In some markets consumers may bid up the price trying to buy what they want. The shortage is eliminated at 3, where the amount that consumers want to buy and businesses want to sell is again equal. The movement of the ...

... at 1: there’s a shortage. Businesses respond to the shortage by raising the price. In some markets consumers may bid up the price trying to buy what they want. The shortage is eliminated at 3, where the amount that consumers want to buy and businesses want to sell is again equal. The movement of the ...

This PDF is a selection from a published volume from

... securities. Finally, the interest rate is also affected by other general macroeconomic factors besides capital that influence output (Y); in the simple model here, that includes labor and multifactor productivity. Thus, there is usually some accounting for general macroeconomic factors that can affe ...

... securities. Finally, the interest rate is also affected by other general macroeconomic factors besides capital that influence output (Y); in the simple model here, that includes labor and multifactor productivity. Thus, there is usually some accounting for general macroeconomic factors that can affe ...