Eurosystem Monetary Targeting: Lessons from U.S. Data ¤ Glenn D. Rudebusch

... for money, as signalled by the announcement of a quantitative reference value of 4-1/2 percent for the growth rate of the broad monetary aggregate M3 which is regarded as being compatible with price stability. The second comprises a broadly based assessment of the outlook for price developments and ...

... for money, as signalled by the announcement of a quantitative reference value of 4-1/2 percent for the growth rate of the broad monetary aggregate M3 which is regarded as being compatible with price stability. The second comprises a broadly based assessment of the outlook for price developments and ...

International Capital Flows and U.S. Interest Rates Francis E. Warnock

... Agency bonds are another story: The TIC system consistently overestimates foreigners’ purchases of agency bonds.10 The discrepancy between flows implied from high-quality benchmark surveys and TIC reported flows makes it difficult for market participants to interpret and use the TIC transactions da ...

... Agency bonds are another story: The TIC system consistently overestimates foreigners’ purchases of agency bonds.10 The discrepancy between flows implied from high-quality benchmark surveys and TIC reported flows makes it difficult for market participants to interpret and use the TIC transactions da ...

the guide to understanding deflation

... with that buyer’s, then the value of the asset falls, and it falls for everyone who owns it. If a million other people own it, then their net worth goes down even though they did nothing. Two investors made it happen by transacting, and the rest of the investors made it happen by choosing not to dis ...

... with that buyer’s, then the value of the asset falls, and it falls for everyone who owns it. If a million other people own it, then their net worth goes down even though they did nothing. Two investors made it happen by transacting, and the rest of the investors made it happen by choosing not to dis ...

Zimbabwe - COMESA Monetary Institute (CMI)

... It is against this heightened requirement for greater coordination of fiscal and monetary policy for countries moving towards or in a monetary union that it becomes imperative to assess the interaction of fiscal and monetary policy in Zimbabwe. The assessment of fiscal and monetary coordination in Z ...

... It is against this heightened requirement for greater coordination of fiscal and monetary policy for countries moving towards or in a monetary union that it becomes imperative to assess the interaction of fiscal and monetary policy in Zimbabwe. The assessment of fiscal and monetary coordination in Z ...

Meeting Financial Goals—Rate of Return

... inflation tends to decrease wealth because the same amount of money buys fewer goods and services over time. 12. Define the real rate of return on an investment as the rate of return on the investment minus the inflation rate. Explain that an asset must have a rate of return greater than the inflati ...

... inflation tends to decrease wealth because the same amount of money buys fewer goods and services over time. 12. Define the real rate of return on an investment as the rate of return on the investment minus the inflation rate. Explain that an asset must have a rate of return greater than the inflati ...

The IS-LM-FE Model - Pearson Higher Education

... Beginning in late 1991, the Fed cut short-term interest rates to stimulate the economy’s recovery from the 1990–1991 recession. In particular, the Fed hoped to encourage businesses to invest in new plant and equipment by making it cheaper to finance spending on capital assets. As output increased an ...

... Beginning in late 1991, the Fed cut short-term interest rates to stimulate the economy’s recovery from the 1990–1991 recession. In particular, the Fed hoped to encourage businesses to invest in new plant and equipment by making it cheaper to finance spending on capital assets. As output increased an ...

Inflation Targeting

... exceed the target, then it can implement contractionary monetary policy by raising its policy interest rate. On the other hand, if the BSP sees the inflation forecast to be lower than the target or there is need to increase liquidity in the financial system, then it can implement expansionary moneta ...

... exceed the target, then it can implement contractionary monetary policy by raising its policy interest rate. On the other hand, if the BSP sees the inflation forecast to be lower than the target or there is need to increase liquidity in the financial system, then it can implement expansionary moneta ...

The implications of herding on volatility. The

... adjust to new information Then volatility is only caused by the adjustment of stock prices to new information • But… ...

... adjust to new information Then volatility is only caused by the adjustment of stock prices to new information • But… ...

duration gap in the context of a bank`s strategic

... sensitivity only if the yield curve is flat and shifts in the yield curve are parallel, these authors choose to use this less realistic measure of duration so that they can focus on the differences in the duration gap measure resulting from the choice of desired target account. Shaffer [11] also exp ...

... sensitivity only if the yield curve is flat and shifts in the yield curve are parallel, these authors choose to use this less realistic measure of duration so that they can focus on the differences in the duration gap measure resulting from the choice of desired target account. Shaffer [11] also exp ...

Why Companies Should Prepare for Inflation

... excess reserves at the Federal Reserve, and the money multiplier has actually dropped precipitously, from between 1.5 and 2.0 to below 1.0.6 In other words, for every new dollar created by the Fed, there is less than one new dollar circulating in the economy as credit. Because the banks have held o ...

... excess reserves at the Federal Reserve, and the money multiplier has actually dropped precipitously, from between 1.5 and 2.0 to below 1.0.6 In other words, for every new dollar created by the Fed, there is less than one new dollar circulating in the economy as credit. Because the banks have held o ...

3 estimation of the impact of single monetary policy on - Hal-SHS

... between effective and potential levels of global economy production, i.e. "the output gap". The evolution of potential production can be defined starting from the growth rate of real GDP bearable in medium term. Its evolution is determined by the increase in capital stock and labour supply, and by t ...

... between effective and potential levels of global economy production, i.e. "the output gap". The evolution of potential production can be defined starting from the growth rate of real GDP bearable in medium term. Its evolution is determined by the increase in capital stock and labour supply, and by t ...

Inflation Targeting, Reserves Accumulation, and Exchange Rate

... Macroeconomics paradigm. Likewise, there is no role for nor any mention of a need for international reserves accumulation. This analysis is the basis for the usual opposition, from IT proponents, to have a monetary policy response to exchange rate shocks over and above the implications of those shoc ...

... Macroeconomics paradigm. Likewise, there is no role for nor any mention of a need for international reserves accumulation. This analysis is the basis for the usual opposition, from IT proponents, to have a monetary policy response to exchange rate shocks over and above the implications of those shoc ...

Chapter 02 Financial Assets, Money, Financial

... 21. Money's role as a standard of value means that it is usually the only financial asset which virtually every business, household and unit of government will accept in payment for goods and services. ...

... 21. Money's role as a standard of value means that it is usually the only financial asset which virtually every business, household and unit of government will accept in payment for goods and services. ...

Accelerating infrastructure in Canada: a win win success

... ratings but are limited to the bank lending market, where tenors typically do not exceed 10 years. Since public private partnerships generate the most benefits when at least part of the private financing is long term, as in 20 – 40 years, the Bank could, in this instance, be used to enhance the cred ...

... ratings but are limited to the bank lending market, where tenors typically do not exceed 10 years. Since public private partnerships generate the most benefits when at least part of the private financing is long term, as in 20 – 40 years, the Bank could, in this instance, be used to enhance the cred ...

Chapter 1: Introduction

... Notice two things about this equation. First, it is real money demand--demand for real money balances, for the nominal money stock divided by the price level, for an amount of purchasing power held in readily-spendable form rather than an amount of pictures of George Washington—that is proportional ...

... Notice two things about this equation. First, it is real money demand--demand for real money balances, for the nominal money stock divided by the price level, for an amount of purchasing power held in readily-spendable form rather than an amount of pictures of George Washington—that is proportional ...

Setting up a Sovereign Wealth Fund: Some Policy and

... From a practical viewpoint, this approach taken by countries can be explained, perhaps, by the concept of mental accounting. Coined by Richard Thaler (1980), mental accounting is one of the assumptions underpinning behavioral finance. Compared with a traditional investment approach, which assumes th ...

... From a practical viewpoint, this approach taken by countries can be explained, perhaps, by the concept of mental accounting. Coined by Richard Thaler (1980), mental accounting is one of the assumptions underpinning behavioral finance. Compared with a traditional investment approach, which assumes th ...

International Spillovers of Large

... (LSAPs; also known as quantitative easing or QE), at the zero lower bound. Several studies have found significant effects of these asset purchases in terms of lowering U.S. long-term yields and strengthening economic activity (see Baumeister and Benati, 2013; D’amico et al., 2012; Gagnon et al., 201 ...

... (LSAPs; also known as quantitative easing or QE), at the zero lower bound. Several studies have found significant effects of these asset purchases in terms of lowering U.S. long-term yields and strengthening economic activity (see Baumeister and Benati, 2013; D’amico et al., 2012; Gagnon et al., 201 ...

Stocks Gain on Stimulus Optimism

... European markets Shares rebounded from Wednesday’s losses and finished solidly in positive territory. Optimism was sparked by Fed Chairman Ben Bernanke’s comments late Wednesday. He eased investor concerns over tapering of Fed stimulus by reiterating his stance to maintain monetary policy. The FTSE ...

... European markets Shares rebounded from Wednesday’s losses and finished solidly in positive territory. Optimism was sparked by Fed Chairman Ben Bernanke’s comments late Wednesday. He eased investor concerns over tapering of Fed stimulus by reiterating his stance to maintain monetary policy. The FTSE ...

A Dynamic Model of Aggregate Demand and Aggregate Supply

... • The dynamic model of aggregate demand and aggregate supply (DAD-DAS) determines both – real GDP (Y), and – the inflation rate (π) ...

... • The dynamic model of aggregate demand and aggregate supply (DAD-DAS) determines both – real GDP (Y), and – the inflation rate (π) ...

Interest Rates and Their Role in the Economy during Transition. The

... He showed that this coefficient is less than in some other developed countries, such as Great Britain and France – about 100% and 65% respectively. The monetisation of the Ukrainian economy was decreasing since 1992 (monetisation was 80%) to the beginning of 1997 (11%) and then began to rise slightl ...

... He showed that this coefficient is less than in some other developed countries, such as Great Britain and France – about 100% and 65% respectively. The monetisation of the Ukrainian economy was decreasing since 1992 (monetisation was 80%) to the beginning of 1997 (11%) and then began to rise slightl ...

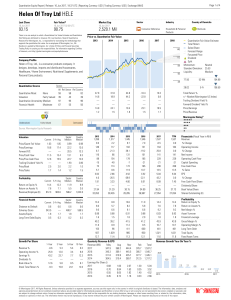

Helen Of Troy Ltd HELE

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

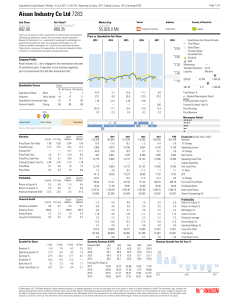

Aisan Industry Co Ltd 7283

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

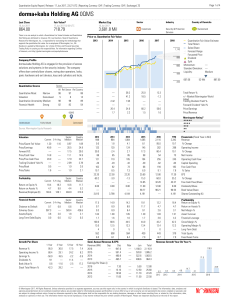

dorma+kaba Holding AG 0QMS

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...