Financial Crises and Systemic Bank Runs in a

... The two key ingredients that give rise to multiple equilibria are liquidity risk à la Diamond and Dybvig (1983) and debt deflation in the spirit of Fisher (1933).1 While several papers use liquidity risk or debt deflation to model financial crises,2 this paper explores the interaction of these two e ...

... The two key ingredients that give rise to multiple equilibria are liquidity risk à la Diamond and Dybvig (1983) and debt deflation in the spirit of Fisher (1933).1 While several papers use liquidity risk or debt deflation to model financial crises,2 this paper explores the interaction of these two e ...

"Great Inflation" Lessons for Monetary Policy

... of the second oil price shocks. After the dollar peg was abandoned in March 1973, Germany’s NEER appreciated swiftly, but then fluctuated comparatively little until 1976, which saw the beginning of a period of rapid appreciation that lasted until the end of 1979. The relative stability of the German ...

... of the second oil price shocks. After the dollar peg was abandoned in March 1973, Germany’s NEER appreciated swiftly, but then fluctuated comparatively little until 1976, which saw the beginning of a period of rapid appreciation that lasted until the end of 1979. The relative stability of the German ...

Inflation During and After the Zero Lower Bound

... dynamics should one expect before and after nominal interest rates lift off from the ZLB? Third, does the fact that both Japan and U.S. have experienced near zero interest rates for more than five years mean that these countries have entered a new, persistent regime in which inflation rates will rem ...

... dynamics should one expect before and after nominal interest rates lift off from the ZLB? Third, does the fact that both Japan and U.S. have experienced near zero interest rates for more than five years mean that these countries have entered a new, persistent regime in which inflation rates will rem ...

- TestbankU

... conditions in each market. As funds leave a country with low interest rates, this places upward pressure on that country’s interest rates. The international flow of funds caused this type of reaction. 14. Impact of War. A war tends to cause significant reactions in financial markets. Why would a war ...

... conditions in each market. As funds leave a country with low interest rates, this places upward pressure on that country’s interest rates. The international flow of funds caused this type of reaction. 14. Impact of War. A war tends to cause significant reactions in financial markets. Why would a war ...

Mankiw 6e PowerPoints

... (M/P)d = real money demand, depends negatively on i i is the opp. cost of holding money positively on Y higher Y more spending so, need more money (“L” is used for the money demand function because money is the most liquid asset.) CHAPTER 4 Money and Inflation ...

... (M/P)d = real money demand, depends negatively on i i is the opp. cost of holding money positively on Y higher Y more spending so, need more money (“L” is used for the money demand function because money is the most liquid asset.) CHAPTER 4 Money and Inflation ...

Integration of Real and Monetary Sectors with Labor Market – SD

... Currency in circulation may be represented by the sum of cash stocks held by consumers, producers and government, while deposits are the amount of money consumers deposit with banks. For instance, whenever consumers purchase consumption goods from producers, the ownership of money changes hands from ...

... Currency in circulation may be represented by the sum of cash stocks held by consumers, producers and government, while deposits are the amount of money consumers deposit with banks. For instance, whenever consumers purchase consumption goods from producers, the ownership of money changes hands from ...

Chapter 5 - Aufinance

... The Supply of Loanable Funds … continued • Creation of Credit by the Domestic Banking System. Commercial banks and nonbank thrift institutions offering payments accounts can create credit by lending and investing their excess reserves. • Foreign lending is sensitive to the spread between domestic an ...

... The Supply of Loanable Funds … continued • Creation of Credit by the Domestic Banking System. Commercial banks and nonbank thrift institutions offering payments accounts can create credit by lending and investing their excess reserves. • Foreign lending is sensitive to the spread between domestic an ...

Money and Monetary Policy - Current Practice

... The book tries to explain the firm framework of the current money and the current monetary policy in major countries (the USA, Eurozone, Japan and the United Kingdom). Even if the book is based on the contemporary banking practice, it comes from careful examination of historical development of opini ...

... The book tries to explain the firm framework of the current money and the current monetary policy in major countries (the USA, Eurozone, Japan and the United Kingdom). Even if the book is based on the contemporary banking practice, it comes from careful examination of historical development of opini ...

influence of selected factors on the demand for money 1994–2000

... hold money that does not yield any interest, instead of securities or similar assets. An answer to the question is closely related to the scope of transactions that the money is to service, as well as to the degree of uncertainty associated with the future results of economic activities of companies ...

... hold money that does not yield any interest, instead of securities or similar assets. An answer to the question is closely related to the scope of transactions that the money is to service, as well as to the degree of uncertainty associated with the future results of economic activities of companies ...

BIS 76th Annual Report - June 2006

... Economic indicators for the United States . . . . . . . . . . . . . . . . . . . . . . . Yield spread, inflation and business cycles in the United States . . . . . Economic indicators for the euro area . . . . . . . . . . . . . . . . . . . . . . . . . . Monetary analysis and monetary policy in the eu ...

... Economic indicators for the United States . . . . . . . . . . . . . . . . . . . . . . . Yield spread, inflation and business cycles in the United States . . . . . Economic indicators for the euro area . . . . . . . . . . . . . . . . . . . . . . . . . . Monetary analysis and monetary policy in the eu ...

Document

... The Fed's $10,000 bond purchase directly creates $10,000 in money in the form of bank deposits, and indirectly permits up to $90,000 in additional money to be created through the multiple expansion in bank deposits. ...

... The Fed's $10,000 bond purchase directly creates $10,000 in money in the form of bank deposits, and indirectly permits up to $90,000 in additional money to be created through the multiple expansion in bank deposits. ...

Download attachment

... • If all the assets of the joint project are in liquid form, the certificate will represent a certain proportion of money owned by the project. ...

... • If all the assets of the joint project are in liquid form, the certificate will represent a certain proportion of money owned by the project. ...

NBER WORKING PAPER SERIES SUPPLY SHOCKS AND OPTIMAL MONETARY POLICY Stephen J. Turnovsky

... turns out that the optimal monetary response to a supply shock is virtually identical to that under complete information. The only difference is that the actual disturbance is replaced by the perceived disturbance determined by solving the appropriate signal extraction problem. ...

... turns out that the optimal monetary response to a supply shock is virtually identical to that under complete information. The only difference is that the actual disturbance is replaced by the perceived disturbance determined by solving the appropriate signal extraction problem. ...

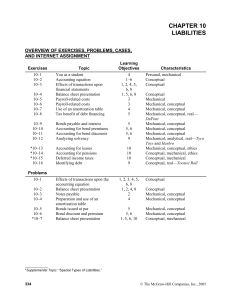

Internet Assignment

... capital—that is, applying leverage. In essence, if you can borrow money at a relatively low rate and invest it at a significantly higher one, you will benefit from doing so. But some businesses have borrowed such large amounts—and at such high interest rates—that they have been unable to earn enough ...

... capital—that is, applying leverage. In essence, if you can borrow money at a relatively low rate and invest it at a significantly higher one, you will benefit from doing so. But some businesses have borrowed such large amounts—and at such high interest rates—that they have been unable to earn enough ...

One money, but many fiscal policies in Europe

... to the cost-push shocks. However, with several fiscal authorities acting on their own, the fiscal authorities will also react to the European average of cost-push shocks, creating deficits in an effort of fighting the impact of the anti-inflationary measures by the central bank on their own economies ...

... to the cost-push shocks. However, with several fiscal authorities acting on their own, the fiscal authorities will also react to the European average of cost-push shocks, creating deficits in an effort of fighting the impact of the anti-inflationary measures by the central bank on their own economies ...

g - Weebly

... all nominal variables—including prices— will double. all real variables—including relative prices— will remain unchanged. © 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a cert ...

... all nominal variables—including prices— will double. all real variables—including relative prices— will remain unchanged. © 2012 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a cert ...

Document

... permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. ...

... permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. ...

Monetary and Macroprudential Policy Rules in a Model with House

... but that policy mistakes are possible. In particular, when …nancial or housing demand shocks drive the credit and housing boom, using a macroprudential instrument that reacts to credit growth will improve welfare. On the other hand, restricting credit using macroprudential policies when the source o ...

... but that policy mistakes are possible. In particular, when …nancial or housing demand shocks drive the credit and housing boom, using a macroprudential instrument that reacts to credit growth will improve welfare. On the other hand, restricting credit using macroprudential policies when the source o ...

NBER WORKING PAPER SERIES THE CONDUCT OF DOMESTIC ICY Robert J. Gordon

... in nominal GNP growth will be divided between inflation and real GNP growth. The results from the equation estimated through 1980 are used to examine the behavior of inflation during the 1981—82 recession, and to predict the behavior of inflation and unemployment that would accompany alternative pat ...

... in nominal GNP growth will be divided between inflation and real GNP growth. The results from the equation estimated through 1980 are used to examine the behavior of inflation during the 1981—82 recession, and to predict the behavior of inflation and unemployment that would accompany alternative pat ...

Volume 72 No. 2, June 2009 Contents

... The Reserve Bank of New Zealand has developed a new core macroeconomic model to replace the existing FPS (Forecasting and Policy System) model. KITT (Kiwi Inflation Targeting Technology), the new model, advances our modelling towards the frontier in terms of both theory and empirics. KITT reconfirms ...

... The Reserve Bank of New Zealand has developed a new core macroeconomic model to replace the existing FPS (Forecasting and Policy System) model. KITT (Kiwi Inflation Targeting Technology), the new model, advances our modelling towards the frontier in terms of both theory and empirics. KITT reconfirms ...

IMF Global Financial Stability Report (GFSR) April 2013

... times, the report seeks to play a role in preventing crises by highlighting policies that may mitigate systemic risks, thereby contributing to global financial stability and the sustained economic growth of the IMF’s member countries. Risks to financial stability have declined since the October 2012 ...

... times, the report seeks to play a role in preventing crises by highlighting policies that may mitigate systemic risks, thereby contributing to global financial stability and the sustained economic growth of the IMF’s member countries. Risks to financial stability have declined since the October 2012 ...

Estimation of Money Demand Function for Selected

... This study evaluates the nature of the demand for broad money (M2) in seven selected countries of Australia, Canada, Hungary, Iceland, Singapore, South Africa, and Switzerland as a panel data analysis. This is important in a sense that money demand function in monetary policies rely on its permanenc ...

... This study evaluates the nature of the demand for broad money (M2) in seven selected countries of Australia, Canada, Hungary, Iceland, Singapore, South Africa, and Switzerland as a panel data analysis. This is important in a sense that money demand function in monetary policies rely on its permanenc ...

The Federal Reserve sets the nation`s monetary policy to promote

... Lower consumer loan rates will elicit greater demand for consumer goods, especially bigger-ticket items such as motor vehicles. Lower mortgage rates will make housing more affordable and lead to more home purchases. They will also encourage mortgage refinancing, which will reduce ongoing housing cos ...

... Lower consumer loan rates will elicit greater demand for consumer goods, especially bigger-ticket items such as motor vehicles. Lower mortgage rates will make housing more affordable and lead to more home purchases. They will also encourage mortgage refinancing, which will reduce ongoing housing cos ...

Economics of Money, Banking, and Financial Markets, 8e

... 31) When the expected inflation rate increases, the demand for bonds ________, the supply of bonds ________, and the interest rate ________, everything else held constant. A) increases; increases; rises B) decreases; decreases; falls C) increases; decreases; falls D) decreases; increases; rises Answ ...

... 31) When the expected inflation rate increases, the demand for bonds ________, the supply of bonds ________, and the interest rate ________, everything else held constant. A) increases; increases; rises B) decreases; decreases; falls C) increases; decreases; falls D) decreases; increases; rises Answ ...

HOW TO REFORM THE EUROPEAN CENTRAL BANK Jean-Paul Fitoussi and Jérôme Creel

... another coalition, since a minority faction can achieve a University Press, majority by offering certain members of the current 1981. majority a better position if they switch sides. Only political regime change can break this potentially endless cycle. Non-political channels of change and decision- ...

... another coalition, since a minority faction can achieve a University Press, majority by offering certain members of the current 1981. majority a better position if they switch sides. Only political regime change can break this potentially endless cycle. Non-political channels of change and decision- ...