mmi14-vanveen 19106661 en

... 4.5 percent served the same purpose.8 Nevertheless, actual M3 structurally grew faster than 4.5 percent per year in the first years of ECB operation but without noticeable effects on inflation or inflationary expectations. It definitely contributed to the ECB decision to lower the weight of the mone ...

... 4.5 percent served the same purpose.8 Nevertheless, actual M3 structurally grew faster than 4.5 percent per year in the first years of ECB operation but without noticeable effects on inflation or inflationary expectations. It definitely contributed to the ECB decision to lower the weight of the mone ...

PDF Download

... adjustment mechanisms than any other country or region in the world. The absence of an adjustable nominal exchange rate – an advantage when it comes to facilitating financial integration – may become a liability when divergent developments require significant adjustments. Alternative adjustment chan ...

... adjustment mechanisms than any other country or region in the world. The absence of an adjustable nominal exchange rate – an advantage when it comes to facilitating financial integration – may become a liability when divergent developments require significant adjustments. Alternative adjustment chan ...

Macroeconomics – Austrians vs. Keynesians

... invaluable. I have copied several comments from the Rate My Professor web site below. Even the negative feedback has been beneficial. In particular, I would like to thank Jaeo Han, who has been invaluable to me as an intern during the later stages of the book. Without his helpful comments, suggestio ...

... invaluable. I have copied several comments from the Rate My Professor web site below. Even the negative feedback has been beneficial. In particular, I would like to thank Jaeo Han, who has been invaluable to me as an intern during the later stages of the book. Without his helpful comments, suggestio ...

monetary reform - a better monetary system for iceland

... Commercial banks create money when they make loans and delete money when loans are repaid. The Central Bank of Iceland must provide banks with reserves (money in accounts at the CBI) as ...

... Commercial banks create money when they make loans and delete money when loans are repaid. The Central Bank of Iceland must provide banks with reserves (money in accounts at the CBI) as ...

Inflation Targeting and Inflation Prospects in Canada

... • High inflation variability leads to confusion about relative price movements ...

... • High inflation variability leads to confusion about relative price movements ...

Monetary Conditions in the Euro Area

... This paper takes a closer look at the leading indicator qualities of monetary conditions. For this purpose the relationship of two widely used monetary conditions indicators to the output gap as a proxy for aggregate demand conditions in the euro area is considered. A simple plot of both variables i ...

... This paper takes a closer look at the leading indicator qualities of monetary conditions. For this purpose the relationship of two widely used monetary conditions indicators to the output gap as a proxy for aggregate demand conditions in the euro area is considered. A simple plot of both variables i ...

Textbook of Economics

... he must sacrifice his present consumption. This requires forward looking. Sacrifice of the present consumption means decreasing your present standard of living. One must be able to see in the future and to be willing to risk. The ability to look forward and to take the risk should be rewarded by an ...

... he must sacrifice his present consumption. This requires forward looking. Sacrifice of the present consumption means decreasing your present standard of living. One must be able to see in the future and to be willing to risk. The ability to look forward and to take the risk should be rewarded by an ...

Vo l u m e 6 6 ... C o n t e n t s

... other indicators of inflationary pressure when formulating monetary policy and uses judgement where appropriate. ...

... other indicators of inflationary pressure when formulating monetary policy and uses judgement where appropriate. ...

Wed issue Dft#1 040710(2)IF

... imagine 2,700 pages that no one in Congress read, that was passed, so we could see what was in it. Every Democrat deserves to be thrown out of office for this piece of criminality. Corruption in government, Wall Street and banking knows no end. This in addition to the looting of funds for Social Sec ...

... imagine 2,700 pages that no one in Congress read, that was passed, so we could see what was in it. Every Democrat deserves to be thrown out of office for this piece of criminality. Corruption in government, Wall Street and banking knows no end. This in addition to the looting of funds for Social Sec ...

18.6 Problems In Implementing Monetary Policy

... If the Bank of Canada wants to contract the money supply, it will raise the rate. Conversely, if the Bank of Canada wants to expand the money supply, it will lower the bank rate, making it cheaper to borrow funds. The lower the interest rate, the higher the potential profit from new loans, so more n ...

... If the Bank of Canada wants to contract the money supply, it will raise the rate. Conversely, if the Bank of Canada wants to expand the money supply, it will lower the bank rate, making it cheaper to borrow funds. The lower the interest rate, the higher the potential profit from new loans, so more n ...

The 3-Equation New Keynesian Model — a Graphical

... simple models found in principles and intermediate macro textbooks — notably, the IS-LM -AS approach — and the models currently at the heart of the debates in monetary macroeconomics in academic and central bank circles that are taught in graduate courses. Our aim is to show how a graphical approach ...

... simple models found in principles and intermediate macro textbooks — notably, the IS-LM -AS approach — and the models currently at the heart of the debates in monetary macroeconomics in academic and central bank circles that are taught in graduate courses. Our aim is to show how a graphical approach ...

CHAP1.WP (Word5)

... they believe that with interest rates so close to zero that there is nothing left for them to do. With short-term Japanese interest rates at extremely low levels, there is speculation that the Japanese economy is experiencing a liquidity trap. Same is also true for the U.S. economy since 2008. Expla ...

... they believe that with interest rates so close to zero that there is nothing left for them to do. With short-term Japanese interest rates at extremely low levels, there is speculation that the Japanese economy is experiencing a liquidity trap. Same is also true for the U.S. economy since 2008. Expla ...

Covered Bonds: FDIC Action Might Spur US Covered

... must be limited to performing mortgages on one-tofour family residential properties, underwritten at the fully indexed rate and in accordance with existing guidance on residential mortgages and relying on documented income (“Eligible Mortgages”). Up to 10% of the collateral may consist of AAA-rated ...

... must be limited to performing mortgages on one-tofour family residential properties, underwritten at the fully indexed rate and in accordance with existing guidance on residential mortgages and relying on documented income (“Eligible Mortgages”). Up to 10% of the collateral may consist of AAA-rated ...

Optimal monetary policy in an economy with inflation persistence

... This paper presents a closed economy dynamic stochastic general equilibrium model with monopolistic competition and sticky prices. Two types of price setters are assumed to exist. One acts rationally given Calvo-type constraints on price setting. The other type sets prices according to a rule-of-thu ...

... This paper presents a closed economy dynamic stochastic general equilibrium model with monopolistic competition and sticky prices. Two types of price setters are assumed to exist. One acts rationally given Calvo-type constraints on price setting. The other type sets prices according to a rule-of-thu ...

The Supply and Demand for Safe Assets

... debt and privately-created near-riskless debt has remained constant as a percentage of all U.S. assets since 1952. Xie (2012) shows that the issuance of asset-backed securities tends to occur when the outstanding government debt is low and Sunderam (2012) documents the same phenomenon with respect ...

... debt and privately-created near-riskless debt has remained constant as a percentage of all U.S. assets since 1952. Xie (2012) shows that the issuance of asset-backed securities tends to occur when the outstanding government debt is low and Sunderam (2012) documents the same phenomenon with respect ...

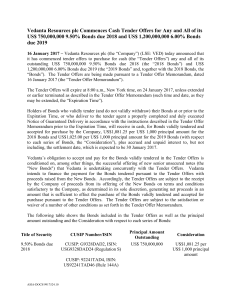

Vedanta - Tender Offer Launch Press Release

... 16 January 2017 – Vedanta Resources plc (the “Company”) (LSE: VED) today announced that it has commenced tender offers to purchase for cash (the “Tender Offers”) any and all of its outstanding US$ 750,000,000 9.50% Bonds due 2018 (the “2018 Bonds”) and US$ 1,200,000,000 6.00% Bonds due 2019 (the “20 ...

... 16 January 2017 – Vedanta Resources plc (the “Company”) (LSE: VED) today announced that it has commenced tender offers to purchase for cash (the “Tender Offers”) any and all of its outstanding US$ 750,000,000 9.50% Bonds due 2018 (the “2018 Bonds”) and US$ 1,200,000,000 6.00% Bonds due 2019 (the “20 ...

The data are collected at a quarterly frequency, over a

... speech (King, 2006) that “rapid growth of money – as central banks have kept official interest rates very low – has helped to push up asset prices as investors search for yield. Data from the IMF suggest that world broad money in 2004 and 2005 was growing at its fastest rate since the late 1980s." S ...

... speech (King, 2006) that “rapid growth of money – as central banks have kept official interest rates very low – has helped to push up asset prices as investors search for yield. Data from the IMF suggest that world broad money in 2004 and 2005 was growing at its fastest rate since the late 1980s." S ...

THE DEMAND FOR MONEY

... Money is the medium of exchange and the final payment in most transactions involves the transfer of money. But this alone is not enough to generate a demand for money. To see why, suppose that there are two assets in the economy: bonds that pay risk free interest and money that bears no interest, bu ...

... Money is the medium of exchange and the final payment in most transactions involves the transfer of money. But this alone is not enough to generate a demand for money. To see why, suppose that there are two assets in the economy: bonds that pay risk free interest and money that bears no interest, bu ...

this PDF file - IUG Journal of Humanities and Social

... major activity of banks is lending which involves the risk that the borrower will not pay back the loan as promised, and paying a fixed rate of interest on term deposits. Also lending rates could drop, leaving the bank earning less on its investments than it is paying out on deposits. The debate on ...

... major activity of banks is lending which involves the risk that the borrower will not pay back the loan as promised, and paying a fixed rate of interest on term deposits. Also lending rates could drop, leaving the bank earning less on its investments than it is paying out on deposits. The debate on ...

Inflation and the business cycle

... 2. Increase in cash increases prices directly; 3. Value of money declines leading to a switch towards other types of assets. Will lower money’s value and increase inflation further; 4. Lags in tax collection implies government revenue falls in real terms (at 100% inflation per month, a one month lag ...

... 2. Increase in cash increases prices directly; 3. Value of money declines leading to a switch towards other types of assets. Will lower money’s value and increase inflation further; 4. Lags in tax collection implies government revenue falls in real terms (at 100% inflation per month, a one month lag ...

The impact of monetary policy on particular sectors of the economy

... affecting. The official goals usually include relatively stable prices and low unemployment. Monetary theory provides insight into how to craft optimal monetary policy. It is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money ...

... affecting. The official goals usually include relatively stable prices and low unemployment. Monetary theory provides insight into how to craft optimal monetary policy. It is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money ...

Monetary Policy and the Behavior of Long

... are cash-flow constrained may care more about the nominal interest rate on their mortgage, because it determines the monthly cash payment that they must make, than about the rea! interest rate. Even for this example, however, many of the constrained households would be considering fixed-rate mortgag ...

... are cash-flow constrained may care more about the nominal interest rate on their mortgage, because it determines the monthly cash payment that they must make, than about the rea! interest rate. Even for this example, however, many of the constrained households would be considering fixed-rate mortgag ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... real interest rate exceeds the growth rate of output. Accordingly, there must eventually be an inflationary liquidation of debt or else a sharp increase in the inflation tax. But for the present we will not look at debt finance. Instead we will focus on the situation in which the entire deficit is f ...

... real interest rate exceeds the growth rate of output. Accordingly, there must eventually be an inflationary liquidation of debt or else a sharp increase in the inflation tax. But for the present we will not look at debt finance. Instead we will focus on the situation in which the entire deficit is f ...

On the Predictive Power of Interest Rates and Internet Rate Spreads

... contained in a wide variety of economic variables in an attempt to construct a new index of leading indicators. Stock and Watson found that two interest rate spreads--the difference between thesix-month commercial paper rate and the six-month Treasury bill rate, and the difference between the ten-ye ...

... contained in a wide variety of economic variables in an attempt to construct a new index of leading indicators. Stock and Watson found that two interest rate spreads--the difference between thesix-month commercial paper rate and the six-month Treasury bill rate, and the difference between the ten-ye ...

Monetary Policy, Financial Conditions, and Financial Stability

... taking, because of financial frictions, also substantially increases the vulnerability of the financial system to shocks, then the risk-taking channel will increase risks to financial stability. This effect on vulnerabilities can operate through asset prices or financial firms, or both. Low interes ...

... taking, because of financial frictions, also substantially increases the vulnerability of the financial system to shocks, then the risk-taking channel will increase risks to financial stability. This effect on vulnerabilities can operate through asset prices or financial firms, or both. Low interes ...