EIB - EESC European Economic and Social Committee

... Programme 2015-2016 • This programme, which began in March at a monthly rate of EUR 60 000 million and will last “at least” until September 2016, will be implemented through the acquisition of financial assets. • So, “at least” it will reach 1,14 trillion EUR (As a reference: more than 50 times the ...

... Programme 2015-2016 • This programme, which began in March at a monthly rate of EUR 60 000 million and will last “at least” until September 2016, will be implemented through the acquisition of financial assets. • So, “at least” it will reach 1,14 trillion EUR (As a reference: more than 50 times the ...

spd04 Missale2 225568 en

... We show that the debt-to-GDP ratio can be stabilized by issuing debt instruments that provide a hedge against variations in the debt ratio due to lower-than-expected inflation and output growth. For instance, if interest rates and output were negatively correlated, a long maturity debt would insulate ...

... We show that the debt-to-GDP ratio can be stabilized by issuing debt instruments that provide a hedge against variations in the debt ratio due to lower-than-expected inflation and output growth. For instance, if interest rates and output were negatively correlated, a long maturity debt would insulate ...

English - Inter-American Development Bank

... in Venezuela (around 55 percent) can be directly related to the occurrence of shocks that have their origin in fiscal and FX actions. This evidence also points out that policy shocks have, on average, contributed importantly to explaining credit expansion during the exchange rate control. While an u ...

... in Venezuela (around 55 percent) can be directly related to the occurrence of shocks that have their origin in fiscal and FX actions. This evidence also points out that policy shocks have, on average, contributed importantly to explaining credit expansion during the exchange rate control. While an u ...

Inflation vs Deflation

... the costs of higher inflation as central banks, which typically have restrictive inflation targets of around 2%. Here’s Joseph Stiglitz: “Moderate inflation, under 8% to 10%, does not have any significant effect on growth.” Meanwhile, IMF Chief Economist Blanchard suggested that inflation targets sh ...

... the costs of higher inflation as central banks, which typically have restrictive inflation targets of around 2%. Here’s Joseph Stiglitz: “Moderate inflation, under 8% to 10%, does not have any significant effect on growth.” Meanwhile, IMF Chief Economist Blanchard suggested that inflation targets sh ...

ISS research paper template

... series data was used covering the period 1970 to 2006. Domestic borrowing was found to have an incomplete crowding out effect on private credit. The study also revealed that the domestic borrowing does not impact on private credit through interest rate and credit availability seem to be more relevan ...

... series data was used covering the period 1970 to 2006. Domestic borrowing was found to have an incomplete crowding out effect on private credit. The study also revealed that the domestic borrowing does not impact on private credit through interest rate and credit availability seem to be more relevan ...

Monetary policy in albania: froM the past to the

... stronger than ever and has developed and reached unprecendented dimensions. However, some of the main drivers of this system are facing serious difficulties and concerns. The euro area is crisis-striken, primarily caused by the effects of globalisation, in other words, the ignored competitiveness in ...

... stronger than ever and has developed and reached unprecendented dimensions. However, some of the main drivers of this system are facing serious difficulties and concerns. The euro area is crisis-striken, primarily caused by the effects of globalisation, in other words, the ignored competitiveness in ...

Inflation-Indexed Securities: Description and Market Experience

... Individual interest in marketable Treasury inflation-indexed securities would appear to be weak, based on recent Treasury auction results and an examination of the Treasury DIRECT database. To date, small savers’ participation in mutual funds based on inflation-indexed bonds has been disappointing. ...

... Individual interest in marketable Treasury inflation-indexed securities would appear to be weak, based on recent Treasury auction results and an examination of the Treasury DIRECT database. To date, small savers’ participation in mutual funds based on inflation-indexed bonds has been disappointing. ...

Preparing for inflation - Charles Schwab Bank Collective Trust Funds

... We started our analysis from January 1, 1982, due to data availability, thereby excluding periods that in some instances included abnormally high inflation. Sources overlapped in a few instances, and we closely examined these periods separately. This methodology was chosen because we believe that we ...

... We started our analysis from January 1, 1982, due to data availability, thereby excluding periods that in some instances included abnormally high inflation. Sources overlapped in a few instances, and we closely examined these periods separately. This methodology was chosen because we believe that we ...

The New IS-LM Model: Language, Logic, and Limits

... not using microfoundations as a guide to the specification of estimable equations and also for avoiding central issues of identification (Sims 1980, Sargent 1981). The rational expectations revolution suggested that new macroeconomic frameworks were necessary—both small analytical frameworks like th ...

... not using microfoundations as a guide to the specification of estimable equations and also for avoiding central issues of identification (Sims 1980, Sargent 1981). The rational expectations revolution suggested that new macroeconomic frameworks were necessary—both small analytical frameworks like th ...

The influence of macroeconomic developments on Austrian banks

... interest rates) and indirectly (eg via their customers) dependent on the state of the economy. The main findings for the 1990s in Austria are as follows. Austrian banks increase risk provisions in times of falling real GDP growth rates and in times of rising bank operating income or operating result ...

... interest rates) and indirectly (eg via their customers) dependent on the state of the economy. The main findings for the 1990s in Austria are as follows. Austrian banks increase risk provisions in times of falling real GDP growth rates and in times of rising bank operating income or operating result ...

Inflation During and After the Zero Lower Bound

... blessing for empirical researchers who are trying to explain very different macroeconomic experiences, say in the U.S. and Japan, with a single economic model. Unfortunately, it may turn out to be a curse for policy makers, because the same monetary policy action of, say, changing interest rates or ...

... blessing for empirical researchers who are trying to explain very different macroeconomic experiences, say in the U.S. and Japan, with a single economic model. Unfortunately, it may turn out to be a curse for policy makers, because the same monetary policy action of, say, changing interest rates or ...

Chapter 21 Stabilization Policy with Backward

... Although many economists believe that all of these costs of anticipated inflation are relatively small, the fact that they are positive nevertheless suggests that the target inflation rate should be zero. However, a zero inflation rate may impair the central bank’s ability to stabilise the economy. ...

... Although many economists believe that all of these costs of anticipated inflation are relatively small, the fact that they are positive nevertheless suggests that the target inflation rate should be zero. However, a zero inflation rate may impair the central bank’s ability to stabilise the economy. ...

Federal Reserve Transparency and Financial Market Forecasts of Short-Term Interest Rates

... the individuals or groups listed above, the Federal Reserve System, or its Board of Governors. ...

... the individuals or groups listed above, the Federal Reserve System, or its Board of Governors. ...

EIB - EESC European Economic and Social Committee

... the target set by the ECB itself, namely lower but close to 2% annually. ...

... the target set by the ECB itself, namely lower but close to 2% annually. ...

Three Essays on The Term Structure of Interest Rates

... these papers can not be borne without them. I also thank parents, BCF of Korean Church of Columbus, and all for helps which they have kindly provided to me. ...

... these papers can not be borne without them. I also thank parents, BCF of Korean Church of Columbus, and all for helps which they have kindly provided to me. ...

Business Economics – II (MB1B4): January 2009

... (a) Decline as firms reduces production to stop the buildup of inventories (b) Increase as firms cut their prices to try to stop depletion of inventories (c) Decline as firms increase their prices to stop the buildup o f inventories (d) Increase as firms increase production to try to stop depletion ...

... (a) Decline as firms reduces production to stop the buildup of inventories (b) Increase as firms cut their prices to try to stop depletion of inventories (c) Decline as firms increase their prices to stop the buildup o f inventories (d) Increase as firms increase production to try to stop depletion ...

M S T F

... financial markets. It means stress testing is focusing on how the capital adequacy ratios of the banks would be affected by the baseline and the stress scenarios. Three scenarios are considered for the stress testing exercise in general. The first is the baseline scenario that is based on the medium ...

... financial markets. It means stress testing is focusing on how the capital adequacy ratios of the banks would be affected by the baseline and the stress scenarios. Three scenarios are considered for the stress testing exercise in general. The first is the baseline scenario that is based on the medium ...

Volume 68 No. 1, March 2005 Contents

... of whether they contribute to a country’s debt servicing capability. These parties would probably express concern if New Zealand’s reserves were substantially out of line with the rest of the world. ...

... of whether they contribute to a country’s debt servicing capability. These parties would probably express concern if New Zealand’s reserves were substantially out of line with the rest of the world. ...

Macro Sample Questions All Chapters McConnell 20 edition TO

... percentage point decline in the interest rate. Refer to the information. Using i and I to indicate the interest rate and investment (in billions of dollars) respectively, which of the following is the correct tabular presentation of the described relationship? A. Option A B. Option B C. Option C ...

... percentage point decline in the interest rate. Refer to the information. Using i and I to indicate the interest rate and investment (in billions of dollars) respectively, which of the following is the correct tabular presentation of the described relationship? A. Option A B. Option B C. Option C ...

Spotlight on catastrophe bonds

... For around 15 years, Insurance Linked Securities (ILS) have helped reinsurers manage their exposure to very large risks such as natural disasters. Over this time, ILS as an asset class has also proved to be very attractive to pension funds and other institutional investors. In this paper we discuss ...

... For around 15 years, Insurance Linked Securities (ILS) have helped reinsurers manage their exposure to very large risks such as natural disasters. Over this time, ILS as an asset class has also proved to be very attractive to pension funds and other institutional investors. In this paper we discuss ...

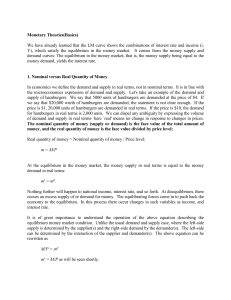

Monetary Theories(Basics) We have already learned that the LM

... control the price level. The demanders of money or the general public determine the price level. To recap, the monetary authority determines the nominal money supply not the real money supply. How does the monetary authority determine the nominal quantity of money supply? The monetary authority dete ...

... control the price level. The demanders of money or the general public determine the price level. To recap, the monetary authority determines the nominal money supply not the real money supply. How does the monetary authority determine the nominal quantity of money supply? The monetary authority dete ...

the use of reserve requirements in an optimal monetary policy

... Some inflation targeting countries like Brazil, Colombia and Peru, have used reserve requirements on domestic deposits as a macro-prudential policy tool aimed at increasing lending interest rates, reducing credit growth and curbing excessive private sector leverage during the expansionary phase of t ...

... Some inflation targeting countries like Brazil, Colombia and Peru, have used reserve requirements on domestic deposits as a macro-prudential policy tool aimed at increasing lending interest rates, reducing credit growth and curbing excessive private sector leverage during the expansionary phase of t ...

relatório e contas de 2003

... In the second quarter of 2014, according to the first data available, Gross Domestic Product increased by 0.8 % when compared with the same period last year, with a quarterly change of 0.6%, thus recovering from the drop in the first quarter (-0.6 % quarter-on-quarter). This performance of the natio ...

... In the second quarter of 2014, according to the first data available, Gross Domestic Product increased by 0.8 % when compared with the same period last year, with a quarterly change of 0.6%, thus recovering from the drop in the first quarter (-0.6 % quarter-on-quarter). This performance of the natio ...

Economics of Money, Banking, and Financial Markets, 8e

... 46) The spread between the interest rates on Baa corporate bonds and U.S. government bonds is very large during the Great Depression years 1930 -1933. Explain this difference using the bond supply and demand analysis. Answer: During the Great Depression many businesses failed. The default risk for ...

... 46) The spread between the interest rates on Baa corporate bonds and U.S. government bonds is very large during the Great Depression years 1930 -1933. Explain this difference using the bond supply and demand analysis. Answer: During the Great Depression many businesses failed. The default risk for ...

The Liquidity Premium of Near-Money Assets

... In the model of Greenwood, Hanson, and Stein (2014) an expansion in T-bill supply reduces household’s marginal benefit of liquidity, which lowers the liquidity premium and reduces the incentive of the private sector to produce money-like short-term debt. In my model, the central bank would want to ...

... In the model of Greenwood, Hanson, and Stein (2014) an expansion in T-bill supply reduces household’s marginal benefit of liquidity, which lowers the liquidity premium and reduces the incentive of the private sector to produce money-like short-term debt. In my model, the central bank would want to ...