Optimal Monetary and Prudential Policies

... simple monetary and prudential policy rules with each other by computing welfare numerically, and does not address the issue of the optimal capital requirement in the steady state.4 Recent work on monetary policy and financial stability emphasizes the credit cycle and the “risk-taking channel” of mo ...

... simple monetary and prudential policy rules with each other by computing welfare numerically, and does not address the issue of the optimal capital requirement in the steady state.4 Recent work on monetary policy and financial stability emphasizes the credit cycle and the “risk-taking channel” of mo ...

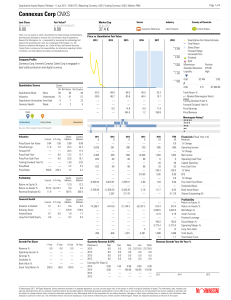

Connexus Corp CNXS

... investment research report that exceeds 0.5% of the total issued share capital of the security. To determine if such is the case, please click http://msi.morningstar.com and http://mdi.morningstar.com. The Head of Quantitative Research compensation is derived from Morningstar's overall earnings and ...

... investment research report that exceeds 0.5% of the total issued share capital of the security. To determine if such is the case, please click http://msi.morningstar.com and http://mdi.morningstar.com. The Head of Quantitative Research compensation is derived from Morningstar's overall earnings and ...

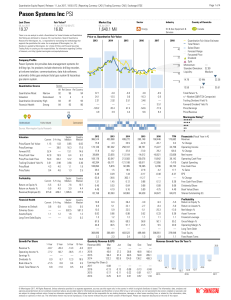

Pason Systems Inc PSI

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

... their clients in making an investment decision. While Morningstar has obtained data, statistics and information from sources it believes to be reliable, Morningstar does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. The quantitati ...

This PDF is a selec on from a published volume... Bureau of Economic Research

... The tight connection between seigniorage financing and inflation in Sargent and Wallace’s model stems from the assumption that bonds are real, or perfectly indexed to the price level. Higher real debt requires the government to raise more real resources—like seigniorage—to fully back the debt. But i ...

... The tight connection between seigniorage financing and inflation in Sargent and Wallace’s model stems from the assumption that bonds are real, or perfectly indexed to the price level. Higher real debt requires the government to raise more real resources—like seigniorage—to fully back the debt. But i ...

Monetary policy trade-offs and forward guidance

... breached, would mean that the guidance would no longer apply: first, if in the MPC’s view, it is more likely than not that CPI inflation 18 to 24 months ahead will be at least half a percentage point above the 2% target; and second, if medium-term inflation expectations no longer remain sufficiently ...

... breached, would mean that the guidance would no longer apply: first, if in the MPC’s view, it is more likely than not that CPI inflation 18 to 24 months ahead will be at least half a percentage point above the 2% target; and second, if medium-term inflation expectations no longer remain sufficiently ...

Macroprudential Policy: Promise and Challenges * By Enrique G

... relatively small. But periods of financial distress are very different, because these are points in the steep region of the theoretical pricing function, and in that region the errors of the local approximation are large. The data could be producing yields as predicted by the theoretical pricing fu ...

... relatively small. But periods of financial distress are very different, because these are points in the steep region of the theoretical pricing function, and in that region the errors of the local approximation are large. The data could be producing yields as predicted by the theoretical pricing fu ...

Volume 69 No. 1, March 2006 Contents

... This article presents a step towards a broad conceptual framework for promoting financial system stability and guiding the Bank’s policy actions. We argue that the preconditions for financial stability are met when all financial system risks are being adequately identified, allocated, priced and managed ...

... This article presents a step towards a broad conceptual framework for promoting financial system stability and guiding the Bank’s policy actions. We argue that the preconditions for financial stability are met when all financial system risks are being adequately identified, allocated, priced and managed ...

ESBies: Safety in the tranches

... First, in Section 4, simulations gauge ESBies’ safety. With a subordination level of 30%, ESBies have an expected loss rate slightly lower than German bunds. At the same time, they would approximately double the supply of safe assets relative to the status quo. The corresponding junior securities wo ...

... First, in Section 4, simulations gauge ESBies’ safety. With a subordination level of 30%, ESBies have an expected loss rate slightly lower than German bunds. At the same time, they would approximately double the supply of safe assets relative to the status quo. The corresponding junior securities wo ...

Volume 72 No. 3, September 2009 Contents

... Quality of bank capital in New Zealand Kevin Hoskin and Stuart Irvine1 The four largest banks in New Zealand have been accredited to operate as ‘internal models’ (IM) banks under the Basel II capital framework. Under this approach, banks are allowed to use their own models as a basis of determining ...

... Quality of bank capital in New Zealand Kevin Hoskin and Stuart Irvine1 The four largest banks in New Zealand have been accredited to operate as ‘internal models’ (IM) banks under the Basel II capital framework. Under this approach, banks are allowed to use their own models as a basis of determining ...

Rethinking the central bank`s mandate 4

... “When a new nation state seeks to establish itself, the foundation of an independent central bank will be an early item on the agenda, slightly below the design of the flag, but above the establishment of a national airline.”1 This quote is from a conference volume published in connection with the B ...

... “When a new nation state seeks to establish itself, the foundation of an independent central bank will be an early item on the agenda, slightly below the design of the flag, but above the establishment of a national airline.”1 This quote is from a conference volume published in connection with the B ...

inflation modeling for the sudan 1970-2002

... levels had been resorted almost everywhere. In 1930’s,the great depression spread over to many countries. Most of the industrial countries experienced declining prices and the cost of living decreased substantially. With World war II, inflation reappeared and spread quickly throughout trading nation ...

... levels had been resorted almost everywhere. In 1930’s,the great depression spread over to many countries. Most of the industrial countries experienced declining prices and the cost of living decreased substantially. With World war II, inflation reappeared and spread quickly throughout trading nation ...

Monetary and Fiscal Policy with Sovereign Default

... as an optimal distributive policy. Pouzo and Presno (2014) extend the incomplete markets model of Aiyagari et al. (2002) by considering a policy maker who cannot commit to debt payments. SosaPadilla (2013) studies Markov-perfect fiscal policy in a model where a sovereign default triggers a banking ...

... as an optimal distributive policy. Pouzo and Presno (2014) extend the incomplete markets model of Aiyagari et al. (2002) by considering a policy maker who cannot commit to debt payments. SosaPadilla (2013) studies Markov-perfect fiscal policy in a model where a sovereign default triggers a banking ...

Macroeconomic Shocks and Monetary Policy

... open economies and net importers of commodities meaning that they participate in the international trade of commodities but are small enough compared to their trading partners that they are not able to alter world commodity prices i.e. they are price takers (Bhattacharya & Quadros, 2011). Commodity ...

... open economies and net importers of commodities meaning that they participate in the international trade of commodities but are small enough compared to their trading partners that they are not able to alter world commodity prices i.e. they are price takers (Bhattacharya & Quadros, 2011). Commodity ...

targeting financial stability: macroprudential or monetary policy?

... The global financial crisis highlighted deficiencies in macro-financial policy toolkits. Monetary policy focused on price stability; prudential regulation was mostly concerned with practices at individual firms. Some central banks had a mandate to consider the stability of the financial system as a ...

... The global financial crisis highlighted deficiencies in macro-financial policy toolkits. Monetary policy focused on price stability; prudential regulation was mostly concerned with practices at individual firms. Some central banks had a mandate to consider the stability of the financial system as a ...

What has Happened to Monetarism? An Investigation into the

... rejecting the idea that velocity might be some "natural constant," an overstatement of the quantity theory which had contributed to its downfall, Friedman (1956, 21) refers to the "extraordinary empirical stability and regularity" of income velocity--when properly specified as a stable function of c ...

... rejecting the idea that velocity might be some "natural constant," an overstatement of the quantity theory which had contributed to its downfall, Friedman (1956, 21) refers to the "extraordinary empirical stability and regularity" of income velocity--when properly specified as a stable function of c ...

Measuring Systematic Monetary Policy

... one that the financial markets read into Federal Reserve policy: while ultimately it may aim to control inflation, it does so through contingent responses to inflation and real developments, and it expects its policy actions to affect the real economy systematically. The manner in which the Federal ...

... one that the financial markets read into Federal Reserve policy: while ultimately it may aim to control inflation, it does so through contingent responses to inflation and real developments, and it expects its policy actions to affect the real economy systematically. The manner in which the Federal ...

A big leap forward

... Message from the Chairman 2012 was a great year for the Maybank Group and a particularly eventful one for Maybank Philippines, Inc. (MPI). Consistent with its aspiration to be a regional financial services leader, the Group further expanded its regional footprint, which now spans 10 Asian countries ...

... Message from the Chairman 2012 was a great year for the Maybank Group and a particularly eventful one for Maybank Philippines, Inc. (MPI). Consistent with its aspiration to be a regional financial services leader, the Group further expanded its regional footprint, which now spans 10 Asian countries ...

Deutsche Bundesbank - Annual Report

... 1997 was a year of many facets ± in national and international terms alike. And this time, to a greater extent than in previous years, any look back is almost inevitably associated with a look forward, too. That applies particularly to the European economic and monetary union (EMU), whose outlines a ...

... 1997 was a year of many facets ± in national and international terms alike. And this time, to a greater extent than in previous years, any look back is almost inevitably associated with a look forward, too. That applies particularly to the European economic and monetary union (EMU), whose outlines a ...

Passthrough Efficiency in the Fed`s New Monetary Policy Setting

... In equilibrium, the competitiveness of deposit rates depends on the fraction of fast investors, the number N of banks competing for the deposits of a given fast investor, and the costs to slow investors for search and monitoring. Banks choose a profit-maximizing distribution of deposit rates. Becaus ...

... In equilibrium, the competitiveness of deposit rates depends on the fraction of fast investors, the number N of banks competing for the deposits of a given fast investor, and the costs to slow investors for search and monitoring. Banks choose a profit-maximizing distribution of deposit rates. Becaus ...

ExamView - CH 28 sample test questions.tst

... a. occurs in the United States during each business cycle. b. occurs only in theory, never in reality. c. has never occurred in the United States. d. happens in all countries at some time during their business cycle. e. is a period of time when inflation exceeds 20 percent per year. ____ 58. In the ...

... a. occurs in the United States during each business cycle. b. occurs only in theory, never in reality. c. has never occurred in the United States. d. happens in all countries at some time during their business cycle. e. is a period of time when inflation exceeds 20 percent per year. ____ 58. In the ...

Master Thesis The Relation Between Quantitative Easing and

... These quotes illustrate the concern of Klaas Knot, president of the Dutch Central Bank (De Nederlandsche Bank, DNB), that quantitative easing (QE) might lead to bubbles in financial markets. This thesis aims to provide an insight in the effects of QE on bubbles in stock markets. Almost every day, fi ...

... These quotes illustrate the concern of Klaas Knot, president of the Dutch Central Bank (De Nederlandsche Bank, DNB), that quantitative easing (QE) might lead to bubbles in financial markets. This thesis aims to provide an insight in the effects of QE on bubbles in stock markets. Almost every day, fi ...

annual hyman p. minsky conference on the state of the us and world

... were anything but random or ad hoc. He had discovered that our complex and sophisticated economic system was prone to an endogenous generation of instability. He was keenly aware of the limitations of macroeconomic theory and policy, and he insistently advocated that the conventional wisdom—that fin ...

... were anything but random or ad hoc. He had discovered that our complex and sophisticated economic system was prone to an endogenous generation of instability. He was keenly aware of the limitations of macroeconomic theory and policy, and he insistently advocated that the conventional wisdom—that fin ...

Language after Liftoff: Fed Communication Away from the Zero

... transparency. This was particularly true for the Federal Reserve. Prior to 1995, the FOMC did not even publicly announce its target for the federal funds rate, its primary monetary policy instrument, forcing market participants to infer the target from the Fed’s actions. Starting in the 1990s, this ...

... transparency. This was particularly true for the Federal Reserve. Prior to 1995, the FOMC did not even publicly announce its target for the federal funds rate, its primary monetary policy instrument, forcing market participants to infer the target from the Fed’s actions. Starting in the 1990s, this ...

Textbook of Economics

... that many students have deficiencies in mathematics as many of them had finished high school years ago. Therefore where mathematics is necessary a Math Box is included. Each chapter is followed by Numerical Examples that can be used in seminars to practice the acquired knowledge. The examples and th ...

... that many students have deficiencies in mathematics as many of them had finished high school years ago. Therefore where mathematics is necessary a Math Box is included. Each chapter is followed by Numerical Examples that can be used in seminars to practice the acquired knowledge. The examples and th ...

... This book consists of various chapters: each of them contains basic information and can be referred to individually, as and when required. The degree of complexity is, however, higher in Chapters 4 and 5 than in the first few chapters. In order to understand fully Chapter 5, it is necessary to have r ...