* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Canoe Floating Rate Income Fund

Private equity in the 2000s wikipedia , lookup

Leveraged buyout wikipedia , lookup

Interbank lending market wikipedia , lookup

Private equity wikipedia , lookup

Corporate venture capital wikipedia , lookup

International investment agreement wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Internal rate of return wikipedia , lookup

Rate of return wikipedia , lookup

Investment banking wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Negative gearing wikipedia , lookup

Private equity secondary market wikipedia , lookup

Money market fund wikipedia , lookup

Early history of private equity wikipedia , lookup

Auction rate security wikipedia , lookup

Private money investing wikipedia , lookup

Socially responsible investing wikipedia , lookup

Mutual fund wikipedia , lookup

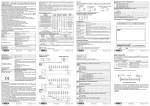

November 2014 January 2016 Canoe Floating Rate Income Fund (formerly O’Leary Floating Rate Income Fund) Fund Details Reasons To Own This Fund • • • Potential for attractive portfolio yield positioned to increase as interest rates increase Protection of short portfolio duration, under one year, limits impact of increasing interest rates Diversification alternative to traditional fixed income and preferred equity investments Investment Objective Fund Category Floating Rate Fund Type Mutual Fund Trust Dist. Frequency Monthly Base Currency CAD The Fund’s objectives are to provide income by investing in a diversified portfolio comprised primarily of senior floating rate loans, floating rate notes and other floating rate securities, as well as other debt obligations, of investment grade and non-investment grade Canadian and global issuers. Total Holdings 66 Management Fee - Series A - Series F 1.45% 0.75% Compounded Returns (%) Minimum Investment* Series A 1 MTH 3 MTH YTD 0.6 4.4 0.6 1 YR 8.4 3 YR - 5 YR - Since Incept 12.6 Series A Commenced Operations As At January 31, 2016. Inception June 25, 2013. Total Net Assets Calendar Year Returns (%) Series A Additional Investment 2013* 2014 2015 3.3 9.3 17.9 Portfolio Sub -Advisor $1,000 $50 August 15, 2013 $124.1M Aegon USA Investment Management, LLC * From August 15, 2013 to Dec 31, 2013 Growth of $10, 000 Investment – Series A* $13, 309 Risk Tolerance LOW MED MED HIGH MED HIGH For a description of the specific risks of this fund, please see the fund’s simplified prospectus. LOW As at 12/31/15 *Since commencement of operations (August 15, 2013), which represents the first date investors purchased units of the series. Page 1 of 2 November 2014 January 2016 Canoe Floating Rate Income Fund (formerly O’Leary Floating Rate Income Fund) Fund Code & Distributions Top Holdings (%) Series Fund Code Target Since Incept A OLF1571 $0.0275 $1.1369 B&G Foods Inc. 3.75% 05/10/2022 2.8 A (Hgd) OLF1501 $0.0275 $0.8387 Cablevision Systems Corp 8.0% 15/04/2020 2.8 A (USD) OLF1511 $0.0275 $0.9313 Alberstson’s LLC 5.5% 25/08/2021 2.8 F OLF1582 $0.0350 $1.2663 Summit Materials LLC 4.25% 17/07/2022 2.8 F (Hgd) OLF1502 $0.0350 $1.0437 Red Lobster Management LLC 6.25% 28/07/2021 2.7 F (USD) OLF1512 $0.0350 $0.9345 Petsmart Inc. 4.25% 10/03/2022 2.7 Univar USA Inc. 4.25% 01/07/2022 2.7 Sam Finance LUX SARL 4.25% 17/12/2020 2.7 Federal-Mogul Holdings Corp. 4.75 26/11/2020 2.4 Level 3 Financing Inc. 4.1005% 15/11/2016 2.3 Bond Characteristics As at December 31, 2105 Yield to Worst: 6.5% Average Duration 0.31 Average Credit Rating As at December 31, 2015 B Asset Allocation Geographic Allocation Sector Allocation As at December 31, 2015 The information contained in this report should not be considered as personal investment advice or an offer or solicitation to buy or sell securities. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. The performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returnsPlease read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Page 2 of 2