* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Effective Factors on Public Participation in the Capital Market (Case

International investment agreement wikipedia , lookup

Early history of private equity wikipedia , lookup

Socially responsible investing wikipedia , lookup

Market (economics) wikipedia , lookup

Short (finance) wikipedia , lookup

Investment banking wikipedia , lookup

Investment fund wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Investment management wikipedia , lookup

Securities fraud wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Stock market wikipedia , lookup

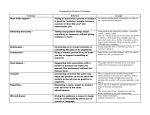

MAGNT Research Report (ISSN. 1444-8939) Vol.2 (4):PP. 4050-4057 Effective Factors on Public Participation in the Capital Market (Case study: East Azarbaijan Regional Stock Exchange) Nazila Helmi*1, Hossein Bodaghi Khajeh Noubar2 and Khadijeh Khadivi Javngleh3 1 2 Department of Management, East Azarbaijan Science and Research Branch, Islamic Azad University, Tabriz, Iran. Department of Management, East Azarbaijan Science and Research Branch, Islamic Azad University, Tabriz, Iran. 3 M.sc instructor in Economics at PNU Universit, Gowgan Branch, Iran. Abstract This paper aims to investigate the effective factors on public participation in the East Azerbaijan regional stock exchange capital market. The statistical population consisted of all referrers to Tabriz stock exchange agencies in Iran. In this research, 2200 individuals were selected as the statistical population (averagely in weeks 18 and 19 of 2013 about 100 individuals had been referd to each agency in Tabriz. (Averagely 2200 individuals have referd to22 agencies in Tabriz).The statistical sample was estimated 327 individuals based on Cochran formula. The hypotheses were analyzed by Regression test and correlation coefficient. The results showed that all hypotheses except stockholders culture in external factors impact on the public participation. Also, regression test indicates linearity of the persuasion of the people to investment. Key words: investment, stock exchange, public participation Introduction Investment, as an economic development and growth motor, is important for all countries in the world(Ahnagari,2008).It is necessary to remember that inattention to this component can be considered as a factor for economic decline (Helmi,2013).So, economic development and increase of public welfare in long term is impossible with inattention to investment and its effective factors. The exact study and analysis of the investment and its effective factors in the investors active environment could reduce inflation rate and liquidity in one hand and increase of employment and improve management and enhance wealth of the investor in other hand (Samadi,2008). According to this fact that investment is done in different ways, by providing possibility of investment in the firms that are subjected to offer their stock for public, stock exchange could play significant role in dynamicity of the firms and economics(Khodaei and Yahyaei,2010).So, the firms by offering their share by stock exchange and the investors by purchasing share and investment in the firms, stock provide possibility of participation in economic development and consider themselves as an active in economy development(Khataei,1999).According to this fact that there are numerous opportunities for investment and unplanned investment in Iran ,stock exchange plays a main role in this regard(Saedi,2008).Thus, identification of the investors behavior and its prediction can be considered as effective step in persuasion of the public in participation in the capital market. (DOI: dx.doi.org/14.9831/1444-8939.2014/2-4/MAGNT.94) Different factors influence on public participation in the capital market. For example1- Shareholding culture: working culture in a society can be effective in stability of the society. Thus, investment culture in stock exchange and stock market and allocating some part of the investment to land ownership, dwelling, automobile and others and in stock exchange could persuade the individuals in investment in this sector. So, shareholding culture in stock exchange can be defined as institutionalization of the allocating some part of investment in stock exchange (Safari,2005). Geographic allocation: in developing countries due to lack of sufficient development of internet and related issues and lack of electronic transaction infrastructures(electronic commerce, electronic banking, supporting regulations and etc) investment in stock and stock exchange is carried out in traditional way in stock exchange forums (Abzari and Safari,2006).Thus, establishment of forums and agencies in proper location and easy access facilities to investment in stock exchange can be considered as a progressive factor or preventive factor in persuasion of the public participation in investment in stock exchange(Maya, 2003); Political and economic factors: stock exchange as a reflector of national economic directly is influenced by economic factors and certainly, economic factors impact on the people who want to invest in stock exchange(Abzari,Samadi,Safari,2007:10).Also, due to influence on economic issues, political factors influence indirectly on the stock exchange and its progress and decline. So, political revolution and shifts could be considered as effective factor in investment in stock exchange(Niya,2003); MAGNT Research Report (ISSN. 1444-8939) Advertisement and information dissemination; from the past advertisement has been used in business for persuasion of the individuals for purchasing products and services and every day its role is added (Abzari, Samadi and Safari,2007:10).Nowadays, advertisement and information dissemination has been employed in financial and investment sector as a tool for awareness of investment, legal issues, minimum investment level, investment return, minimum expected return and etc. So, advertisement by media by stock exchange could persuade the individuals in investment in stock exchange(Maya,2003).According to the above factors and review of literature the aim of this research is to investigate the effective factors on public participation(internal factors: dividend, stock price, investment risk and expected return rate; external factors: economic and political factors, geographical location, advertisement and information dissemination and shareholding culture) in East Azerbaijan regional stock exchange capital market. Review of literature 1-In a research on the role of reference group in persuasion of the individuals in investment in stock exchange in 2007(case study: Isfahan stock exchange),Abzari,Samadi and Safari concluded that the research hypothesis of reference group role in persuasion of the individuals in investment in Isfahan stock exchange is confirmed; the statistics of secondary questions is confirmed by the second questionnaire concerning on the being affectedness of the reference group from macro factors like shareholding culture,economic and political factors,also, concerning on the being affectedness of the reference group by micro factors like advertisement , agencies and geographical location of the stock exchange are rejected and and it is (DOI: dx.doi.org/14.9831/1444-8939.2014/2-4/MAGNT.94) Vol.2 (4):PP. 4050-4057 confirmed related to profitability(Abzari,Samadi and Safari,2007). 2-In 2013, a research was carried out as solutions for increase public participation in the country capital market in Yazd regional stock exchange by Osku and Soltani. The results showed that all hypothesis are accepted except hypothesis of significant relationship between investor needs and accessibility. Also, regression test indicated linearity of the prediction models for persuasion of the individuals for investment,needs and expectations of the investors (Osku and Sultani,2010). 3-Enayat(2001) investigated the problems of the capital market and introduced five categories of the problems and barriers: legal infrastructures, capital market structural barriers,market information system, participants problems and economic,social and cultural barriers(Enayat,2001). 4Mokhtairyan(2004) and Warneryd(2001) investigated the effective factors on investors decision making and found that following factors influence on the capital market: political factors; profitability record;economic factors; shareholding culture; agencies operation;price trend; industry;stock price; firmidentification base;geographical location; financial statements; financial ratios, accountancy tool; advertising and public training conditions. 5-Halstead (2002), Taylor (2002) and Warnyd(2003)emphasized on the importance of dividend and stock characteristics in decision making on investment to buy stock. 6-Merikas et al (2003) and Al Tamimi(2006) investigated the importance of the effect of financial and accountancy information and Sultana(2010) investigated the effect of demographic factors like gender,age, study level and marital status and behaviors such as self conception and external behaviors like manner of investment on the decision making for investment. MAGNT Research Report (ISSN. 1444-8939) Research Vol.2 (4):PP. 4050-4057 conceptual model Economic and political factors Advertisement and information Shareholding culture External factors Effective factors Public participation Geographicallocat ion Independent variable Methodology This research is applied (Masoumi and et al,2013) and survey descriptive from method and filed study.The data were collected by library and field study(Masoumi,2013).For collection of the data on subject literature,library method like magazine, domestic and foreign MA theses and reports on stock exchange and computer sites and questionnaire were employed. The reliability depicts the level of compatibility of the questionnaire in measuring a concept(Beheshti,2013).The reliability of this research is 0.815 and since it is higher than 0.7 so the questionnaire is highly reliable.The validitymeanscorrectness and accuracy of the questionnaire (Attazadeh,2013).In this research the validity of the questionnaire was confirmed by content validity. The statisticalpopulationconsists of all individuals, objects that they are common Serial 1 2 3 Dependant variable minimum in one point (Attazadeh,2014).The statistical population of this research consisted of the investors referd to East Azerbaijan stock exchange agencies for purchasing stock.The sample invoked sings that selected from a large part or a group or a society (Masoumi,2013).In this researchthe sample was obtained 327 by Cochran formula with available sampling method. The data were analyzed by descriptive statistics and the hypotheses were tested by inferential statistics like Spearman correlation test and regression test.The extracted data of the questionnaire spss 18 was employed. Analysis of data In this part at first the main demographic variables like gender, income level, studies level ,age, marital status and then hypotheses test have been mentioned. Table (1) individual frequency distribution based on income Income level Frequency Percentage Valid percentage Lower than 1000000* 64 19.6% 19.6% From 1000000 to 1500000 112 34.3% 34.3% From 1500000 to 2000000 98 30.0% 30.0% Higher than 200000 53 16.2% 16.2% Total 327 100.0% 100.0% *toman (DOI: dx.doi.org/14.9831/1444-8939.2014/2-4/MAGNT.94) Additive % 19.6% 53.8% 83.8% 100.0% MAGNT Research Report (ISSN. 1444-8939) Vol.2 (4):PP. 4050-4057 Table 1 depicts the characteristics of the respondents from income level. It can said that among %100 of the respondents: % 19.6 has lower than 1000000 tomans income,% 34.3 has 100000 to lower than 1500000 tomans ,% 30.0 has from 1500000tomans to lower than 2000000 tomans and %16.2 has 200000 and upper income. Table (2) Individual frequency distribution based on study level Study level Frequency Percentage Valid percentage Additive % Diploma and under diploma 4 1.2% 1.2% 1.2% Associate 18 5.5% 5.5% 6.7% Bachelor of science 217 66.4% 66.4% 73.1% Master of science 88 26.9% 26.9% 100.0% Total 327 100.0% 100.0% Table 2 depicts the respondents study level. It can be %66.4 is Bachelor of Science and %26.9 is master of said that among %100 respondents: %12 is diploma science and upper. and under diploma, %5.5 is with associate degree and Serial 1 2 3 4 Table (3) Individual frequency distribution based on job Income level Frequency Percentage Valid percentage Additive % Unemployed 57 17.4% 17.4% 17.4% Self employed 197 60.2% 60.2% 77.7% Governmental job 73 22.3% 22.3% 100.0% Total 327 100.0% 100.0% Table 3 depicts the respondents’ job. It can be said %60.2 is self employed and %22.3 has governmental that among %100 respondents:% 17.4 is unemployed, job. Serial 1 2 3 Table (4) individual frequency distribution based on gender Gender Frequency Percentage Valid percentage Female 86 26.3% 26.3% Male 241 73.7% 73.7% Total 327 100.0% 100.0% Table 4 depicts the respondents’ gender. It can be said that among %100 respondents:%26.3 is female and %73.7 is male. Serial 1 2 Additive % 26.3% 100.0% Table (5) Main statistics of the effective factors on inventors’ participation in East Azarbaijan stock exchange Dependant Independent variable variable External factors Public participation Geographical location Shareholding culture Advertisement and information Economic and olitical factors Statistics 40.66 41.00 44 4.372 19.115 -0.300 28 50 22 14.67 16.00 16 4.096 16.774 -0.772 4 20 16 6.89 7.00 10 2.512 6.311 -0.378 2 10 8 9.46 9.00 15 4.789 22.930 -0.073 3 15 12 28.65 32.00 8 9.737 94.810 -0.861 8 40 32 Mean Median Mood SD Variance Skewers Min Max Conversion (DOI: dx.doi.org/14.9831/1444-8939.2014/2-4/MAGNT.94) MAGNT Research Report (ISSN. 1444-8939) Vol.2 (4):PP. 4050-4057 Table 5 depicts main statistics of the effective factors on inventors’ participation in East Azerbaijan stock exchange. Normal and abnormal data Table (6) the results of Kolomogrove- Smearnov of internal and external factors Public participation Geographical location Culture Advertisement Economic and political factors 327 40.66 4.372 0.074 0.039 -0.074 1.345 0.054 327 14.67 4.096 0.141 0.097 -0.141 2.551 0.000 327 6.89 2.512 0.136 0.108 -0.136 2.452 0.000 327 9.46 4.789 0.188 0.143 -0.188 3.403 0.000 327 28.65 9.737 0.136 0.122 -0.136 2.458 0.000 Normal Abnormal Abnormal Abnormal Abnormal No. Sd mean Normal parameters Absolute Positive Negative Significant difference K-S Sig Results Table 6 shows the results of Kolomogrove –Smearnov. According to the significance level that is lower than 0.05 for all variables except public participation, it can be said that all variables except public participation has abnormal distribution. Main hypotheses External factors First impact on main public hypoth participation in esis capital market. H1 H2 H3 Table (7) Hypotheses Secondary hypotheses Economic and political factors impact on public participation in capital market Advertisement (information) impacts on public participation in capital market. Shareholding culture impacts on public participation in capital market. H4 Geographical location impacts on public participation in capital market Table (8) Variables Spearman correlation results Public participation Variables Correlation coefficient Sig Result Economic and political factors 0.157 0.004 Yes External factors Advertisement and information 0.215 0.000 Yes Geographical location 0.181 0.001 Yes Shareholding culture 0.040 0.467 No Table 8 depicts variables Spearman correlation culture have a significant relationship with public coefficient and significance level. According to the participation. Among internal factors, advertisement significance level that it is higher than 0.05 for a and information has highest correlation coefficient shareholding culture it can be said that there is no (0.215). relationship among, shareholding culture and public For hypotheses one to four regression test was used. participation. Also, all variables except shareholding Model 1 Table (9) Independent variables, omitted variables and cases used for regression Variable Entered Variable Removed Geographical location, economic and political factors, shareholding 0 culture, advertisement and information (DOI: dx.doi.org/14.9831/1444-8939.2014/2-4/MAGNT.94) Method Enter MAGNT Research Report (ISSN. 1444-8939) Vol.2 (4):PP. 4050-4057 Table 9is the first regression output and depicts independent variables, omitted variables and cases used for regression. Table (10) multiple correlation coefficient, estimate and adjusted coefficients Model R R square Adjust R square Std. error of the estimate 1 0.258 0.057 0.055 4.250 Table 10 is the second regression output and indicates multiple correlation coefficient, estimate and adjusted coefficients. Table (11) Results of analysis of regression variance among external variables Model Sum of Squares df Mean Square F Sig. Regression 415.043 4 103.761 5.744 0.000a 1 Residual 5816.596 322 18.064 Total 6231.639 326 Table 11 is the third regression output. This table depicts results of analysis of regression variance to investigate the certainty of the linear relationship among variables. The significance level is 0.000so; linearity of the model is confirmed. Table (12) Results of regression and constant value Unstandardized Coefficients Standardized Coefficients Model t Sig. B Std. Error Beta (Constant) 35.289 1.349 26.158 0.000 Economic and political factors 0.039 0.025 0.087 1.565 0.119 1 Advertisement and information 0.154 0.051 0.169 3.025 0.003 Shareholding culture 0.094 0.094 0.054 1.005 0.316 Geographical location 0.146 0.058 0.136 2.525 0.012 Table 12 depicts the results of regression and people trust related to continuity of activities of the constant value. According to the significance level in investors, return and profitability.Sanctions and table 12 it can be said that in regression modelall political revolutions or change in economic indices variables influence on the public participation except impact negatively on people. In other hand, change in economic and political, advertisement and prices of items like dwelling and gold affects on the information and geographical location factors. In transactions and increase and decrease of price and other hand, if independent variables are shown with public participation. So, it is recommended to X and dependent variable is shown with Y, the progress in economic analysis and provide context regression model is calculated as follows: for production of the primary products inside the country and transfer of technology that decrease the 0.146𝑥2 +0.154𝑥1 +γ = 32.289 impact of sanctions. The agencies of the stock are According to beta coefficients, it can be said that recommended to disseminate information on the among mentioned external variables and residual in advantages of investment in stock exchange that the regression, advertisement and information have influence positively on people participation. the most impact on the public participation in the According to the secondhypothesis it can be said that capital market. since identification of people on capital market can be an effective factor in public participation so any Conclusion enhancing people awareness it can be increased According to the results, economic factors, publicparticipation in capital market. Since advertisement and information and advertisement and information dissemination is one geographicallocation are external factors that impact of the marketing techniques so it is recommended the on public participation in the capitalmarket that actors of stock arrange marketing and investment advertisement and information have the highesteffect training courses and offer information on financial in this regard, followings are proposed: aspects of capital market and disseminate information Concerning to first hypothesis it can be said that by media that increases people awareness on capital economic and political stability influence on the (DOI: dx.doi.org/14.9831/1444-8939.2014/2-4/MAGNT.94) MAGNT Research Report (ISSN. 1444-8939) market and investment in stock exchange and as a result public participation. Concerning to the effect of geographical location on publicparticipation it is recommended that since investment in stock exchange is carried out traditionally in forums due to lack of sufficient development of internet and related issues and deficiency in electronic transactions infrastructures like electroniccommerce, electronic banking and related regulations.So, establishment of forums in a proper location for easy access can be considered as progressive factor.In other hand,establishment of agencies in national level and provinces reduce time required for investment that encouragespeopleparticipation in the capital market.Thus, observing required actions for expansion of internet and considering electronic transactions and related regulations and establishment of agencies provide the investors toaccess these agencies easily. References 1. Ahangari ,A., A.(2008). The relationship between risk and private investment in Iran, Economic research, Year VIII, No. 3 , 42-55 . 2 .Helmi,N.(2013). Factors influencing people's participation in the capital market case study ( East Azerbaijan Province stock exchange ) , MA thesis,Science and Research University of East Azerbaijan . 3. Samadi , S., Abzari,M.( 2008). The role of reference groups in encouraging people to invest in the Stock Exchange, the Fourth Management Conference. 4. Khodai Valle Zagrad, M.,Yahyaei,M.( 2010). The relationship between the quality of financial reporting and the effectiveness of investment in Stock Exchange , Journal of Management Accounting , third , fifth number . 5.Khataei , M. (2009).Financial Markets and Economic Development , First Edition, published by the Institute for Monetary and Financial Studies . 6 .Saeedi, P.(2008). Stock market and importance of financial market, Journal of Tadbir , the nineteenth year . No. 192. 7 .Safari , AS.(2005). Investigate the factors affecting individual fundraising Stock Exchange (TSE Case Study of Isfahan), MAthesis, Faculty of Economics, University of Isfahan. 8. Abzari, M. , Safari , A . (2006). The electronic exchange and its development inIran, Modern business economy research and scientific querterly, 2 , pp. 86-106 . (DOI: dx.doi.org/14.9831/1444-8939.2014/2-4/MAGNT.94) Vol.2 (4):PP. 4050-4057 9.Mayya, MR.(2003). Regional Stock Exchange, Retrieved, Jun9, 2004, From: http://www.bseindia.com/downloads/RegionalStockE xchanges.pdf. 10.Abzari , M. , Samadi , S.; Safari, A.(2007). The role of the Reference Group to persuade people to invest in stock market capitalization (case study: Tehran Stock Exchange) , review of accounting and auditing , year 14 , No. 48 , 3-22 . 11.Nia, EJ, 2003, Regional Stock Exchange-A viable from Wales and other UK Region? Institute of Welsh Affairs, Cardiff Retrieved May30, 2000 from: http :/ / www. Databank / grup.com / internet / research / knowledge bank / regional stock & change, PDF. 12 .Neveu , Raymond P. (2006).Financial Management , Translation: Ali Jhankhany and Ali Parsaeian , Volume I, published by SAMT. 13.Osku, V.,. Soltani , M. (2012). Strategies to increase public participation in the capital market of the country case study: regional Exchange of Yazd, the National Conference of accounting, financial management and venture capital, University of Science and Applied. 14. Enayat , S. , A. (2001). Problems and bottlenecks in the Iranian capital market, Journal of Pazhoheshanmeh ,second year , No. 3 , pp. 139-161 . 15. Mokhtarian , A.(2004).Factors affecting investment decision making, MA thesis , TarbiatModarres University. 16.Warneryd, K.(2001). Stock market psychology: How people Value and trade Stocks, Cheltenham: Edward Elgar. 17.Halstead, T(2002).Technical Analysis Tutorial. http: www.investopedia.com/university/technical 18. Taylor, S., 2002, Stock Bausics Tutorial.www.investopedia.com/university/stock/yiel d 19 .Warneryd, K (2003) How people Value and Trade Stocks. Stock Market Psychology. 20. Merilkas, A. and Prasad, d(2003). Factor influencing Greek investor behavior on the Athens stock Exchange, paper presented at the Annual meeting of Academy of Financial Services , Colorado, October.8-9. 21.AL-Tamimi, H.A.H(2006). Factors Influencing Individual Investor Behavior: An Empirical Study of the UAE Financial Markets. The Business Review, Cambridge, 5(2),225-232. 22.Masomi, E. and et al.(2013). The Relationship between Organizational Climate Dimensions and Corporate Entrepreneurship (Case Study: MeshkinshahrPayam Noor University), Research Journal of Recent Sciences, 2(11), 23.Masomi E. and et al.(2013).Survey on the role of knowledge management on the quality of working MAGNT Research Report (ISSN. 1444-8939) life (Case Study: Islamic Azad University, Pars Abad Branch), Research Journal of Recent Sciences, 2(11), November 24.Beheshti V. Iranzadeh S. and JabbariKhamaneh H.(2013). Survey on the Impact of Financial Payment on Employees’ Motivation (Case Study: Ardebil Melli(National) Bank), Research Journal of Recent Sciences, 2(8), August 25.Atazade Y. Iranzadeh S. and JabbariKhamaneh H.(2013). Effective Internal strategic factors on customer satisfaction from the perspective of organization’s managers in Tabriz travel agencies,Research Journal of Recent Sciences, 2(9),September (DOI: dx.doi.org/14.9831/1444-8939.2014/2-4/MAGNT.94) Vol.2 (4):PP. 4050-4057 26. Atazade Y. and et al.(2014). Interactive Relationship Between the Dimensions of Social Capital and Entrepreneurial Orientation With Respect to The Characteristics Approach (Case Study: City of Tabriz (Iran)),Research Journal of Recent Sciences 27.Masomi E. and et al.(2013). The Study of Corporate Entrepreneurship and its Relationship with job satisfaction (Case study: Sepah Bank, branches of Golestan Province), Research Journal of Recent Sciences, 2(12), December