* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Looking to gain from small-cap inefficiencies with active management

International investment agreement wikipedia , lookup

Short (finance) wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Leveraged buyout wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Private equity wikipedia , lookup

Securities fraud wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Corporate venture capital wikipedia , lookup

Investment banking wikipedia , lookup

Private equity secondary market wikipedia , lookup

Mutual fund wikipedia , lookup

Fund governance wikipedia , lookup

Stock trader wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Early history of private equity wikipedia , lookup

Private money investing wikipedia , lookup

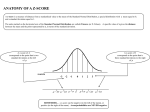

For professional investors and financial advisers only – not for use by retail investors Looking to gain from small-cap inefficiencies with active management Image description here Seeking more from small caps with active management Unlike large-cap companies, small-cap stocks have fewer Wall Street analysts dedicated to researching them. There were an average of 24 analysts dedicated to researching a large-cap company and 13 analysts dedicated to a mid-cap company.A Small-cap companies had an average of seven analysts. The high coverage large caps receive means these companies are priced by the market. And with such extensive research externally available on these stocks, there leaves little room to capture opportunities in mispriced stocks. This is the reverse case for small caps. The small-cap universe is one corner of the market where there are abundant opportunities to exploit market inefficiencies through fundamental analysis and stock picking. But powerful stock picking requires significant active management. Especially when it comes to small-caps (where the needed research may not be available), active management is the key ingredient to capitalising on market inefficiencies. Why active? Often, when investors are buying into passive index and exchangetraded funds (ETFs), they are buying the package deal without needing or wanting everything in the set. Active management can help reduce this blind buying by being more selective with small cap companies. Also, because active managers are not limited to just the investments within the index, they are open to capturing more opportunities than what looks available to the rest of the market. Wall Street analysts per stock, on average 23 Large cap 17 Mid cap Why Small Caps Now? Average z-score (1978-2015) 3 2 1 0 -1 -2 -3 78 80 85 90 85 As noted above, there aren’t nearly as many analysts to do the lifting on researching small-cap companies (concurrently making sure they make suitable investments that can add value). While this leaves smallcap managers like us to have to do more heavy work, we view this as an advantage because of the abundant opportunities there are to find inefficiencies within the small-cap market and capitalise on them. Our entire firm is driven by first-hand research, so we already possessed the tools needed to carry out this kind of needed fundamental research for small caps. 10 15 Source: BofA Merrill Lynch Small Cap Research; Russell Investment Group, September 2015. For illustrative purposes only. Z-score is a statistical measurement of a data point’s relationship to the mean; a negative z-score is below, 0 is the same as, and positive is above the mean. The average z-score was taken and percentiled and then further quintiled to create certain buckets. When the average z-score fell into quintile 1, small caps (Russell 2000) were cheap relative to large caps (Russell 1000). When the average z-score fell into quintile 5, small caps were relatively expensive. Acting on active management Getting the most out of the small-cap universe may be easier said than done. Capitalising on small-cap efficiencies and the dynamics that exist in today’s investment environment requires a substantial amount of resources. Active share measures how active a fund is compared to its benchmark. It looks at the aggregate differences in portfolio holding weights compared to the benchmark constituent weights. This percentage score, attributed to its founders Martijn Cremers and Antti Petajisto, reveals the extent to which your manager is using active management for your investments. This can make a significant difference in the small cap asset class, where locating opportunities requires a more hands-on approach. A vehicle with an active share of 0 would hold exactly the same portfolio as the benchmark index, while a vehicle with an active share of 100 would have no holdings in common with the benchmark. Aberdeen Global - North American Smaller Companies FundB Active Share: 95.9% Source: Aberdeen Asset Management, as at 31 August 2016. As of February 29 2016, the Aberdeen Small Cap Fund changed its name to the Aberdeen Global North American Smaller Companies Fund. Bloomberg, February 2016. B 05 Are you getting the most from your active managers? 7 Small cap Source: Bloomberg, 2016. For illustrative purposes only. A 00 Expensive (top quintile z-scores (above 0.74) Cheap (bottom quintile z-scores (below -0.64) Talking about Aberdeen Global - North American Smaller Companies Fund with your clients Our North American Smaller Companies Fund has a portfolio team of 13 investment professionals who do all their own on-the-ground research to pick stocks from the bottom-up. We carry out our own due diligence and never invest in a company without meeting management face-to-face. This is critical when buying small-cap stocks because we have to do more of our legwork given the lack of information available externally. Aberdeen Global - North American Smaller Companies Fund – Fund Facts BenchmarkC Minimum Initial Investment Ongoing Charges Figure (OCF) D Class A Institutional Class Russell 2000 Russell 2000 $1,500 $1,000,000 1.75% 0.96% The fund returns to the reporting date are based on dealing NAVs using a 13:00 CET valuation point: for US Equity Funds this means the dealing NAV uses security prices at close of the previous working day. The benchmark index, if unadjusted, would use the closing prices of the reporting date: when a US Equity benchmark is compared against a US equity fund this valuation point difference may produce a significant distortion in benchmark-relative performance. In order to neutralise this distortion, the benchmark returns shown are to the day previous to the reporting date. D The Ongoing Charge Figure (OCF), is the overall cost shown as a percentage of the value of the assets of the Funds. It is made up of the Annual Management Charge (AMC) of 1.50% and other charges. It does not include any initial charges or the cost of buying and selling stocks for the Funds. The Ongoing Charges figure can help you compare the annual operating expenses of different Funds. C The value of investments and the income from them can go down as well as up and your clients may get back less than the amount invested Important information PLEASE CONSIDER THE RISKS Risk factors you should consider before investing: • The value of shares and the income from them can go down as well as up and you may get back less than the amount invested. • Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of your investment. • Shares of smaller companies may be more difficult to buy and sell than those of larger companies. This means that the Investment Manager may not be able to buy and sell at the best time or may suffer losses. This could reduce your returns. • The Sub-Fund’s exposure to a single country market, which may be subject to particular political and economic risks, may cause the sub-fund to be more volatile than more broadly diversified funds. For professional investors and financial advisers only – not for use by retail investors Further information For more information please contact your local Aberdeen representative, or visit our website at aberdeen-asset.com The Fund is a Luxembourg-domiciled UCITS fund, incorporated as a Société Anonyme and organised as a Société d’investissement à Capital Variable (a “SICAV”). The information contained in this marketing document should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. It is not intended for distribution or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication or use would be prohibited. The Fund is not registered under the United States Securities Act of 1933, nor the United States Investment Company Act of 1940 and therefore may not directly or indirectly be offered or sold in the United States of America or any of its states, territories, possessions or other areas subject to its jurisdiction or to or for the benefit of a United States Person. No information, opinions or data in this document constitute investment, legal, tax or other advice and are not to be relied upon in making an investment or other decision. Subscriptions for shares in the Fund may only be made on the basis of the latest prospectus, relevant Key Investor Information Document (KIID) and Supplementary Information Document (SID). These can be obtained free of charge from Aberdeen Asset Managers Limited, 10 Queens Terrace, Aberdeen, AB10 1YG, Scotland and are also available on aberdeen-asset.com. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. You should obtain specific professional advice before making any investment decision. Issued by Aberdeen Asset Managers Limited which is authorised and regulated by the Financial Conduct Authority in the United Kingdom. 121025568 09/16

![Special Interview : Hideo Shiozumi [PDF 134KB]](http://s1.studyres.com/store/data/016787266_1-72016ef51958c0d1f7fbc9dd7e05b59e-150x150.png)