* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Click to download Firth AVF March 2012

Private equity wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Short (finance) wikipedia , lookup

Corporate venture capital wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Early history of private equity wikipedia , lookup

International investment agreement wikipedia , lookup

Private equity secondary market wikipedia , lookup

Stock trader wikipedia , lookup

Money market fund wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Investment banking wikipedia , lookup

Private money investing wikipedia , lookup

Socially responsible investing wikipedia , lookup

Mutual fund wikipedia , lookup

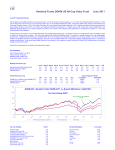

Hereford Funds - Firth Asian Value Fund March 2012 March 2012 Investment Review In March 2012 the Fund’s net asset value fell by 1.4% (after deducting all fees and expenses). By comparison the MSCI AC Asia ex Japan Small Cap index fell by 3.8% and the MSCI AC Asia ex Japan index fell by 3.1%. After such a strong start to 2012, it was perhaps inevitable that Asia ex-Japan’s markets and currencies weakened during March. This was true too in the portfolio where a handful of stocks that had done exceptionally well in January and February slipped back. The reporting season for end 2011 results also provided the usual mix of pleasant and less pleasant surprises for a number of the portfolio’s holdings. The sale of the Fund’s holding in Quanta Storage, a Taiwan-listed manufacturer of optical storage products, was completed during March. Meanwhile, new holdings were established in a Hong Kong-listed trading company and a Korea-listed retailer. Both of these represent special situations where we are attracted for stock specific reasons rather than because they are from a particular sector or country. Key Information Hereford Funds - Firth Asian Value Fund NAV A Shares (30/3/12): $94.13 Total Fund Size: $8.6 million Strategy Assets: $35.4 million (a) Fund Launch Date: 31/05/11 Performance (%) (net of fees and expenses) Jun 11 Hereford Funds - Firth Asian Value Fund MSCI AC Asia ex Japan Small Cap USD Net MSCI AC Asia ex Japan USD Net 105 2012 YTD Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 -1.2 -2.4 -2.3 0.6 2.8 1.1 -8.5 -11.4 -9.9 -12.6 -16.3 -13.2 6.4 10.1 12.0 -5.9 -8.7 -8.3 0.8 -1.2 0.6 6.1 10.0 10.8 12.1 9.0 6.0 -1.4 -3.8 -3.1 Since Launch 17.3 15.4 13.7 Hereford Funds - MSCI AC Asia ex Japan Small Cap USD Net HF FAVF MSCI AC Asia ex Japan Small Cap USD Net (Rebased) MSCI AC Asia ex Japan USD Net (Rebased) 100 95 90 85 80 75 70 65 Country breakdown Hong Kong/China Indonesia Korea Malaysia Philippines Singapore Thailand Taiwan Cash % of assets 39 4 10 10 3 12 1 12 10 Sectoral breakdown Consumer Discretionary Consumer Staples Financials Health Care Industrials Information Technology Materials Cash % of assets 48 10 6 2 13 9 2 10 -5.9 -14.7 -9.2 Investment Objective Hereford Funds - Firth Asian Value Fund is to generate long term capital growth from a portfolio of listed company securities in Asia (ex-Japan). The Compartment will follow a value-based investing approach and will have a bias towards smaller capitalisation stocks. The Compartment will directly invest primarily in shares of companies located in, incorporated in, headquartered in, listed on exchanges in or with significant operations in or significant income derived from Hong Kong, India, Indonesia, Korea, Malaysia, the Philippines, the PRC, Singapore, Taiwan and Thailand. The Compartment may also directly invest in smaller or developing economies in Asia such as Bangladesh, Cambodia, Laos, Pakistan, Sri Lanka or Vietnam. The Compartment will not invest in China A Shares when investing in the PRC. The Compartment will directly invest actively in a diversified portfolio of listed equity securities. The Compartment will generally only invest in securities admitted to official listing on a recognized stock exchange, or dealt in on another regulated market. Although the Compartment intends to invest in a portfolio of not less than 40 stocks and not more than 100 stocks, it is not restricted in or subject to any material concentration or diversification restrictions, and may hold a more limited number of investment positions. The Compartment will typically be near fully invested but may hold liquid assets on an ancillary basis. Under normal market conditions, investment in liquid assets and debt instruments of any kind will not exceed 15% of the Compartment's net assets. In exceptional market circumstances and on a temporary basis only, this limit may be increased to 100% with due regard to the principle of risk spreading. The Investment Manager intends to meet the Fund’s objective primarily through stock selection and country allocation based upon the investment advice of the Investment Adviser. Typically stocks will be bought and held. This is not a trading strategy and it is not intended to attempt to time general market movements. While portfolio returns will be measured against the Benchmark Index, portfolio management will not be constrained by reference to the index. Fund Codes Bloomberg ISIN Reuters Sedol Valoren WKN HFIRASA LX * LU0618975774 NA B64KS81 12853411 A1H9V4 * Share Class A Fund Details Dealing Day Dividends Investment Manager Investment Advisor Promoter Fund Administrator Custodian Legal Advisers Auditor Daily None - income accumulated within the fund Swiss-Asia Financial Services Pte. Ltd. 8 Temasek Blvd, #43-01 Suntec City Tower 3, Singapore Firth Investment Management Pte. Ltd. 180 Cecil Street, #13-03 Bangkok Bank Building, Singapore VP Bank (Luxembourg) S.A., 26 Avenue de la Liberté, L-4030 Luxembourg VPB Finance S.A., 26 Avenue de la Liberté, L-4030 Luxembourg VP Bank (Luxembourg) S.A., 26 Avenue de la Liberté, L-4030 Luxembourg Elvinger, Hoss & Prussen, 2 Place Winston Churchill, L-1340 Luxembourg Deloitte,560 Rue de Neudorf, L-2220 Luxembourg Annual Management Charge Share Class A (b) Share Class D Annual Management Charge 1.5% 2.0% Performance fee: High water mark?: Hurdle rate: 10% Yes MSCI AC Asia ex Japan Small Cap USD Net Minimum Investment Share Class A (b) Share Class D Order Transmission Information Original Applications To: VPB Finance S.A. attn. Fund Operations / TA-HFF P.O. Box 923 L-2040 Luxembourg or, for transmissions via courier service, 26, avenue de la Liberté, L-4030 Luxembourg $100,000 initial / $10,000 subsequent $10,000 initial / $1,000 subsequent Subsequent Applications Only Via Facsimile: VPB Finance S.A. attn. Fund Operations / TA-HFF Fax: (+352) 404 770 283 Tel: (+352) 404 770 260 e-mail: [email protected] (a) This refers to the total assets to which the Investment Adviser applies the reference strategy. (b) Share Class A: these shares both have UK reporting status and are German tax registered from launch. (c) Share Class D: these shares have not yet been launched. This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. This information does not provide any accounting, legal, regulatory or tax advice. Please consult your own professional advisers in order to evaluate and judge the matters referred to herein. An investment should be made only on the basis of the prospectus, the annual and any subsequent semi-annual-reports of HEREFORD FUNDS (the "Fund"), a société d'investissement à capital variable, established in Luxembourg and registered under Part I of Luxembourg law of 20 December, approved by the Commission de Surveillance du Secteur Financier (CSSF). These can be obtained from [the Fund, 26, avenue de la Liberté, L-1930 Luxembourg or from VPB Finance S.A., 26, avenue de la Liberté, L-1930 Luxembourg and any distributor or intermediary appointed by the Fund]. No warranty is given, in whole or in part, regarding performance of the Fund. There is no guarantee that its investment objectives will be achieved. Potential investors shall be aware that the value of investments can fall as well as rise and that they may not get back the full amount invested. Past performance is no guide to future performance. The information provided in this document may be subject to change without any warning or prior notice and should be read in conjunction with the most recent publication of the prospectus of the Fund. Whilst great care is taken to ensure that information contained herein is accurate, no responsibility can be accepted for any errors, mistakes or omission or for future returns. This document is intended for the use of the addressee or recipient only and may not be reproduced, redistributed, passed on or published, in whole or in part, for any purpose, without the prior written consent of HEREFORD FUNDS. Neither the CSSF nor any other regulator has approved this document.