* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Click to download Firth AVF November 2013

Survey

Document related concepts

Corporate venture capital wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Stock trader wikipedia , lookup

International investment agreement wikipedia , lookup

Early history of private equity wikipedia , lookup

Private equity secondary market wikipedia , lookup

Money market fund wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Investment banking wikipedia , lookup

Private money investing wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Mutual fund wikipedia , lookup

Socially responsible investing wikipedia , lookup

Transcript

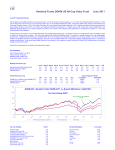

Hereford Funds – Firth Asian Value Fund November 2013 November 2013 Investment Review In November 2013 the total return of the Fund after deducting all fees and expenses was 0.7%. By comparison the total return of the MSCI AC Asia ex Japan Small Cap index was -0.9% and the total return of the MSCI AC Asia ex Japan index was 0.2%. Results for longer periods are shown in the table below. Asia ex Japan currencies and small cap markets were generally weaker in November. The Bank of Thailand cut its policy rate which was unexpected and suggests credit growth, populist policies and political unrest may be taking a toll on the economy. This is not likely to help the baht especially given the current account deficit. Inflation is less of a concern in Thailand but appears to be the main reason behind the November rate rise by Indonesia’s central bank. The rupiah and the baht were therefore weak during November as were their respective small cap stock markets. Small caps in the Philippines also fared poorly after the typhoon, reflecting a likely slowing of the economy following the natural disaster. Asia ex Japan vs. USD exchange rates Source: Bloomberg, Firth Investment Management Asia ex Japan small cap country performance Source: Bloomberg, Firth Investment Management China released a policy blueprint in November following the Third Plenum which outlined further economic reform. Much depends on the detail and implementation, but more financial sector reform is expected particularly to bank interest and deposit rates. This could lead to a more market driven allocation of capital which would be beneficial to small and medium sized businesses and consumers. It also implies less preferential access to capital by state owned enterprises but it is not clear whether greater reform to the SOE sector is intended. Similarly, it is too early to expect full liberalisation of the currency but a widening of the trading band and less central bank intervention seems likely. Changes to China’s one child policy have received a lot of publicity. However, this is unlikely to shift China’s aging demographics, or at least not for some time, and may be intended as a more symbolic relaxation of state control. It seems unlikely that a new attitude toward political and social reform is emerging. The Party’s renewed efforts to censor the internet and cleanse ranks after the leadership change, as well as its poor treatment of foreign journalists investigating China’s wealthy families, suggest a desire to consolidate power within the ruling elite rather than introduce greater accountability and transparency. For a good account of China’s reform agenda we recommend Capital Economics “Reform package exceeds expectations” and “How will we know if the Plenum reforms are on track”. Several HK/China holdings performed well in November. As well as reform news from China, interim results generally showed some improvement. This was the case whether export manufacturer/industrial or consumer related and was mainly driven by internal improvements to cost structure and efficiency. An eventual recovery in revenues, combined with better operating leverage, should prompt a further rerating of those companies that have adapted to the higher cost, lower growth environment. There were few changes to the portfolio during November. We trimmed our position in Gome given the strong price performance. Likewise Straco, a Singapore listed and managed but China based leisure business, posted excellent results and we reduced our target weight due to the rising valuation risk. We’ve taken an initial position in a Singapore electronic manufacturing services company which should benefit from a cyclical recovery and continue to pay a good dividend in the meantime. Key Information Hereford Funds – Firth Asian Value Fund NAV A Shares (29/11/13): Total Fund Size: Strategy Assets: Fund Launch Date: $112.35 $67 million $184 million (a) 31/05/11 Performance (%) (net of fees and expenses) Jan Feb Mar HFFAVF1 2 Small Cap Asia ex Japan HFFAVF1 3 2 Small Cap Asia ex Japan 3 HFFAVF1 Small Cap2 Asia ex Japan3 Apr May Jun Jul Aug Sep Oct Nov Dec 2011 - -1.2 -2.4 -2.3 0.6 2.8 1.1 -8.5 -11.4 -9.9 -12.6 -16.3 -13.2 6.4 10.1 12.0 -5.9 -8.7 -8.3 0.8 -1.2 0.6 -19.7 -26.1 -20.2 - - - - Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2012 6.1 10.0 10.8 12.1 9.0 6.0 -1.4 -3.8 -3.1 -0.9 -1.7 0.0 -5.9 -7.8 -9.6 0.9 1.8 3.0 3.9 0.0 2.6 4.2 2.2 -0.5 3.1 6.7 7.0 2.2 -1.1 -0.3 -0.2 2.9 2.8 3.3 3.5 3.1 29.6 22.4 22.4 Jan Feb Mar* Apr May Jun Jul Aug Sep Oct Nov Dec 2013 3.8 3.5 1.7 1.9 1.6 -0.1 2.0 0.5 -2.2 1.0 2.6 1.8 0.4 1.2 -1.3 -4.8 -8.7 -5.7 0.9 0.8 1.8 -1.9 -2.5 -1.5 2.9 6.2 5.4 1.0 2.7 4.4 0.7 -0.9 0.2 Since Launch HFFAVF1 Small Cap2 Asia ex Japan 8.0 6.7 4.2 12.4 -3.5 1.8 3 Source: Bloomberg, Firth Investment Management * Month end date used is March 28, 2013. 1. Hereford Funds – Firth Asian Value Fund 2. MSCI AC Asia ex Japan Small Cap USD Net Index 3. MSCI AC Asia ex Japan USD Net Index (large and mid cap) Source: Bloomberg, Firth Investment Management *Both MSCI benchmark indices (Bloomberg: MSLUAAJN and NDUECAXJ) are net total return indices in USD. MSCI calculates net total return by reinvesting any dividend income after deducting withholding taxes. Country breakdown Hong Kong/China Indonesia India Korea Malaysia Philippines Singapore Taiwan Thailand Others Cash % of assets 43 0 3 11 3 0 11 11 1 4 13 Sectoral breakdown Consumer Discretionary Consumer Staples Financials Health Care Industrials Information Technology Materials Others Cash % of assets 48 8 3 0 11 10 3 4 13 Investment Objective Hereford Funds - Firth Asian Value Fund is to generate long term capital growth from a portfolio of listed company securities in Asia (ex-Japan). The Compartment will follow a value-based investing approach and will have a bias towards smaller capitalisation stocks. The Compartment will directly invest primarily in shares of companies located in, incorporated in, headquartered in, listed on exchanges in or with significant operations in or significant income derived from Hong Kong, India, Indonesia, Korea, Malaysia, the Philippines, the PRC, Singapore, Taiwan and Thailand. The Compartment may also directly invest in smaller or developing economies in Asia such as Bangladesh, Cambodia, Laos, Pakistan, Sri Lanka or Vietnam. The Compartment will not invest in China A Shares when investing in the PRC. The Compartment will directly invest actively in a diversified portfolio of listed equity securities. The Compartment will generally only invest in securities admitted to official listing on a recognized stock exchange, or dealt in on another regulated market. Although the Compartment intends to invest in a portfolio of not less than 40 stocks and not more than 100 stocks, it is not restricted in or subject to any material concentration or diversification restrictions, and may hold a more limited number of investment positions. The Compartment will typically be near fully invested but may hold liquid assets on an ancillary basis. Under normal market conditions, investment in liquid assets and debt instruments of any kind will not exceed 15% of the Compartment's net assets. In exceptional market circumstances and on a temporary basis only, this limit may be increased to 100% with due regard to the principle of risk spreading. The Investment Manager intends to meet the Fund’s objective primarily through stock selection and country allocation. Typically stocks will be bought and held. This is not a trading strategy and it is not intended to attempt to time general market movements. While portfolio returns will be measured against the Benchmark Index, portfolio management will not be constrained by reference to the index. Fund Codes Bloomberg ISIN Reuters Sedol Valoren WKN HFIRASA LX * LU0618975774 NA B64KS81 12853411 A1H9V4 * Share Class A Fund Details Dealing Day Dividends Investment Manager Promoter Fund Administrator Custodian Legal Advisers Auditor Daily None - income accumulated within the fund Firth Investment Management Pte. Ltd. 180 Cecil Street, #13-03 Bangkok Bank Building, Singapore VP Bank (Luxembourg) S.A., 26 Avenue de la Liberté, L-1930 Luxembourg VPB Finance S.A., 26 Avenue de la Liberté, L-1930 Luxembourg VP Bank (Luxembourg) S.A., 26 Avenue de la Liberté, L-1930 Luxembourg Elvinger, Hoss & Prussen, 2 Place Winston Churchill, L-1340 Luxembourg Deloitte, 560 Rue de Neudorf, L-2220 Luxembourg Annual Management Charge Share Class A Share Class D (b) 1.5% 2.0% Annual Management Charge Performance fee: High water mark?: Hurdle rate: 10% Yes MSCI AC Asia ex Japan Small Cap USD Net Minimum Investment Share Class A (b) Share Class D $100,000 initial / $10,000 subsequent $10,000 initial / $1,000 subsequent Order Transmission Information Original Applications To: VPB Finance S.A. attn. Fund Operations / TA-HFF P.O. Box 923 L-2019 Luxembourg or, for transmissions via courier service, 26, avenue de la Liberté, L-1930 Luxembourg Subsequent Applications Only Via Facsimile: VPB Finance S.A. attn. Fund Operations / TA-HFF Fax: (+352) 404 770 283 Tel: (+352) 404 770 260 e-mail: [email protected] (a) This refers to the total assets to which the Investment Adviser applies the reference strategy. (b) Share Class A: these shares have UK reporting since launch and are registered with the BaFin for public distribution in Germany from 17/10/12. Germany – Paying Agent as defined by German Regulation: Marcard, Stein & Co – Ballindamm 36, 20095 Hamburg; Phone: +49/40.32.099.556, Fax: +49/40.32.099.206 (c) Share Class D: these shares have not yet been launched. This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. This information does not provide any accounting, legal, regulatory or tax advice. Please consult your own professional advisers in order to evaluate and judge the matters referred to herein. An investment should be made only on the basis of the prospectus, the annual and any subsequent semi-annual-reports of HEREFORD FUNDS (the "Fund"), a société d'investissement à capital variable, established in Luxembourg and registered under Part I of Luxembourg law of 20 December, approved by the Commission de Surveillance du Secteur Financier (CSSF). These can be obtained from [the Fund, 26, avenue de la Liberté, L-1930 Luxembourg or from VPB Finance S.A., 26, avenue de la Liberté, L-1930 Luxembourg and any distributor or intermediary appointed by the Fund]. No warranty is given, in whole or in part, regarding performance of the Fund. There is no guarantee that its investment objectives will be achieved. Potential investors shall be aware that the value of investments can fall as well as rise and that they may not get back the full amount invested. Past performance is no guide to future performance. The information provided in this document may be subject to change without any warning or prior notice and should be read in conjunction with the most recent publication of the prospectus of the Fund. Whilst great care is taken to ensure that information contained herein is accurate, no responsibility can be accepted for any errors, mistakes or omission or for future returns. This document is intended for the use of the addressee or recipient only and may not be reproduced, redistributed, passed on or published, in whole or in part, for any purpose, without the prior written consent of HEREFORD FUNDS. Neither the CSSF nor any other regulator has approved this document.