* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download NAV | USD 10.0716 (As of 29-Sep-15)

Mark-to-market accounting wikipedia , lookup

Private equity wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Corporate venture capital wikipedia , lookup

Private equity secondary market wikipedia , lookup

International investment agreement wikipedia , lookup

Interbank lending market wikipedia , lookup

Money market fund wikipedia , lookup

Early history of private equity wikipedia , lookup

Internal rate of return wikipedia , lookup

Mutual fund wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Investment banking wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Socially responsible investing wikipedia , lookup

Private money investing wikipedia , lookup

Rate of return wikipedia , lookup

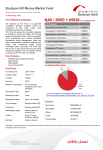

Boubyan USD Liquidity Fund Fund Licensed by the Kuwaiti CMA (F/2014/0020) 30 September 2015 Fund Objective & Strategy : The objective of the fund is to generate competitive shari’a compliant returns by increasing its Net Asset Value, while maintaining a high level of liquidity. The fund will pursue its investment objective by investing in short and medium term Islamic money market instruments that are Shari’a compliant; such investments may include: deposits with banks, investment grade Sukuk (corporate and sovereign), bank deposit certificates, repurchase agreements or any other Sharia compliant cash instrument. Fund Features : • • • Potential returns higher than the fixed deposit rate. High liquidity. Low risk investment. Fund Facts : Performance Annualized one week return 0.602% Annualized 1 month return 0.587% Annualized 3 month return 0.573% Annualized 6 month return 0.568% 1 Year Return 0.548% Annualized YTD return 0.555% Cumulative YTD return 0.419% Annualized Since Inception return 0.521% Cumulative Since Inception return 0.716% Standard Deviation 0.016% Investment Allocation : Fund structure : Inception date : Open ended 22-May-14 Liquidity : Weekly Currency : USD Min. subscription : Subscription fees : $10,000 with multiples of $1000 thereafter None Redemption fees: None Management fees : Up to 1% annually Fund manager : Boubyan Capital Investment Company K.S.C.C. Distributer and investment advisor: Boubyan Bank K.S.C. Custodian and investment controller : Kuwait Clearing Company K.S.C.C. Shari’ah Auditor : Legitimate Auditor House Company Auditor : Ernst & Young (Kuwait) Kuwait Domicile : NAV | USD 10.0716 (As of 29-Sep-15) Sukuk 11.5% Cash 0.1% Fixed Deposits 88.4% A copy of the Articles of Association can be found on: http://www.boubyancapital.com/PDF/USD_Liquidity%20Fund_AOA.pdf Fund ID’s : Bloomberg BCUSDLF KK Morningstar F00000VX6S Zawya BOUUSDL.IF Lipper 68278625 Eurekahedge EH43072 Disclaimer - Past performance is no guarantee of future performance. The value of units can increase as well as decrease. This product is suitable for low risk investors . boubyancapital.com T: 22325800|P.O box 28950, Safat, 13150