T Group LTD - The Trade Representation of the Russian Federation

... General strategy of our Company is directed on the further transformation to the industrial company of the international level which on a level of market cost and the basic financial and economic parameters will meet to leading enterprises of the world. Basic elements of strategy of development are: ...

... General strategy of our Company is directed on the further transformation to the industrial company of the international level which on a level of market cost and the basic financial and economic parameters will meet to leading enterprises of the world. Basic elements of strategy of development are: ...

About - Nasdaq

... Since its debut in 1971 as the world’s first electronic stock market, The NASDAQ Stock Market‚ has been at the forefront of innovation, using technology to bring millions of investors together with the world’s leading companies. Today, NASDAQ‚ (OTCBB: NDAQ) is the world’s largest electronic stock ma ...

... Since its debut in 1971 as the world’s first electronic stock market, The NASDAQ Stock Market‚ has been at the forefront of innovation, using technology to bring millions of investors together with the world’s leading companies. Today, NASDAQ‚ (OTCBB: NDAQ) is the world’s largest electronic stock ma ...

Stock PPT - Issaquah Connect

... S&P 500 Index comprises the largest 500 companies in the U.S. The popular S&P 500 Index, also known as "Spiders" by its ticker symbol SPY, has more than $1 trillion trades on the AMEX. ...

... S&P 500 Index comprises the largest 500 companies in the U.S. The popular S&P 500 Index, also known as "Spiders" by its ticker symbol SPY, has more than $1 trillion trades on the AMEX. ...

beta coefficient web introduction of dse

... - Market Surveillance. - Publication of Monthly Review. - Monitoring the activities of listed companies. - Investors grievance Cell (Disposal of complaint by laws) ...

... - Market Surveillance. - Publication of Monthly Review. - Monitoring the activities of listed companies. - Investors grievance Cell (Disposal of complaint by laws) ...

Regulatory Analyst, Derivatives

... proactively identifying emerging risks caused by market changes and developing regulatory solutions to mitigate those risks. The opportunity: We are looking to add to our team an industry professional who wants to make a lasting impact on Alberta’s capital market. This individual will support and wo ...

... proactively identifying emerging risks caused by market changes and developing regulatory solutions to mitigate those risks. The opportunity: We are looking to add to our team an industry professional who wants to make a lasting impact on Alberta’s capital market. This individual will support and wo ...

David Sobotka

... TRADING AND THE DEVELOPMENT OF FUTURES MARKETS FOR CRUDE OIL AND REFINED PRODUCTS. BASED ON THE VOLATILITY PRESENT IN THE ENERGY MARKETS AT THAT TIME, IT DID NOT TAKE FINANCIAL INSTITUTIONS LONG TO FIGURE OUT THAT 1) THERE WERE PROFITABLE TRADING OPPORTUNITIES AVAILABLE AND 2) THEIR CUSTOMERS WERE I ...

... TRADING AND THE DEVELOPMENT OF FUTURES MARKETS FOR CRUDE OIL AND REFINED PRODUCTS. BASED ON THE VOLATILITY PRESENT IN THE ENERGY MARKETS AT THAT TIME, IT DID NOT TAKE FINANCIAL INSTITUTIONS LONG TO FIGURE OUT THAT 1) THERE WERE PROFITABLE TRADING OPPORTUNITIES AVAILABLE AND 2) THEIR CUSTOMERS WERE I ...

Trading Issues and Enhanced Regulatory Disclosures

... Rule: In connection with an offering of equity securities for cash pursuant to a registration statement or notification on certain Securities Act of 1933 forms, it is unlawful for a person to sell short the security that is the subject of the offering and purchase the offered securities from an unde ...

... Rule: In connection with an offering of equity securities for cash pursuant to a registration statement or notification on certain Securities Act of 1933 forms, it is unlawful for a person to sell short the security that is the subject of the offering and purchase the offered securities from an unde ...

- SlideBoom

... In case the movement takes place at or after 1 p.m. but before 2.30 p.m. there will be a trading halt for ½ hour. In case the movement takes place at or after 2.30 p.m. there will be no trading halt at the 10% level and the market will continue trading. In case of a 15% movement of either index, the ...

... In case the movement takes place at or after 1 p.m. but before 2.30 p.m. there will be a trading halt for ½ hour. In case the movement takes place at or after 2.30 p.m. there will be no trading halt at the 10% level and the market will continue trading. In case of a 15% movement of either index, the ...

Listed Index Fund International Bond (Citi WGBI) Monthly

... deterioration in the financial conditions of constituent securities of issuers, or other market causes. Losses may arise from these factors. As such, invested capital is not guaranteed. Additionally, in cases of margin trading, losses may occur in excess of the deposited margin. - When trading ETFs, ...

... deterioration in the financial conditions of constituent securities of issuers, or other market causes. Losses may arise from these factors. As such, invested capital is not guaranteed. Additionally, in cases of margin trading, losses may occur in excess of the deposited margin. - When trading ETFs, ...

Directive 6: Market Information

... In exceptional cases for which sufficient grounds exist, market data fees may be waived for automated trading systems. This is conditional upon the participant using the price data exclusively for trading on SIX Swiss Exchange markets, confirmation of which must be provided by the compliance officer ...

... In exceptional cases for which sufficient grounds exist, market data fees may be waived for automated trading systems. This is conditional upon the participant using the price data exclusively for trading on SIX Swiss Exchange markets, confirmation of which must be provided by the compliance officer ...

Document

... Easy access to Exchange information Market to be opened up for banks, fund houses and Foreign Investors ...

... Easy access to Exchange information Market to be opened up for banks, fund houses and Foreign Investors ...

Optimal execution of portfolio transactions

... the growing popularity of trading algorithms. Speed and effectiveness of implementing an investment decision and the resulting trade have become key factors for success. ...

... the growing popularity of trading algorithms. Speed and effectiveness of implementing an investment decision and the resulting trade have become key factors for success. ...

CDS Trading under MiFID II FAQ

... interests that was not caught by one of MiFID’s existing venue classifications. The OTF is only open to non-equity instruments and the same pre-and-post trade transparency requirements apply to an OTF as to other regulated trading venues. ...

... interests that was not caught by one of MiFID’s existing venue classifications. The OTF is only open to non-equity instruments and the same pre-and-post trade transparency requirements apply to an OTF as to other regulated trading venues. ...

September 2010 - Capital Markets Board of Turkey

... CMB decision dated July 23, 2010 (the “Decision”) was classifying the stocks traded on the ISE into 3 groups (A, B or C). Some trading rules were differentiated based on this classification. For example, Group B and Group C stocks cannot be subject to margin trading and short sale. The Decision was ...

... CMB decision dated July 23, 2010 (the “Decision”) was classifying the stocks traded on the ISE into 3 groups (A, B or C). Some trading rules were differentiated based on this classification. For example, Group B and Group C stocks cannot be subject to margin trading and short sale. The Decision was ...

Securities Markets Primary Versus Secondary Markets How

... Commission: fee paid to broker for making the transaction Spread: Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

... Commission: fee paid to broker for making the transaction Spread: Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

Monitoring trade data reduces the cost of asset

... measured daily, monthly, quarterly, yearly by comparison to situational averages, including trading by stock, country, speed, trade type and less quantifiable categories including service quality and research. The availability of this data has allowed buy-side traders to become sophisticated manager ...

... measured daily, monthly, quarterly, yearly by comparison to situational averages, including trading by stock, country, speed, trade type and less quantifiable categories including service quality and research. The availability of this data has allowed buy-side traders to become sophisticated manager ...

CBOT 2005 - National Taiwan University

... • Reliable transaction data not readily available until recent years. • 3 measure of trading activity: • daily volume • trade size • number of trades ...

... • Reliable transaction data not readily available until recent years. • 3 measure of trading activity: • daily volume • trade size • number of trades ...

Job Title: Trading Compliance Officer Location: Downtown

... solutions to both the retail public as well as the customers of over 200 financial institutions including credit unions, banks, trust companies and financial planning companies across Canada. Qtrade currently administers over $9 billion of investment assets through our subsidiaries and is ranked as ...

... solutions to both the retail public as well as the customers of over 200 financial institutions including credit unions, banks, trust companies and financial planning companies across Canada. Qtrade currently administers over $9 billion of investment assets through our subsidiaries and is ranked as ...

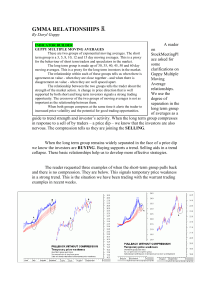

gmma relationships

... These are two groups of exponential moving averages. The short term group is a 3, 5, 8, 10, 12 and 15 day moving averages. This is a proxy for the behaviour of short term traders and speculators in the market. The long term group is made up of 30, 35, 40, 45, 50 and 60 day moving averages. This is a ...

... These are two groups of exponential moving averages. The short term group is a 3, 5, 8, 10, 12 and 15 day moving averages. This is a proxy for the behaviour of short term traders and speculators in the market. The long term group is made up of 30, 35, 40, 45, 50 and 60 day moving averages. This is a ...

Why Do People Trade? - Ethiopia Commodity Exchange

... A commodity exchange is designed to minimize the search costs of trading and to ensure a market for all types of actors. An exchange depends on high volumes traded in the given commodities, low margins, and a certain amount of volatility that provides arbitrage possibilities for both dealers and spe ...

... A commodity exchange is designed to minimize the search costs of trading and to ensure a market for all types of actors. An exchange depends on high volumes traded in the given commodities, low margins, and a certain amount of volatility that provides arbitrage possibilities for both dealers and spe ...

Document

... spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period from 2001 to 2006, was collected from ASE publications. The suggested explanatory variables (security's specific factors: stock price, price volatility, trading volume, number of trades), ...

... spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period from 2001 to 2006, was collected from ASE publications. The suggested explanatory variables (security's specific factors: stock price, price volatility, trading volume, number of trades), ...

David Aranzabal

... Time flexibility is a great advantage for people with various schedules and allows for adaptation to everyone's day ...

... Time flexibility is a great advantage for people with various schedules and allows for adaptation to everyone's day ...

Technical analysis

... The technician contends that there are several problems with accounting statements: 1-the lack of great deal of info needed by security analysts, such as a info related to sales, earning, and capital utilized by product line and customers. 2-according to GAAP corporations may choose among several p ...

... The technician contends that there are several problems with accounting statements: 1-the lack of great deal of info needed by security analysts, such as a info related to sales, earning, and capital utilized by product line and customers. 2-according to GAAP corporations may choose among several p ...

“MiFID and Regulated Markets”

... Burçak Inel, Head of Regulatory Affairs, Federation of European Securities Exchanges London, 28 June 2006 [email protected] www.fese.org ...

... Burçak Inel, Head of Regulatory Affairs, Federation of European Securities Exchanges London, 28 June 2006 [email protected] www.fese.org ...