The Nasdaq-100 Index Option - The New York Stock Exchange

... The Nasdaq-100 is a modified capitalization weighted index composed of 100 of the largest non-financial securities listed on the Nasdaq Stock Market. The index was created in 1985 with a base value set to 250 on February 1 of that year. After reaching a level of nearly 800 on December 31, 1993, the ...

... The Nasdaq-100 is a modified capitalization weighted index composed of 100 of the largest non-financial securities listed on the Nasdaq Stock Market. The index was created in 1985 with a base value set to 250 on February 1 of that year. After reaching a level of nearly 800 on December 31, 1993, the ...

Accelerating the Growth of Electronic Trading Systems to

... Content & transaction capability combined Webstation – Web-based content – Window on content and applications – E.g. market data, news, research, analytics, trade capture, chat, video, position keeping ...

... Content & transaction capability combined Webstation – Web-based content – Window on content and applications – E.g. market data, news, research, analytics, trade capture, chat, video, position keeping ...

Shopping - MBA6113-Technology

... another. He did not want to be stuck holding big blocks of stocks when their values unexpectedly plunged. If trading in a particular stock began losing money, an employee could switch off the program for that stock. In the early 2000s, electronic marketplaces such as Island ECN and Archipelago court ...

... another. He did not want to be stuck holding big blocks of stocks when their values unexpectedly plunged. If trading in a particular stock began losing money, an employee could switch off the program for that stock. In the early 2000s, electronic marketplaces such as Island ECN and Archipelago court ...

Chapter 11

... changes in security prices Prices assumed to move in trends that persist Changes in trends result from changes in supply and demand conditions Old strategy that can be traced back to the ...

... changes in security prices Prices assumed to move in trends that persist Changes in trends result from changes in supply and demand conditions Old strategy that can be traced back to the ...

Emerging Derivative Markets

... Risk management issues EM lessons (Mexico, Thailand, Russia): FX and Credit D may not be compatible with fixed FX and credit policies OTC risk concentration: Public banks’ transparency, weak best practices, trend to central counterparties Disclosure (IAS39) essential for insurance solvency, dist ...

... Risk management issues EM lessons (Mexico, Thailand, Russia): FX and Credit D may not be compatible with fixed FX and credit policies OTC risk concentration: Public banks’ transparency, weak best practices, trend to central counterparties Disclosure (IAS39) essential for insurance solvency, dist ...

Investments: Analysis and Behavior

... People begin to believe they are good at flipping, not lucky. ...

... People begin to believe they are good at flipping, not lucky. ...

SECURITIES OPERATIONS

... There are two basic categories of debt owners: 1) the public, which includes foreign investors and domestic investors and, 2) federal accounts, also known as "intragovernmental holdings." Each category is explained below. ...

... There are two basic categories of debt owners: 1) the public, which includes foreign investors and domestic investors and, 2) federal accounts, also known as "intragovernmental holdings." Each category is explained below. ...

Competition and Regulation in Trading Arenas

... pursue mergers and alliances across the entire world. 2 Investors can increasingly trade the same security anywhere in the world. Financial engineers are often able to repackage the same instrument in different wrappers, so as to allow investors to choose among trading markets and regulatory environ ...

... pursue mergers and alliances across the entire world. 2 Investors can increasingly trade the same security anywhere in the world. Financial engineers are often able to repackage the same instrument in different wrappers, so as to allow investors to choose among trading markets and regulatory environ ...

Credit Market Liquidity

... volumes as companies strive to take advantage of an attractive financing environment and investors scramble to satisfy their seemingly insatiable demand for yield in the face of the “new normal,” low interest rate environment. While easy monetary policy and low interest rates have undoubtedly been a ...

... volumes as companies strive to take advantage of an attractive financing environment and investors scramble to satisfy their seemingly insatiable demand for yield in the face of the “new normal,” low interest rate environment. While easy monetary policy and low interest rates have undoubtedly been a ...

April 17, 2017 - Portfolio Advisory Council

... This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of ...

... This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of ...

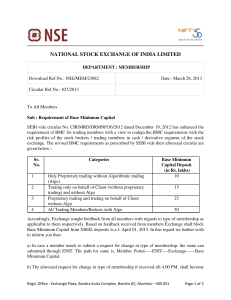

Ref No

... c) The Base Minimum Capital primarily shall be blocked from NSEIL deposits of Capital Market segment. In case the NSEIL deposits of Capital Market segment are not enough to cover the BMC requirement, NSEIL deposits of Futures & Options segment and Currency Derivatives segment shall also be utilised ...

... c) The Base Minimum Capital primarily shall be blocked from NSEIL deposits of Capital Market segment. In case the NSEIL deposits of Capital Market segment are not enough to cover the BMC requirement, NSEIL deposits of Futures & Options segment and Currency Derivatives segment shall also be utilised ...

Another Year, Another Stock Market Increase

... markets, day in and day out. The last few years have been among the best in any investor’s lifetime with double digit increases in each of the last three years. On average, the S&P 500 Index goes down more than 5% three times a year. Once a year, on average, it goes down more than 10%. In recent yea ...

... markets, day in and day out. The last few years have been among the best in any investor’s lifetime with double digit increases in each of the last three years. On average, the S&P 500 Index goes down more than 5% three times a year. Once a year, on average, it goes down more than 10%. In recent yea ...

Stock Market Crash

... crash was also preceded by the period of strong economy. From 1982 to 1987 DJIA grew from 776 to 2722. World’s markets were growing too. There are no obvious reasons for the crash: no major news or causes for panic. The prices started falling since October, 14: DJIA fell 3.82% on Thursday and 4.60% ...

... crash was also preceded by the period of strong economy. From 1982 to 1987 DJIA grew from 776 to 2722. World’s markets were growing too. There are no obvious reasons for the crash: no major news or causes for panic. The prices started falling since October, 14: DJIA fell 3.82% on Thursday and 4.60% ...

Junior Trader

... new job. Instead, you will start by following in a three months intensive in-house training program that covers all the intricate details of the trading processes. As a member of an informal team, you will then gradually take on more responsibilities, start monitoring markets and only then start mak ...

... new job. Instead, you will start by following in a three months intensive in-house training program that covers all the intricate details of the trading processes. As a member of an informal team, you will then gradually take on more responsibilities, start monitoring markets and only then start mak ...

Information Disclosure and Market Quality

... SEC Rule 605 and 606 Increase the visibility of execution quality of the U.S. securities markets for public ...

... SEC Rule 605 and 606 Increase the visibility of execution quality of the U.S. securities markets for public ...

Securities Regulation

... Basis for duty • Securities professionals have special duty • Insiders should not gain personal benefit • Investors should have equal access ...

... Basis for duty • Securities professionals have special duty • Insiders should not gain personal benefit • Investors should have equal access ...

Capital Market

... WSE markets: - Main Market (trade in equities, equity-related and other cash instruments, derivatives), - NewConnect (trade in equities and equity-related instruments of small and medium-sized enterprises), - Catalyst (trade in corporate, municipal, co-operative, Treasury and mortgage bonds operate ...

... WSE markets: - Main Market (trade in equities, equity-related and other cash instruments, derivatives), - NewConnect (trade in equities and equity-related instruments of small and medium-sized enterprises), - Catalyst (trade in corporate, municipal, co-operative, Treasury and mortgage bonds operate ...

April 24, 2017 - Portfolio Advisory Council

... This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of ...

... This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of ...

Understanding premiums and discounts in ETFs

... and thus the value of an ETF can be reflected in its market price and net asset value (“NAV”). Ideally, the market price of an ETF should be close to its NAV though there are often factors driving them apart. When an ETF trades at a market price higher than its NAV, it is trading at a premium. On th ...

... and thus the value of an ETF can be reflected in its market price and net asset value (“NAV”). Ideally, the market price of an ETF should be close to its NAV though there are often factors driving them apart. When an ETF trades at a market price higher than its NAV, it is trading at a premium. On th ...

Portfolio Advisory Council, LLC presents:

... This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of ...

... This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of ...

Common Stock: Analysis and Strategy - it

... in security prices – Prices assumed to move in trends that persist – Changes in trends result from changes in supply and demand conditions – Old strategy that can be traced back to the late nineteenth century ...

... in security prices – Prices assumed to move in trends that persist – Changes in trends result from changes in supply and demand conditions – Old strategy that can be traced back to the late nineteenth century ...

13 characteristics of a successful trader

... government notes), oil, gold, and major global stock indexes. On an intraday basis, they look to these other markets for confirmation of short-term U.S. dollar directional bias. For example, if the dollar is moving higher, U.S. ten-year yields are rising, and gold is falling, it’s confirmation from ...

... government notes), oil, gold, and major global stock indexes. On an intraday basis, they look to these other markets for confirmation of short-term U.S. dollar directional bias. For example, if the dollar is moving higher, U.S. ten-year yields are rising, and gold is falling, it’s confirmation from ...

Extended Hours Trading Risk Disclosure Statement

... in extended hours trading than in regular trading hours. As a result, your order may only be partially executed, or not at all, or the price you receive when engaging in extended hours trading may be inferior to the price you would receive during regular trading hours. • Risk of Changing Prices. The ...

... in extended hours trading than in regular trading hours. As a result, your order may only be partially executed, or not at all, or the price you receive when engaging in extended hours trading may be inferior to the price you would receive during regular trading hours. • Risk of Changing Prices. The ...

Traders` Questionnaire

... trading, but may also be closed off to subtle, intuitive cues when a trade starts to go sour. In my recent experience, I have been surprised at how successful gut traders are often relatively neurotic traders. Very active trading methods are particularly challenging for such traders, as they don’t a ...

... trading, but may also be closed off to subtle, intuitive cues when a trade starts to go sour. In my recent experience, I have been surprised at how successful gut traders are often relatively neurotic traders. Very active trading methods are particularly challenging for such traders, as they don’t a ...