NSE/CMTR/34693 Date

... standardized lot size for SME Exchange/Platform. In view of the guidelines mentioned in the above circular the Exchange has reviewed the lot size of the security Nandani Creation Limited on SME Platform. The change in the market lot for the security is as follows: Symbol NANDANI ...

... standardized lot size for SME Exchange/Platform. In view of the guidelines mentioned in the above circular the Exchange has reviewed the lot size of the security Nandani Creation Limited on SME Platform. The change in the market lot for the security is as follows: Symbol NANDANI ...

Lecture 17

... Finance, Dec. 1994, pointed out that “odd eighths” spreads were rare on NASDAQ: dealers rarely quote prices ending in 1/8, 3/8, 5/8 and 7/8. • Therefore inside spread is always at least ¼. • Day after study reported in news, spreads narrow. • Authors interpret as evidence of tacit collusion. • Feder ...

... Finance, Dec. 1994, pointed out that “odd eighths” spreads were rare on NASDAQ: dealers rarely quote prices ending in 1/8, 3/8, 5/8 and 7/8. • Therefore inside spread is always at least ¼. • Day after study reported in news, spreads narrow. • Authors interpret as evidence of tacit collusion. • Feder ...

Chapter 11 Securities Markets

... Security Market Indexes are used to track overall market and sector performance for stocks, bonds, and other investments Well-known stock market indexes: – Dow Jones Industrial Average • Based on price – Standard & Poor’s (S&P) 500 • Based on market value ...

... Security Market Indexes are used to track overall market and sector performance for stocks, bonds, and other investments Well-known stock market indexes: – Dow Jones Industrial Average • Based on price – Standard & Poor’s (S&P) 500 • Based on market value ...

addressing emerging risks in the nigerian

... listed securities The NASD Platform for trading in unlisted securities of public companies FMDQ is the OTC platform for trading fixed income securities ...

... listed securities The NASD Platform for trading in unlisted securities of public companies FMDQ is the OTC platform for trading fixed income securities ...

The OECD Principles as a reference point for good

... capital market, to support access to finance for business innovation and growth? • Of course many other important factors related to macroeconomic conditions (interest rates, global liquidity), currency stability, tax incentives, etc. must also be considered. • And bank finance also a key pillar and ...

... capital market, to support access to finance for business innovation and growth? • Of course many other important factors related to macroeconomic conditions (interest rates, global liquidity), currency stability, tax incentives, etc. must also be considered. • And bank finance also a key pillar and ...

Commodity Marketing Activity

... date in the future • Hedging: minimize risk in cash market • Options on Futures Contracts: right, but not the obligation to buy or sell a futures contract at a specified price ...

... date in the future • Hedging: minimize risk in cash market • Options on Futures Contracts: right, but not the obligation to buy or sell a futures contract at a specified price ...

CSE RULE 11 – Trading of Other Listed Securities

... The Exchange may designate securities listed on an exchange recognized in a jurisdiction in Canada as eligible for trading as Other Listed Securities provided such securities are not suspended or subject to a regulatory halt. ...

... The Exchange may designate securities listed on an exchange recognized in a jurisdiction in Canada as eligible for trading as Other Listed Securities provided such securities are not suspended or subject to a regulatory halt. ...

Circuit Breaker Levels for the Fourth Quarter

... There may be occasions when marketplaces in Canada are open for trading and the NYSE is closed for a recognized holiday in the United States. On those days, IIROC would invoke “circuit breakers” using levels representing 10%, 20% and 30% of the average closing value of the S&P/TSX Composite Index in ...

... There may be occasions when marketplaces in Canada are open for trading and the NYSE is closed for a recognized holiday in the United States. On those days, IIROC would invoke “circuit breakers” using levels representing 10%, 20% and 30% of the average closing value of the S&P/TSX Composite Index in ...

Regulatory and accounting issues: a focus on energy commodity

... and technology investment required to report derivatives for financial reporting purposes. Over recent years, however, LNG trading has gained trading activity to the various regulatory bodies as proposed under the regulation. It is crucial, however, substantial momentum to become one of the more tha ...

... and technology investment required to report derivatives for financial reporting purposes. Over recent years, however, LNG trading has gained trading activity to the various regulatory bodies as proposed under the regulation. It is crucial, however, substantial momentum to become one of the more tha ...

Learning Goals

... through an electronic network. These market makers maintain inventories and buy and sell stocks from their inventories to individual customers and other dealers. Each market maker on the Nasdaq is required to give a two-sided quote, meaning they must state a firm bid price and a firm ask price that ...

... through an electronic network. These market makers maintain inventories and buy and sell stocks from their inventories to individual customers and other dealers. Each market maker on the Nasdaq is required to give a two-sided quote, meaning they must state a firm bid price and a firm ask price that ...

Tips for Investors in Volatile Markets

... denotes the amount of variation or deviation that might be expected. For example, the S&P 500 has a standard deviation around 15% while a guaranteed investment like a bank account has a standard deviation of zero because the return never varies. Volatile markets are characterized by wide price fluct ...

... denotes the amount of variation or deviation that might be expected. For example, the S&P 500 has a standard deviation around 15% while a guaranteed investment like a bank account has a standard deviation of zero because the return never varies. Volatile markets are characterized by wide price fluct ...

Investments

... For Large Issues, a Syndicate is Used Hot Issue Market - During some periods, over 50 news firms go public every month. - Many investors want these shares - Initial returns are high Who gets shares? - Those who want shares ask their broker. - When more shares are sought, than are being issued, prior ...

... For Large Issues, a Syndicate is Used Hot Issue Market - During some periods, over 50 news firms go public every month. - Many investors want these shares - Initial returns are high Who gets shares? - Those who want shares ask their broker. - When more shares are sought, than are being issued, prior ...

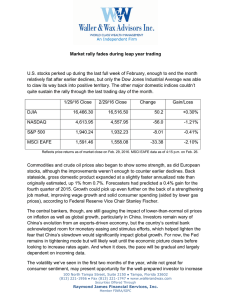

Market rally fades during leap year trading U.S. stocks perked up

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

Three Market Idiots

... supporting your household when you're sitting around doing nothing, holding positions for weeks at a time. So the Gambler actively trades in and out of markets, pretends like he’s got a job, and every so often berates his spouse when she wonders when the family will be able to pay its bills. My take ...

... supporting your household when you're sitting around doing nothing, holding positions for weeks at a time. So the Gambler actively trades in and out of markets, pretends like he’s got a job, and every so often berates his spouse when she wonders when the family will be able to pay its bills. My take ...

ALPHA BITES Rovers Return? - Alpha Portfolio Management

... Profit warnings are still coming thick and fast with Balfour Beatty this morning which, had been expected to be benefiting from an upturn in the UK economy and construction activity. This looks like a company specific issue, the CEO is going and a potential sale of its Professional Services business ...

... Profit warnings are still coming thick and fast with Balfour Beatty this morning which, had been expected to be benefiting from an upturn in the UK economy and construction activity. This looks like a company specific issue, the CEO is going and a potential sale of its Professional Services business ...

i̇mkb at a glance

... The information and data contained in this publication are presented for general information only. While careful effort has been made to ensure the accuracy of this information, the İMKB assumes no responsibility for any omissions or errors. The data should not be used for investment advise, as the ...

... The information and data contained in this publication are presented for general information only. While careful effort has been made to ensure the accuracy of this information, the İMKB assumes no responsibility for any omissions or errors. The data should not be used for investment advise, as the ...

Disputation, August 4th, 2009, Ryan Riordan

... social uselessness) than high-frequency trading. The stock market is supposed to allocate capital to its most productive uses, for example by helping companies with good ideas raise money. But it's hard to see how traders who place their orders one-thirtieth of a second faster than anyone else do an ...

... social uselessness) than high-frequency trading. The stock market is supposed to allocate capital to its most productive uses, for example by helping companies with good ideas raise money. But it's hard to see how traders who place their orders one-thirtieth of a second faster than anyone else do an ...

Extended Hours Trading Disclosure

... . Volatility refers to the changes in price that securities undergo when trading. Generally, the higher the volatility of a security, the greater its price swings. There may be greater volatility in extended hours trading than in regular trading hours. As a result, Your order may only be partiall ...

... . Volatility refers to the changes in price that securities undergo when trading. Generally, the higher the volatility of a security, the greater its price swings. There may be greater volatility in extended hours trading than in regular trading hours. As a result, Your order may only be partiall ...

A look at trading volumes in the euro

... One year after the launch of the euro, it is interesting to gauge its importance as a transactions medium in the foreign exchange market. This role is important because of its implication for the euro’s attractiveness to international investors. To that end, this note analyses information on trading ...

... One year after the launch of the euro, it is interesting to gauge its importance as a transactions medium in the foreign exchange market. This role is important because of its implication for the euro’s attractiveness to international investors. To that end, this note analyses information on trading ...

Markets

... Third and Fourth Markets • Third Market: Over-the-counter transactions in securities listed on organized exchanges • Fourth market: Trading network among investors interested in buying and selling large blocks of stock ...

... Third and Fourth Markets • Third Market: Over-the-counter transactions in securities listed on organized exchanges • Fourth market: Trading network among investors interested in buying and selling large blocks of stock ...

Trading Volumes in Perspective

... Strategy Group (ISG), which analyzes market and economic indicators to develop asset allocation strategies. ISG consists of five investment professionals who consult regularly with portfolio managers and investment officers across the firm. Information is obtained from sources deemed reliable, but t ...

... Strategy Group (ISG), which analyzes market and economic indicators to develop asset allocation strategies. ISG consists of five investment professionals who consult regularly with portfolio managers and investment officers across the firm. Information is obtained from sources deemed reliable, but t ...

Michael Shulman - AAII

... • Real world recession • Real world debt crisis and credit contraction • A casino market ...

... • Real world recession • Real world debt crisis and credit contraction • A casino market ...

News as rtf

... market maker for the Spanish, French and Italian Power Futures Markets. Under the new agreement RWE Supply & Trading will promote liquidity in these markets by providing bidoffer spreads for Baseload Month, Quarter and Year contracts in the order book. “In 2016, we made significant progress in these ...

... market maker for the Spanish, French and Italian Power Futures Markets. Under the new agreement RWE Supply & Trading will promote liquidity in these markets by providing bidoffer spreads for Baseload Month, Quarter and Year contracts in the order book. “In 2016, we made significant progress in these ...