ABSTRACT Ashfia, Tazkiah. 2013. Handphone Blackberry Trading by

... This research aims at providing and understanding explicitly about practice of Blackberry trading by black market system, especially students of State Islamic University Maulana Malik Ibrahim (UIN Maliki) Malang, because the trading system has penetrated the students affair. The type of research tha ...

... This research aims at providing and understanding explicitly about practice of Blackberry trading by black market system, especially students of State Islamic University Maulana Malik Ibrahim (UIN Maliki) Malang, because the trading system has penetrated the students affair. The type of research tha ...

Untitled

... Officials with Chicago-based DRW Trading Group see the data -feed lags at CME as a "fact of life," not an unfair advantage, because any firm trading in milliseconds can take advantage of it if they build their systems properly, according to a person familiar with their views. Firms can use their ear ...

... Officials with Chicago-based DRW Trading Group see the data -feed lags at CME as a "fact of life," not an unfair advantage, because any firm trading in milliseconds can take advantage of it if they build their systems properly, according to a person familiar with their views. Firms can use their ear ...

Press Release

... ayondo is a global Financial Technology group with subsidiaries authorised and regulated in the UK (FCA) and Germany (BaFin), offering innovative trading and investment solutions for retail and institutional customers. ayondo specialises in Social Trading, with a sophisticated online trading platfor ...

... ayondo is a global Financial Technology group with subsidiaries authorised and regulated in the UK (FCA) and Germany (BaFin), offering innovative trading and investment solutions for retail and institutional customers. ayondo specialises in Social Trading, with a sophisticated online trading platfor ...

special report series: defining high frequency trading

... forms of abusive behaviour if misused. ESMA’s “HFT guidelines” note that different types of manipulative strategies can be implemented using algorithms (such as spoofing, layering and quote stuffing). Significantly, MiFID II requires that persons dealing on their own account using a “high-frequency ...

... forms of abusive behaviour if misused. ESMA’s “HFT guidelines” note that different types of manipulative strategies can be implemented using algorithms (such as spoofing, layering and quote stuffing). Significantly, MiFID II requires that persons dealing on their own account using a “high-frequency ...

NSE DGs pronouncement today may determine market direction

... In the wake of improved market activity on the floor of the Nigerian Stock Exchange (NSE) which led to a recorded four percent gain in just one week, Ndi Okereke-Onyiuke, director-general of the Nigerian Stock Exchange, will today appraise the Exchange’s 2009 performance and review activities of the ...

... In the wake of improved market activity on the floor of the Nigerian Stock Exchange (NSE) which led to a recorded four percent gain in just one week, Ndi Okereke-Onyiuke, director-general of the Nigerian Stock Exchange, will today appraise the Exchange’s 2009 performance and review activities of the ...

Operating Instruction nº 54/2017 INITIAL

... 1.- Take as a reference price the closing price of the session of July 13 , the expected last trading day in the segment of Growing Companies belonging to Mercado Alternativo Bursátil (MAB). During the opening auction, orders shall be allowed that entail prices within a 50% static range of the refer ...

... 1.- Take as a reference price the closing price of the session of July 13 , the expected last trading day in the segment of Growing Companies belonging to Mercado Alternativo Bursátil (MAB). During the opening auction, orders shall be allowed that entail prices within a 50% static range of the refer ...

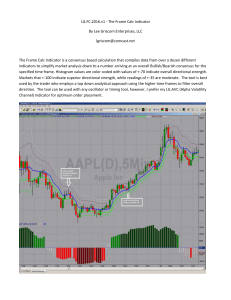

LG.FC.2016.v1

... specified time frame. Histogram values are color coded with values of +-70 indicate overall directional strength. Markets that +-100 indicate superior directional strength, while readings of +-35 are moderate. The tool is best used by the trader who employs a top down analytical approach using the h ...

... specified time frame. Histogram values are color coded with values of +-70 indicate overall directional strength. Markets that +-100 indicate superior directional strength, while readings of +-35 are moderate. The tool is best used by the trader who employs a top down analytical approach using the h ...

What market features reduce uncertainty?

... Stock prices will fall (probably dramatically) because they are no longer tied to economic fundamentals ...

... Stock prices will fall (probably dramatically) because they are no longer tied to economic fundamentals ...

світовий валютний ринок forex .аналізйого функціювання

... 1.The object of my master's research is the international currency market FOREX 2. The subject of the master's study is the mechanism of functioning of the global currency market FOREX 3.The purpose of my master's research is the theoretical analysis of functioning of the global currency market FOR ...

... 1.The object of my master's research is the international currency market FOREX 2. The subject of the master's study is the mechanism of functioning of the global currency market FOREX 3.The purpose of my master's research is the theoretical analysis of functioning of the global currency market FOR ...

rainbow trading corporation spyglass trading. lp

... • Opening position in a stock or index of a short put or call • Later add a short of the opposite option • Little to no additional margin required • Risk needs to be low to be effective ...

... • Opening position in a stock or index of a short put or call • Later add a short of the opposite option • Little to no additional margin required • Risk needs to be low to be effective ...

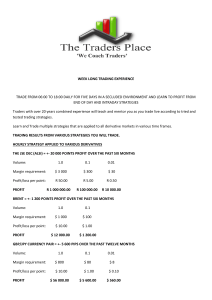

week long trading experience trade from 06:00 to 18:00 daily for five

... Warren began trading stocks in 2003 and progressed to Index and Forex trading in 2004. In 2005 he joined Share Direct, a financial market training company where he trained retail traders in Stocks, Index and Forex trading. He later joined Ideal CFD’s a CFD provider that was bought by IG Markets, he ...

... Warren began trading stocks in 2003 and progressed to Index and Forex trading in 2004. In 2005 he joined Share Direct, a financial market training company where he trained retail traders in Stocks, Index and Forex trading. He later joined Ideal CFD’s a CFD provider that was bought by IG Markets, he ...

Changes to Result in Better Framework and Incentive Structure for

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

Pro-Active Investor 12-07-09

... Buy & hold is safe I should trade based on News My Guru tells me when to buy Mutual funds are a smart way to balance your portfolio I should study companies Financials The best time to make money is when the market is going up Shorting is un-American - not cool ...

... Buy & hold is safe I should trade based on News My Guru tells me when to buy Mutual funds are a smart way to balance your portfolio I should study companies Financials The best time to make money is when the market is going up Shorting is un-American - not cool ...

Surveillance in a changing SecuritieS market landScape

... century surveillance challenges faced by regulators, exchanges and broker-dealers. Clearly broker-dealers and exchanges require flexible surveillance systems, so they can constantly innovate and keep up with rapid change. The CAT would be extremely useful in identifying market participants and the o ...

... century surveillance challenges faced by regulators, exchanges and broker-dealers. Clearly broker-dealers and exchanges require flexible surveillance systems, so they can constantly innovate and keep up with rapid change. The CAT would be extremely useful in identifying market participants and the o ...

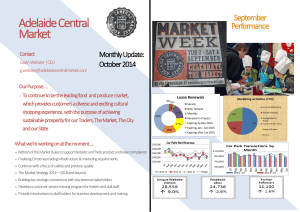

Adelaide Central Market

... sustainable prosperity for our Traders, The Market, The City and our State ...

... sustainable prosperity for our Traders, The Market, The City and our State ...

ENGL 301 Definitions rewritten

... the higher the frequency, the larger the returns and the lower the drawdowns (i.e. the lowest point during the holding period of a security) but the higher the operational costs (usually more than USD$200,000 annually) and the lower the trading capacity (referring to the maximum amount of capital t ...

... the higher the frequency, the larger the returns and the lower the drawdowns (i.e. the lowest point during the holding period of a security) but the higher the operational costs (usually more than USD$200,000 annually) and the lower the trading capacity (referring to the maximum amount of capital t ...

Gleadell Market Report

... Soybeans have moved sideways over the week, attempting to build some support on the futures market. The US harvest is moving into its final stages and the focus now turns to South American plantings, particularly Brazil, where conditions have been less than perfect. The MATIF futures market has been ...

... Soybeans have moved sideways over the week, attempting to build some support on the futures market. The US harvest is moving into its final stages and the focus now turns to South American plantings, particularly Brazil, where conditions have been less than perfect. The MATIF futures market has been ...

trader application form

... Campus Food and Drink Market Trader Application If you would like to be considered as a trader at one of our monthly markets, please complete this form ensuring you attach all relevant documentation and email it to Kelly Hart at [email protected] Please note that the cost of holding a stall at the ma ...

... Campus Food and Drink Market Trader Application If you would like to be considered as a trader at one of our monthly markets, please complete this form ensuring you attach all relevant documentation and email it to Kelly Hart at [email protected] Please note that the cost of holding a stall at the ma ...

Chapter 12: Market Microstructure and Strategies

... – Orders are instructions that traders give to the brokers and exchanges that arrange their trades. – They specify: ...

... – Orders are instructions that traders give to the brokers and exchanges that arrange their trades. – They specify: ...

Referee report on Ph.D. dissertation “Essays on the Behavior of

... PIN represents a private information measure because it is a function of abnormal order flow. The underlying assumption is that public information is directly incorporated into prices without the need of trading activity, whereas private information is reflected in excess buying or excess selling pr ...

... PIN represents a private information measure because it is a function of abnormal order flow. The underlying assumption is that public information is directly incorporated into prices without the need of trading activity, whereas private information is reflected in excess buying or excess selling pr ...

Prof. Giovanni Petrella

... At the end of this section of the course the student will be able to: – Estimate bid-ask spread and price impact. – Recognize the determinants of bid-ask spread and price impact. – Define trading strategies based on the intraday behaviour of trading volume, volatility, returns and spread. 5. Trading ...

... At the end of this section of the course the student will be able to: – Estimate bid-ask spread and price impact. – Recognize the determinants of bid-ask spread and price impact. – Define trading strategies based on the intraday behaviour of trading volume, volatility, returns and spread. 5. Trading ...

Charting and Technical Analysis

... walker would disagree with this statement. For any trend to persist there has to be some collective 'irrationality') Changes in trend are caused by shifts in demand and supply. These shifts no matter why they occur, can be detected sooner or later in the action of the market itself. (In the financia ...

... walker would disagree with this statement. For any trend to persist there has to be some collective 'irrationality') Changes in trend are caused by shifts in demand and supply. These shifts no matter why they occur, can be detected sooner or later in the action of the market itself. (In the financia ...

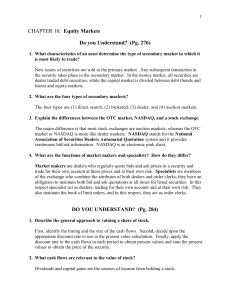

CHAPTER 10: Equity Markets

... The four types are (1) direct search, (2) brokered, (3) dealer, and (4) auction markets. 3. Explain the differences between the OTC market, NASDAQ, and a stock exchange. The major difference is that most stock exchanges are auction markets, whereas the OTC market or NASDAQ is more like dealer market ...

... The four types are (1) direct search, (2) brokered, (3) dealer, and (4) auction markets. 3. Explain the differences between the OTC market, NASDAQ, and a stock exchange. The major difference is that most stock exchanges are auction markets, whereas the OTC market or NASDAQ is more like dealer market ...

entrada - Bolsa de Madrid

... at risk by artificial fragmentation structures. One of last year’s events that has most revived the debate about trading models has been the flash crash on 6 May. This incident led to an in-depth investigation by the two main regulators in the US, the SEC and the CFTC. In their joint report about th ...

... at risk by artificial fragmentation structures. One of last year’s events that has most revived the debate about trading models has been the flash crash on 6 May. This incident led to an in-depth investigation by the two main regulators in the US, the SEC and the CFTC. In their joint report about th ...