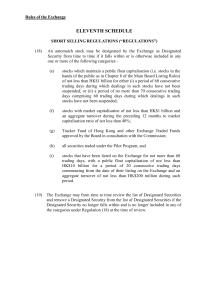

Amendments to the Rules of the Exchange in relation to the

... an aggregate turnover during the preceding 12 months to market capitalisation ratio of not less than 40%; ...

... an aggregate turnover during the preceding 12 months to market capitalisation ratio of not less than 40%; ...

Economics Chapter 11 Test Study Guide

... Individual Retirement Account (IRA) portfolio diversification capital market tax-exempt Standard and Poor’s 500 (S & P 500) bear market mutual fund finance company 401 (k) plan Concepts Municipal Bonds What are they? What is their risk level? What type of investor do they a ...

... Individual Retirement Account (IRA) portfolio diversification capital market tax-exempt Standard and Poor’s 500 (S & P 500) bear market mutual fund finance company 401 (k) plan Concepts Municipal Bonds What are they? What is their risk level? What type of investor do they a ...

assessing behaviour within an environment of uncertainty and risk

... Our current technology records every decision candidates make, and the market environment in which they made them. Our new performance heat map (not shown) is expected to be completed by June 2016. ...

... Our current technology records every decision candidates make, and the market environment in which they made them. Our new performance heat map (not shown) is expected to be completed by June 2016. ...

financial engineer / front office quantitative researcher

... At Raiffeisen Centrobank, the equity house of Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. ...

... At Raiffeisen Centrobank, the equity house of Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. ...

Chapter 12.2 notes - Effingham County Schools

... buyers and sellers meet to trade securities New York Stock Exchange (NYSE) – oldest and largest original exchange; in NYC; use auctioning process through face to face trading; now a lot of trades are electronic ...

... buyers and sellers meet to trade securities New York Stock Exchange (NYSE) – oldest and largest original exchange; in NYC; use auctioning process through face to face trading; now a lot of trades are electronic ...

Lecture 9 Financial Exchanges

... means that “market makers” obtain zero profit. But further increases in HFT exacerbate stale quote sniping, and actually increase spreads – because competition is on speed rather than on price! ...

... means that “market makers” obtain zero profit. But further increases in HFT exacerbate stale quote sniping, and actually increase spreads – because competition is on speed rather than on price! ...

Regulatory Focus on Market Structure and Trading Issues

... Trillium Brokerage Services and several individuals settled with FINRA for a total of $2,300,000 in September 2010 FINRA found that the traders were using an improper trading strategy which used orders that were immediately cancelled to create a false appearance of trading activity Traders ent ...

... Trillium Brokerage Services and several individuals settled with FINRA for a total of $2,300,000 in September 2010 FINRA found that the traders were using an improper trading strategy which used orders that were immediately cancelled to create a false appearance of trading activity Traders ent ...

Trading Nokia: The Roles of the Helsinki vs. the New York Stock

... between its price formation processes in the different markets becomes an important and interesting issue. Is perhaps one market leading the other in incorporating new information into the price of the stock? Discovering such patterns ...

... between its price formation processes in the different markets becomes an important and interesting issue. Is perhaps one market leading the other in incorporating new information into the price of the stock? Discovering such patterns ...

A Day in the Life of an ETF Portfolio Manager

... our sails as quickly. “Nasdaq down again.” The massive order flow once again crashes the system. It’s beginning to feel like a bad episode of The Twilight Zone. We could leave trades unexecuted and trade them on Monday, exposing our funds to risk that stocks won’t open where they closed—the funds wo ...

... our sails as quickly. “Nasdaq down again.” The massive order flow once again crashes the system. It’s beginning to feel like a bad episode of The Twilight Zone. We could leave trades unexecuted and trade them on Monday, exposing our funds to risk that stocks won’t open where they closed—the funds wo ...

FMA Doctoral Consortium Market Microstructure

... Buy-side Order Strategy • Trading is a search problem. • We need better models of the time dimension of liquidity. – Liquidity is more than bid/ask spread. ...

... Buy-side Order Strategy • Trading is a search problem. • We need better models of the time dimension of liquidity. – Liquidity is more than bid/ask spread. ...

AN ANALYSIS OF GLOBAL HFT REGULATION Motivations, Market

... Recent market events like the “flash crash” of 2010, algorithmic failures at Knight Capital, and the release of Michael Lewis’s book Flash Boys (2014)—with his claims that markets are “rigged”—have heightened scrutiny of high-frequency trading (HFT) and increased demands for more aggressive regulati ...

... Recent market events like the “flash crash” of 2010, algorithmic failures at Knight Capital, and the release of Michael Lewis’s book Flash Boys (2014)—with his claims that markets are “rigged”—have heightened scrutiny of high-frequency trading (HFT) and increased demands for more aggressive regulati ...

Technical Analysis

... The following is a matrix of stocks that have made a new high or low price today subcategorized by exchange, volume and price. ...

... The following is a matrix of stocks that have made a new high or low price today subcategorized by exchange, volume and price. ...

PreConf-Session B – Heaney

... Change: To make the form, nature, content etc. of something different from what it is. Regulation and Enforcement are Here to Stay ...

... Change: To make the form, nature, content etc. of something different from what it is. Regulation and Enforcement are Here to Stay ...

Capital Markets in Egypt

... Macroeconomic Stabilization & Improved Performance - Transition to unified flexible FX rate regime (Dec.2004) -- subsequent stabilization - strengthened external position ...

... Macroeconomic Stabilization & Improved Performance - Transition to unified flexible FX rate regime (Dec.2004) -- subsequent stabilization - strengthened external position ...

Desired Skills and Experience - The Municipal Analysts Group of

... Evaluator - Municipal Bonds-High Yield Interactive Data Corporation is a trusted leader in financial information. Thousands of financial institutions and active traders, as well as hundreds of software and service providers, subscribe to our fixed income evaluations, reference data, real-time market ...

... Evaluator - Municipal Bonds-High Yield Interactive Data Corporation is a trusted leader in financial information. Thousands of financial institutions and active traders, as well as hundreds of software and service providers, subscribe to our fixed income evaluations, reference data, real-time market ...

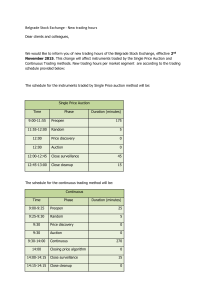

Belgrade Stock Exchange - New trading hours Dear clients and

... November 2015. This change will affect instruments traded by the Single Price Auction and Continuous Trading methods. New trading hours per market segment are according to the trading schedule provided below: ...

... November 2015. This change will affect instruments traded by the Single Price Auction and Continuous Trading methods. New trading hours per market segment are according to the trading schedule provided below: ...

10 Min Options Strategy Handout - MarketClub

... All trades, patterns, charts, systems, etc., discussed in this advertisement and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect tho ...

... All trades, patterns, charts, systems, etc., discussed in this advertisement and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect tho ...

5th of February 2017 A Trading Shift: Back To Basics Last week was

... Quantitatively, we can notice a higher density of market turning points. The average variability of asset trends (averaged across major asset classes) shows turning points occurring at the fastest pace in recent history (over the last 30 years). Additionally, information is created and consumed at ...

... Quantitatively, we can notice a higher density of market turning points. The average variability of asset trends (averaged across major asset classes) shows turning points occurring at the fastest pace in recent history (over the last 30 years). Additionally, information is created and consumed at ...

File

... • With the same process and stock, intention and definition of objectives separate trading from investing ...

... • With the same process and stock, intention and definition of objectives separate trading from investing ...

SciDAC Poster: INCITE

... instant (before t+t) • Survival rate - probability an added order will survive beyond a certain time • Competing risks – orders may be fully or partially traded or cancelled ...

... instant (before t+t) • Survival rate - probability an added order will survive beyond a certain time • Competing risks – orders may be fully or partially traded or cancelled ...

what is the “upstairs market?” the causes of market impact for block

... The upstairs market is a network of broker trading desks and institutional investors where block trades are matched. Unlike trades that are paired at an exchange (or ATS), these trades are typically negotiated via phone. Once a trade has been consummated it is “printed” on a marketplace. In order fo ...

... The upstairs market is a network of broker trading desks and institutional investors where block trades are matched. Unlike trades that are paired at an exchange (or ATS), these trades are typically negotiated via phone. Once a trade has been consummated it is “printed” on a marketplace. In order fo ...

the golden ticket gold day-trading system

... Methodology – Golden Ticket is a customizable day trading system for traders and institutions with experience trading Gold Future Contracts (@GC). It is designed to take advantages of momentum in the Gold market based on a unique algorithm that looks for strong professional buying and an unusual imb ...

... Methodology – Golden Ticket is a customizable day trading system for traders and institutions with experience trading Gold Future Contracts (@GC). It is designed to take advantages of momentum in the Gold market based on a unique algorithm that looks for strong professional buying and an unusual imb ...

Master the Language of the Market

... It's come to my attention that readers are having a difficult time deciphering advertisements and newsletters in the trading media. Some of the phrases used in these publications are obscure and in need of translation. Below is a handy guide that will save you considerable anguish and capital when y ...

... It's come to my attention that readers are having a difficult time deciphering advertisements and newsletters in the trading media. Some of the phrases used in these publications are obscure and in need of translation. Below is a handy guide that will save you considerable anguish and capital when y ...

CFA-AFR-Dark-Pools-2.. - CFA Society Melbourne

... Citing a survey by the London-based CFA Institute, Philip Stafford reports trading of US equities on dark pools has grown by 48 per cent in the past three years, and accounts for 31 per cent of total market volume as of March. – Rhodri Preece, director of capital markets policy at the CFA and author ...

... Citing a survey by the London-based CFA Institute, Philip Stafford reports trading of US equities on dark pools has grown by 48 per cent in the past three years, and accounts for 31 per cent of total market volume as of March. – Rhodri Preece, director of capital markets policy at the CFA and author ...

Bovespa

... Exchanges in Latin America have an additional challenge: face the problem of low volume and, in consequence, the low scale of operations ...

... Exchanges in Latin America have an additional challenge: face the problem of low volume and, in consequence, the low scale of operations ...