Brian developed his interest for the futures market, while growing up

... He graduated with a B.S. Social Studies from Minot State University. Brian began his career in the futures industry as an employee of the Minneapolis Grain Exchange. While at the MGEX, his duties allowed him to gain knowledge of the mechanism of futures trading. These duties included enforcement of ...

... He graduated with a B.S. Social Studies from Minot State University. Brian began his career in the futures industry as an employee of the Minneapolis Grain Exchange. While at the MGEX, his duties allowed him to gain knowledge of the mechanism of futures trading. These duties included enforcement of ...

Cattle marketing: understanding traders perceptions and market

... • Markets play a role in the exchange of ownership for livestock resources destined for breeding, fattening and slaughter. • Markets acts as a hub for a bigger network which can enhance disease spread to other production systems and farms. • A clear understanding on how markets operate and weaknesse ...

... • Markets play a role in the exchange of ownership for livestock resources destined for breeding, fattening and slaughter. • Markets acts as a hub for a bigger network which can enhance disease spread to other production systems and farms. • A clear understanding on how markets operate and weaknesse ...

MS DOC - University of Nairobi

... • Markets play a role in the exchange of ownership for livestock resources destined for breeding, fattening and slaughter. • Markets acts as a hub for a bigger network which can enhance disease spread to other production systems and farms. • A clear understanding on how markets operate and weaknesse ...

... • Markets play a role in the exchange of ownership for livestock resources destined for breeding, fattening and slaughter. • Markets acts as a hub for a bigger network which can enhance disease spread to other production systems and farms. • A clear understanding on how markets operate and weaknesse ...

CfP: Workshop on Commodity Trading Companies in the First

... multinational enterprise, replacing the role and services offered by merchants and trading companies. Theory suggests that falling margins and competition from manufacturing firms force trading companies to either disappear or diversify away from pure trading and turn into hybrid trading companies o ...

... multinational enterprise, replacing the role and services offered by merchants and trading companies. Theory suggests that falling margins and competition from manufacturing firms force trading companies to either disappear or diversify away from pure trading and turn into hybrid trading companies o ...

Integrating Markets in Financial Instruments

... • CSDs to handle access requests from other EU RMs and MTFs • Harmonization of post-trading infrastructure with Europe ...

... • CSDs to handle access requests from other EU RMs and MTFs • Harmonization of post-trading infrastructure with Europe ...

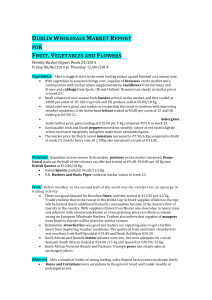

Weekly Market Report Week 24 2014

... from Brazil to Europe will be down for similar reasons. Demand for strawberries was good and traders are expecting sales to get a further boost from improving weather conditions. The quality of Irish and Dutch strawberries was excellent, Irish 8x454g sold at €19.00 and Dutch 8x500g at €20.50. So ...

... from Brazil to Europe will be down for similar reasons. Demand for strawberries was good and traders are expecting sales to get a further boost from improving weather conditions. The quality of Irish and Dutch strawberries was excellent, Irish 8x454g sold at €19.00 and Dutch 8x500g at €20.50. So ...

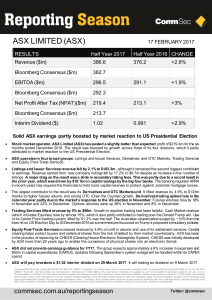

View PDF Report

... Equity Post-Trade Services increased revenue by 3.8% on a lift in volume and use of its settlement services. Central clearing helps protect buyers and sellers of shares from the risk of default by their market counterparty. ASX has been in the process of replacing its CHESS (Clearing House Electroni ...

... Equity Post-Trade Services increased revenue by 3.8% on a lift in volume and use of its settlement services. Central clearing helps protect buyers and sellers of shares from the risk of default by their market counterparty. ASX has been in the process of replacing its CHESS (Clearing House Electroni ...

This talk will be a short and elementary introduction to mathematical

... joint dynamics of (often) visible prices of a defined set of market securities or contracts. Time value of money is a central premise for fixed income models. Simply stated, receiving monies early is preferable (and hence valued higher) than receiving the same amount at a later date. Although simple ...

... joint dynamics of (often) visible prices of a defined set of market securities or contracts. Time value of money is a central premise for fixed income models. Simply stated, receiving monies early is preferable (and hence valued higher) than receiving the same amount at a later date. Although simple ...

Specific parameters for the Liquidity Provider Raiffeisen Centrobank

... Minimum volume corresponding to the firm bid-ask quote applies to every limit order in the firm offer, respectively 500 instruments for the buy order and 500 instruments for the sell order. Note2: The responsibility of the Liquidity Provider to provide the minimum volume correspondent to the ask quo ...

... Minimum volume corresponding to the firm bid-ask quote applies to every limit order in the firm offer, respectively 500 instruments for the buy order and 500 instruments for the sell order. Note2: The responsibility of the Liquidity Provider to provide the minimum volume correspondent to the ask quo ...

Interest Rate Parity

... of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

... of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

BAML Partners with Thesys on New High-Speed Trading

... BAML Partners with Thesys on New High-Speed Trading Platform Bank of America Merrill Lynch has rolled out a low-latency market access and risk control platform developed in partnership with a high-frequency trading and technology firm. The platform currently provides access only to U.S. equity excha ...

... BAML Partners with Thesys on New High-Speed Trading Platform Bank of America Merrill Lynch has rolled out a low-latency market access and risk control platform developed in partnership with a high-frequency trading and technology firm. The platform currently provides access only to U.S. equity excha ...

PowerPoint ****

... Fourth Market The direct trading of exchange-listed securities between investors (large institutions) ...

... Fourth Market The direct trading of exchange-listed securities between investors (large institutions) ...

Buyside Traders Want SEC to Press Exchanges and Dark Pools for

... disclosure process would certainly help. Comparing and contrasting existing disclosures and then challenging any differences among providers is cumbersome and time consuming. There are a few providers who offer their own standardized ‘checklist’ for wider dissemination; but again, this lack of stand ...

... disclosure process would certainly help. Comparing and contrasting existing disclosures and then challenging any differences among providers is cumbersome and time consuming. There are a few providers who offer their own standardized ‘checklist’ for wider dissemination; but again, this lack of stand ...

Rupee likely to show upward movement According to Lt Col Ajay

... Asian future market. Indian bullion may show firm opening. But as per finical astrology some profit booking also expected after 7pm. Today Saturn in "Singh Rashi, Sun and mercury in Kanya rashi, Mars is in Tula while Venus is in Vrashik rashi. Moon is in Karak rashi. All these planets are indicating ...

... Asian future market. Indian bullion may show firm opening. But as per finical astrology some profit booking also expected after 7pm. Today Saturn in "Singh Rashi, Sun and mercury in Kanya rashi, Mars is in Tula while Venus is in Vrashik rashi. Moon is in Karak rashi. All these planets are indicating ...

Securities Markets

... ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

... ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

Stock Market Liquidity: Behavior of Short-Term and Long-Term

... London Stock Exchange. This phenomenon is often referred to as hot potato trading. A typical short-term trader, who also provides liquidity in the market, protects herself against trading with those having superior information through the bid-ask spread. However, there is also the need to process in ...

... London Stock Exchange. This phenomenon is often referred to as hot potato trading. A typical short-term trader, who also provides liquidity in the market, protects herself against trading with those having superior information through the bid-ask spread. However, there is also the need to process in ...

Ethics in Finance

... agent must announce his intention to takeover the company, if that is the intent Stock prices go up in anticipation of takeover battle Management of target company sends greenmails to prevent a shareholder from taking over the company Takeover agent ends up selling the shares back to company at an i ...

... agent must announce his intention to takeover the company, if that is the intent Stock prices go up in anticipation of takeover battle Management of target company sends greenmails to prevent a shareholder from taking over the company Takeover agent ends up selling the shares back to company at an i ...

INSIDER TRADING RWM abides by national and local laws, rules

... RWM abides by national and local laws, rules and regulations, including all applicable guidelines issued by the Philippine Stock Exchange (PSE). It is therefore illegal to buy or sell securities of any company, including RWM’s, based on material non-public information, unless exempted under the law. ...

... RWM abides by national and local laws, rules and regulations, including all applicable guidelines issued by the Philippine Stock Exchange (PSE). It is therefore illegal to buy or sell securities of any company, including RWM’s, based on material non-public information, unless exempted under the law. ...

pICkING thE BESt tRADING OppORtUNItIES

... margin loans to take advantage of this positive sentiment, new trading opportunities arise in many different sectors. The question still looms; what quantifies a ‘good’ trading stock and out of more than 2000 companies listed on the ASX, how do I find the best 20 to add to my watch list? Keeping in ...

... margin loans to take advantage of this positive sentiment, new trading opportunities arise in many different sectors. The question still looms; what quantifies a ‘good’ trading stock and out of more than 2000 companies listed on the ASX, how do I find the best 20 to add to my watch list? Keeping in ...

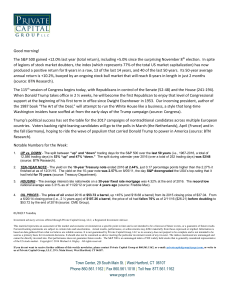

01-03-2017 Weekly Market Review

... based on data gathered from what we believe are reliable sources. It is not guaranteed by Private Capital Group, LLC as to accuracy does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the partic ...

... based on data gathered from what we believe are reliable sources. It is not guaranteed by Private Capital Group, LLC as to accuracy does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the partic ...

Money_Quest_2014 MAINE

... • Do good research or buy good research. • Sell covered calls expiring each month on holdings. • Re-populate portfolio if called away with stocks that meet your criteria. I call my investment advisor each month to find out what they like at that moment. • Money Market Alternative, Buy XLE or SLB or ...

... • Do good research or buy good research. • Sell covered calls expiring each month on holdings. • Re-populate portfolio if called away with stocks that meet your criteria. I call my investment advisor each month to find out what they like at that moment. • Money Market Alternative, Buy XLE or SLB or ...

CEE Trader - Wiener Börse

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

The course presents an introduction to financial intermediation and

... The course takes the move from the institutional level, and describes the banking and trading industry with special focus on: role of banks and stability of the banking system, market structures (trading sessions and execution systems), order properties (mar ...

... The course takes the move from the institutional level, and describes the banking and trading industry with special focus on: role of banks and stability of the banking system, market structures (trading sessions and execution systems), order properties (mar ...

Slide 1

... • Start of the new trading platform – XETRA (16.06.2008) • X3News – a specialized financial media through which the public companies and the other issuers of securities can fulfill their legal obligations for disclosure of regulated information. (January 2008) ...

... • Start of the new trading platform – XETRA (16.06.2008) • X3News – a specialized financial media through which the public companies and the other issuers of securities can fulfill their legal obligations for disclosure of regulated information. (January 2008) ...

Cowen Electronic Disclosure

... you may receive an inferior price in extended hours trading than you would during regular market hours. 4. Risk of Unlinked Markets. Depending on the extended hours trading system or the time of day, the prices displayed on a particular extended hours system may not reflect the prices in other concu ...

... you may receive an inferior price in extended hours trading than you would during regular market hours. 4. Risk of Unlinked Markets. Depending on the extended hours trading system or the time of day, the prices displayed on a particular extended hours system may not reflect the prices in other concu ...