Chapter 259 South African Rand/US Dollar (ZAR/USD)

... Interpretations & Special Notices Section of Chapter 5. A Person seeking an exemption from position limits for bona fide commercial purposes shall apply to the Market Regulation Department on forms provided by the Exchange, and the Market Regulation Department may grant qualified exemptions in its s ...

... Interpretations & Special Notices Section of Chapter 5. A Person seeking an exemption from position limits for bona fide commercial purposes shall apply to the Market Regulation Department on forms provided by the Exchange, and the Market Regulation Department may grant qualified exemptions in its s ...

Going Back to the Basics – Rethinking Market Efficiency

... We mentioned that conventional economics makes its inferences on efficient markets on the basis of a model in which economic agents are entities that act according to the rational expectation strategy. Any differences in planning horizons, frequency of trading or institutional constraints are neglec ...

... We mentioned that conventional economics makes its inferences on efficient markets on the basis of a model in which economic agents are entities that act according to the rational expectation strategy. Any differences in planning horizons, frequency of trading or institutional constraints are neglec ...

The future of corporate bond market liquidity

... focused, which only accentuates market movements. While investors might think these strategies are longterm focused, the actual management of the money is very short-term in nature. This is profoundly influencing financial markets, making them much more susceptible to extreme moves, which can be see ...

... focused, which only accentuates market movements. While investors might think these strategies are longterm focused, the actual management of the money is very short-term in nature. This is profoundly influencing financial markets, making them much more susceptible to extreme moves, which can be see ...

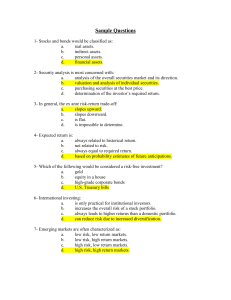

Sample Questions - U of L Class Index

... declined to $69. The outlook for the stock is mixed, so she would cover her short position if the stock moves up as much as $1 but hold if it continues down. Ms. Brown should place a: a. sell stop order at $70. b. buy stop order at $70. c. sell limit order at $70. d. buy limit order at $70. 38- Mr. ...

... declined to $69. The outlook for the stock is mixed, so she would cover her short position if the stock moves up as much as $1 but hold if it continues down. Ms. Brown should place a: a. sell stop order at $70. b. buy stop order at $70. c. sell limit order at $70. d. buy limit order at $70. 38- Mr. ...

Inflection Performance: January 2017

... buy, and that they typically hold the bonds to maturity. These buyers typically do not have the time or resources to do a deep credit analysis of the bonds they buy and thus are often caught wrong-footed around credit rating events and other changes in fundamentals that create mismatches in supply a ...

... buy, and that they typically hold the bonds to maturity. These buyers typically do not have the time or resources to do a deep credit analysis of the bonds they buy and thus are often caught wrong-footed around credit rating events and other changes in fundamentals that create mismatches in supply a ...

Bolsa Comercio Santiago (Santiago Stock Exchange)

... amounts, dividends, and other information. This system is operated over the telephone. InfoMail, like FonoBolsa, offers access to some of the same information summarizing the market, its index as well as closing prices Similarly StockView offered directly through the website allows the traders a ...

... amounts, dividends, and other information. This system is operated over the telephone. InfoMail, like FonoBolsa, offers access to some of the same information summarizing the market, its index as well as closing prices Similarly StockView offered directly through the website allows the traders a ...

Tom Lawless

... But as separate markets – Different rules and Members (brokers in equities, banks in bonds and derivatives) Recognise that trading and risk methodologies are not the same for each market ...

... But as separate markets – Different rules and Members (brokers in equities, banks in bonds and derivatives) Recognise that trading and risk methodologies are not the same for each market ...

CME Group customer forum

... because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited for a futures and a swap position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a porti ...

... because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited for a futures and a swap position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a porti ...

Economic Insight The Market is Full of Sound and Fury

... There are many headlines that the media may use to cause investors to focus on what’s wrong with the market. This leads to portfolio withdrawals during volatile markets. Withdrawing on the downside exacerbates the downside impact, meaning you would need additional gains on the upside to recover. Vol ...

... There are many headlines that the media may use to cause investors to focus on what’s wrong with the market. This leads to portfolio withdrawals during volatile markets. Withdrawing on the downside exacerbates the downside impact, meaning you would need additional gains on the upside to recover. Vol ...

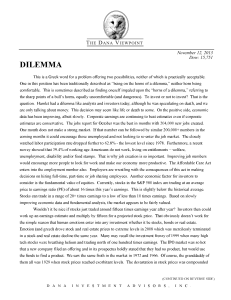

November 2013 - Dana Investment Advisors

... and Twitter) and business media stocks (LinkedIn). Activity is also heating up with 3D printing stocks. These are not recommendations, but merely examples, and they are very volatile. This market will continue to advance as long as interest rates are low and the Fed keeps buying bonds. That will be ...

... and Twitter) and business media stocks (LinkedIn). Activity is also heating up with 3D printing stocks. These are not recommendations, but merely examples, and they are very volatile. This market will continue to advance as long as interest rates are low and the Fed keeps buying bonds. That will be ...

TO: NYSE Listed Company Executives FROM: NYSE Regulation, Inc

... Although trading on the Exchange stops at 4:00 p.m. ET, the order book for each listed security is manually closed by the security’s Designated Market Maker (“DMM”), a process that may, on occasion, take a brief period of time before the closing auction is completed. Because trading continues after ...

... Although trading on the Exchange stops at 4:00 p.m. ET, the order book for each listed security is manually closed by the security’s Designated Market Maker (“DMM”), a process that may, on occasion, take a brief period of time before the closing auction is completed. Because trading continues after ...

REITs` mean reversion presents trading opportunities

... The existence of excessive price instability provides us as an active manager with opportunities that more docile markets wouldn’t, given that we are willing to stomach these sharp movements and be opportunistic. While the preponderance of our efforts revolve around identifying only the best longert ...

... The existence of excessive price instability provides us as an active manager with opportunities that more docile markets wouldn’t, given that we are willing to stomach these sharp movements and be opportunistic. While the preponderance of our efforts revolve around identifying only the best longert ...

my presentation - Fuller Treacy Money

... economy was in severe recession, or perhaps even worse. ...

... economy was in severe recession, or perhaps even worse. ...

Role of Switzerland as a hub for commodity trading

... …..and political uncertainties in a debt crisis environment ...

... …..and political uncertainties in a debt crisis environment ...

Optimal Portfolios under Worst Case Scenarios

... assume that investors only look at the distributional properties of strategies and do not care about the states of the world in which the cash-flows are received. In a very interesting paper Dybvig (1988a, 1988b) essentially showed that in these instances optimal portfolios are decreasing in the sta ...

... assume that investors only look at the distributional properties of strategies and do not care about the states of the world in which the cash-flows are received. In a very interesting paper Dybvig (1988a, 1988b) essentially showed that in these instances optimal portfolios are decreasing in the sta ...

Can Asia`s financial markets continue to grow without AEV`s

... Some AEV’s such as Chi-X are willing to share and provide technology solutions to Exchanges and Regulators – such as a Smart Order Router and market data management so that all market participants, including retail, can access the best price ...

... Some AEV’s such as Chi-X are willing to share and provide technology solutions to Exchanges and Regulators – such as a Smart Order Router and market data management so that all market participants, including retail, can access the best price ...

Research Online Trading Sites and DRIPs you will evaluate the

... Research Online Trading Sites and DRIPs you will evaluate the choices in purchasing stock via online brokerage accounts (where you can buy and sell stock via the Internet) and the use of dividend reinvestment plans (known as DIPs and DRIPs) or mutual funds or index funds. For online brokers, you wil ...

... Research Online Trading Sites and DRIPs you will evaluate the choices in purchasing stock via online brokerage accounts (where you can buy and sell stock via the Internet) and the use of dividend reinvestment plans (known as DIPs and DRIPs) or mutual funds or index funds. For online brokers, you wil ...

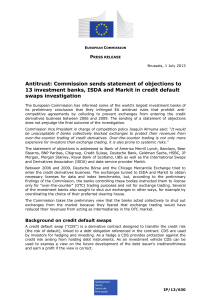

European Commission

... (the risk of default), linked to a debt obligation referenced in the contract. CDS are used by investors for hedging and investing. As a hedge a CDS provides protection against the credit risk arising from holding debt instruments. As an investment vehicle CDS can be used to express a view on the fu ...

... (the risk of default), linked to a debt obligation referenced in the contract. CDS are used by investors for hedging and investing. As a hedge a CDS provides protection against the credit risk arising from holding debt instruments. As an investment vehicle CDS can be used to express a view on the fu ...

Secondary Market Regulations of Government Bonds

... Role of Salespeople or Brokers (1) Can efficiency alone create liquidity? ...

... Role of Salespeople or Brokers (1) Can efficiency alone create liquidity? ...

Market Capitalisation– The overall market capitalisation remained

... return by RBG underpinned the increase in STRI value. Dividend will be payable to RBG shareholders on 25th February 2016. Bid-Offer Spread – FMF maintains the narrowest bid-offer margin spread of $0.10 while PBF maintains the widest bidoffer margin with a spread of $3.00. The Bid to Offer ratio stan ...

... return by RBG underpinned the increase in STRI value. Dividend will be payable to RBG shareholders on 25th February 2016. Bid-Offer Spread – FMF maintains the narrowest bid-offer margin spread of $0.10 while PBF maintains the widest bidoffer margin with a spread of $3.00. The Bid to Offer ratio stan ...

Эффективные рынки

... Which country has the highest ratio of total fin assets to GDP? How does the ratio of bonds to stocks vary across the countries? What is the largest inst investor in the world judging by fin assets? What inst investor has the fastest growth of assets in the world? NES FF 2005/06 ...

... Which country has the highest ratio of total fin assets to GDP? How does the ratio of bonds to stocks vary across the countries? What is the largest inst investor in the world judging by fin assets? What inst investor has the fastest growth of assets in the world? NES FF 2005/06 ...

implementing regulation to the exchange rules setting trading

... length of 60 minutes Spot Products At least 50% of the trading period within the continuous regime. ...

... length of 60 minutes Spot Products At least 50% of the trading period within the continuous regime. ...

Chapter1

... *If Ingrid at Chase posts a quote of 125.00-.10 and is called by Taka at Sumitomo who wants to “hit her ask” and have her buy his yen for her dollars, she may wonder if Taka knows something she doesn’t *what private information could Taka have? order flow his bank receives from customers early infor ...

... *If Ingrid at Chase posts a quote of 125.00-.10 and is called by Taka at Sumitomo who wants to “hit her ask” and have her buy his yen for her dollars, she may wonder if Taka knows something she doesn’t *what private information could Taka have? order flow his bank receives from customers early infor ...