The causal impact of algorithmic trading

... Rate of electronic message traffic Message traffic, Order-to-trade ratio Strategic Runs NASDAQ HFT dataset ...

... Rate of electronic message traffic Message traffic, Order-to-trade ratio Strategic Runs NASDAQ HFT dataset ...

What Trading Teaches Us About Life

... Note: This article first appeared on the TraderFeed site, 8/14/06 ...

... Note: This article first appeared on the TraderFeed site, 8/14/06 ...

Stock Trading Stock Trading

... PBHK Stock Trading is a “Native App” which provides you with a fast, convenient and secured securities trading platform. Together with the comprehensive market information, it assists you to capture your investment opportunities anytime and anywhere. Investment involves risk. For enquiry, please cal ...

... PBHK Stock Trading is a “Native App” which provides you with a fast, convenient and secured securities trading platform. Together with the comprehensive market information, it assists you to capture your investment opportunities anytime and anywhere. Investment involves risk. For enquiry, please cal ...

High-frequency trading

... • In the early 2000s, high-frequency trading still accounted for fewer than 10% of equity orders. • According to data from the NYSE, trading volume grew by about 164% between 2005 and 2009 for which high-frequency trading might be responsible. • As of the first quarter in 2009, total assets under ma ...

... • In the early 2000s, high-frequency trading still accounted for fewer than 10% of equity orders. • According to data from the NYSE, trading volume grew by about 164% between 2005 and 2009 for which high-frequency trading might be responsible. • As of the first quarter in 2009, total assets under ma ...

Math Club Meeting #4 Friday, March 12th, 2010

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...

Lalin Dias, VP Exchange Systems, MillenniumIT

... MillenniumIT is a leading provider of high performance, flexible and multi-asset class technology to exchanges, broker-dealers, clearing houses, depositories and regulators. Its trading engine, smart order routing, market data, clearing, CSD and surveillance products have been implemented at over 30 ...

... MillenniumIT is a leading provider of high performance, flexible and multi-asset class technology to exchanges, broker-dealers, clearing houses, depositories and regulators. Its trading engine, smart order routing, market data, clearing, CSD and surveillance products have been implemented at over 30 ...

On Market Makers` Contribution to Trading Efficiency in Options

... decided to encourage market making in shekel-euro options by offering direct remuneration to market makers in exchange for obligations they would assume. These obligations include the obligation to enter quotes for sell and buy orders. Market makers began to operate in March 2004. This event creates ...

... decided to encourage market making in shekel-euro options by offering direct remuneration to market makers in exchange for obligations they would assume. These obligations include the obligation to enter quotes for sell and buy orders. Market makers began to operate in March 2004. This event creates ...

gbpusd - Forex Factory

... DISCLAIMER: Forex (off-exchange foreign currency futures and options or FX) trading involves substantial risk of loss and is not suitable for every investor. The value of currencies may fluctuate and investors may lose all or more than their original investments. Risks also include, but are not limi ...

... DISCLAIMER: Forex (off-exchange foreign currency futures and options or FX) trading involves substantial risk of loss and is not suitable for every investor. The value of currencies may fluctuate and investors may lose all or more than their original investments. Risks also include, but are not limi ...

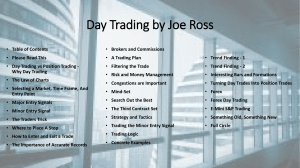

Financial Health- Understanding the Market

... 2. There are two types of traders Fundamental Traders Technical traders 3. How stock market functions 4. Simply economics of supply and demand 5. Stock market is slow to move up and fast to move down ...

... 2. There are two types of traders Fundamental Traders Technical traders 3. How stock market functions 4. Simply economics of supply and demand 5. Stock market is slow to move up and fast to move down ...

Document

... Challenges for Large Traders • Large, institutional traders know that their actions can impact market prices. • Large traders are more likely to suffer “ex post” regret about their trades. • Therefore, many large traders do not fully reveal their order sizes, thus creating strong, latent demand to ...

... Challenges for Large Traders • Large, institutional traders know that their actions can impact market prices. • Large traders are more likely to suffer “ex post” regret about their trades. • Therefore, many large traders do not fully reveal their order sizes, thus creating strong, latent demand to ...