IB Comment Letter to SEC Opposing New Margin Requirements for

... change in market conditions, an unexpectedly large gain or loss in the position, or because the trade was done to take advantage of an available arbitrage opportunity. By artificially constraining investors’ decisions, because those investors may fear being categorized as a “pattern day trader”, the ...

... change in market conditions, an unexpectedly large gain or loss in the position, or because the trade was done to take advantage of an available arbitrage opportunity. By artificially constraining investors’ decisions, because those investors may fear being categorized as a “pattern day trader”, the ...

An Introduction to Hackney`s Markets

... Kingsland Waste is a general street market which operates on Saturdays only. The market is based on a historical site. Kings Road was originally a Roman road which extended north to Bishopgate and later became a cattle drover’s road. It is a busy market selling household items, bric-a-brac, tools, h ...

... Kingsland Waste is a general street market which operates on Saturdays only. The market is based on a historical site. Kings Road was originally a Roman road which extended north to Bishopgate and later became a cattle drover’s road. It is a busy market selling household items, bric-a-brac, tools, h ...

Chap. 5 How Securities are Traded Buying and Selling Securities

... • On the NYSE, etc., a price quote will appear to be a similar bid-ask from a dealer, but in fact will more likely reflect the best limit orders from other investors. • In the absence of reasonable limit orders, the price would reflect the specialist’s bid or ask price. • When you leave your securit ...

... • On the NYSE, etc., a price quote will appear to be a similar bid-ask from a dealer, but in fact will more likely reflect the best limit orders from other investors. • In the absence of reasonable limit orders, the price would reflect the specialist’s bid or ask price. • When you leave your securit ...

Investments, Mon. Feb. 4, `08

... Agents are equipped with initial portfolios and then they trade via a market maker. Equilibrium (”ligevægt”) is when no further trades can be made. ...

... Agents are equipped with initial portfolios and then they trade via a market maker. Equilibrium (”ligevægt”) is when no further trades can be made. ...

CBOE SYSTEMS ACRONYM DICTIONARY

... FLEX – Flexible Options contracts: variable term contracts for which the specifications and trading procedures are provided under Chapter 24A of CBOE Rules. FLEX are traded on a stand-alone system that is not linked to the other floor-trading systems. GUI – Graphical User Interface: The windowed inf ...

... FLEX – Flexible Options contracts: variable term contracts for which the specifications and trading procedures are provided under Chapter 24A of CBOE Rules. FLEX are traded on a stand-alone system that is not linked to the other floor-trading systems. GUI – Graphical User Interface: The windowed inf ...

Document

... the informed-uninformed theory with a fast incorporation of information into price • Price formation is closer to a slow digestion process in which liquidity takers try to hide their intention and to minimize their impact; liquidity providers try to detect patterns created by liquidity takers making ...

... the informed-uninformed theory with a fast incorporation of information into price • Price formation is closer to a slow digestion process in which liquidity takers try to hide their intention and to minimize their impact; liquidity providers try to detect patterns created by liquidity takers making ...

Kevin Houstoun

... Examining one recommendation “New types of circuit breakers triggered by ex ante rather than ex post trading may be effective in dealing with periodic illiquidity.” “In times of overall market stress there is a need for coordination of circuit breakers across markets, and this could be a mandate fo ...

... Examining one recommendation “New types of circuit breakers triggered by ex ante rather than ex post trading may be effective in dealing with periodic illiquidity.” “In times of overall market stress there is a need for coordination of circuit breakers across markets, and this could be a mandate fo ...

China Financial Market and Case Study for Capital Operation

... o A second board which is inferior to main board o A NASDAQ-type exchange for high-growth, high-tech start-ups o The youngest, started on October 23, 2009 o Only on SZSE o Only open to domestic investors ...

... o A second board which is inferior to main board o A NASDAQ-type exchange for high-growth, high-tech start-ups o The youngest, started on October 23, 2009 o Only on SZSE o Only open to domestic investors ...

Full text

... exchange is defined as an organized marketplace, where stocks, bonds and common stocks equivalents are traded by brokers and traders. Electronic stock exchange involves the usage of electronic terminals by traders to place orders on an exchange through their brokers. Speculative traders or speculato ...

... exchange is defined as an organized marketplace, where stocks, bonds and common stocks equivalents are traded by brokers and traders. Electronic stock exchange involves the usage of electronic terminals by traders to place orders on an exchange through their brokers. Speculative traders or speculato ...

Alan Hull`s tutorials in technical analysis Pattern Recognition

... Alan Hull is one of Australia’s leading Technical Analysts Alan has been trading and investing in Australian Blue Chip shares for decades and is one of Australia’s most respected Technical Analysts, Stockmarket expert and best selling author. He has appeared on Sky Business channel and is a keynote ...

... Alan Hull is one of Australia’s leading Technical Analysts Alan has been trading and investing in Australian Blue Chip shares for decades and is one of Australia’s most respected Technical Analysts, Stockmarket expert and best selling author. He has appeared on Sky Business channel and is a keynote ...

Sentiment Analysis and Earnings

... 4. A ratio of .85 is considered neutral sentiment because more people understand and use long calls and it is expected that there will be more orders for them. ...

... 4. A ratio of .85 is considered neutral sentiment because more people understand and use long calls and it is expected that there will be more orders for them. ...

iShares US Treasury Bond 7-10 Year JPY Hedged ETF

... - Because ETFs invest in securities whose prices fluctuate, the market price or base value may decrease due to shifts in the underling index or foreign exchange market, fluctuations in the price of constituent securities, bankruptcy or deterioration in the financial conditions of constituent securit ...

... - Because ETFs invest in securities whose prices fluctuate, the market price or base value may decrease due to shifts in the underling index or foreign exchange market, fluctuations in the price of constituent securities, bankruptcy or deterioration in the financial conditions of constituent securit ...

extended hours trading disclosure

... less liquidity, and wider bid/ask spreads than during regular market hours. Prior to participating in this unique extended hours session, you should review and be aware of the various risks and requirements involved with extended hours trading. For your convenience, below is a list ...

... less liquidity, and wider bid/ask spreads than during regular market hours. Prior to participating in this unique extended hours session, you should review and be aware of the various risks and requirements involved with extended hours trading. For your convenience, below is a list ...

Pengana Capital Funds

... This alpha is far more stable, consistent and predictable, he says. The range of returns and maximum peak to trough loss (or maximum drawdown) is far narrower and the correlation with the equity market is negative in a number of periods. As to the cost, Crowley says ‘beta is cheap, but it isn’t fre ...

... This alpha is far more stable, consistent and predictable, he says. The range of returns and maximum peak to trough loss (or maximum drawdown) is far narrower and the correlation with the equity market is negative in a number of periods. As to the cost, Crowley says ‘beta is cheap, but it isn’t fre ...

trading instructions

... the value of securities trade divided by the number of possible trading days equal to or higher than 1,000 BAM; the number of transactions in securities divided by the number of possible trading days equals to or higher than 3; the number of days when security was traded divided by the number ...

... the value of securities trade divided by the number of possible trading days equal to or higher than 1,000 BAM; the number of transactions in securities divided by the number of possible trading days equals to or higher than 3; the number of days when security was traded divided by the number ...

M.I.T. 15.460 Sloan School of Management Financial Engineering

... Financial Engineering Course Description This course provides an introduction to financial engineering. The course covers the following topics: asset pricing theory and its applications, financial optimization, market equilibrium, market frictions, dynamics trading strategies, risk management, and s ...

... Financial Engineering Course Description This course provides an introduction to financial engineering. The course covers the following topics: asset pricing theory and its applications, financial optimization, market equilibrium, market frictions, dynamics trading strategies, risk management, and s ...

Guidance for Market Operators

... There are now some additional powers that Local Authorities may adopt to control Markets and Car Boot Sales but regulations may vary from Borough to Borough in particular outside of the London Area. The Council's Street Enforcement Officer can be contacted by telephone if further details are require ...

... There are now some additional powers that Local Authorities may adopt to control Markets and Car Boot Sales but regulations may vary from Borough to Borough in particular outside of the London Area. The Council's Street Enforcement Officer can be contacted by telephone if further details are require ...

Networking Solutions for the Financial Trading Industry

... Despite their increased prominence and growing weight in the national GDP of many countries (US, Canada, etc.), the road ahead for financial institutions and the financial trading ecosystem that surrounds them is not without challenges. We will focus on three main areas of concern. First, government ...

... Despite their increased prominence and growing weight in the national GDP of many countries (US, Canada, etc.), the road ahead for financial institutions and the financial trading ecosystem that surrounds them is not without challenges. We will focus on three main areas of concern. First, government ...

3

... The price computation proceeds in unit time steps of one day. For the sake of simplicity, only one stock is traded in the market. The system has three main degrees of freedom, i.e. three state variables: the amount of cash in the system, the number of stocks in the system and the price of the stock. ...

... The price computation proceeds in unit time steps of one day. For the sake of simplicity, only one stock is traded in the market. The system has three main degrees of freedom, i.e. three state variables: the amount of cash in the system, the number of stocks in the system and the price of the stock. ...

05 October 2012 Dear Sirs, FIA European Principal Traders

... Total facts and circumstances As we have stated above, FIA EPTA is currently concerned that the cost of complying with these exemption provisions is just as onerous as the cost of complying with the short-sale restrictions without the exemption. Because the burden on market makers to obtain the exem ...

... Total facts and circumstances As we have stated above, FIA EPTA is currently concerned that the cost of complying with these exemption provisions is just as onerous as the cost of complying with the short-sale restrictions without the exemption. Because the burden on market makers to obtain the exem ...

March 2015 - Warnke/Nichols Ltd.

... of 2000 has experienced zero return over the last 15 years. And, adjusted for inflation, he’d still be about 25% below the 2000 highs. This is what happens when markets get extremely overvalued. The year 2000 NASDAQ was being driven by a mania in technology companies, in which many were going public ...

... of 2000 has experienced zero return over the last 15 years. And, adjusted for inflation, he’d still be about 25% below the 2000 highs. This is what happens when markets get extremely overvalued. The year 2000 NASDAQ was being driven by a mania in technology companies, in which many were going public ...

Security Analysis and Portfolio Management

... financial markets and exchanges representing a vast array of financial products. Some of these markets have always been open to private investors; others remained the exclusive domain of major international banks and financial professionals until the very end of the twentieth ...

... financial markets and exchanges representing a vast array of financial products. Some of these markets have always been open to private investors; others remained the exclusive domain of major international banks and financial professionals until the very end of the twentieth ...

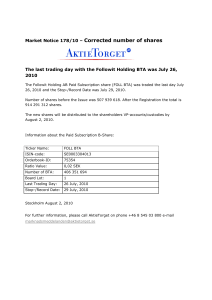

Market Notice 178/10 – Corrected number of shares

... The last trading day with the Followit Holding BTA was July 26, ...

... The last trading day with the Followit Holding BTA was July 26, ...

DOC - Europa.eu

... OPCOM for discriminating against EU electricity traders The European Commission has imposed a fine of just over € 1 million on S.C. OPCOM S.A. for abusing its dominant position in the Romanian market for facilitating electricity spot trading, in breach of EU antitrust rules. OPCOM operates the only ...

... OPCOM for discriminating against EU electricity traders The European Commission has imposed a fine of just over € 1 million on S.C. OPCOM S.A. for abusing its dominant position in the Romanian market for facilitating electricity spot trading, in breach of EU antitrust rules. OPCOM operates the only ...

Generali China - Unit Linked Growth

... meanwhile the real estate market is still getting worse in short-term and moreover the finance data is much worse than expectation. Base on the high frequency data and also referred to the macro-economy data over July, the economy had not show the strong signs of internal demands recovery The struct ...

... meanwhile the real estate market is still getting worse in short-term and moreover the finance data is much worse than expectation. Base on the high frequency data and also referred to the macro-economy data over July, the economy had not show the strong signs of internal demands recovery The struct ...