bolsas y mercados españoles, sistemas de negociación, sa

... Bearing in mind the different characteristics of the securities in question and based on whether the securities' market of origin or the market in which they are most liquid is open, the Market Supervisory Committee shall establish, through Operating Instructions, the market presence parameters for ...

... Bearing in mind the different characteristics of the securities in question and based on whether the securities' market of origin or the market in which they are most liquid is open, the Market Supervisory Committee shall establish, through Operating Instructions, the market presence parameters for ...

Performance Measurement

... • Objective (P&L, minimize transactions cost, timing, …) ©Schwartz, Sipress, Weber ...

... • Objective (P&L, minimize transactions cost, timing, …) ©Schwartz, Sipress, Weber ...

Williams Percent R (%R)

... used it to measure conditions of overbought and oversold; the overbought region being the area below 20% and the oversold region the area above 80%. With the ability to invert the values, it can be looked at in the same manner as other overbought/oversold indicators. Note: We will use the traditiona ...

... used it to measure conditions of overbought and oversold; the overbought region being the area below 20% and the oversold region the area above 80%. With the ability to invert the values, it can be looked at in the same manner as other overbought/oversold indicators. Note: We will use the traditiona ...

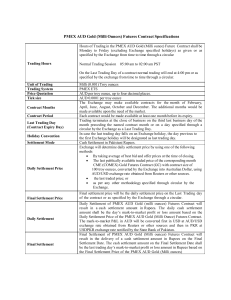

PMEX AUD Gold Futures Contract

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

risk periods and “extreme” market conditions

... • “Market Neutral” involves a mix of factor hedging (model/normal times) and “shock protection” strategies (build into the strategy extra convexity and insurance) __ “Turn this frown upside down, boy!” • Diversification to reduce specific shock risks (look across many ...

... • “Market Neutral” involves a mix of factor hedging (model/normal times) and “shock protection” strategies (build into the strategy extra convexity and insurance) __ “Turn this frown upside down, boy!” • Diversification to reduce specific shock risks (look across many ...

Market equilibrium and trading strategies with

... C measures the effect of noise shocks (u) on the price relative to the effect of information shocks (s). B measures the responsiveness of the price to information. It can be shown that the price responds less to information (s) than in the REE. Once again, the optimization problem of an informed tra ...

... C measures the effect of noise shocks (u) on the price relative to the effect of information shocks (s). B measures the responsiveness of the price to information. It can be shown that the price responds less to information (s) than in the REE. Once again, the optimization problem of an informed tra ...

Making ads responsible: How we enforce the advertising rules

... Trading Standards will act in a fair and proportionate way when making their decisions and in choosing which sanction would be appropriate to apply. Ultimately, however, it is down to you as the marketer to become compliant or the above-mentioned sanctions could be imposed. Marketers are encouraged ...

... Trading Standards will act in a fair and proportionate way when making their decisions and in choosing which sanction would be appropriate to apply. Ultimately, however, it is down to you as the marketer to become compliant or the above-mentioned sanctions could be imposed. Marketers are encouraged ...

New York Mercantile Exchange

... The basic principles of hedging can be used for many commodities for which no futures contract exists, because often they are similar to commodities that are traded. For example, diesel fuel and jet fuel are similar to heating oil, and the three are often priced within a few cents of each other. So, ...

... The basic principles of hedging can be used for many commodities for which no futures contract exists, because often they are similar to commodities that are traded. For example, diesel fuel and jet fuel are similar to heating oil, and the three are often priced within a few cents of each other. So, ...

Amazing Market Why does the stock market exist? The answer

... a portion of any earnings, while their potential loss was limited to the amount each had invested in a company's stock. As Hamilton had earlier recognized with government bonds, investors will buy new shares of stock only if they're able to sell them later on if they want their cash back. Here again ...

... a portion of any earnings, while their potential loss was limited to the amount each had invested in a company's stock. As Hamilton had earlier recognized with government bonds, investors will buy new shares of stock only if they're able to sell them later on if they want their cash back. Here again ...

Trade Scheduling in Equity Markets: Theory and Practice

... Stocks with higher bid-ask spreads tend to be more expensive to trade Volatile stocks tend to be more expensive to trade than stocks that stay in tight trading ranges Similar stocks in different countries and on different exchanges within a country may be more or less expensive, depending on e ...

... Stocks with higher bid-ask spreads tend to be more expensive to trade Volatile stocks tend to be more expensive to trade than stocks that stay in tight trading ranges Similar stocks in different countries and on different exchanges within a country may be more or less expensive, depending on e ...

Efficient Markets Lecture

... Market Efficiency is much less restrictive than market perfection. An efficient market allocates capital properly, given the costs of transactions, information etc. ...

... Market Efficiency is much less restrictive than market perfection. An efficient market allocates capital properly, given the costs of transactions, information etc. ...

Research Paper No. 58: A Review of the Global and Local

... uncertainties about US interest rate hikes – Although the US Fed had pledged to raise interest rates at a gradual pace, the actual pace for future rate hikes remains uncertain. There are worries that subsequent rate hikes could continue to be a drag on the global economy. Higher volatility in overse ...

... uncertainties about US interest rate hikes – Although the US Fed had pledged to raise interest rates at a gradual pace, the actual pace for future rate hikes remains uncertain. There are worries that subsequent rate hikes could continue to be a drag on the global economy. Higher volatility in overse ...

Endogenous Risk - RiskResearch.org

... The Brady Commission Report (1988) notes that whereas some portfolio insurers rebalanced several times per day, many others followed the strategy of rebalancing their portfolios once a day - at the open, based on prior day’s close. The sparse trading ensured that transaction costs would be low, but ...

... The Brady Commission Report (1988) notes that whereas some portfolio insurers rebalanced several times per day, many others followed the strategy of rebalancing their portfolios once a day - at the open, based on prior day’s close. The sparse trading ensured that transaction costs would be low, but ...

Downlaod File

... Fundamental analysis determines the intrinsic value of a stock by focusing and analyzing the company’s published financial statements, business environment, industry, competitors and other economic factors that can influence the supply and demand of the stock. ...

... Fundamental analysis determines the intrinsic value of a stock by focusing and analyzing the company’s published financial statements, business environment, industry, competitors and other economic factors that can influence the supply and demand of the stock. ...

Capital Markets

... listing of high-yield bonds (HYB) in Switzerland. This was particularly relevant since Swiss corporate issuers have been increasingly tapping the HYB market over the last few years (e.g., Sunrise, Swissport, gategroup, Orange, Schmolz + Bickenbach). Previously, the listing of HYB on the SIX Swiss Ex ...

... listing of high-yield bonds (HYB) in Switzerland. This was particularly relevant since Swiss corporate issuers have been increasingly tapping the HYB market over the last few years (e.g., Sunrise, Swissport, gategroup, Orange, Schmolz + Bickenbach). Previously, the listing of HYB on the SIX Swiss Ex ...

Mechanics of Trading Securities

... can be accomplished by a computerized system. In fact, some exchanges us an automated system for night trading. A more difficult issue is whether the more discretionary activities of specialist that involve trading for their own accounts, such as maintaining an orderly market, can be replicated by ...

... can be accomplished by a computerized system. In fact, some exchanges us an automated system for night trading. A more difficult issue is whether the more discretionary activities of specialist that involve trading for their own accounts, such as maintaining an orderly market, can be replicated by ...

Trading and Electronic Markets

... adoption of electronic trading strategies by proprietary traders, buy-side traders, and the electronic brokers that serve them. Proprietary traders include dealers, arbitrageurs, and various types of front runners—all of whom are profit-motivated traders. In contrast, buy-side traders trade to fill ...

... adoption of electronic trading strategies by proprietary traders, buy-side traders, and the electronic brokers that serve them. Proprietary traders include dealers, arbitrageurs, and various types of front runners—all of whom are profit-motivated traders. In contrast, buy-side traders trade to fill ...

Are Markets Efficient - NYU Stern School of Business

... the result of endlessly mining the vast financial data banks now available until they cough up some seemingly significant, but wholly spurious, relationship. Moreover, findings of underreaction appear in the data about as frequently as overreaction and so could be random occurrences consistent with ...

... the result of endlessly mining the vast financial data banks now available until they cough up some seemingly significant, but wholly spurious, relationship. Moreover, findings of underreaction appear in the data about as frequently as overreaction and so could be random occurrences consistent with ...

Wing Lung Automated Securities Trading Service User Guide HK

... If incorrect Phone Banking PIN is input more than 4 times, the Automated Securities Trading (“AST”) Service (“system”) will be suspended and the customer will have to come to our Head Office or any one of our branches in person to re-activate the service. ...

... If incorrect Phone Banking PIN is input more than 4 times, the Automated Securities Trading (“AST”) Service (“system”) will be suspended and the customer will have to come to our Head Office or any one of our branches in person to re-activate the service. ...

PPT

... Buy a large number of stocks (like a mutual fund) and hold them. Your rate of return will be the market average so you couldn’t do better by trying to pick stocks. You are diversified so you are minimizing risk. ...

... Buy a large number of stocks (like a mutual fund) and hold them. Your rate of return will be the market average so you couldn’t do better by trying to pick stocks. You are diversified so you are minimizing risk. ...

First North Price List

... by multiplying the number of shares by the closing prices for all trading days of the previous calendar year. Upon admission for trade, the market value of shares is calculated as the product of the number of shares and the weighted average price of transactions recorded with the Estonian CSD during ...

... by multiplying the number of shares by the closing prices for all trading days of the previous calendar year. Upon admission for trade, the market value of shares is calculated as the product of the number of shares and the weighted average price of transactions recorded with the Estonian CSD during ...

Presentation - NCDEX Institute of Commodity Markets and Research

... National Agricultural Policy, 2000. ...

... National Agricultural Policy, 2000. ...

strong trading and a successful transition

... IMPROVED TRADING IN METALS AND MINERALS The market for metals and minerals continues to present significant challenges, not least the uncertainties over the precise path of growth in China. However, there were more positive signs in some segments during the first half. In zinc concentrates, a long-a ...

... IMPROVED TRADING IN METALS AND MINERALS The market for metals and minerals continues to present significant challenges, not least the uncertainties over the precise path of growth in China. However, there were more positive signs in some segments during the first half. In zinc concentrates, a long-a ...

securities trading policy

... reveal any confidential information concerning the Company, use that information in any way that may injure or cause loss to the Company, or use that confidential information to gain an advantage for themselves or someone else. ...

... reveal any confidential information concerning the Company, use that information in any way that may injure or cause loss to the Company, or use that confidential information to gain an advantage for themselves or someone else. ...