Perfect Competition – Economics of Competitive Markets

... 1. Many sellers in the market - each of whom produce a low percentage of market output and cannot influence the prevailing market price – each firm in this market is a price taker 2. Many individual buyers - none has any control over the market price 3. Perfect freedom of entry and exit from the ind ...

... 1. Many sellers in the market - each of whom produce a low percentage of market output and cannot influence the prevailing market price – each firm in this market is a price taker 2. Many individual buyers - none has any control over the market price 3. Perfect freedom of entry and exit from the ind ...

February 2017 - SIX Swiss Exchange

... SIX Swiss Exchange SIX Swiss Exchange is one of the leading exchanges in Europe. It connects companies from around the world with international investors and trading participants. It creates particularly market-oriented framework conditions for listing and trading in its highly liquid segments. SIX ...

... SIX Swiss Exchange SIX Swiss Exchange is one of the leading exchanges in Europe. It connects companies from around the world with international investors and trading participants. It creates particularly market-oriented framework conditions for listing and trading in its highly liquid segments. SIX ...

Principles of Microeconomics - Oman College of Management

... The government gives a single firm the exclusive right to produce some good. Governments may restrict entry by giving a single firm the exclusive right to sell a particular good in certain markets. Patent and copyright laws are two important examples of how government creates a monopoly to serve the ...

... The government gives a single firm the exclusive right to produce some good. Governments may restrict entry by giving a single firm the exclusive right to sell a particular good in certain markets. Patent and copyright laws are two important examples of how government creates a monopoly to serve the ...

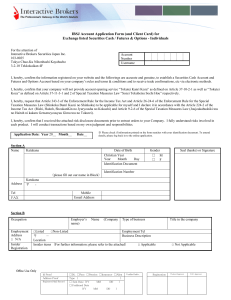

IBSJ Account Application Form (and Client Card) for Exchange listed

... Interactive Brokers (“IB”) can maintain its low commission structure because we have built automated trade processes to minimize human intervention and discretion. In this respect, we have established some simple terms which govern trading in all IB accounts. These rules recognize that from time to ...

... Interactive Brokers (“IB”) can maintain its low commission structure because we have built automated trade processes to minimize human intervention and discretion. In this respect, we have established some simple terms which govern trading in all IB accounts. These rules recognize that from time to ...

To calculate historical volatility

... The latter formula for historical volatility is statistically called a non-centered approach. Traders commonly use it because it is closer to what would actually affect their profits and losses. It also performs better when n is small or when there is a strong trend in the stock in question. In othe ...

... The latter formula for historical volatility is statistically called a non-centered approach. Traders commonly use it because it is closer to what would actually affect their profits and losses. It also performs better when n is small or when there is a strong trend in the stock in question. In othe ...

CH05

... • Stop order: Specifies a particular market price at which a market order takes effect (e.g., a stop order to sell at $50 becomes a market order to sell as soon as the market price reaches (or declines to) $50. • A sell stop order can be used to protect a profit in the case of a price decline ...

... • Stop order: Specifies a particular market price at which a market order takes effect (e.g., a stop order to sell at $50 becomes a market order to sell as soon as the market price reaches (or declines to) $50. • A sell stop order can be used to protect a profit in the case of a price decline ...

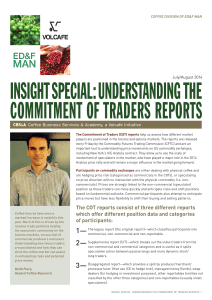

The COT reports consist of three different reports

... five-year average (14%), but lower that the five-year high of 24% (reached in October of 2010). This suggests that investors anticipate prices may increase and are positioned to realize profits in such a move. It also indicates the potential for the speculator position to grow on further buying yet ...

... five-year average (14%), but lower that the five-year high of 24% (reached in October of 2010). This suggests that investors anticipate prices may increase and are positioned to realize profits in such a move. It also indicates the potential for the speculator position to grow on further buying yet ...

a-team-dec-2016

... Proper software can replay market data with multiple algo’s at original rates, latencies, or alter (ex: speed-up, change dynamics, algo goals, etc). Many Mkt Data vendors provide this service ...

... Proper software can replay market data with multiple algo’s at original rates, latencies, or alter (ex: speed-up, change dynamics, algo goals, etc). Many Mkt Data vendors provide this service ...

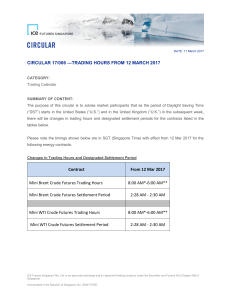

Trading hours from 12 March 2017

... CIRCULAR 17/006 —TRADING HOURS FROM 12 MARCH 2017 CATEGORY: Trading Calendar ...

... CIRCULAR 17/006 —TRADING HOURS FROM 12 MARCH 2017 CATEGORY: Trading Calendar ...

Heding Grain Production with Futures

... production. Had corn price been higher over the duration of the hedge, he would have sold his crop at a higher price, but that would have been offset by loss on the future transaction. July 1: Sold 20 December corn at $6.00 November 1: Bought 20 December corn at $4.50 Profit equals: 20 contracts x $ ...

... production. Had corn price been higher over the duration of the hedge, he would have sold his crop at a higher price, but that would have been offset by loss on the future transaction. July 1: Sold 20 December corn at $6.00 November 1: Bought 20 December corn at $4.50 Profit equals: 20 contracts x $ ...

TSO preferred start time of WD Trading Day

... relates to the time of the peak demand. As shown in the demand curves below, in summer the peak typically happens at lunchtime but on occasion a peak of similar or greater magnitude happens in the evening. In the late spring and early autumn, the demand is consistently high from lunchtime till the l ...

... relates to the time of the peak demand. As shown in the demand curves below, in summer the peak typically happens at lunchtime but on occasion a peak of similar or greater magnitude happens in the evening. In the late spring and early autumn, the demand is consistently high from lunchtime till the l ...

(Platts) Crack Spread (1000mt) BALMO Futures

... Crude Oil Futures first nearby contract settlement price, starting from the selected start date through the end of the contract month, inclusively (using Non-common pricing). The settlement price of the first nearby Brent Crude Oil Futures contract month will be used except on the last day of tradin ...

... Crude Oil Futures first nearby contract settlement price, starting from the selected start date through the end of the contract month, inclusively (using Non-common pricing). The settlement price of the first nearby Brent Crude Oil Futures contract month will be used except on the last day of tradin ...

Chapter 14: Market efficiency

... • On Palm’s IPO day, the price per share went from $38 (offer price) to $95.06. – Palm’s market cap was $54.3 billion – 3Com’s market cap was $28 billion ...

... • On Palm’s IPO day, the price per share went from $38 (offer price) to $95.06. – Palm’s market cap was $54.3 billion – 3Com’s market cap was $28 billion ...

Controlling Institutional Trading Costs

... outsource services in a manner that keeps the cost unobservable to investors. This is accomplished through the trading process. Institutions can legally fund the most basic aspects of their operations out of client assets by paying higher trading commissions, and receiving non-traderelated services ...

... outsource services in a manner that keeps the cost unobservable to investors. This is accomplished through the trading process. Institutions can legally fund the most basic aspects of their operations out of client assets by paying higher trading commissions, and receiving non-traderelated services ...

CCT-eu: a new type of nominal floating rate bonds, indexed to

... auction system to carry out the issuance program of this new class of securities. From June 2010 onwards MEF offered investors the possibility to exchange current CCTs with new CCTs-eu, both during the syndicated deals and standard exchange transactions reserved to the Specialists in Government Bond ...

... auction system to carry out the issuance program of this new class of securities. From June 2010 onwards MEF offered investors the possibility to exchange current CCTs with new CCTs-eu, both during the syndicated deals and standard exchange transactions reserved to the Specialists in Government Bond ...

2.2 The Formal Set-Up

... As anticipated in Lecture 1, it is desirable that the mathematical model of a financial market satisfies some reasonable economic principles. In the following, we see three related criteria, the strongest of which will be taken as assumption for the models we study. Definition 2.3. A trading strateg ...

... As anticipated in Lecture 1, it is desirable that the mathematical model of a financial market satisfies some reasonable economic principles. In the following, we see three related criteria, the strongest of which will be taken as assumption for the models we study. Definition 2.3. A trading strateg ...

What do we know about high-frequency trading?

... but those formulating policy should be especially careful not to reverse the liquidity improvements of the last twenty years. Many HFT strategies are not new. They are simply familiar trading strategies updated for an automated environment. For example, many HFTs make markets using the same business ...

... but those formulating policy should be especially careful not to reverse the liquidity improvements of the last twenty years. Many HFT strategies are not new. They are simply familiar trading strategies updated for an automated environment. For example, many HFTs make markets using the same business ...

O novo mercado ea regulamentação

... At present, there is a project within the National Congress to reform the Corporate Law, aimed at adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater ...

... At present, there is a project within the National Congress to reform the Corporate Law, aimed at adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater ...

IRRI-6 Weekly

... stitched. No tare allowance will be applicable. Karachi or Port Qasim at Exchange approved and designated warehouses. The Exchange will notify in advance the contract weeks available for IRRI-6 Rice futures. Trading in any contract will open at least one week before the last trading day. Contracts w ...

... stitched. No tare allowance will be applicable. Karachi or Port Qasim at Exchange approved and designated warehouses. The Exchange will notify in advance the contract weeks available for IRRI-6 Rice futures. Trading in any contract will open at least one week before the last trading day. Contracts w ...

The Dual-Listing Law:

... Dual-listing on the TASE provides many benefits for U.S/U.K.-traded Israeli companies and for investors, as well as for the Israeli securities industry as a whole. The dual-listing law enables companies to list easily and at no cost. Thirty-seven companies have dual-listed on the TASE since October ...

... Dual-listing on the TASE provides many benefits for U.S/U.K.-traded Israeli companies and for investors, as well as for the Israeli securities industry as a whole. The dual-listing law enables companies to list easily and at no cost. Thirty-seven companies have dual-listed on the TASE since October ...

IBD MEETUP/NORTHRIDGE

... • Get up an hour before the market opens, switch on the computer, go online and immediately log into one of the popular trading chat rooms or message boards. • When looking at these boards, focus on stocks that are generating a significant amount of buzz. Look at stocks that are the focus of trading ...

... • Get up an hour before the market opens, switch on the computer, go online and immediately log into one of the popular trading chat rooms or message boards. • When looking at these boards, focus on stocks that are generating a significant amount of buzz. Look at stocks that are the focus of trading ...

Trading Decision Maker: Stock Trading Decision by Price Series

... 3. Setting of Experiments In our experiments, we use the Taiwan Stock Exchange Capitalization Weighted Index (TAIEX) price series from 1995 to 2003. The experimental data set collected from 1995 to 2000, was used in the parameter selection procedure, while other data collected from 2001 to 2003 was ...

... 3. Setting of Experiments In our experiments, we use the Taiwan Stock Exchange Capitalization Weighted Index (TAIEX) price series from 1995 to 2003. The experimental data set collected from 1995 to 2000, was used in the parameter selection procedure, while other data collected from 2001 to 2003 was ...

Regional Equity Market Integration in South America

... By the time Phase II of the integration is complete, individual investors will have direct access to markets in all three countries. Benefits for investors include portfolio diversification & a reduction of transaction costs, while stock issuers benefit primarily from greater access to capital marke ...

... By the time Phase II of the integration is complete, individual investors will have direct access to markets in all three countries. Benefits for investors include portfolio diversification & a reduction of transaction costs, while stock issuers benefit primarily from greater access to capital marke ...

Markets Update - Salford City Council

... 6.2.2 Previous reports have referred to improving the market facilities and links to Salford Shopping City as a way of addressing the general decline in markets caused by changed shopping habits, Sunday trading and competition from other shopping attractions. 6.2.3 Discussions held with representati ...

... 6.2.2 Previous reports have referred to improving the market facilities and links to Salford Shopping City as a way of addressing the general decline in markets caused by changed shopping habits, Sunday trading and competition from other shopping attractions. 6.2.3 Discussions held with representati ...

hw1-adam

... capable of outperforming a human in the world of asset management; however, Renaissance’s success with quantitative computer strategies may not be the best model for everyone. In fact, we know that if everyone were to trade according to such rules, the financial system would become highly unstable. ...

... capable of outperforming a human in the world of asset management; however, Renaissance’s success with quantitative computer strategies may not be the best model for everyone. In fact, we know that if everyone were to trade according to such rules, the financial system would become highly unstable. ...