File: Ch04, Chapter 4 Securities Markets Type: Multiple Choice 1

... EASY Response: The chief function of capital markets is to allocate resources optimally, with investors providing companies with the capital necessary to expand their operations. Section: The Importance of Financial Markets. ...

... EASY Response: The chief function of capital markets is to allocate resources optimally, with investors providing companies with the capital necessary to expand their operations. Section: The Importance of Financial Markets. ...

list of eu regulated markets - Agencija za trg vrednostnih papirjev

... Article 47 of Directive 2004/39/EC requires that each Member State maintains an updated list of regulated markets authorised by it. This information should be communicated to other Member States and the European Commission. Under the same Article (Article 47 of Directive 2004/39/EC), the Commission ...

... Article 47 of Directive 2004/39/EC requires that each Member State maintains an updated list of regulated markets authorised by it. This information should be communicated to other Member States and the European Commission. Under the same Article (Article 47 of Directive 2004/39/EC), the Commission ...

Securities Trading Policy

... pass on information to any person, if you know or ought to reasonably know that the person may use the information to buy, sell or otherwise deal (or procure another person to buy, sell or otherwise deal) in Metals X securities. ...

... pass on information to any person, if you know or ought to reasonably know that the person may use the information to buy, sell or otherwise deal (or procure another person to buy, sell or otherwise deal) in Metals X securities. ...

STOCCER – A Forecasting Market for the FIFA World

... STOCCER is highly dynamic. New markets and stocks can be added during the tournament. This is required since we plan to trade stocks for several rounds, such as quarter finals, and it is not known in advance which teams will in the end take part in those rounds. Giving out new stocks can be done in ...

... STOCCER is highly dynamic. New markets and stocks can be added during the tournament. This is required since we plan to trade stocks for several rounds, such as quarter finals, and it is not known in advance which teams will in the end take part in those rounds. Giving out new stocks can be done in ...

No news is bad news - CIS @ UPenn

... launch news flow products is now on. Investment firms can now either do this in-house using text analytic software or buy pre-processed data services from the vendors. ...

... launch news flow products is now on. Investment firms can now either do this in-house using text analytic software or buy pre-processed data services from the vendors. ...

Competitive Analysis of On-line Securities Investment

... knowledge of each alternative’s future worth. The finance management problem has attracted substantial attention lately due to the coexistence of high returns and high risks. Like many other ongoing financial activities, securities investing must be carried out in an on-line fashion, with no secure kn ...

... knowledge of each alternative’s future worth. The finance management problem has attracted substantial attention lately due to the coexistence of high returns and high risks. Like many other ongoing financial activities, securities investing must be carried out in an on-line fashion, with no secure kn ...

Profitability of Pairs Trading Strategy

... stocks whose prices move together over an indicated historical time period. If the pair prices deviate wide enough, the strategy calls for shorting the increasing-price security, while simultaneously buying the declining-price security. The idea behind the pair trade is to profit from convergence fo ...

... stocks whose prices move together over an indicated historical time period. If the pair prices deviate wide enough, the strategy calls for shorting the increasing-price security, while simultaneously buying the declining-price security. The idea behind the pair trade is to profit from convergence fo ...

Trading Behaviors Under Floating Exchange Rate System: An Analysis of South Korea’s Financial Market

... Most previous papers focus on the impacts of exchange rate volatility on stock prices and returns; for example, Chen and Shen (2004) investigate the inter-linkages between Taiwan’s stock and exchange rate markets. Their results show that unrestricted trading volumes reveal more information regarding ...

... Most previous papers focus on the impacts of exchange rate volatility on stock prices and returns; for example, Chen and Shen (2004) investigate the inter-linkages between Taiwan’s stock and exchange rate markets. Their results show that unrestricted trading volumes reveal more information regarding ...

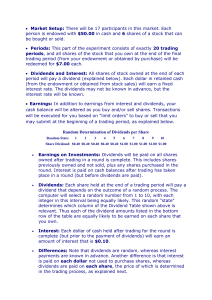

Experimental Instructions

... interest rate. The dividends may not be known in advance, but the interest rate will be known. Earnings: In addition to earnings from interest and dividends, your cash balance will be altered as you buy and/or sell shares. Transactions will be executed for you based on "limit orders" to buy or sel ...

... interest rate. The dividends may not be known in advance, but the interest rate will be known. Earnings: In addition to earnings from interest and dividends, your cash balance will be altered as you buy and/or sell shares. Transactions will be executed for you based on "limit orders" to buy or sel ...

Self Regulation - Superfinanciera

... The US Experience Ethiopis Tafara US Securities & Exchange Commission ...

... The US Experience Ethiopis Tafara US Securities & Exchange Commission ...

Bombay Stock Exchange Limited

... recognised stock exchanges for dissemination, atleast fifteen days prior to the general body meeting where approval of shareholders is being sought for the proposed private placement; BSE-SME Institutional Trading Platform ...

... recognised stock exchanges for dissemination, atleast fifteen days prior to the general body meeting where approval of shareholders is being sought for the proposed private placement; BSE-SME Institutional Trading Platform ...

High frequency trading: assessing the impact on market

... The abolishment of the concentration rule, under which, in some European countries, required all trades to go through a regulated exchange, ensured that there would be greater competition amongst trading venues in Europe. Provisions in MiFID to allow competing structures (multilateral trade faciliti ...

... The abolishment of the concentration rule, under which, in some European countries, required all trades to go through a regulated exchange, ensured that there would be greater competition amongst trading venues in Europe. Provisions in MiFID to allow competing structures (multilateral trade faciliti ...

Securities Trading Policy

... holder of Identity Card number (__) issued by (__), hereafter referred to as "Declarant", as (__) of (__), a legal entity of private law, established on (__) (__), in (__), in the State of (__), enrolled in the National Register of Legal Entities of the Ministry of Finance (CNPJ) under number (__), ...

... holder of Identity Card number (__) issued by (__), hereafter referred to as "Declarant", as (__) of (__), a legal entity of private law, established on (__) (__), in (__), in the State of (__), enrolled in the National Register of Legal Entities of the Ministry of Finance (CNPJ) under number (__), ...

Rational Expectations Lecture

... Consumer demand for a product is a linear function of price, and that market pre-testing has established: ...

... Consumer demand for a product is a linear function of price, and that market pre-testing has established: ...

ASX Operating Rules Section 01

... which might interfere with the operational efficiency or proper functioning of the Trading Platform; and ...

... which might interfere with the operational efficiency or proper functioning of the Trading Platform; and ...

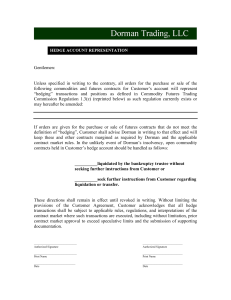

Hedge Accounts - Dorman Trading

... Notwithstanding the foregoing, no transactions or positions shall be classified as bona fide hedging for purposes of section 4a of the Act unless their purpose is to offset price risks incidental to commercial cash or spot operations and such positions are established and liquidated in an orderly ma ...

... Notwithstanding the foregoing, no transactions or positions shall be classified as bona fide hedging for purposes of section 4a of the Act unless their purpose is to offset price risks incidental to commercial cash or spot operations and such positions are established and liquidated in an orderly ma ...

Professor Venkatesh Panchapagesan

... This course examines the theory and practice behind the organization of world’s major financial markets. Students will learn about key economic principles that drive wellfunctioning financial markets along with practical, institutional details necessary to navigate them. The course covers equity, de ...

... This course examines the theory and practice behind the organization of world’s major financial markets. Students will learn about key economic principles that drive wellfunctioning financial markets along with practical, institutional details necessary to navigate them. The course covers equity, de ...

Topic Note-Market efficiency

... securities. Investors who invest in these funds thus invest in a large portfolio, whose composition is changed from time to time at the discretion of the managers of these funds. Mutual funds claim that they provide two kinds of services to their clients: First, they help an investor to diversify, t ...

... securities. Investors who invest in these funds thus invest in a large portfolio, whose composition is changed from time to time at the discretion of the managers of these funds. Mutual funds claim that they provide two kinds of services to their clients: First, they help an investor to diversify, t ...

OTAS Technologies to integrate cutting

... OTAS Core alerts you to hidden risks and opportunity in your portfolio or your watch list which you would normally find concealed in market data. The information is presented in a format designed for market professionals working under pressure in difficult markets. Important information can be conce ...

... OTAS Core alerts you to hidden risks and opportunity in your portfolio or your watch list which you would normally find concealed in market data. The information is presented in a format designed for market professionals working under pressure in difficult markets. Important information can be conce ...

Full article text

... concept of the self-fulfilling prophecy was first developed by Merton who characterized the self-fulfilling prophecy as an initially incorrect definition of a situation triggering new actions which then verify the initial false conception. In a recent questionnaire survey of foreign exchange profess ...

... concept of the self-fulfilling prophecy was first developed by Merton who characterized the self-fulfilling prophecy as an initially incorrect definition of a situation triggering new actions which then verify the initial false conception. In a recent questionnaire survey of foreign exchange profess ...

HEADER: XTX Markets joins Aquis Exchange as a member firm XTX

... Facility. The Aquis MTF uses a subscription pricing model which works by charging users according to the message traffic they generate, rather than a percentage of the value of each stock that they trade. Aquis operates a lit order book and does not allow aggressive non-client proprietary trading, t ...

... Facility. The Aquis MTF uses a subscription pricing model which works by charging users according to the message traffic they generate, rather than a percentage of the value of each stock that they trade. Aquis operates a lit order book and does not allow aggressive non-client proprietary trading, t ...

Presentation

... consistent across the sector, prices themselves vary widely among carriers. On major routes, the highest price was often four times the lowest price ...

... consistent across the sector, prices themselves vary widely among carriers. On major routes, the highest price was often four times the lowest price ...

Basics with Equity Market Neutral

... still today continue to benefit from key characteristics of the strategy. The market crisis in particular has strengthened many of the benefits offered by equity market neutral. For example, equity market neutral occupies a distinct place in the hedge fund landscape by exhibiting one of the lowest c ...

... still today continue to benefit from key characteristics of the strategy. The market crisis in particular has strengthened many of the benefits offered by equity market neutral. For example, equity market neutral occupies a distinct place in the hedge fund landscape by exhibiting one of the lowest c ...

Weekly Economic Update

... performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or ...

... performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or ...