Instructions for Setting Up and Operating Firebird

... trending up, then the trend line should be under the price action and similarly for a market trending down. ...

... trending up, then the trend line should be under the price action and similarly for a market trending down. ...

Risk management through introduction of futures contracts in tea

... producers to insure themselves against price risk. • However, informal systems of entering into forward contracts with reputed buyers of bulk tea already exist in the Indian market and for futures contracts to be used popularly as a hedge, they would have to offer superior cover compared to the exis ...

... producers to insure themselves against price risk. • However, informal systems of entering into forward contracts with reputed buyers of bulk tea already exist in the Indian market and for futures contracts to be used popularly as a hedge, they would have to offer superior cover compared to the exis ...

Evaluation of the performance of a pairs trading strategy of JSE

... This paper aims to investigate the profitability of a pairs trading strategy on the Johannesburg Securities Exchange using the distance approach. It builds on similar studies done by Perlin (2006). This study will aim to prove whether or not a pairs trading strategy is profitable by using a model de ...

... This paper aims to investigate the profitability of a pairs trading strategy on the Johannesburg Securities Exchange using the distance approach. It builds on similar studies done by Perlin (2006). This study will aim to prove whether or not a pairs trading strategy is profitable by using a model de ...

Financial Markets in Electricity: Introduction to Derivative Instruments

... Spread: The difference between the price of one futures, forward or spot market and the price on another (usually related) futures, forward, or spot market. For example, an electricity generator may wish to wishes to guarantee a minimum difference between the cost of his fuel and the price of electr ...

... Spread: The difference between the price of one futures, forward or spot market and the price on another (usually related) futures, forward, or spot market. For example, an electricity generator may wish to wishes to guarantee a minimum difference between the cost of his fuel and the price of electr ...

The Market Microstructure Approach to Foreign Exchange: Looking

... analysis of floating exchange rates. This view is best appreciated in terms of Karl Popper’s depiction of the progress of science. For Popper, science is an evolutionary process in which theories are proposed, falsified by evidence, and then improved in light of the evidence. Such criticism is an es ...

... analysis of floating exchange rates. This view is best appreciated in terms of Karl Popper’s depiction of the progress of science. For Popper, science is an evolutionary process in which theories are proposed, falsified by evidence, and then improved in light of the evidence. Such criticism is an es ...

Title Is Times New Roman 28 Pt., Line Spacing .9 Lines

... Sweden, Switzerland, the United Kingdom and the United States. An investment cannot be made directly in a market index. ...

... Sweden, Switzerland, the United Kingdom and the United States. An investment cannot be made directly in a market index. ...

NextShares Display Guidelines

... Nasdaq makes available trade and quote prices in the NAV-based display format on the Nasdaq Basic (QBBO), Nasdaq Last Sale (NLS) and NLS Plus data feeds. The increment/decrement from NAV may also be determined by deducting $100.00 from disseminated proxy prices. IIVs and NAVs For each NextShares fun ...

... Nasdaq makes available trade and quote prices in the NAV-based display format on the Nasdaq Basic (QBBO), Nasdaq Last Sale (NLS) and NLS Plus data feeds. The increment/decrement from NAV may also be determined by deducting $100.00 from disseminated proxy prices. IIVs and NAVs For each NextShares fun ...

Presentation

... If they see an opportunity for exploiting a misaligned price without taking a risk, and after accounting for the opportunity cost of funds that are required to be deployed, they will seize it and exploit it to the hilt. ...

... If they see an opportunity for exploiting a misaligned price without taking a risk, and after accounting for the opportunity cost of funds that are required to be deployed, they will seize it and exploit it to the hilt. ...

Stock Market Efficiency and Insider Trading Kris McKinley, Elon

... to the executive level an individual must have confidence in themselves and their ability to perform well in the future. This can be seen in Michael Eisner’s (CEO of Disney) comment about his ability to face challenges. “No obstacle ever seemed too difficult to surmount.” Maybe this confidence, whic ...

... to the executive level an individual must have confidence in themselves and their ability to perform well in the future. This can be seen in Michael Eisner’s (CEO of Disney) comment about his ability to face challenges. “No obstacle ever seemed too difficult to surmount.” Maybe this confidence, whic ...

ethiopian commodity exchange - Making The Connection: Value

... ‘to build a world class institution signaling Ethiopia’s entry into a modern global market’; ...

... ‘to build a world class institution signaling Ethiopia’s entry into a modern global market’; ...

Document

... – speculating on the basis means an investor will want to be either • short in the futures contract and long in the spot market, or • long in the futures contract and short in the spot market ...

... – speculating on the basis means an investor will want to be either • short in the futures contract and long in the spot market, or • long in the futures contract and short in the spot market ...

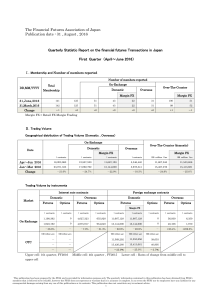

The Financial Futures Association of Japan Publication date : 31

... Open position of the overall FX margin trading transactions at the end of the first quarter was down due to Brexit shock. On the other hand, the open interest both of on-exchange currency related options and interest related options increased from the previous term. ...

... Open position of the overall FX margin trading transactions at the end of the first quarter was down due to Brexit shock. On the other hand, the open interest both of on-exchange currency related options and interest related options increased from the previous term. ...

Binomial Model - UCSD Mathematics

... The following theorem is the multi-period analogue of the single period Theorem 2.2.1. First we specify the notion of arbitrage in stock, bond and contingent claim to be used in the multi-period context. Let C0 be the price charged for the contingent claim at time zero. Since we are only specifying ...

... The following theorem is the multi-period analogue of the single period Theorem 2.2.1. First we specify the notion of arbitrage in stock, bond and contingent claim to be used in the multi-period context. Let C0 be the price charged for the contingent claim at time zero. Since we are only specifying ...

An approach on how to trade in commodities market

... that investment gives you and whether those returns beat inflation. We always crib about inflation; inflation means things getting expensive; products like pulses, oil, gold, silver, spices, cotton all keep on getting expensive. So when you invest in these commodities through futures trading, you ar ...

... that investment gives you and whether those returns beat inflation. We always crib about inflation; inflation means things getting expensive; products like pulses, oil, gold, silver, spices, cotton all keep on getting expensive. So when you invest in these commodities through futures trading, you ar ...

TA Pai Management Institute - Xavier Institute of Management

... If they see an opportunity for exploiting a misaligned price without taking a risk, and after accounting for the opportunity cost of funds that are required to be deployed, they will seize it and exploit it to the hilt. ...

... If they see an opportunity for exploiting a misaligned price without taking a risk, and after accounting for the opportunity cost of funds that are required to be deployed, they will seize it and exploit it to the hilt. ...

FINAL NOTICE: Michael Coscia

... United States through a Direct Market Access provider 2. This Notice is concerned with trading by Mr Coscia which was conducted on his own proprietary account. 8. Mr Coscia traded the following products on ICE during the Relevant Period: a. ...

... United States through a Direct Market Access provider 2. This Notice is concerned with trading by Mr Coscia which was conducted on his own proprietary account. 8. Mr Coscia traded the following products on ICE during the Relevant Period: a. ...

How Wave-Wavelet Trading Wins and" Beats" the Market

... last part of the paper shows that the answer to Problem 3 is actually a “YES”, which is quite surprising. The trading strategies presented are based mainly on information obtained from the movements of waves and wavelets created by large and small fluctuations of market prices. They do not involve a ...

... last part of the paper shows that the answer to Problem 3 is actually a “YES”, which is quite surprising. The trading strategies presented are based mainly on information obtained from the movements of waves and wavelets created by large and small fluctuations of market prices. They do not involve a ...

Lecture Presentation to accompany Investment

... • This implies that many insiders had private information from which they derived above-average returns on their company stock • Studies showed that public investors who traded with the insiders based on announced transactions would have enjoyed excess risk-adjusted returns (after commissions), but ...

... • This implies that many insiders had private information from which they derived above-average returns on their company stock • Studies showed that public investors who traded with the insiders based on announced transactions would have enjoyed excess risk-adjusted returns (after commissions), but ...

Title Is Times New Roman 28 Pt., Line Spacing .9 Lines

... In economics, a Consumer Price Index (CPI, also retail price index) is a statistical measure of a weighted average of prices of a specified set of goods and services purchased by wage earners in urban areas. It is a price index that tracks the prices of a specified set of consumer goods and services ...

... In economics, a Consumer Price Index (CPI, also retail price index) is a statistical measure of a weighted average of prices of a specified set of goods and services purchased by wage earners in urban areas. It is a price index that tracks the prices of a specified set of consumer goods and services ...

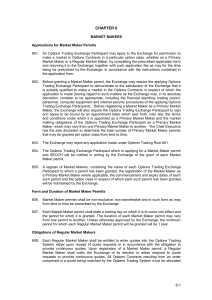

Market Makers

... 614D. A Market Maker wishing to conduct Options Hedging Short Selling shall notify the Exchange of its intention. A Market Maker may also apply to the Exchange to register one or more Exchange Participants as its Options Hedging Participants which will conduct on its behalf Options Hedging Transact ...

... 614D. A Market Maker wishing to conduct Options Hedging Short Selling shall notify the Exchange of its intention. A Market Maker may also apply to the Exchange to register one or more Exchange Participants as its Options Hedging Participants which will conduct on its behalf Options Hedging Transact ...

contracts 9,899,780,283 traded

... participated in the top five list all six years. Monep, which became part of Paris Bourse, was in fifth place in 1999; Paris Bourse was in third and fourth place in 2000 and 2001 respectively. Euronext appeared first on the list in 2002 in the number three spot which it held onto in 2003 before drop ...

... participated in the top five list all six years. Monep, which became part of Paris Bourse, was in fifth place in 1999; Paris Bourse was in third and fourth place in 2000 and 2001 respectively. Euronext appeared first on the list in 2002 in the number three spot which it held onto in 2003 before drop ...

David Gray Remarks CBOE Update OIC Conference, Miami, Florida

... The addition of MSCI, FTSE and Russell options to a product suite that includes SPX options and VIX options and futures enables investors to hedge and trade global volatility, the global stock market, the broad U.S. stock market, U.S. small caps, European and Asian international equities and the wor ...

... The addition of MSCI, FTSE and Russell options to a product suite that includes SPX options and VIX options and futures enables investors to hedge and trade global volatility, the global stock market, the broad U.S. stock market, U.S. small caps, European and Asian international equities and the wor ...

URNER BARRY MARKET REPORTING GUIDELINES

... Urner Barry Publications, Inc. is the oldest commodity market news reporting service in America. Roots of the company date back to 1858, when one of the founders, Benjamin Urner, published the first issue of the Producers’ Price-Current. Benjamin Urner owned a printing shop in New York’s Washington ...

... Urner Barry Publications, Inc. is the oldest commodity market news reporting service in America. Roots of the company date back to 1858, when one of the founders, Benjamin Urner, published the first issue of the Producers’ Price-Current. Benjamin Urner owned a printing shop in New York’s Washington ...

The Microstructure of Foreign Exchange Markets

... markets having microstructures that differ in some ways makes it less likely that microstructure-based models will help explain away these empirical problems. On the other hand, the markets also have some similarities, which might hold the key to the problem. A second reason to study market microstr ...

... markets having microstructures that differ in some ways makes it less likely that microstructure-based models will help explain away these empirical problems. On the other hand, the markets also have some similarities, which might hold the key to the problem. A second reason to study market microstr ...

Word - HIMIPref

... Ontario’s highest marginal tax-bracket has historically been about 50bp higher through an investment in preferred shares vs. corporate bonds – with return figures calculated using index values and therefore ignoring the potential for excess returns in what remains a highly inefficient marketplace. A ...

... Ontario’s highest marginal tax-bracket has historically been about 50bp higher through an investment in preferred shares vs. corporate bonds – with return figures calculated using index values and therefore ignoring the potential for excess returns in what remains a highly inefficient marketplace. A ...