Finding a new balance with alternatives

... of categories (see Exhibit 2). Investors may not know what they’re getting. To meet today’s diversification challenges, investors will need to distinguish liquid alternative strategies that rely on new market exposure, such as volatility and frontier markets, and those that rely on manager skill, su ...

... of categories (see Exhibit 2). Investors may not know what they’re getting. To meet today’s diversification challenges, investors will need to distinguish liquid alternative strategies that rely on new market exposure, such as volatility and frontier markets, and those that rely on manager skill, su ...

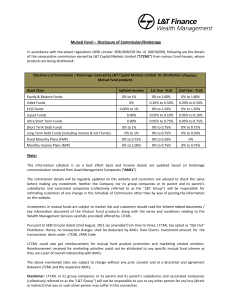

RBC High Yield Bond Fund - RBC Global Asset Management

... reported MER would have been had management fee changes been in effect throughout 2016. Series H and Series I are not available for purchase by new investors. Existing investors who hold Series H or Series I units can continue to make additional investments into the same series of the funds they hol ...

... reported MER would have been had management fee changes been in effect throughout 2016. Series H and Series I are not available for purchase by new investors. Existing investors who hold Series H or Series I units can continue to make additional investments into the same series of the funds they hol ...

Exploiting Inefficiencies Across Asset Classes, Globally

... This article seeks to highlight the benefits of looking outside a rigid benchmark-constrained approach, to access the broadest possible opportunity set in our universe. At any given point in time, compelling value can be found in selected CEF subsectors and we believe institutional investors, high n ...

... This article seeks to highlight the benefits of looking outside a rigid benchmark-constrained approach, to access the broadest possible opportunity set in our universe. At any given point in time, compelling value can be found in selected CEF subsectors and we believe institutional investors, high n ...

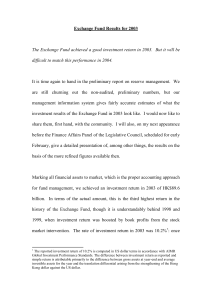

Exchange Fund Results for 2003

... of Exchange Fund paper, and other expenses, including fees for external managers and for the safe custody of financial assets totalling HK$6.4 billion, the profits made for the Exchange Fund in 2003 amounted to HK$83.4 billion. This is the second highest on record, next only to 1999, but surpassing ...

... of Exchange Fund paper, and other expenses, including fees for external managers and for the safe custody of financial assets totalling HK$6.4 billion, the profits made for the Exchange Fund in 2003 amounted to HK$83.4 billion. This is the second highest on record, next only to 1999, but surpassing ...

Media Release Europe replaces China as main concern for

... More than half of the fund managers anticipate increasing demand for lower cost products (57.89%), together with rise of financial technology in funds distribution (47.37%) and regulatory obligations (45.61%) as future drivers of investment and innovation in the next three years. 64.91% cited increa ...

... More than half of the fund managers anticipate increasing demand for lower cost products (57.89%), together with rise of financial technology in funds distribution (47.37%) and regulatory obligations (45.61%) as future drivers of investment and innovation in the next three years. 64.91% cited increa ...

Chap022

... Real Estate Investment Performance Portfolio risk – Standard deviation Not a weighted average There is interaction between returns of assets ...

... Real Estate Investment Performance Portfolio risk – Standard deviation Not a weighted average There is interaction between returns of assets ...

(acc) USD - Fund Fact Sheet - Franklin Templeton Investments

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

Hiding in Plain Sight

... a bastion of undiscovered talent? And if it is, how does a boutique private banking and wealth advisory firm go about finding its hidden gems? Are these managers hiding? Investment funds cited herein are available for qualified investors by prospectus, which should be read carefully before investing ...

... a bastion of undiscovered talent? And if it is, how does a boutique private banking and wealth advisory firm go about finding its hidden gems? Are these managers hiding? Investment funds cited herein are available for qualified investors by prospectus, which should be read carefully before investing ...

JPM US Value X (acc)

... a specific Share Class. The Prospectus and annual and semiannual financial reports are prepared for JPMorgan Funds. The Sub-Fund is part of JPMorgan Funds. Under Luxembourg law, there is segregated liability between Sub-Funds. This means that the assets of a Sub-Fund will not be available to meet a ...

... a specific Share Class. The Prospectus and annual and semiannual financial reports are prepared for JPMorgan Funds. The Sub-Fund is part of JPMorgan Funds. Under Luxembourg law, there is segregated liability between Sub-Funds. This means that the assets of a Sub-Fund will not be available to meet a ...

Key Investor Information

... This document provides you with key investor information about this subfund. It is not marketing material. The information is required by law to help you to understand the nature and the risks of investing in this subfund. You are advised to read it so you can make an informed decision about whether ...

... This document provides you with key investor information about this subfund. It is not marketing material. The information is required by law to help you to understand the nature and the risks of investing in this subfund. You are advised to read it so you can make an informed decision about whether ...

PDF - Faircourt Asset Management

... are corporate owned and offer consumers a strong value proposition at select fixed price points of $3 or less. Boyd Group Income Fund, a North American auto-body repair company has generated excellent growth over the past several years, was up 12% in the first quarter of 2015. We continue to see att ...

... are corporate owned and offer consumers a strong value proposition at select fixed price points of $3 or less. Boyd Group Income Fund, a North American auto-body repair company has generated excellent growth over the past several years, was up 12% in the first quarter of 2015. We continue to see att ...

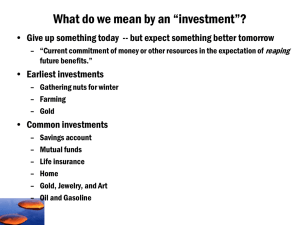

Chap001_overview

... o Security selection & analysis Choosing specific securities w/in an asset class ...

... o Security selection & analysis Choosing specific securities w/in an asset class ...

NAV | KWD 1.05938 (As of 29-Nov-16)

... The objective of the Fund is to generate competitive Shari'ah compliant returns by increasing its Net Asset Value while maintaining a high level of liquidity. The Fund will pursue its investment objective by investing in short and medium term money market instruments that are Shari’a compliant; Such ...

... The objective of the Fund is to generate competitive Shari'ah compliant returns by increasing its Net Asset Value while maintaining a high level of liquidity. The Fund will pursue its investment objective by investing in short and medium term money market instruments that are Shari’a compliant; Such ...

Goldman Sachs Financial Square Government Fund

... quotations more closely reflect the current earnings of the Fund than the total return quotations. The Quarter-End Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter end. They assume r ...

... quotations more closely reflect the current earnings of the Fund than the total return quotations. The Quarter-End Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter end. They assume r ...

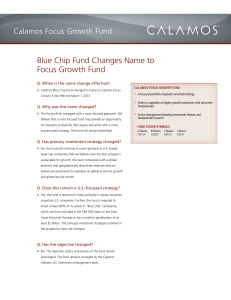

Blue Chip Fund Changes Name to Focus Growth Fund

... The principal risks of investing in the Calamos Focus Growth Fund include: equity securities risk, growth stock risk, value stock risk, foreign securities risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated w ...

... The principal risks of investing in the Calamos Focus Growth Fund include: equity securities risk, growth stock risk, value stock risk, foreign securities risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated w ...

Everything old is new again

... The Schroders Superannuation Fund completed the most recent financial year near the top of the charts with a -5.6% return for the year to June 2009, after fees and tax. This compares with the average superannuation fund which is estimated to post a loss of -13% for the same time period according to ...

... The Schroders Superannuation Fund completed the most recent financial year near the top of the charts with a -5.6% return for the year to June 2009, after fees and tax. This compares with the average superannuation fund which is estimated to post a loss of -13% for the same time period according to ...

RBC Microcap Value Fund - RBC Global Asset Management

... growth rates provide the mutual fund investor details on the underlying stock holdings and their estimated growth in earnings per share. This does not imply an increase in earnings to the mutual fund investor, it only illustrates the expected increase in EPS growth rates of the underlying stocks tha ...

... growth rates provide the mutual fund investor details on the underlying stock holdings and their estimated growth in earnings per share. This does not imply an increase in earnings to the mutual fund investor, it only illustrates the expected increase in EPS growth rates of the underlying stocks tha ...

Standard Life MyFolio Market Funds

... this process is the support given by the multi asset team, which has significant experience in running complex multi asset strategies and developing global asset allocated portfolios. This, in combination with the external resource of Moody’s Analytics, gives the asset allocation process a very robu ...

... this process is the support given by the multi asset team, which has significant experience in running complex multi asset strategies and developing global asset allocated portfolios. This, in combination with the external resource of Moody’s Analytics, gives the asset allocation process a very robu ...

Blue Bay Funds Prospectus - BlueBay Asset Management

... weakness over the army and gendarmes striking for higher wages. There was also some position rotation out of the region as investors made room for the new issuance described above. We expect market volatility to rise as Trump takes a firm grip on power. We also expect the forthcoming monthly global ...

... weakness over the army and gendarmes striking for higher wages. There was also some position rotation out of the region as investors made room for the new issuance described above. We expect market volatility to rise as Trump takes a firm grip on power. We also expect the forthcoming monthly global ...