smarterinsightTM - Donald Wealth Management

... Markets will be markets Equity markets have the ability to thrill and terrify investors in equal measure on a more or less daily basis - they always have and they always will. The present turmoil in the Eurozone and the lacklustre pace of recovery in the UK economy, combined with the sensationalist, ...

... Markets will be markets Equity markets have the ability to thrill and terrify investors in equal measure on a more or less daily basis - they always have and they always will. The present turmoil in the Eurozone and the lacklustre pace of recovery in the UK economy, combined with the sensationalist, ...

Corruption in the financial markets 29012009

... risk, and shareholder value, vs stakeholders, CSR. Getting there with the advice of head hunters, who are at least conflicted. Employees and brokers financially motivated to sell some products, rather than to advise. ...

... risk, and shareholder value, vs stakeholders, CSR. Getting there with the advice of head hunters, who are at least conflicted. Employees and brokers financially motivated to sell some products, rather than to advise. ...

DESJARDINS CANADIAN EQUITY VALUE FUND

... The Desjardins Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. The indicated rates of return are the historical annual compounded total returns as indicated the date of the present document including changes in securit ...

... The Desjardins Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. The indicated rates of return are the historical annual compounded total returns as indicated the date of the present document including changes in securit ...

How the Market Works… and What It Means for Your Portfolio

... about the suitability of investing in each emerging market, making considerations that include local market accessibility, government stability, and property rights, before making investments. For educational purposes; should not be used as investment advice. ...

... about the suitability of investing in each emerging market, making considerations that include local market accessibility, government stability, and property rights, before making investments. For educational purposes; should not be used as investment advice. ...

Smartfund 80% Protected Growth Fund (USD)

... CLIENTS. Past performance should not be seen as a guide to future performance. The value of this investment and the income from it can go down as well as ...

... CLIENTS. Past performance should not be seen as a guide to future performance. The value of this investment and the income from it can go down as well as ...

The Benefits of High-Quality in an Uncertain Environment

... confidence in our opinions, actual results may differ from those we anticipate. We cannot assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Statistical data was taken from sources ...

... confidence in our opinions, actual results may differ from those we anticipate. We cannot assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Statistical data was taken from sources ...

Investment Policy - United States Power Squadrons

... Investment Policy Statement for the USPS Educational Fund Purposes of the USPS Educational Fund: The purposes, set forth in the Trust Agreement, are: To promote the development of and for the furtherance of educational programs, techniques and courses in boating, seamanship, navigation, engine maint ...

... Investment Policy Statement for the USPS Educational Fund Purposes of the USPS Educational Fund: The purposes, set forth in the Trust Agreement, are: To promote the development of and for the furtherance of educational programs, techniques and courses in boating, seamanship, navigation, engine maint ...

Investment returns - Rother District Council

... The use of capital resources over the next 5 years will also reduce the amount the Council achieves in investment returns. As part of the resetting work currently underway this to will need to be addressed to reduce reliance in the revenue budget on investment returns. Members are asked to refer to ...

... The use of capital resources over the next 5 years will also reduce the amount the Council achieves in investment returns. As part of the resetting work currently underway this to will need to be addressed to reduce reliance in the revenue budget on investment returns. Members are asked to refer to ...

AC ALTERNATIVES® Equity Market Neutral

... The opinions expressed are those of the portfolio investment team and are no guarantee of the future performance of any American Century Investments portfolio. Statements regarding specific holdings represent personal views and compensation has not been received in connection with such views. This i ...

... The opinions expressed are those of the portfolio investment team and are no guarantee of the future performance of any American Century Investments portfolio. Statements regarding specific holdings represent personal views and compensation has not been received in connection with such views. This i ...

how does a pooled vehicle deliver better risk

... on how to actively manage the allocations based on traditional fundamental or valuation measures. By pooling assets with others, investors could not only gain better diversification than on their own, but they can access other strategies as well. In addition, actively managing the allocation to spec ...

... on how to actively manage the allocations based on traditional fundamental or valuation measures. By pooling assets with others, investors could not only gain better diversification than on their own, but they can access other strategies as well. In addition, actively managing the allocation to spec ...

Municipal Pension Plan AGM

... bcIMC MPP’s Investment Manager bcIMC is an investment management corporation for BC’s public sector funds and entities ...

... bcIMC MPP’s Investment Manager bcIMC is an investment management corporation for BC’s public sector funds and entities ...

Robo-advisors have yet to be tested

... The latest competitor in investment management is the online portfolio manager – colloquially known as a robo-advisor. These platforms build a portfolio of exchangetraded funds (ETFs) for investors on the basis of a short questionnaire. While convenient and low-cost there are problems with relying o ...

... The latest competitor in investment management is the online portfolio manager – colloquially known as a robo-advisor. These platforms build a portfolio of exchangetraded funds (ETFs) for investors on the basis of a short questionnaire. While convenient and low-cost there are problems with relying o ...

Equity Share Class Fact Sheet

... subject to any deferred sales charges. Transactions in the Class occur only when the net asset value (NAV) is calculated at the close of every Wednesday and last business day of each month and quarter. Suitability and Risk Profile It is important to ensure that the investment strategy is suitable fo ...

... subject to any deferred sales charges. Transactions in the Class occur only when the net asset value (NAV) is calculated at the close of every Wednesday and last business day of each month and quarter. Suitability and Risk Profile It is important to ensure that the investment strategy is suitable fo ...

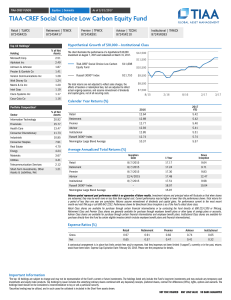

TIAA-CREF Social Choice Low Carbon Equity Fund

... Morningstar Ranking/Number of Funds in Category displays the Fund’s actual rank within its Morningstar Category based on average annual total return and number of funds in that Category. The returns assume reinvestment of dividends and do not reflect any applicable sales charge. Absent expense limit ...

... Morningstar Ranking/Number of Funds in Category displays the Fund’s actual rank within its Morningstar Category based on average annual total return and number of funds in that Category. The returns assume reinvestment of dividends and do not reflect any applicable sales charge. Absent expense limit ...

Infrastructure Investment Trust

... CMB contributed to the topic by issuing the draft “Infrastructure Investment Trust” in order to enhance the investment climate. The purpose of this regulation is to arrange the principals and procedures of the responsibilities which are related to the establishers of Infrastructure Investment Trust, ...

... CMB contributed to the topic by issuing the draft “Infrastructure Investment Trust” in order to enhance the investment climate. The purpose of this regulation is to arrange the principals and procedures of the responsibilities which are related to the establishers of Infrastructure Investment Trust, ...

NEI Northwest Emerging Markets Fund

... reflected in each fund’s Annual Management Report of Fund Performance. ...

... reflected in each fund’s Annual Management Report of Fund Performance. ...

Why alternative asset classes offer attractive returns

... adding asset classes with long term track records of generating attractive and non-correlated returns. “While the scale of the Irish funds industry is well known with assets under administration of €3.8 trillion and approximately half of these assets domiciled in Ireland, what is less well known is ...

... adding asset classes with long term track records of generating attractive and non-correlated returns. “While the scale of the Irish funds industry is well known with assets under administration of €3.8 trillion and approximately half of these assets domiciled in Ireland, what is less well known is ...

On Profiling the Superior IT Portfolio Characteristics

... How is it possible to derive the superior IT investment portfolio? One main identified research objective in IT portfolio management (ITPM) is to manage a set of IT assets, similar to manage a financial portfolio to attain the superior return and risk. Among various IT assets, the investment in IT p ...

... How is it possible to derive the superior IT investment portfolio? One main identified research objective in IT portfolio management (ITPM) is to manage a set of IT assets, similar to manage a financial portfolio to attain the superior return and risk. Among various IT assets, the investment in IT p ...