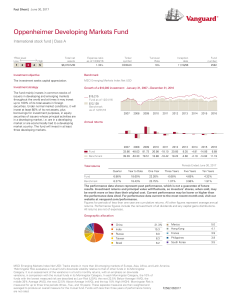

Oppenheimer Developing Markets Fund - Vanguard

... China Region: Investing in the China region, including Hong Kong, the People’s Republic of China, and Taiwan, may be subject to greater volatility because of the social, regulatory, and political risks of that region, as well as the Chinese government’s significant level of control over China’s econ ...

... China Region: Investing in the China region, including Hong Kong, the People’s Republic of China, and Taiwan, may be subject to greater volatility because of the social, regulatory, and political risks of that region, as well as the Chinese government’s significant level of control over China’s econ ...

An Asian Investment Fund - Global Clearinghouse for Development

... ▪ Lending ▪ Equity investment ▫ pooling SME assets for securitization ▫ creating a fund of private equity funds ...

... ▪ Lending ▪ Equity investment ▫ pooling SME assets for securitization ▫ creating a fund of private equity funds ...

Portfolio manager Liu-Er Chen leads Delaware Emerging Markets

... [email protected] The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may ...

... [email protected] The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may ...

Absa Multi Managed Bond Fund - Absa | Wealth And Investment

... electronic and telephone banking platform. All requests for transactions received on or before 16:00 every day will be traded at ruling prices and valued after 16:00 on that day. Investments in funds with foreign securities may involve various material risks, which include potential constraints on l ...

... electronic and telephone banking platform. All requests for transactions received on or before 16:00 every day will be traded at ruling prices and valued after 16:00 on that day. Investments in funds with foreign securities may involve various material risks, which include potential constraints on l ...

Regulation of credit and maximum rates: an analysis of their effects

... orientation of the economic and social policies of the State. These regulatory changes with restrictions and explicit limits require a modification of the composition of the portfolio of financial institutions, a process that could affect the efficiency of their investments. In this sense, the objec ...

... orientation of the economic and social policies of the State. These regulatory changes with restrictions and explicit limits require a modification of the composition of the portfolio of financial institutions, a process that could affect the efficiency of their investments. In this sense, the objec ...

New Star Asia raises 325m - Investment International

... Asian markets specialists Ian Beattie and Michelle Sanders will be the fund Advisers. The investment strategy of The Fund is similar to that of the non-guaranteed New Star Asia Renaissance Hedge Fund (managed by Ian Beattie and Michelle Sanders), which has produced a return of 29.6 per cent between ...

... Asian markets specialists Ian Beattie and Michelle Sanders will be the fund Advisers. The investment strategy of The Fund is similar to that of the non-guaranteed New Star Asia Renaissance Hedge Fund (managed by Ian Beattie and Michelle Sanders), which has produced a return of 29.6 per cent between ...

Risk Considerations - RMR Real Estate Income Fund

... securities. Many real estate companies or real estate investment trusts (REITs) focus on particular types of properties or properties which are especially suited for certain uses, and those real estate companies or REITs are affected by the risks which impact the users of their properties. Market Va ...

... securities. Many real estate companies or real estate investment trusts (REITs) focus on particular types of properties or properties which are especially suited for certain uses, and those real estate companies or REITs are affected by the risks which impact the users of their properties. Market Va ...

File

... Keywords: asianinvestor | awards | investment performance | hedge funds | hedge fund awards | alternatives AsianInvestor is pleased to announce the 2010 winners for institutional funds management. We conclude the awards announcements today by recognising the best in hedge funds and alternatives hous ...

... Keywords: asianinvestor | awards | investment performance | hedge funds | hedge fund awards | alternatives AsianInvestor is pleased to announce the 2010 winners for institutional funds management. We conclude the awards announcements today by recognising the best in hedge funds and alternatives hous ...

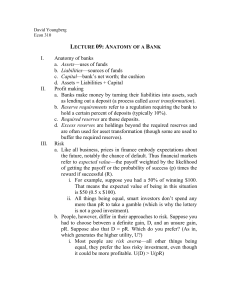

2/27 - David Youngberg

... That means the expected value of being in this situation is $50 (0.5 x $100). ii. All things being equal, smart investors don’t spend any more than pR to take a gamble (which is why the lottery is not a good investment). b. People, however, differ in their approaches to risk. Suppose you had to choo ...

... That means the expected value of being in this situation is $50 (0.5 x $100). ii. All things being equal, smart investors don’t spend any more than pR to take a gamble (which is why the lottery is not a good investment). b. People, however, differ in their approaches to risk. Suppose you had to choo ...

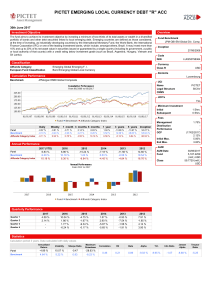

Fund Profile - nab asset management

... preparation. However, no representation or warranty (express or implied) is given as to its accuracy, reliability or completeness (which may change without notice). This communication contains general information and may constitute general advice. This report does not take account of an investor’s p ...

... preparation. However, no representation or warranty (express or implied) is given as to its accuracy, reliability or completeness (which may change without notice). This communication contains general information and may constitute general advice. This report does not take account of an investor’s p ...

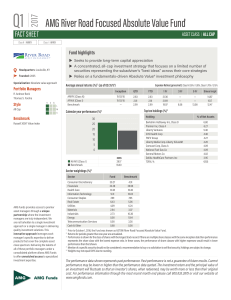

AMG River Road Focused Absolute Value Fund1

... and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may ...

... and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may ...

CURRICULUM VITAE

... learn fast. I am an individual with an update interest on the financial market with experience of working under highly commercially driven environments, whereby a fast, dynamic and adaptable approach is required. As an analyst part of my responsibility have varied from global-macro analysis to condu ...

... learn fast. I am an individual with an update interest on the financial market with experience of working under highly commercially driven environments, whereby a fast, dynamic and adaptable approach is required. As an analyst part of my responsibility have varied from global-macro analysis to condu ...

The Investment Process

... We will recommend the portfolio which most closely matches your risk score but the risk taken by the DFM could vary slightly higher or lower than your actual score, e.g. if you have a risk score of 6 the portfolio could sometimes be a 5 or a 7 depending upon the views of the DFM ...

... We will recommend the portfolio which most closely matches your risk score but the risk taken by the DFM could vary slightly higher or lower than your actual score, e.g. if you have a risk score of 6 the portfolio could sometimes be a 5 or a 7 depending upon the views of the DFM ...

DOE-Personal Finance Boot Camp-#3

... FINANCE, Fifth Edition, Tax-Sheltered Returns are Greater than Taxable Returns (Illustration: 8% Annual Return and $2,000 ...

... FINANCE, Fifth Edition, Tax-Sheltered Returns are Greater than Taxable Returns (Illustration: 8% Annual Return and $2,000 ...

Euro High Yield Bond Class A-sek h

... primarily issued by companies of the EU, OECD-countries or any other of Western or Eastern Europe, Asia, Oceania, the American countries or Africa, and denominated in Euro. The investment strategy is active. The currency risk is limited since the fund aims to hedge currency risks of non-euro denomin ...

... primarily issued by companies of the EU, OECD-countries or any other of Western or Eastern Europe, Asia, Oceania, the American countries or Africa, and denominated in Euro. The investment strategy is active. The currency risk is limited since the fund aims to hedge currency risks of non-euro denomin ...

Alternative Investment Exposures at Endowments

... Sharpe ratios and efficient frontiers require normally distributed returns, where skewness and excess kurtosis are zero ...

... Sharpe ratios and efficient frontiers require normally distributed returns, where skewness and excess kurtosis are zero ...

Endowment Fund Performance

... volatile markets such as we’re experiencing now the results are good. Small caps as a whole did better than the general market and NFJ did 17% better than its own index. As a value contrarian style investor who concentrates on out of favor, low multiple small cap companies they provide more downside ...

... volatile markets such as we’re experiencing now the results are good. Small caps as a whole did better than the general market and NFJ did 17% better than its own index. As a value contrarian style investor who concentrates on out of favor, low multiple small cap companies they provide more downside ...

US Commercial Real Estate Markets

... • Nuts and Bolts of Institutional Real Estate - 3 day seminar consisting of classes in key disciplines represented at NCREIF (Accounting, ...

... • Nuts and Bolts of Institutional Real Estate - 3 day seminar consisting of classes in key disciplines represented at NCREIF (Accounting, ...

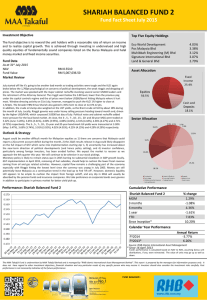

What does the Fund invest in? FUND PERFORMANCE REPORT

... *Portfolio Mix & Sector Allocation may shift depending on market conditions. ...

... *Portfolio Mix & Sector Allocation may shift depending on market conditions. ...