AB Global High Yield Portfolio1

... risk, derivatives risk, borrowing risk, taxation risk, fixed income securities risk, interest rate risk, lower rated and unrated investments risk, prepayment risk, sovereign debt obligations risk, corporate debt risk and lower- or unrated securities risk. The Portfolio is entitled to use derivative ...

... risk, derivatives risk, borrowing risk, taxation risk, fixed income securities risk, interest rate risk, lower rated and unrated investments risk, prepayment risk, sovereign debt obligations risk, corporate debt risk and lower- or unrated securities risk. The Portfolio is entitled to use derivative ...

FIN4504c3

... Fund is a corporation formed by an investment advisory firm that selects the board of trustees. Trustees hire a management company. ...

... Fund is a corporation formed by an investment advisory firm that selects the board of trustees. Trustees hire a management company. ...

the document - Lyxor Asset Management

... appropriateness of investing in any securities or financial instrument or participating in any investment strategy. Before you decide to invest in any account or fund, you should carefully read the relevant client agreements and offering documentation. No representation is made that your investment ...

... appropriateness of investing in any securities or financial instrument or participating in any investment strategy. Before you decide to invest in any account or fund, you should carefully read the relevant client agreements and offering documentation. No representation is made that your investment ...

Minutes March 2016

... As Rutabaga invests in small, turnaround situations, the benchmark agnostic strategy can be, and has been, very volatile. Mr. Scannell noted that the 7-8 stocks in the portfolio which have driven the significant under performance have been reviewed carefully and subsequent action taken where warrant ...

... As Rutabaga invests in small, turnaround situations, the benchmark agnostic strategy can be, and has been, very volatile. Mr. Scannell noted that the 7-8 stocks in the portfolio which have driven the significant under performance have been reviewed carefully and subsequent action taken where warrant ...

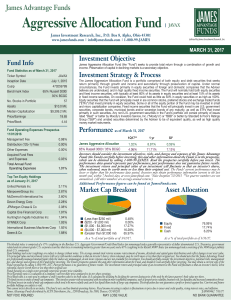

Aggressive Allocation Fund | JAVAX

... listed U.S. companies). Fund holdings and sector weightings are subject to change without notice. The average annual total returns assume reinvestment of income, dividends and capital gains distributions and reflect changes in net asset value. The principal value and investment return will vary with ...

... listed U.S. companies). Fund holdings and sector weightings are subject to change without notice. The average annual total returns assume reinvestment of income, dividends and capital gains distributions and reflect changes in net asset value. The principal value and investment return will vary with ...

US Dollar Currency Fund, a sub-fund of Fidelity Funds II, A-USD

... The assets and liabilities of each sub-fund of Fidelity Funds II are segregated by law and with that assets of this sub-fund will not be used to pay liabilities of other sub-funds. More share classes are available for this UCITS. Details can be found in the Prospectus. You have the right to switch f ...

... The assets and liabilities of each sub-fund of Fidelity Funds II are segregated by law and with that assets of this sub-fund will not be used to pay liabilities of other sub-funds. More share classes are available for this UCITS. Details can be found in the Prospectus. You have the right to switch f ...

Deutsche Bank And UOB Asset Management Partner

... significant private & business banking franchise in Germany and other selected countries in Continental Europe. For more information, visit www.deutsche-bank.com ...

... significant private & business banking franchise in Germany and other selected countries in Continental Europe. For more information, visit www.deutsche-bank.com ...

Afghanistan`s only private equity fund launched InFrontier

... landmark Fund that will enable InFrontier to build on three years of investment track record in Afghanistan,” commented Benj Conway, Director at InFrontier Ltd. “CDC is a pioneering investor with a mandate to invest into some of the world’s hardest places. That’s why we’re backing InFrontier, the te ...

... landmark Fund that will enable InFrontier to build on three years of investment track record in Afghanistan,” commented Benj Conway, Director at InFrontier Ltd. “CDC is a pioneering investor with a mandate to invest into some of the world’s hardest places. That’s why we’re backing InFrontier, the te ...

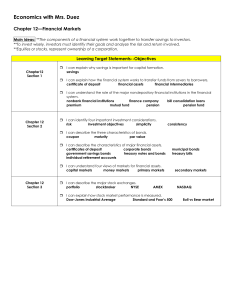

government - Humble ISD

... Main Ideas: **The components of a financial system work together to transfer savings to investors. **To invest wisely, investors must identify their goals and analyze the risk and return involved. **Equities or stocks, represent ownership of a corporation. ...

... Main Ideas: **The components of a financial system work together to transfer savings to investors. **To invest wisely, investors must identify their goals and analyze the risk and return involved. **Equities or stocks, represent ownership of a corporation. ...

What does the Fund invest in? FUND PERFORMANCE REPORT

... hike in 2017 following lower inflation expectations ...

... hike in 2017 following lower inflation expectations ...

Job Description - Private Equity

... institutional investor, sovereign wealth fund, or similar entity, with a focus on equity and quasiequity investments preferred Strong practical experience in structuring, negotiating and monitoring fund investments and direct co-investment transactions, preferably in a fund of funds context Strong u ...

... institutional investor, sovereign wealth fund, or similar entity, with a focus on equity and quasiequity investments preferred Strong practical experience in structuring, negotiating and monitoring fund investments and direct co-investment transactions, preferably in a fund of funds context Strong u ...

Solvay Business School

... (4.2) What is the market portfolio? Why does this portfolio play an central role in the CAPM? (4.3) Draw a graph showing how the expected return varies with beta. (4.4) What is the required return on an investment with a beta of 1.5? QUESTION 5 Virtual.com is a firm with a debt-to-equity ratio of 1. ...

... (4.2) What is the market portfolio? Why does this portfolio play an central role in the CAPM? (4.3) Draw a graph showing how the expected return varies with beta. (4.4) What is the required return on an investment with a beta of 1.5? QUESTION 5 Virtual.com is a firm with a debt-to-equity ratio of 1. ...

Mutual Funds - Monetta Funds

... A mutual fund is a regulated investment company or trust that invests monies in a diversified portfolio of stocks or bonds, on behalf of individuals and institutions with similar investment objectives. A mutual fund pools the money of thousands of individual investors with common ...

... A mutual fund is a regulated investment company or trust that invests monies in a diversified portfolio of stocks or bonds, on behalf of individuals and institutions with similar investment objectives. A mutual fund pools the money of thousands of individual investors with common ...

Legg Mason Western Asset US Money Market Fund

... calculated on a NAV to NAV basis (USD). Performance for periods greater than one year is cumulative. Performance is based on reinvestment of any income and capital gains distribution derived from securities held in the Fund. Past performance is not indicative of future results. 1. Source: Legg Mason ...

... calculated on a NAV to NAV basis (USD). Performance for periods greater than one year is cumulative. Performance is based on reinvestment of any income and capital gains distribution derived from securities held in the Fund. Past performance is not indicative of future results. 1. Source: Legg Mason ...

Fact Sheet - Toroso Investments

... embedded investment management fee paid to the investment adviser of the ETP. In addition, trading and transaction fees and other expenses such as custody and clearing are incurred in the management of the Sector Opportunities Portfolio. The market price for a share of an ETP may fluctuate from the ...

... embedded investment management fee paid to the investment adviser of the ETP. In addition, trading and transaction fees and other expenses such as custody and clearing are incurred in the management of the Sector Opportunities Portfolio. The market price for a share of an ETP may fluctuate from the ...

Portfolio consists of assets with varying expected returns, risks and

... Markowitz’s theory compares all the possible portfolios according to the total expected return and risk. In the [risk, expected return] space all possible portfolios define a region bounded by a hyperbola called the Efficient Frontier which represents portfolios with the lowest risk for a given leve ...

... Markowitz’s theory compares all the possible portfolios according to the total expected return and risk. In the [risk, expected return] space all possible portfolios define a region bounded by a hyperbola called the Efficient Frontier which represents portfolios with the lowest risk for a given leve ...

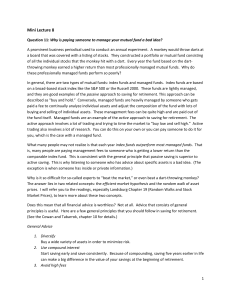

Mini Lecture 8

... A good rule of thumb is to avoid funds with a management fee greater than 1%. 4. Beware of stock price bubbles In the long term, stocks outperform bonds by a significant amount, but in the short term, stock prices are much more volatile than bond prices. This is why one should start to shift out of ...

... A good rule of thumb is to avoid funds with a management fee greater than 1%. 4. Beware of stock price bubbles In the long term, stocks outperform bonds by a significant amount, but in the short term, stock prices are much more volatile than bond prices. This is why one should start to shift out of ...

Investment Management Policy

... rated A, B (incase of Private institution), D (incase of State Owned institution) grade financial institutions. Portfolio at Risk (PAR) of above mentioned financial institutions should not exceed 3% of total asset. Financial Institutions should have been in continuous operation for more than 5 y ...

... rated A, B (incase of Private institution), D (incase of State Owned institution) grade financial institutions. Portfolio at Risk (PAR) of above mentioned financial institutions should not exceed 3% of total asset. Financial Institutions should have been in continuous operation for more than 5 y ...

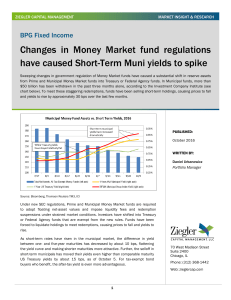

Changes In Money Market Fund Regulations

... Part of this short-term municipal selling has been in the “bread and butter” holdings that Municipal Money funds use for liquidity, Variable-Rate Demand Notes (VRDNs), which have cheapened significantly. VRDNs are securities that typically have a longer-term final maturity and “for which the intere ...

... Part of this short-term municipal selling has been in the “bread and butter” holdings that Municipal Money funds use for liquidity, Variable-Rate Demand Notes (VRDNs), which have cheapened significantly. VRDNs are securities that typically have a longer-term final maturity and “for which the intere ...

2017 1Q LCIV - Todd Asset Management Large Cap Intrinsic Value

... composite was 0.50%. Actual investment advisory fees incurred by clients may vary. The currency used to calculate and express performance is U.S. dollars. All cash reserves and equivalents have been included in the performance. The composite performance has been compared to the following benchmarks. ...

... composite was 0.50%. Actual investment advisory fees incurred by clients may vary. The currency used to calculate and express performance is U.S. dollars. All cash reserves and equivalents have been included in the performance. The composite performance has been compared to the following benchmarks. ...

portfolio objective

... The portfolio takes the form of a monthly RSP, with the aim of addressing the needs of “newbie” investors who have limited starting capital, but would like to embark on a long term process of accumulating and growing their wealth. The portfolio construction process adheres to the core principle of d ...

... The portfolio takes the form of a monthly RSP, with the aim of addressing the needs of “newbie” investors who have limited starting capital, but would like to embark on a long term process of accumulating and growing their wealth. The portfolio construction process adheres to the core principle of d ...

Revolving doors, musical chairs and portfolio performance

... instance, this suggests that the result is not mere chance. Thus, the 5/15 observations of significant performance improvement in the case of fixed interest is roughly three times what might be expected randomly. Similarly, the 5/22 significant increase in return in equity portfolios is more than tw ...

... instance, this suggests that the result is not mere chance. Thus, the 5/15 observations of significant performance improvement in the case of fixed interest is roughly three times what might be expected randomly. Similarly, the 5/22 significant increase in return in equity portfolios is more than tw ...

Investment Insights CIO REPORTS

... whole or in part, or in any form or manner, without the express written consent of Merrill Lynch. Any unauthorized use or disclosure is prohibited. The information herein was obtained from various sources that we deem reliable, but we do not guarantee its accuracy. This report provides general inf ...

... whole or in part, or in any form or manner, without the express written consent of Merrill Lynch. Any unauthorized use or disclosure is prohibited. The information herein was obtained from various sources that we deem reliable, but we do not guarantee its accuracy. This report provides general inf ...

Month-End Portfolio Data Now Available for Federated Investors

... Intermediate Municipal Income Fund (NYSE: FPT) as of Feb. 28, 2017, are now available in the Products section of FederatedInvestors.com. To order hard copies of this data or to be placed on a mailing list, call 800-245-0242 x5587538, email [email protected] or write to Federated Investors, 100 ...

... Intermediate Municipal Income Fund (NYSE: FPT) as of Feb. 28, 2017, are now available in the Products section of FederatedInvestors.com. To order hard copies of this data or to be placed on a mailing list, call 800-245-0242 x5587538, email [email protected] or write to Federated Investors, 100 ...