Reitway Global`s Investment Process

... philosophy is the cornerstone of our investment process, with the same philosophy and culture applied to all the portfolios managed by Reitway Global. Being convinced that a consistent adherence to our investment process produces better relative returns, we avoid modifying our philosophy to suit pre ...

... philosophy is the cornerstone of our investment process, with the same philosophy and culture applied to all the portfolios managed by Reitway Global. Being convinced that a consistent adherence to our investment process produces better relative returns, we avoid modifying our philosophy to suit pre ...

Click to download Firth AVF May 2015

... Marcard, Stein & Co – Ballindamm 36, 20095 Hamburg; Phone: +49/40.32.099.556, Fax: +49/40.32.099.206 (c) Share Class D: these shares have not yet been launched. This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. ...

... Marcard, Stein & Co – Ballindamm 36, 20095 Hamburg; Phone: +49/40.32.099.556, Fax: +49/40.32.099.206 (c) Share Class D: these shares have not yet been launched. This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. ...

Is This The Road To Normalisation?

... IMMEDIATE RELEASE Notes to Editors J.P. Morgan Asset Management (“JPMAM”) is the brand name of J.P. Morgan Chase & Co’s asset management companies, including JPMorgan ...

... IMMEDIATE RELEASE Notes to Editors J.P. Morgan Asset Management (“JPMAM”) is the brand name of J.P. Morgan Chase & Co’s asset management companies, including JPMorgan ...

press release text the wall street journal category kings

... involve additional risks such as the market price trading at a discount to its net asset value, an active secondary trading market may not develop or be maintained or trading may be halted by the exchange in which they trade, which may impact the fund's ability to sell its shares. Derivatives, such ...

... involve additional risks such as the market price trading at a discount to its net asset value, an active secondary trading market may not develop or be maintained or trading may be halted by the exchange in which they trade, which may impact the fund's ability to sell its shares. Derivatives, such ...

Order Number: 41512 Running Head: A JOB AT EAST COAST

... The mutual funds are more advantageous that the companies stocks. The mutual stocks have a low level of risk as compared to the stocks. The mutual funds offer divergent options. These options include the dividend payout, growth and dividend reinvestment, (Kirk, 2011). The mutual funds offer vivid as ...

... The mutual funds are more advantageous that the companies stocks. The mutual stocks have a low level of risk as compared to the stocks. The mutual funds offer divergent options. These options include the dividend payout, growth and dividend reinvestment, (Kirk, 2011). The mutual funds offer vivid as ...

march 23rd-27th, 2015 - Imber Wealth Advisors

... This commentary is not intended as investment advice or an investment recommendation. It is solely the opinion of our investment managers at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Past performance is no indication of future per ...

... This commentary is not intended as investment advice or an investment recommendation. It is solely the opinion of our investment managers at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Past performance is no indication of future per ...

Standard EPS Shell Presentation

... Major holdings contributed by RHJ Funds and related entity in exchange for shares in March 2005 ...

... Major holdings contributed by RHJ Funds and related entity in exchange for shares in March 2005 ...

Sizing up active small-cap - Charles Schwab Investment Management

... Consider the Schwab Small-Cap Equity Fund™ (SWSCX), which takes a disciplined approach to capturing market inefficiencies. SWSCX is true to its “small-cap” name. Unlike some funds that are labeled small-cap but tend to drift into the mid-cap space, SWSCX is true to its name. In fact, when compared t ...

... Consider the Schwab Small-Cap Equity Fund™ (SWSCX), which takes a disciplined approach to capturing market inefficiencies. SWSCX is true to its “small-cap” name. Unlike some funds that are labeled small-cap but tend to drift into the mid-cap space, SWSCX is true to its name. In fact, when compared t ...

Document

... How much is invested in pooled funds in the UK ? A. £2.5 trillion B. £1.5 trillion C. £5.5 trillion ...

... How much is invested in pooled funds in the UK ? A. £2.5 trillion B. £1.5 trillion C. £5.5 trillion ...

Pengana Capital Funds

... This alpha is far more stable, consistent and predictable, he says. The range of returns and maximum peak to trough loss (or maximum drawdown) is far narrower and the correlation with the equity market is negative in a number of periods. As to the cost, Crowley says ‘beta is cheap, but it isn’t fre ...

... This alpha is far more stable, consistent and predictable, he says. The range of returns and maximum peak to trough loss (or maximum drawdown) is far narrower and the correlation with the equity market is negative in a number of periods. As to the cost, Crowley says ‘beta is cheap, but it isn’t fre ...

The land of the rising sun

... This information is of a general nature only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. Before acting on the information, a person should consider its appropriateness having regard to these factors. Advance Asset Managemen ...

... This information is of a general nature only and has been prepared without taking into account the objectives, financial situation or needs of any particular person. Before acting on the information, a person should consider its appropriateness having regard to these factors. Advance Asset Managemen ...

performance summary contributors to performance detractors from

... through higher commodity prices to consumers. Corporate bonds generally offer investors a significant yield increment over government bonds in this low yield environment. The portfolio managers believe that, over time, this should translate into additional return in the fixed income portion of the m ...

... through higher commodity prices to consumers. Corporate bonds generally offer investors a significant yield increment over government bonds in this low yield environment. The portfolio managers believe that, over time, this should translate into additional return in the fixed income portion of the m ...

1) Corporate financial plans are often used as a basis

... c. Manager A may make all the right decisions, but fail to meet the plan because of events beyond his control. Manager B may make the wrong decisions, but be rescued by good luck. In other words, it may be difficult to separate performance and ability from results. Corporations use numerous arrangem ...

... c. Manager A may make all the right decisions, but fail to meet the plan because of events beyond his control. Manager B may make the wrong decisions, but be rescued by good luck. In other words, it may be difficult to separate performance and ability from results. Corporations use numerous arrangem ...

european investment strategy

... clients in making better investment decisions through the delivery of leading-edge economic analysis and comprehensive investment strategy research. BCA provides its services to financial professionals across six continents through a wide range of products, services, and meetings. The firm maintains ...

... clients in making better investment decisions through the delivery of leading-edge economic analysis and comprehensive investment strategy research. BCA provides its services to financial professionals across six continents through a wide range of products, services, and meetings. The firm maintains ...

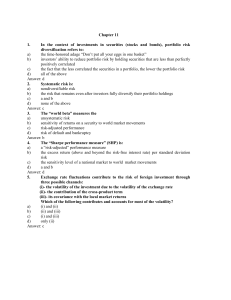

TEST BANK

... Exchange rate fluctuations contribute to the risk of foreign investment through three possible channels: (i)- the volatility of the investment due to the volatility of the exchange rate (ii)- the contribution of the cross-product term (iii)- its covariance with the local market returns Which of the ...

... Exchange rate fluctuations contribute to the risk of foreign investment through three possible channels: (i)- the volatility of the investment due to the volatility of the exchange rate (ii)- the contribution of the cross-product term (iii)- its covariance with the local market returns Which of the ...

HSBC Global Asset Management

... We contact companies to raise issues highlighted by that research, by our own investment processes or in pursuit on particular engagement themes. ...

... We contact companies to raise issues highlighted by that research, by our own investment processes or in pursuit on particular engagement themes. ...

Factsheet Total Emerging Markets Fund Class I USD

... your investment can go down depending on market conditions. International investing involves special risks including, but not limited to currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets. Investments in emerging markets may be consid ...

... your investment can go down depending on market conditions. International investing involves special risks including, but not limited to currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets. Investments in emerging markets may be consid ...

Product research and analysis Manager

... regarded in its field. The company’s growth has been a result of a talented and innovative management team combined with focussed organic growth and a shrewd policy of acquisitions. The company is now about to embark on the next phase of its development with a clear strategy in place. ...

... regarded in its field. The company’s growth has been a result of a talented and innovative management team combined with focussed organic growth and a shrewd policy of acquisitions. The company is now about to embark on the next phase of its development with a clear strategy in place. ...

Governance, Transparency and Good Portfolio Management

... 1. Resource constrained: financial (budget) and staffing 2. “In public eye”: decisions are reviewed publicly 3. Need to demonstrate that decisions not political; need to show financial impact of political constraints 4. Good governance and transparency critical ...

... 1. Resource constrained: financial (budget) and staffing 2. “In public eye”: decisions are reviewed publicly 3. Need to demonstrate that decisions not political; need to show financial impact of political constraints 4. Good governance and transparency critical ...

STATE OF WISCONSIN INVESTMENT BOARD PORTFOLIO

... STATE OF WISCONSIN INVESTMENT BOARD PORTFOLIO PERFORMANCE WITH BENCHMARKS PERIODS ENDING 6/30/16 ANNUALIZED RETURNS (%) ...

... STATE OF WISCONSIN INVESTMENT BOARD PORTFOLIO PERFORMANCE WITH BENCHMARKS PERIODS ENDING 6/30/16 ANNUALIZED RETURNS (%) ...