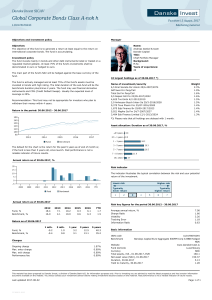

Global Corporate Bonds Class A-nok h

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

Putnam New Flag Euro High Yield Fund

... Mutual funds that invest in bonds are subject to certain risks including interestrate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and ...

... Mutual funds that invest in bonds are subject to certain risks including interestrate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and ...

Asset Allocation Bulletin -March 2016 Public

... Recipients of this report will not be treated as a client by virtue of having received this report. No part of this report may be redistributed to others or replicated in any form without the prior consent of Capital One. All charts and graphs are shown for illustrative purposes only. Opinions, esti ...

... Recipients of this report will not be treated as a client by virtue of having received this report. No part of this report may be redistributed to others or replicated in any form without the prior consent of Capital One. All charts and graphs are shown for illustrative purposes only. Opinions, esti ...

Quarterly Newsletter - March 1999 : Pinney and Scofield : http://www

... management. We believe that diversification management is the safest and most reliable way to achieve a longterm acceptable rate of return on an investment portfolio. A diversified portfolio will be spread out among many asset classes. Our view is that the portfolio should be constructed with equal ...

... management. We believe that diversification management is the safest and most reliable way to achieve a longterm acceptable rate of return on an investment portfolio. A diversified portfolio will be spread out among many asset classes. Our view is that the portfolio should be constructed with equal ...

Portfolio Breadth: The forgotten success factor in active management

... not intended to provide specific advice to any individual or institution. Some information provided herein was obtained from third-party sources deemed to be reliable. HighMark and its affiliates make no representations or warranties with respect to the timeliness, accuracy, or completeness of this ...

... not intended to provide specific advice to any individual or institution. Some information provided herein was obtained from third-party sources deemed to be reliable. HighMark and its affiliates make no representations or warranties with respect to the timeliness, accuracy, or completeness of this ...

FUND FACTSHEET – APRIL 2016 RHB MALAYSIA DIVA FUND

... fragile and could be derailed by quicker pace of normalization of monetary policy. The state of China economy, crude oil prices and strength of dollar will come under scrutiny for spillover effects on asset allocation and capital flows. Global portfolio adjustments would continue from bonds to equit ...

... fragile and could be derailed by quicker pace of normalization of monetary policy. The state of China economy, crude oil prices and strength of dollar will come under scrutiny for spillover effects on asset allocation and capital flows. Global portfolio adjustments would continue from bonds to equit ...

LargeCap Growth Fund II (J) as of 03/31/2017

... Investors should carefully consider a fund’s investment objectives, risks, charges, and expenses prior to investing. A prospectus, or summary prospectus if available, containing this and other information can be obtained by contacting a financial professional, visiting principalfunds.com, or calling ...

... Investors should carefully consider a fund’s investment objectives, risks, charges, and expenses prior to investing. A prospectus, or summary prospectus if available, containing this and other information can be obtained by contacting a financial professional, visiting principalfunds.com, or calling ...

American Funds Bond Fund

... Alpha Measures the portion of a fundŮs return that is unrelated to movements in the benchmark. It is calculated over the most recent 36 months of data. Beta Measures the degree to which a fundŮs return is affected by movements in the market, represented by the fundŮs benchmark index. The market is r ...

... Alpha Measures the portion of a fundŮs return that is unrelated to movements in the benchmark. It is calculated over the most recent 36 months of data. Beta Measures the degree to which a fundŮs return is affected by movements in the market, represented by the fundŮs benchmark index. The market is r ...

Raaj Rohan Reddy Pasunoor

... Equity Derivative Structuring: Built a Python HTML parser that scrapes through N-Q forms filed by 2,500 mutual funds to extract their investment holdings in various structured products along with tenor and counterparty. The tool identified 140 new custom indices ($3.4B notional) offered in the marke ...

... Equity Derivative Structuring: Built a Python HTML parser that scrapes through N-Q forms filed by 2,500 mutual funds to extract their investment holdings in various structured products along with tenor and counterparty. The tool identified 140 new custom indices ($3.4B notional) offered in the marke ...

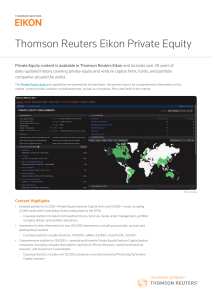

Eikon Private Equity PDF

... • Mergers & Acquisitions: Over 1,100,000 global M&A transactions from the 1970s to present, including 350,000+ US-target and 750,000+ non-US-target transactions • Debt Capital Markets: Over 900,000 bond deals since the 1960s, including investment-grade, high-yield, and emerging market corporate bond ...

... • Mergers & Acquisitions: Over 1,100,000 global M&A transactions from the 1970s to present, including 350,000+ US-target and 750,000+ non-US-target transactions • Debt Capital Markets: Over 900,000 bond deals since the 1960s, including investment-grade, high-yield, and emerging market corporate bond ...

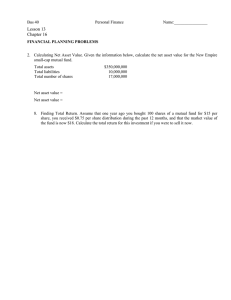

Lesson 13 key - Bakersfield College

... 8. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for $15 per share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this investment if you were to sell it now ...

... 8. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for $15 per share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this investment if you were to sell it now ...

RUSSIAN DIRECT INVESTMENT FUND

... RDIF was created in 2011 under the leadership of both the President and the Prime Minister of Russia ...

... RDIF was created in 2011 under the leadership of both the President and the Prime Minister of Russia ...

Fundamentals of Investing Chapter Fifteen

... Chapter 13: Investment Fundamentals and Portfolio Management ...

... Chapter 13: Investment Fundamentals and Portfolio Management ...

Real I.S. acquires office building in Brussels for BGV VI

... The Real I.S. Group has a track record of more than 25 years as BayernLB’s fund provider specialised in real estate investment. As a member company of the Sparkassen-Finanzgruppe (group of German savings banks, Landesbanken and associated companies), the Group ranks among the leading asset managers ...

... The Real I.S. Group has a track record of more than 25 years as BayernLB’s fund provider specialised in real estate investment. As a member company of the Sparkassen-Finanzgruppe (group of German savings banks, Landesbanken and associated companies), the Group ranks among the leading asset managers ...

JBWere SMA Growth Portfolio

... For years investors have been weighing up the flexibility and transparency of listed security ownership against the convenience and expertise of managed funds. Separately Managed Accounts (SMAs) offer a third way to invest that combines some of the best features of listed securities and managed fund ...

... For years investors have been weighing up the flexibility and transparency of listed security ownership against the convenience and expertise of managed funds. Separately Managed Accounts (SMAs) offer a third way to invest that combines some of the best features of listed securities and managed fund ...

NVIT Large Cap Growth Fund — Class I

... NVIT Large Cap Growth Fund — Class I Investment Strategy from investment’s prospectus The investment seeks long-term capital growth. The fund invests at least 80% of its net assets in common stocks issued by large-cap companies, utilizing a growth style of investing. It seeks companies whose earning ...

... NVIT Large Cap Growth Fund — Class I Investment Strategy from investment’s prospectus The investment seeks long-term capital growth. The fund invests at least 80% of its net assets in common stocks issued by large-cap companies, utilizing a growth style of investing. It seeks companies whose earning ...

Investors want active management

... Despite market volatility, undervalued Australian equities have presented favourable buying opportunities when active management has been applied, a survey conducted at the recent Legg Mason Investment Symposium has shown. The survey was conducted with 120 investment professionals including asset co ...

... Despite market volatility, undervalued Australian equities have presented favourable buying opportunities when active management has been applied, a survey conducted at the recent Legg Mason Investment Symposium has shown. The survey was conducted with 120 investment professionals including asset co ...

Sanlam Investment Management Value Fund Class A1

... investment schemes are generally medium- to long-term investments. Please note that past performances are not necessarily a guide to future performances, and that the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is avail ...

... investment schemes are generally medium- to long-term investments. Please note that past performances are not necessarily a guide to future performances, and that the value of investments / units / unit trusts may go down as well as up. A schedule of fees and charges and maximum commissions is avail ...

The Walt Lunsford Financial Advisory Group of Raymond James

... In addition to numerous industry registrations including the Series 7, Series 63, Series 31 and Series 65, Walt is licensed as a provider of variable annuities and life, accident and health insurance. He has earned the Accredited Asset Management Specialist designation (AAMS) from the College for Fi ...

... In addition to numerous industry registrations including the Series 7, Series 63, Series 31 and Series 65, Walt is licensed as a provider of variable annuities and life, accident and health insurance. He has earned the Accredited Asset Management Specialist designation (AAMS) from the College for Fi ...

What annual returns do investors expect?

... of Alberta investors plan to invest primarily in stocks of investors in Manitoba and Saskatchewan plan to invest in GICs, savings accounts and other ...

... of Alberta investors plan to invest primarily in stocks of investors in Manitoba and Saskatchewan plan to invest in GICs, savings accounts and other ...

CHAPTER 13

... Offer coverage for automobile accidents, fire, theft, personal neglicence, malpractice etc. ...

... Offer coverage for automobile accidents, fire, theft, personal neglicence, malpractice etc. ...