LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 1. What is mean by investment? 2. What are the two components of Indian capital market? 3. What are the determinants of expected return? 4. In what way the financial investment is different from general investment? 5. On what basis strong form of efficient market hypothesis differ from the weak form ...

... 1. What is mean by investment? 2. What are the two components of Indian capital market? 3. What are the determinants of expected return? 4. In what way the financial investment is different from general investment? 5. On what basis strong form of efficient market hypothesis differ from the weak form ...

Introduction to Investments

... predictability of future prices -Investment analysis debt securities, equity securities, derivatives -Investment strategy Portfolio management issues ...

... predictability of future prices -Investment analysis debt securities, equity securities, derivatives -Investment strategy Portfolio management issues ...

MicroVest announces new CIO and MD Equity

... new lending and equity operations for projects, financial institutions, corporate clients, and SMEs. As Managing Director of Equity Mr. Young, who has been with MicroVest since 2006, will be responsible for all the of firm’s Private Equity portfolio, as well as for the development and implementation ...

... new lending and equity operations for projects, financial institutions, corporate clients, and SMEs. As Managing Director of Equity Mr. Young, who has been with MicroVest since 2006, will be responsible for all the of firm’s Private Equity portfolio, as well as for the development and implementation ...

US High Yield Fund

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

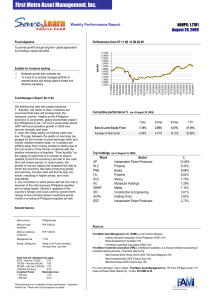

08.20.09-salef - First Metro Asset Management Inc

... Moderate growth with moderate risk. To invest in an actively managed portfolio of selected stocks with strong balance sheets and attractive valuations. ...

... Moderate growth with moderate risk. To invest in an actively managed portfolio of selected stocks with strong balance sheets and attractive valuations. ...

John Augustine, Chief Investment Strategist, Fifth Third

... John Augustine, Chief Investment Strategist, Fifth Third Bank John is based in Cincinnati as the Chief Investment Strategist for Fifth Third Asset Management, Inc., which has more than $20 billion in assets under management. He is a member of the Investment Policy Committee, Investment Strategy Team ...

... John Augustine, Chief Investment Strategist, Fifth Third Bank John is based in Cincinnati as the Chief Investment Strategist for Fifth Third Asset Management, Inc., which has more than $20 billion in assets under management. He is a member of the Investment Policy Committee, Investment Strategy Team ...