20-Year Portfolio Performance Examining the past 20 years

... Government bonds and Treasury bills are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than the other asset classes. Risk is measured by standard deviation. Standa ...

... Government bonds and Treasury bills are guaranteed by the full faith and credit of the United States government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than the other asset classes. Risk is measured by standard deviation. Standa ...

Saracen Growth Fund February Commentary February proved to be

... commentary will know, we shy away from investing in IPO’s unless they are either demonstrably cheaper than existing peers or offer something different. DX was floated on a single digit P/E for 2014 and a yield of 6% for its first full year in 2015. This appears to offer very good value. Morgan Advan ...

... commentary will know, we shy away from investing in IPO’s unless they are either demonstrably cheaper than existing peers or offer something different. DX was floated on a single digit P/E for 2014 and a yield of 6% for its first full year in 2015. This appears to offer very good value. Morgan Advan ...

Risk Averse Equity Management

... We invest only in companies that we understand, that are capable of weathering economic downturns, but that are also well positioned to benefit during periods of economic expansion, with the potential to grow faster than their industry and the overall market. We are bottom up, fundamental, long-term ...

... We invest only in companies that we understand, that are capable of weathering economic downturns, but that are also well positioned to benefit during periods of economic expansion, with the potential to grow faster than their industry and the overall market. We are bottom up, fundamental, long-term ...

November 2006 - Samuel Terry

... Fund was in cash, of which 5.4% was in $A and 4.9% in gold. The Fund owned securities issued by 25 companies. Fred Woollard 15 December 2006 Samuel Terry Asset Management Pty Limited (AFSL 278294) does not guarantee the repayment of capital or any particular rate of return from the Trust. Past perfo ...

... Fund was in cash, of which 5.4% was in $A and 4.9% in gold. The Fund owned securities issued by 25 companies. Fred Woollard 15 December 2006 Samuel Terry Asset Management Pty Limited (AFSL 278294) does not guarantee the repayment of capital or any particular rate of return from the Trust. Past perfo ...

Dynamic Bond Fund - Birla Sun Life Mutual Fund

... The Financial Solution (Savings Solutions) stated above is ONLY for highlighting the many advantages perceived from investments in Mutual Funds but does not in any manner, indicate or imply, either the quality of any particular Scheme or guarantee any specific performance/returns. ...

... The Financial Solution (Savings Solutions) stated above is ONLY for highlighting the many advantages perceived from investments in Mutual Funds but does not in any manner, indicate or imply, either the quality of any particular Scheme or guarantee any specific performance/returns. ...

and what can you invest in?

... finance and investment management – What are some of the IT tools that you might use and how might they be used? – We will look at how you can integrate IT and finance/investment management on both the professional and personal levels ...

... finance and investment management – What are some of the IT tools that you might use and how might they be used? – We will look at how you can integrate IT and finance/investment management on both the professional and personal levels ...

Aberdeen Global – Select Euro High Yield Bond Fund

... It does not include any initial charges or the cost of buying and selling stocks for the Funds. The Ongoing Charges figure can help you compare the annual operating expenses of different Funds. ...

... It does not include any initial charges or the cost of buying and selling stocks for the Funds. The Ongoing Charges figure can help you compare the annual operating expenses of different Funds. ...

UNIVERSITY of OKLAHOMA Retirement Plans Management

... First discussion point by Weigthman and Kuwitzky would be to determine which two of the active companies could move on. Taylor noted JP Morgan has a 15bps revenue share and committee had expressed interest in the past on moving away from that type of structure. On measuring performance and basis poi ...

... First discussion point by Weigthman and Kuwitzky would be to determine which two of the active companies could move on. Taylor noted JP Morgan has a 15bps revenue share and committee had expressed interest in the past on moving away from that type of structure. On measuring performance and basis poi ...

PL6 - African Development Bank

... Participate in the management of the Bank’s assets versus a specific benchmark or fixed liability schedule with the objective of capital preservation, profitability and liquidity maintenance in accordance with the Investment Guidelines of the specific fund; Determine the optimal asset allocation to ...

... Participate in the management of the Bank’s assets versus a specific benchmark or fixed liability schedule with the objective of capital preservation, profitability and liquidity maintenance in accordance with the Investment Guidelines of the specific fund; Determine the optimal asset allocation to ...

Using Low Volatility Hedge Funds as a Complement to Fixed

... while at the same time shorting a different bond they think is overvalued. Additionally, that manager would have broad discretion to be under invested (i.e. have a large cash position) when they don’t think there are many opportunities available to them. Most traditional investment managers do not h ...

... while at the same time shorting a different bond they think is overvalued. Additionally, that manager would have broad discretion to be under invested (i.e. have a large cash position) when they don’t think there are many opportunities available to them. Most traditional investment managers do not h ...

Portfolio Management

... purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein. ...

... purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein. ...

Epoch Global Equity Shareholder Yield Fund Institutional Class

... TDAM USA Inc. is a Delaware corporation registered as an investment adviser with the U.S. Securities and Exchange Commission (SEC). In providing investment management services and advice, TDAM USA Inc. has available to it, and draws on, the personnel, resources and experience of TD Asset Management ...

... TDAM USA Inc. is a Delaware corporation registered as an investment adviser with the U.S. Securities and Exchange Commission (SEC). In providing investment management services and advice, TDAM USA Inc. has available to it, and draws on, the personnel, resources and experience of TD Asset Management ...

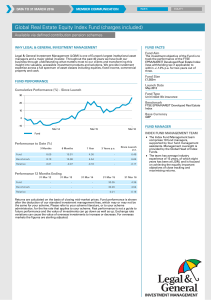

Global Real Estate Equity Index Fund

... This document should not be taken as an invitation to deal in Legal & General investments or any of the stated stock markets. Legal & General Assurance (Pensions Management) Limited ("PMC") is a life insurance company and manages this investment using a policy notional divided into a number of PF se ...

... This document should not be taken as an invitation to deal in Legal & General investments or any of the stated stock markets. Legal & General Assurance (Pensions Management) Limited ("PMC") is a life insurance company and manages this investment using a policy notional divided into a number of PF se ...

Artificial Intelligence (AI) Equity Portfolio Fact Sheet

... performance results are provided for informational purposes only and have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under or over compensated for the impact, if any, ...

... performance results are provided for informational purposes only and have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under or over compensated for the impact, if any, ...

MFIN5600 Practice questions Chapter 1 1. Characterize each of the

... 1. Jane Farkas tells Susan DiMarco that she has seen exciting data on the performance of marketneutral, convertible arbitrage, and global macro hedge funds. Farkas states: ‘‘The Sharpe ratios of all of these hedge fund strategies are much higher than for traditional equities or bonds, which means th ...

... 1. Jane Farkas tells Susan DiMarco that she has seen exciting data on the performance of marketneutral, convertible arbitrage, and global macro hedge funds. Farkas states: ‘‘The Sharpe ratios of all of these hedge fund strategies are much higher than for traditional equities or bonds, which means th ...

Manager Bio - Natixis Global Asset Management

... the firm in 2011. Previously Pavel was a portfolio manager and the head of quantitative research at ING Investment Management where he managed fundamental and quantitative equity portfolios and led quantitative research team in conducting research for all ING equity strategies in the U.S. From 1999 ...

... the firm in 2011. Previously Pavel was a portfolio manager and the head of quantitative research at ING Investment Management where he managed fundamental and quantitative equity portfolios and led quantitative research team in conducting research for all ING equity strategies in the U.S. From 1999 ...

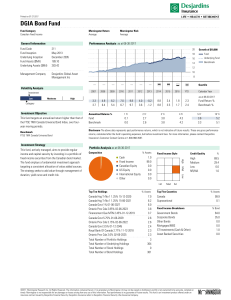

DGIA Bond Fund - Desjardins Life Insurance

... Fixed Income Canadian Equity US Equity International Equity Other ...

... Fixed Income Canadian Equity US Equity International Equity Other ...

Advanced Practicum in Investment Management (FBE453a and

... generosity of Catherine Nicholas and other donors to the University, the USIF program was established in 2008. As of April 1, 2011, the total assets under management for the USIF was about $600,000. ...

... generosity of Catherine Nicholas and other donors to the University, the USIF program was established in 2008. As of April 1, 2011, the total assets under management for the USIF was about $600,000. ...

How do you assess multi-asset funds?

... include short sales or other strategies that are intended to provide inverse exposure to a particular market or other asset class, as well as leverage and may subject a portfolio to potentially dramatic changes (including losses) in a portfolio’s value. Alternative investments commonly include the u ...

... include short sales or other strategies that are intended to provide inverse exposure to a particular market or other asset class, as well as leverage and may subject a portfolio to potentially dramatic changes (including losses) in a portfolio’s value. Alternative investments commonly include the u ...

The Importance of Risk Adjusted Returns

... If historic investment returns alone were to drive investment decisions, and fund sales data suggests this is the case, then at the top of a market cycle those funds that have taken the greatest risks will often attract the greatest inflows, and vice versa. This selection bias may not be well aligne ...

... If historic investment returns alone were to drive investment decisions, and fund sales data suggests this is the case, then at the top of a market cycle those funds that have taken the greatest risks will often attract the greatest inflows, and vice versa. This selection bias may not be well aligne ...

IPAA awards 2009 - Finalist (DOC 375kb)

... Awards 2009, in the category of Innovation in Policy Development and were on Monday 15 February awarded a finalist's certificate for their work on the Whole of Victorian Government Policy Investment Management Standard. This award acknowledges important and distinctive achievements and leadership by ...

... Awards 2009, in the category of Innovation in Policy Development and were on Monday 15 February awarded a finalist's certificate for their work on the Whole of Victorian Government Policy Investment Management Standard. This award acknowledges important and distinctive achievements and leadership by ...