Document

... After a shift from PPR to QAR, on average, risk increases by 41% for EMEs PF, while by 4% for OECD PF. After a shift from PPR to QAR, on average, Sharpe ratio drops by 20% for EMEs PF, while by 3% for OECD PF. As regards optimal portfolio part, there is evidence that higher return required, more all ...

... After a shift from PPR to QAR, on average, risk increases by 41% for EMEs PF, while by 4% for OECD PF. After a shift from PPR to QAR, on average, Sharpe ratio drops by 20% for EMEs PF, while by 3% for OECD PF. As regards optimal portfolio part, there is evidence that higher return required, more all ...

Diversification – Too Much of a Good Thing is a Bad Thing

... the official newsletter of sigma investment counselors ...

... the official newsletter of sigma investment counselors ...

An-Investment-Plan-f.. - Bob

... Train your children to invest a. When they earn their first income (Babysitting – Mowing lawns) help open an index account b. Match each dollar they add to the account for encouragement i. Help them understand the broker statement c. Help them develop an interest in investing i. Evaluate companies u ...

... Train your children to invest a. When they earn their first income (Babysitting – Mowing lawns) help open an index account b. Match each dollar they add to the account for encouragement i. Help them understand the broker statement c. Help them develop an interest in investing i. Evaluate companies u ...

Dynamic Power Canadian Growth Fund Series A

... payable by any security holder that would have reduced returns. The rates of return are used only to illustrate the effects of the compound growth rate and are not intended to reflect future values of the mutual fund or returns on investment in the mutual fund. Investments in mutual funds are not gu ...

... payable by any security holder that would have reduced returns. The rates of return are used only to illustrate the effects of the compound growth rate and are not intended to reflect future values of the mutual fund or returns on investment in the mutual fund. Investments in mutual funds are not gu ...

TA Aegon US Government Securities

... Please keep in mind that a U.S. Backed Government Fund guarantee applies only to the timely payment of principal and interest, and does not remove market risks when shares are redeemed. There are other investment choices available with different management fees associated with each choice. Barclays ...

... Please keep in mind that a U.S. Backed Government Fund guarantee applies only to the timely payment of principal and interest, and does not remove market risks when shares are redeemed. There are other investment choices available with different management fees associated with each choice. Barclays ...

deep value fund

... USA Mutuals Advisors, Inc. is a privately owned investment manager based in Dallas, Texas. As Advisor to a Multiple Series Trust, the firm offers a selection of boutique “Core ...

... USA Mutuals Advisors, Inc. is a privately owned investment manager based in Dallas, Texas. As Advisor to a Multiple Series Trust, the firm offers a selection of boutique “Core ...

Investing During a Non-Normal Market Environment

... allocating less of their portfolio to different types and asset styles of equities, or toward allocating less to higher risk stocks in order to maintain the same equity allocation. Absent such personalized risk-management techniques, the heightened volatility of the stock market will be borne fully ...

... allocating less of their portfolio to different types and asset styles of equities, or toward allocating less to higher risk stocks in order to maintain the same equity allocation. Absent such personalized risk-management techniques, the heightened volatility of the stock market will be borne fully ...

Oil, Currencies, and the Fed

... some of the best performing 2014 major asset classes with the 10 year yielding 2.17%. However, investors need to remain vigilant of knock-on effects of a relatively near-term rise on short-term yields for all income oriented securities. Many investors now consider exchange traded funds (ETFs) as the ...

... some of the best performing 2014 major asset classes with the 10 year yielding 2.17%. However, investors need to remain vigilant of knock-on effects of a relatively near-term rise on short-term yields for all income oriented securities. Many investors now consider exchange traded funds (ETFs) as the ...

Presentation Headline

... forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any stock in particular, nor should it be construed as a recommendation to purchase or sell a security, including futures cont ...

... forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any stock in particular, nor should it be construed as a recommendation to purchase or sell a security, including futures cont ...

Personalised discretionary portfolio management: the tailor

... portfolio management optimising the risk/return ratio To benefit from a direct and personalised contact with a dedicated portfolio manager ...

... portfolio management optimising the risk/return ratio To benefit from a direct and personalised contact with a dedicated portfolio manager ...

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 10. Pluto Ltd. would pay Rs.2.50 as dividend per share for the next year and expected to grow indefinitely at 12%, what would be the equity value if the investor requires 20% return? ANSWER ANY FOUR QUESTIONS: ...

... 10. Pluto Ltd. would pay Rs.2.50 as dividend per share for the next year and expected to grow indefinitely at 12%, what would be the equity value if the investor requires 20% return? ANSWER ANY FOUR QUESTIONS: ...

Dynamic Global Value Fund Series G

... payable by any security holder that would have reduced returns. The rates of return are used only to illustrate the effects of the compound growth rate and are not intended to reflect future values of the mutual fund or returns on investment in the mutual fund. Investments in mutual funds are not gu ...

... payable by any security holder that would have reduced returns. The rates of return are used only to illustrate the effects of the compound growth rate and are not intended to reflect future values of the mutual fund or returns on investment in the mutual fund. Investments in mutual funds are not gu ...

amundi index jp morgan gbi global govies - ie

... This document is provided for information purposes only and does not constitute a recommendation, a solicitation, an offer, advice or an invitation to purchase or sell any units or shares of the fund (FCP), collective employee fund (FCPE), SICAV, SICAV sub-fund or SICAV investing primarily in real es ...

... This document is provided for information purposes only and does not constitute a recommendation, a solicitation, an offer, advice or an invitation to purchase or sell any units or shares of the fund (FCP), collective employee fund (FCPE), SICAV, SICAV sub-fund or SICAV investing primarily in real es ...

Call: June 19, 2015 AFFIDAVIT SAMPLE Contact Person

... 4. - The fund has at least 20% of the target fund size in hard commitments from investors, as included in the table below. Portfolio contributions, as well as any other non-monetary contributions, will not be considered valid for this purpose. Commitments must be represented by a signed letter of in ...

... 4. - The fund has at least 20% of the target fund size in hard commitments from investors, as included in the table below. Portfolio contributions, as well as any other non-monetary contributions, will not be considered valid for this purpose. Commitments must be represented by a signed letter of in ...

ALPHA BITES Rovers Return? - Alpha Portfolio Management

... email [email protected] or call us on 0117 203 3460. This publication is for informational purposes only and should not be relied upon. The opinions expressed here represent analysis by an Alpha Portfolio Management representative at the time of preparation and should not be interpreted as investm ...

... email [email protected] or call us on 0117 203 3460. This publication is for informational purposes only and should not be relied upon. The opinions expressed here represent analysis by an Alpha Portfolio Management representative at the time of preparation and should not be interpreted as investm ...

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 10) A company’s return was 20% and that of the stock market as a whole was 15%. The standard deviation of the portfolio was 10%, while that of the market is 5%. The risk free rate is 6%. What is the Sharpe measure of the company’s portfolio? Comment on its performance. ...

... 10) A company’s return was 20% and that of the stock market as a whole was 15%. The standard deviation of the portfolio was 10%, while that of the market is 5%. The risk free rate is 6%. What is the Sharpe measure of the company’s portfolio? Comment on its performance. ...

Portfolio Update

... surprise indices, etc.) which started in March, we suspect that any softness in risk asset prices will find a floor more rapidly than in the seasonal sell-offs of recent years, buoyed by the tide of central bank liquidity, and the prospect of dovish replacements (Carney, Yellen?) to the incumbent Ce ...

... surprise indices, etc.) which started in March, we suspect that any softness in risk asset prices will find a floor more rapidly than in the seasonal sell-offs of recent years, buoyed by the tide of central bank liquidity, and the prospect of dovish replacements (Carney, Yellen?) to the incumbent Ce ...

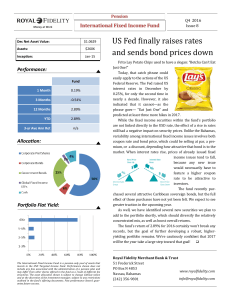

US Fed finally raises rates and sends bond prices down

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

Strong first year for Smartfund 80% Protected

... “We believe that Smartfund 80% Protected is ideal for clients who are reluctant to take risks with their investments, such as investors approaching or in retirement. Smartfund 80% Protected offers an alternative to low-risk investments that may not deliver a client’s financial objectives in the cur ...

... “We believe that Smartfund 80% Protected is ideal for clients who are reluctant to take risks with their investments, such as investors approaching or in retirement. Smartfund 80% Protected offers an alternative to low-risk investments that may not deliver a client’s financial objectives in the cur ...